Synopsis

0

CEP/COS

0

VMF

0

Weekly News Recap #Phispers

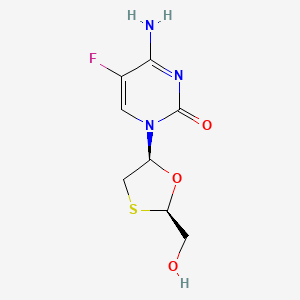

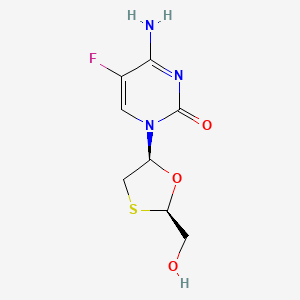

1. Beta L 2',3' Dideoxy 5 Fluoro 3' Thiacytidine

2. Beta-l-2',3'-dideoxy-5-fluoro-3'-thiacytidine

3. Coviracil

4. Emtriva

1. 143491-57-0

2. Emtriva

3. Coviracil

4. (-)-ftc

5. 4-amino-5-fluoro-1-((2r,5s)-2-(hydroxymethyl)-1,3-oxathiolan-5-yl)pyrimidin-2(1h)-one

6. 143491-54-7

7. 524w91

8. Bw-524w91

9. Ftc

10. Racivir

11. 4-amino-5-fluoro-1-[(2r,5s)-2-(hydroxymethyl)-1,3-oxathiolan-5-yl]pyrimidin-2-one

12. Bw524w91

13. (-)-2'-deoxy-5-fluoro-3'-thiacytidine

14. Ftc-(-)

15. Bw 524w91

16. (-)-emtricitabine

17. (2r-cis)-4-amino-5-fluoro-1-(2-(hydroxymethyl)-1,3-oxathiolan-5-yl)-2(1h)-pyrimidinone

18. (-)-beta-2',3'-dideoxy-5-fluoro-3'-thiacytidine

19. Chebi:31536

20. 5-fluoro-1-((2r,5s)-2-(hydroxymethyl)-1,3-oxathiolan-5-yl)cytosine

21. Emtricitabine, (-)-

22. Psi-5004

23. 4-amino-5-fluoro-1-[(2r,5s)-2-(hydroxymethyl)-1,3-oxathiolan-5-yl]pyrimidin-2(1h)-one

24. 145213-48-5

25. G70b4etf4s

26. Uls8902u4o

27. Emtritabine

28. Bw1592

29. (-)-cis-4-amino-5-fluoro-1-(2-hydroxymethyl-1,3-oxathiolan-5-yl)-(1h)-pyrimidin-2-one

30. 2',3'-dideoxy-5-fluoro-3'-thiacytidine

31. Ncgc00164564-01

32. (-)-(2r,5s)-5-fluoro-1-[2-(hydroxymethyl)-1,3-oxathiolan-5-yl]cytosine

33. 2(1h)-pyrimidinone, 4-amino-5-fluoro-1-((2r,5s)-2-(hydroxymethyl)-1,3-oxathiolan-5-yl)-, Rel-

34. 524-w-91

35. Psi 5004

36. Mfcd00870151

37. Ftc, Dl-

38. Coviracil(tm)

39. Drg-0208

40. 4-amino-5-fluoro-1-((2r,5s)-2-hydroxymethyl-[1,3]oxathiolan-5-yl)-1h-pyrimidin-2-one

41. Rel-4-amino-5-fluoro-1-[(2r,5s)-2-(hydroxymethyl)-1,3-oxathiolan-5-yl]-2(1h)-pyrimidinone

42. Emtriva(tm)

43. 2(1h)-pyrimidinone, 4-amino-5-fluoro-1-[(2r,5s)-2-(hydroxymethyl)-1,3-oxathiolan-5-yl]-, Rel-

44. Emtricitabine (emtriva)

45. Smr002533604

46. Bw 1592

47. 2',3',5-ftc

48. Emtricitabine, (+/-)-

49. Hsdb 7337

50. 4-amino-5-fluoro-1-[(2r,5s)-2-(hydroxymethyl)-1,3-oxathiolan-5-yl]-1,2-dihydropyrimidin-2-one

51. Ftc, (-)-

52. Unii-g70b4etf4s

53. Emtricitabine [usan:inn]

54. (-)-.beta.-l-ftc

55. Unii-uls8902u4o

56. Emtricitabinum

57. (+/-)-ftc

58. 2(1h)-pyrimidinone,4-amino-5-fluoro-1-((2r,5s)-2-(hydroxymethyl)-1,3-oxathiolan-5-yl)-

59. 2(1h)-pyrimidinone,4-amino-5-fluoro-1-[(2r,5s)-2-(hydroxymethyl)-1,3-oxathiolan-5-yl]-

60. Emtricitabine- Bio-x

61. Emtricitabine [mi]

62. Chembl885

63. Emtricitabine [inn]

64. Emtricitabine [jan]

65. 2(1h)-pyrimidinone, 4-amino-5-fluoro-1-(2-(hydroxymethyl)-1,3-oxathiolan-5-yl)-, Cis-

66. Dsstox_cid_20129

67. Dsstox_rid_79445

68. Emtricitabine [hsdb]

69. Emtricitabine [usan]

70. Dsstox_gsid_40129

71. Schembl39708

72. Emtricitabine [vandf]

73. Mls003882429

74. Mls006011556

75. Mls006011987

76. Emtricitabine [mart.]

77. Emtricitabine [usp-rs]

78. Emtricitabine [who-dd]

79. Emtricitabine [who-ip]

80. Dtxsid0040129

81. Emtricitabine [ema Epar]

82. Gtpl11244

83. Ex-a150

84. Hms2089i05

85. Hms3713l12

86. Emtricitabine [orange Book]

87. Zinc3629271

88. Tox21_112193

89. ((-))-ftc

90. Bdbm50107843

91. Cs1125

92. Ftc-((-))

93. Nsc804863

94. S1704

95. Atripla Component Emtricitabine

96. Descovy Component Emtricitabine

97. Emtricitabinum [who-ip Latin]

98. Odefsey Component Emtricitabine

99. Truvada Component Emtricitabine

100. Akos015853098

101. Akos015894950

102. Eviplera Component Emtricitabine

103. Stribild Component Emtricitabine

104. Am84393

105. Ccg-220615

106. Cs-1370

107. Db00879

108. Nsc-804863

109. 2',3'-dideoxy-3-thia-5-fluorocytidine

110. Descovy Component Of Emtricitabine

111. Emtricitabine Component Of Atripla

112. Emtricitabine Component Of Descovy

113. Emtricitabine Component Of Genvoya

114. Emtricitabine Component Of Odefsey

115. Emtricitabine Component Of Truvada

116. Ncgc00164564-06

117. Ncgc00164564-09

118. Ncgc00164564-10

119. 2(1h)-pyrimidinone, 4-amino-5-fluoro-1-(2-(hydroxymethyl)-1,3-oxathiolan-5-yl)-, (2r-cis)-

120. 2(1h)-pyrimidinone, 4-amino-5-fluoro-1-(2-(hydroxymethyl)-1,3-oxathiolan-5-yl)-, Cis-(+-)-

121. As-14099

122. Be165946

123. Emtricitabine Component Of Eviplera

124. Emtricitabine Component Of Stribild

125. Hy-17427

126. Cas-143491-57-0

127. E1007

128. Emtricitabine 100 Microg/ml In Acetonitrile

129. Sw220172-1

130. D01199

131. D72669

132. Ent-emtricitabine; Emtricitabine Ip Impurity D

133. Ab01275429-01

134. 491e570

135. Q422604

136. W-201247

137. W-201248

138. 2',3'-dideoxy-5-fluoro-3'-thiacytidine, Dl-

139. Z1739256297

140. .beta.-l-(-)-(2r,5s)-5-fluoro-1-[2-(hydroxymethyl)-1,3-oxathiolan-5-yl]cytosine

141. 5-fluoro-1-(2-(hydroxymethyl)-1,3-oxathiolan-5-yl)cytosine (2r,5s)

142. 2(1h)-pyrimidinone, 4-amino-5-fluoro-1-((2r,5s)-2-(hydroxymethyl)-1,3-oxathiolan-5-yl)-

143. 4-amino-5-fluoro-1-[(2s,5r)-2-(hydroxymethyl)-1,3-oxathiolan-5-yl]-2(1h)-pyrimidinone; (+)-2'-deoxy-3'-thia-5-fluorocytidine; (2s-cis)-4-amino-5-fluoro-1-[2-(hydroxymethyl)-1,3-oxathiolan-5-yl]-2(1h)-pyrimidinone

144. 5-fluoro-(-)-l-2',3'-dideoxy-3'-thiacytidine; (-)-beta-2',3'-dideoxy-5-fluoro-3'-thiacytidine; Emtricitabine; Emtriva

| Molecular Weight | 247.25 g/mol |

|---|---|

| Molecular Formula | C8H10FN3O3S |

| XLogP3 | -0.6 |

| Hydrogen Bond Donor Count | 2 |

| Hydrogen Bond Acceptor Count | 5 |

| Rotatable Bond Count | 2 |

| Exact Mass | 247.04269053 g/mol |

| Monoisotopic Mass | 247.04269053 g/mol |

| Topological Polar Surface Area | 113 Ų |

| Heavy Atom Count | 16 |

| Formal Charge | 0 |

| Complexity | 374 |

| Isotope Atom Count | 0 |

| Defined Atom Stereocenter Count | 2 |

| Undefined Atom Stereocenter Count | 0 |

| Defined Bond Stereocenter Count | 0 |

| Undefined Bond Stereocenter Count | 0 |

| Covalently Bonded Unit Count | 1 |

| 1 of 4 | |

|---|---|

| Drug Name | Emtricitabine |

| PubMed Health | Emtricitabine (By mouth) |

| Drug Classes | Antiretroviral Agent |

| Drug Label | EMTRIVA is the brand name of emtricitabine, a synthetic nucleoside analog with activity against human immunodeficiency virus type 1 (HIV-1) reverse transcriptase.The chemical name of emtricitabine is 5-fluoro-1-(2R,5S)-[2-(hydroxymethyl)-1,3-oxathiol... |

| Active Ingredient | Emtricitabine |

| Dosage Form | Capsule |

| Route | oral |

| Strength | 200mg |

| Market Status | Tentative Approval |

| Company | Matrix Labs; Aurobindo Pharma; Cipla |

| 2 of 4 | |

|---|---|

| Drug Name | Emtriva |

| PubMed Health | Emtricitabine (By mouth) |

| Drug Classes | Antiretroviral Agent |

| Drug Label | EMTRIVA is the brand name of emtricitabine, a synthetic nucleoside analog with activity against human immunodeficiency virus type 1 (HIV-1) reverse transcriptase.The chemical name of emtricitabine is 5-fluoro-1-(2R,5S)-[2-(hydroxymethyl)-1,3-oxathiol... |

| Active Ingredient | Emtricitabine |

| Dosage Form | Capsule; Solution |

| Route | oral; Oral |

| Strength | 200mg; 10mg/ml |

| Market Status | Prescription |

| Company | Gilead |

| 3 of 4 | |

|---|---|

| Drug Name | Emtricitabine |

| PubMed Health | Emtricitabine (By mouth) |

| Drug Classes | Antiretroviral Agent |

| Drug Label | EMTRIVA is the brand name of emtricitabine, a synthetic nucleoside analog with activity against human immunodeficiency virus type 1 (HIV-1) reverse transcriptase.The chemical name of emtricitabine is 5-fluoro-1-(2R,5S)-[2-(hydroxymethyl)-1,3-oxathiol... |

| Active Ingredient | Emtricitabine |

| Dosage Form | Capsule |

| Route | oral |

| Strength | 200mg |

| Market Status | Tentative Approval |

| Company | Matrix Labs; Aurobindo Pharma; Cipla |

| 4 of 4 | |

|---|---|

| Drug Name | Emtriva |

| PubMed Health | Emtricitabine (By mouth) |

| Drug Classes | Antiretroviral Agent |

| Drug Label | EMTRIVA is the brand name of emtricitabine, a synthetic nucleoside analog with activity against human immunodeficiency virus type 1 (HIV-1) reverse transcriptase.The chemical name of emtricitabine is 5-fluoro-1-(2R,5S)-[2-(hydroxymethyl)-1,3-oxathiol... |

| Active Ingredient | Emtricitabine |

| Dosage Form | Capsule; Solution |

| Route | oral; Oral |

| Strength | 200mg; 10mg/ml |

| Market Status | Prescription |

| Company | Gilead |

Antiviral Agents

National Library of Medicine's Medical Subject Headings. Emtricitabine. Online file (MeSH, 2014). Available from, as of November 19, 2013: https://www.nlm.nih.gov/mesh/2014/mesh_browser/MBrowser.html

Emtricitabine is used in conjunction with other antiretroviral agents for the treatment of HIV-1 infection in pediatric patients 12 years of age or older. The fixed combination containing emtricitabine and tenofovir (Truvada) can be used in conjunction with other antiretrovirals in children 12 years of age or older weighing at least 35 kg. For initial treatment of HIV-infected pediatric patients, the HHS Panel on Antiretroviral Therapy and Medical Management of HIV-infected Children recommends antiretroviral therapy with at least 3 drugs, including either a PI or NNRTI with 2 NRTIs. When PI-based or NNRTI-based regimens are used in pediatric patients, emtricitabine and (abacavir (for individuals 3 months of age or older who test negative for the HLA-B*5701 allele), tenofovir (for adolescents 12 years of age or older at Tanner stage 4 or 5), or zidovudine) are preferred dual NRTI options. A dual NRTI combination of emtricitabine and lamivudine is not recommended, because of similar resistance profiles and minimal additive antiretroviral activity. A triple NRTI regimen that includes abacavir, tenofovir, and either lamivudine or emtricitabine or a triple NRTI regimen that includes tenofovir, didanosine, and either lamivudine or emtricitabine should not be used at any time in pediatric patients because of the high rate of early virologic failure reported in antiretroviral-naive adults.

American Society of Health-System Pharmacists 2013; Drug Information 2013. Bethesda, MD. 2013, p. 700

Emtricitabine has been evaluated in a randomized, open-label, multicenter study (study 303) in 440 previously treated adults (mean age: 42 years; 86% male; 64% white; 13% Hispanic; 21% African American; median baseline plasma HIV-1 RNA level: 1.7 log10 copies/mL; mean baseline CD4+ T-cell count: 527 cells/mm3) who had received a lamivudine-containing regimen that also included 2 other antiretrovirals (background regimen) for at least 12 weeks prior to study entry and had plasma HIV-1 levels of 400 copies/mL or less. Patients in this study were randomized to receive emtricitabine in conjunction with stavudine or zidovudine and PI or NNRTI or to continue their lamivudine-containing background regimen (i.e., lamivudine in conjunction with stavudine or zidovudine and a PI or NNRTI). At week 48, 77 and 67% of adults receiving the regimen that included emtricitabine and 82 and 72% of those receiving the regimen that included lamivudine had plasma HIV-1 RNA levels less than 400 or 50 copies/mL, respectively. Virologic failure (i.e., individuals who failed to achieve virologic suppression or experienced rebound after achieving virologic suppression) was reported in 7% of those receiving the emtricitabine-containing regimen and in 8% of those receiving the lamivudine-containing regimen at week 48. Administration of the emtricitabine-containing regimen resulted in a mean increase in CD4+ T-cell counts of 29 cells/mm3; administration of the lamivudine-containing regimen resulted in a mean increase in CD4+ T-cell counts of 61 cells/cu mm.

American Society of Health-System Pharmacists 2013; Drug Information 2013. Bethesda, MD. 2013, p. 700

Safety and efficacy of emtricitabine used in conjunction with other antiretrovirals have been evaluated in a randomized multicenter study in treatment-naive adults (study 301A). In this study, 571 HIV-infected adults (mean age: 36 years; 85% male; 52% white; 26% Hispanic; 16% African American; median baseline plasma HIV-1 RNA level: 4.9 log10 copies/mL; mean baseline CD4+ T-cell count: 318 cells/mm3) were randomized to receive emtricitabine or stavudine in conjunction with didanosine (delayed-release capsules) and efavirenz. Results of this study indicated that an initial regimen that includes emtricitabine in conjunction with didanosine and efavirenz is as effective as an initial regimen of stavudine in conjunction with didanosine and efavirenz. At week 48, 81 and 78% of adults receiving the regimen that included emtricitabine and 68 and 59% of those receiving the regimen that included stavudine had plasma HIV-1 RNA levels less than 400 or 50 copies/mL, respectively. Virologic failure (i.e., individuals who failed to achieve virologic suppression or experienced rebound after achieving virologic suppression) at week 48 was reported in 3% of those receiving the emtricitabine-containing regimen and in 11% of those receiving the stavudine-containing regimen. At week 48, increases in CD4+ T-cell counts were greater in patients receiving the regimen that included emtricitabine (mean increase of 168 cells/mm3) than in those receiving the regimen that included stavudine (mean increase of 134 cells/mm3).

American Society of Health-System Pharmacists 2013; Drug Information 2013. Bethesda, MD. 2013, p. 700

For more Therapeutic Uses (Complete) data for EMTRICITABINE (7 total), please visit the HSDB record page.

Safety and efficacy of emtricitabine have been established for treatment of HIV-1 infection in children 3 months of age and older. The pharmacokinetics and safety of emtricitabine were evaluated in a dose-finding study in 20 neonates born to HIV-infected mothers.20 1 These neonates received zidovudine prophylaxis for 6 weeks. In addition, these neonates received 2 short courses of emtricitabine (3 mg/kg daily for 4 days per course) during the first 12 weeks of life. This dose was well tolerated and was not associated with any safety issues. Systemic exposure (area under the plasma concentration-time curve [AUC]) in infants 0-3 months of age receiving emtricitabine 3 mg/kg daily was similar to that reported in children 3 months to 17 years of age receiving emtricitabine 6 mg/kg daily. All neonates were HIV-1 negative at the end of the study (6 months postpartum); efficacy of emtricitabine for the prevention or treatment of HIV was not determined.

American Society of Health-System Pharmacists 2013; Drug Information 2013. Bethesda, MD. 2013, p. 703

Lactic acidosis and severe hepatomegaly with steatosis, including fatalities, have been reported in patients receiving nucleoside reverse transcriptase inhibitors (NRTIs), including emtricitabine, in conjunction with other antiretroviral agents. Most reported cases have involved women; obesity and long-term therapy with a nucleoside analog also may be risk factors.

American Society of Health-System Pharmacists 2013; Drug Information 2013. Bethesda, MD. 2013, p. 702

Caution should be observed when nucleoside reverse transcriptase inhibitors are used in patients with known risk factors for liver disease; however, lactic acidosis and severe hepatomegaly with steatosis have been reported in patients with no known risk factors. Emtricitabine therapy should be interrupted in any patient with clinical or laboratory findings suggestive of lactic acidosis or pronounced hepatotoxicity (signs of hepatotoxicity include hepatomegaly and steatosis even in the absence of marked increases in serum aminotransferase concentrations).

American Society of Health-System Pharmacists 2013; Drug Information 2013. Bethesda, MD. 2013, p. 702

Prior to initiation of emtricitabine therapy for the treatment of HIV-1 infection, patients should be tested for chronic hepatitis B virus (HBV). Emtricitabine is not indicated for the treatment of chronic HBV infection; safety and efficacy of the drug have not been established in patients with coexisting HBV and HIV infections. Exacerbations of HBV infection have been reported in HIV-infected patients following discontinuance of emtricitabine. Patients with HBV infection and HIV infection should be closely monitored with clinical and laboratory follow-up for at least several months after stopping emtricitabine therapy.

American Society of Health-System Pharmacists 2013; Drug Information 2013. Bethesda, MD. 2013, p. 702

For more Drug Warnings (Complete) data for EMTRICITABINE (13 total), please visit the HSDB record page.

Emtricitabine is indicated in combination with other medications for the treatment of HIV-1 infections; treatment of HIV-1 infections in pediatric patients 25-35kg, treatment of HIV-1 infections in adult patients 35kg, for pre exposure prophylaxis of HIV-1 in adolescent and adult patients excluding those who have receptive vaginal sex; treatment of HIV-1 infections in pediatric and adult patients 17kg, pre exposure prophylaxis in adolescents and adults 35kg; treatment of HIV-1 in patients 12 years and 35kg; treatment of HIV-1 in patients weighing 35kg; treatment of HIV-1 in patients weighing 25kg; and treatment of HIV-1 in patients weighing 40kg.

FDA Label

Emtriva is indicated for the treatment of HIV-1 infected adults and children in combination with other antiretroviral agents.

This indication is based on studies in treatment-naive patients and treatment-experienced patients with stable virological control. There is no experience of the use of Emtriva in patients who are failing their current regimen or who have failed multiple regimens.

When deciding on a new regimen for patients who have failed an antiretroviral regimen, careful consideration should be given to the patterns of mutations associated with different medicinal products and the treatment history of the individual patient. Where available, resistance testing may be appropriate.

Emtricitabine is a cytidine analog that competes with the natural substrate of HIV-1 reverse transcriptase to be incorporated into newly formed DNA, terminating its transcription. It is administered once daily so it has a long duration of action. Patients should be counselled regarding the risk of lactic acidosis and hepatomegaly with steatosis.

Anti-HIV Agents

Agents used to treat AIDS and/or stop the spread of the HIV infection. These do not include drugs used to treat symptoms or opportunistic infections associated with AIDS. (See all compounds classified as Anti-HIV Agents.)

Antiviral Agents

Agents used in the prophylaxis or therapy of VIRUS DISEASES. Some of the ways they may act include preventing viral replication by inhibiting viral DNA polymerase; binding to specific cell-surface receptors and inhibiting viral penetration or uncoating; inhibiting viral protein synthesis; or blocking late stages of virus assembly. (See all compounds classified as Antiviral Agents.)

Reverse Transcriptase Inhibitors

Inhibitors of reverse transcriptase (RNA-DIRECTED DNA POLYMERASE), an enzyme that synthesizes DNA on an RNA template. (See all compounds classified as Reverse Transcriptase Inhibitors.)

J05AF09

J05AF09

S76 | LUXPHARMA | Pharmaceuticals Marketed in Luxembourg | Pharmaceuticals marketed in Luxembourg, as published by d'Gesondheetskeess (CNS, la caisse nationale de sante, www.cns.lu), mapped by name to structures using CompTox by R. Singh et al. (in prep.). List downloaded from https://cns.public.lu/en/legislations/textes-coordonnes/liste-med-comm.html. Dataset DOI:10.5281/zenodo.4587355

J - Antiinfectives for systemic use

J05 - Antivirals for systemic use

J05A - Direct acting antivirals

J05AF - Nucleoside and nucleotide reverse transcriptase inhibitors

J05AF09 - Emtricitabine

Absorption

Emtricitabine reaches a Cmax of 1.80.7g/mL with a Tmax of 1-2 hours, and has an AUC of 103.1g\*hr/mL. The bioavailability of emtricitabine capsules is 93% and the bioavailability of the oral solution is 75%. Taking emtricitabine with food decreases the Cmax by 29%.[L9019

Route of Elimination

Emtricitabine is 86% recovered in the urine and 14% recovered in feces. 13% of the dose is recovered in the urine as metabolites; 9% as 3'-sulfoxide diastereomers and 4% as 2'-O-glucuronide.

Volume of Distribution

The apparent central volume of distribution is 42.3L and the peripheral volume of distribution is 55.4L.

Clearance

Emtricitabine has an apparent elimination rate of 15.1L/h. This rate is closely linked to creatinine clearance.

Emtricitabine is rapidly and extensively absorbed following oral administration with peak plasma concentrations occurring at 1 to 2 hours post-dose. Following multiple dose oral administration of emtriva to 20 HIV-infected subjects, the (mean + or - SD) steady state plasma emtricitabine peak concentration (Cmax) was 1.8 + or 0.7 ug/mL and the area under the plasma concentration-time curve over a 24-hour dosing interval (AUC) was 10.0 + or - 3.1 hr/ug/mL. The mean steady state plasma trough concentration at 24 hours post-dose was 0.09 ug/mL. The mean absolute bioavailability of emtriva was 93%.

Physicians Desk Reference 65th ed. PDR Network, LLC, Montvale, NJ. 2011, p. 1154

In vitro binding of emtricitabine to human plasma proteins was <4% and independent of concentration over the range of 0.02 to 200 ug/mL. At peak plasma concentration, the mean plasma to blood drug concentration ratio was approximately 1.0 and the mean semen to plasma drug concentration ratio was approximately 4.0.

Physicians Desk Reference 65th ed. PDR Network, LLC, Montvale, NJ. 2011, p. 1155

Time to peak concentration: 1 to 2 hours post dose

Thomson.Micromedex. Drug Information for the Health Care Professional. 25th ed. Volume 1. Plus Updates. Content Reviewed by the United States Pharmacopeial Convention, Inc. Greenwood Village, CO. 2005., p. 1265

Emtricitabine is distributed into human milk in low concentrations.

American Society of Health-System Pharmacists 2013; Drug Information 2013. Bethesda, MD. 2013, p. 703

For more Absorption, Distribution and Excretion (Complete) data for EMTRICITABINE (6 total), please visit the HSDB record page.

Emtricitabine is approximately 86% unmetabolized. Approximately 9% of a dose is metabolized to 3'-sulfoxide diastereomers, 4% to the 2'-O-glucuronide, and a minor amount is converted to 5-fluorocytosine.

The biotransformation of emtricitabine includes oxidation of the thiol moiety to form the 3'-sulfoxide diastereomers (approximately 9% of dose) and conjugation with glucuronic acid to form 2'-O-glucuronide (approximately 4% of dose). No other metabolites were identifiable. Emtricitabine is not metabolized by liver enzymes.

Thomson.Micromedex. Drug Information for the Health Care Professional. 25th ed. Volume 1. Plus Updates. Content Reviewed by the United States Pharmacopeial Convention, Inc. Greenwood Village, CO. 2005., p. 1265

The half life of emtricitabine is approximately 10 hours.

The plasma emtricitabine half-life is approximately 10 hours.

Physicians Desk Reference 65th ed. PDR Network, LLC, Montvale, NJ. 2011, p. 1155

Emtricitabine is a cytidine analog which, when phosphorylated to emtricitabine 5'-triphosphate, competes with deoxycytidine 5'-triphosphate for HIV-1 reverse transcriptase. As HIV-1 reverse transcriptase incorporates emtricitabine into forming DNA strands, new nucleotides are unable to be incorporated, leading to viral DNA chain termination. Inhibition of reverse transcriptase prevents transcription of viral RNA into DNA, therefore the virus is unable to incorporate its DNA into host DNA and replicate using host cell machinery. This reduces viral load.

Emtricitabine, a synthetic nucleoside analog of cytosine, is phosphorylated by cellular enzymes to form emtricitabine 5'-triphosphate. Emtricitabine 5'-triphosphate inhibits the activity of the HIV-1 reverse transcriptase by competing with the natural substrate deoxycytidine 5'-triphosphate and by being incorporated into nascent viral DNA which results in chain termination. Emtricitabine 5'-triphosphate is a weak inhibitor of mammalian DNA polymerase alpha, beta, epsilon and mitochondrial DNA polymerase gamma.

Physicians Desk Reference 65th ed. PDR Network, LLC, Montvale, NJ. 2011, p. 1155

Date of Issue : 2023-12-26

Valid Till : 2026-12-03

Written Confirmation Number : WC-0487

Address of the Firm : Plot No. 48-50, 209-211, IDA, Phase-ll, Pashamylaram, Patancheru, Sangareddy Dis...

Date of Issue : 2025-07-11

Valid Till : 2028-06-25

Written Confirmation Number : WC-0023

Address of the Firm : Sy. No\'s. 52,53,58,59,61 to 78, 127 & 128, Pydibhimavaram Village & Sy. No\'s. ...

Date of Issue : 2025-06-19

Valid Till : 2028-07-02

Written Confirmation Number : WC-0141

Address of the Firm : Plot No. D-27, M.I.D.C, Industrial Area, Kurkumbh, Taluka

Date of Issue : 2024-02-19

Valid Till : 2027-02-18

Written Confirmation Number : WC-0578

Address of the Firm : Sy.No.405 & 408, Veliminedu (Village), Chityal (Mandal), Nalgonda District - 508...

Date of Issue : 2025-09-03

Valid Till : 2028-08-08

Written Confirmation Number : WC-0041

Address of the Firm : Unit-I, Sy. No. 10, I.D.A, Gaddapotharam (V), Jinnaram (M), Sangareddy District,...

Date of Issue : 2022-09-30

Valid Till : 2025-08-15

Written Confirmation Number : WC-0065

Address of the Firm : Unit-IX, Plot No. 2, Hetero Infrastructure- SEZ Ltd., N. Narasapuram (Village), ...

Date of Issue : 2024-08-04

Valid Till : 2026-03-22

Written Confirmation Number : WC-0395

Address of the Firm : Plot No. 18, Jawaharlal Nehru Pharma City, Parawada Mandal, Anakapalli District ...

Date of Issue : 2022-09-30

Valid Till : 2025-09-10

Written Confirmation Number : WC-0201

Address of the Firm : T-142, MIDC, Tarapur, Boisar, Palghar - 401506, Maharashtra, India

Date of Issue : 2025-11-12

Valid Till : 2028-11-10

Written Confirmation Number : WC-0079

Address of the Firm : Plot No. - 2209, G.I.D.C., Sarigam - 396 155, Dist - Valsad, Gujarat, India

Emtricitabine IH/IP/USP/Ph. Int

Date of Issue : 2024-03-21

Valid Till : 2027-03-20

Written Confirmation Number : WC-0473

Address of the Firm : Unit-2, Plot No 1203, Ill Phase GIDC, Vapi -396195, Dist.-Valsad, Gujarat, India

FULL SCREEN VIEW Click here to open all results in a new tab [this preview display 10 results]

FULL SCREEN VIEW Click here to open all results in a new tab [this preview display 10 results]

API/FDF Prices: Book a Demo to explore the features and consider upgrading later

API Imports and Exports

| Importing Country | Total Quantity (KGS) |

Average Price (USD/KGS) |

Number of Transactions |

|---|

Upgrade, download data, analyse, strategize, subscribe with us

RLD : No

TE Code : AB

EMTRICITABINE; TENOFOVIR DISOPROXIL FUMARATE

Brand Name : EMTRICITABINE AND TENOFOVIR DISOPROXIL FUMARATE

Dosage Form : TABLET;ORAL

Dosage Strength : 200MG;300MG

Approval Date : 2021-01-13

Application Number : 91055

RX/OTC/DISCN : RX

RLD : No

TE Code : AB

Boost your online visibility by uploading your products, APIs, FDFs, intermediates, excipients, and services for free on PharmaCompass.

Rank higher among suppliers and expand your reach across the internet efficiently and cost-effectively.

Boost your online visibility by uploading your products, APIs, FDFs, intermediates, excipients, and services for free on PharmaCompass.

Rank higher among suppliers and expand your reach across the internet efficiently and cost-effectively.

RLD : No

TE Code : AB

EMTRICITABINE; TENOFOVIR DISOPROXIL FUMARATE

Brand Name : EMTRICITABINE AND TENOFOVIR DISOPROXIL FUMARATE

Dosage Form : TABLET;ORAL

Dosage Strength : 100MG;150MG

Approval Date : 2018-08-22

Application Number : 209721

RX/OTC/DISCN : RX

RLD : No

TE Code : AB

Boost your online visibility by uploading your products, APIs, FDFs, intermediates, excipients, and services for free on PharmaCompass.

Rank higher among suppliers and expand your reach across the internet efficiently and cost-effectively.

Boost your online visibility by uploading your products, APIs, FDFs, intermediates, excipients, and services for free on PharmaCompass.

Rank higher among suppliers and expand your reach across the internet efficiently and cost-effectively.

RLD : No

TE Code :

EMTRICITABINE; TENOFOVIR ALAFENAMIDE FUMARATE

Brand Name : EMTRICITABINE AND TENOFOVIR ALAFENAMIDE FUMARATE

Dosage Form : TABLET;ORAL

Dosage Strength : 120MG;EQ 15MG BASE

Approval Date : 2024-05-17

Application Number : 214053

RX/OTC/DISCN : DISCN

RLD : No

TE Code :

Boost your online visibility by uploading your products, APIs, FDFs, intermediates, excipients, and services for free on PharmaCompass.

Rank higher among suppliers and expand your reach across the internet efficiently and cost-effectively.

Boost your online visibility by uploading your products, APIs, FDFs, intermediates, excipients, and services for free on PharmaCompass.

Rank higher among suppliers and expand your reach across the internet efficiently and cost-effectively.

RLD : No

TE Code : AB

EMTRICITABINE; TENOFOVIR DISOPROXIL FUMARATE

Brand Name : EMTRICITABINE AND TENOFOVIR DISOPROXIL FUMARATE

Dosage Form : TABLET;ORAL

Dosage Strength : 200MG;300MG

Approval Date : 2018-01-26

Application Number : 90513

RX/OTC/DISCN : RX

RLD : No

TE Code : AB

Boost your online visibility by uploading your products, APIs, FDFs, intermediates, excipients, and services for free on PharmaCompass.

Rank higher among suppliers and expand your reach across the internet efficiently and cost-effectively.

Boost your online visibility by uploading your products, APIs, FDFs, intermediates, excipients, and services for free on PharmaCompass.

Rank higher among suppliers and expand your reach across the internet efficiently and cost-effectively.

RLD :

TE Code :

EMTRICITABINE, TENOFOVIR ALAFENAMIDE

Brand Name : EMTRICITABINE AND TENOFOVIR ALAFENAMIDE

Dosage Form : TABLET

Dosage Strength : 15MG

Approval Date :

Application Number : 211680

RX/OTC/DISCN :

RLD :

TE Code :

Boost your online visibility by uploading your products, APIs, FDFs, intermediates, excipients, and services for free on PharmaCompass.

Rank higher among suppliers and expand your reach across the internet efficiently and cost-effectively.

Boost your online visibility by uploading your products, APIs, FDFs, intermediates, excipients, and services for free on PharmaCompass.

Rank higher among suppliers and expand your reach across the internet efficiently and cost-effectively.

RLD : Yes

TE Code : AB

EMTRICITABINE; TENOFOVIR DISOPROXIL FUMARATE

Brand Name : TRUVADA

Dosage Form : TABLET;ORAL

Dosage Strength : 100MG;150MG

Approval Date : 2016-03-10

Application Number : 21752

RX/OTC/DISCN : RX

RLD : Yes

TE Code : AB

Boost your online visibility by uploading your products, APIs, FDFs, intermediates, excipients, and services for free on PharmaCompass.

Rank higher among suppliers and expand your reach across the internet efficiently and cost-effectively.

Boost your online visibility by uploading your products, APIs, FDFs, intermediates, excipients, and services for free on PharmaCompass.

Rank higher among suppliers and expand your reach across the internet efficiently and cost-effectively.

RLD : Yes

TE Code : AB

EMTRICITABINE; RILPIVIRINE HYDROCHLORIDE; TENOFOVIR DISOPROXIL FUMARATE

Brand Name : COMPLERA

Dosage Form : TABLET;ORAL

Dosage Strength : 200MG;EQ 25MG BASE;300MG

Approval Date : 2011-08-10

Application Number : 202123

RX/OTC/DISCN : RX

RLD : Yes

TE Code : AB

Boost your online visibility by uploading your products, APIs, FDFs, intermediates, excipients, and services for free on PharmaCompass.

Rank higher among suppliers and expand your reach across the internet efficiently and cost-effectively.

Boost your online visibility by uploading your products, APIs, FDFs, intermediates, excipients, and services for free on PharmaCompass.

Rank higher among suppliers and expand your reach across the internet efficiently and cost-effectively.

RLD : No

TE Code : AB

EMTRICITABINE; TENOFOVIR ALAFENAMIDE FUMARATE

Brand Name : EMTRICITABINE AND TENOFOVIR ALAFENAMIDE FUMARATE

Dosage Form : TABLET;ORAL

Dosage Strength : 200MG;EQ 25MG BASE

Approval Date : 2024-12-13

Application Number : 213926

RX/OTC/DISCN : RX

RLD : No

TE Code : AB

Boost your online visibility by uploading your products, APIs, FDFs, intermediates, excipients, and services for free on PharmaCompass.

Rank higher among suppliers and expand your reach across the internet efficiently and cost-effectively.

Boost your online visibility by uploading your products, APIs, FDFs, intermediates, excipients, and services for free on PharmaCompass.

Rank higher among suppliers and expand your reach across the internet efficiently and cost-effectively.

RLD :

TE Code :

Brand Name : EMTRICITABINE

Dosage Form : CAPSULE; ORAL

Dosage Strength : 200MG

Approval Date :

Application Number : 90488

RX/OTC/DISCN :

RLD :

TE Code :

Boost your online visibility by uploading your products, APIs, FDFs, intermediates, excipients, and services for free on PharmaCompass.

Rank higher among suppliers and expand your reach across the internet efficiently and cost-effectively.

Boost your online visibility by uploading your products, APIs, FDFs, intermediates, excipients, and services for free on PharmaCompass.

Rank higher among suppliers and expand your reach across the internet efficiently and cost-effectively.

RLD :

TE Code :

EMTRICITABINE; TENOFOVIR DISOPROXIL FUMARATE; NEVIRAPINE

Brand Name : EMTRICITABINE;TENOFOVIR DISOPROXIL FUMARATE;NEVIRAPINE

Dosage Form : TABLET;ORAL

Dosage Strength : 200MG;300MG;200MG

Approval Date :

Application Number : 206042

RX/OTC/DISCN :

RLD :

TE Code :

FULL SCREEN VIEW Click here to open all results in a new tab [this preview display 10 results]

FULL SCREEN VIEW Click here to open all results in a new tab [this preview display 10 results] Boost your online visibility by uploading your products, APIs, FDFs, intermediates, excipients, and services for free on PharmaCompass.

Rank higher among suppliers and expand your reach across the internet efficiently and cost-effectively.

Boost your online visibility by uploading your products, APIs, FDFs, intermediates, excipients, and services for free on PharmaCompass.

Rank higher among suppliers and expand your reach across the internet efficiently and cost-effectively.

Regulatory Info : Originator

Registration Country : South Africa

Brand Name : Truvada

Dosage Form : TAB

Dosage Strength : 200mg

Packaging : 30X1mg

Approval Date :

Application Number :

Regulatory Info : Originator

Registration Country : South Africa

Boost your online visibility by uploading your products, APIs, FDFs, intermediates, excipients, and services for free on PharmaCompass.

Rank higher among suppliers and expand your reach across the internet efficiently and cost-effectively.

Boost your online visibility by uploading your products, APIs, FDFs, intermediates, excipients, and services for free on PharmaCompass.

Rank higher among suppliers and expand your reach across the internet efficiently and cost-effectively.

Regulatory Info : Generic

Registration Country : South Africa

Brand Name : Tencitab

Dosage Form : TAB

Dosage Strength : 200mg

Packaging : 30X1mg

Approval Date :

Application Number :

Regulatory Info : Generic

Registration Country : South Africa

Boost your online visibility by uploading your products, APIs, FDFs, intermediates, excipients, and services for free on PharmaCompass.

Rank higher among suppliers and expand your reach across the internet efficiently and cost-effectively.

Boost your online visibility by uploading your products, APIs, FDFs, intermediates, excipients, and services for free on PharmaCompass.

Rank higher among suppliers and expand your reach across the internet efficiently and cost-effectively.

Regulatory Info : Generic

Registration Country : South Africa

Brand Name : Tribuss

Dosage Form : FCT

Dosage Strength : 200mg

Packaging : 30X1mg

Approval Date :

Application Number :

Regulatory Info : Generic

Registration Country : South Africa

Regulatory Info : Generic

Registration Country : South Africa

Brand Name : Teerenz

Dosage Form : TAB

Dosage Strength : 200mg

Packaging : 30X1mg

Approval Date :

Application Number :

Regulatory Info : Generic

Registration Country : South Africa

Boost your online visibility by uploading your products, APIs, FDFs, intermediates, excipients, and services for free on PharmaCompass.

Rank higher among suppliers and expand your reach across the internet efficiently and cost-effectively.

Boost your online visibility by uploading your products, APIs, FDFs, intermediates, excipients, and services for free on PharmaCompass.

Rank higher among suppliers and expand your reach across the internet efficiently and cost-effectively.

Regulatory Info : Generic

Registration Country : South Africa

Brand Name : Adco Emtevir

Dosage Form : TAB

Dosage Strength : 200mg

Packaging : 60X1mg

Approval Date :

Application Number :

Regulatory Info : Generic

Registration Country : South Africa

Boost your online visibility by uploading your products, APIs, FDFs, intermediates, excipients, and services for free on PharmaCompass.

Rank higher among suppliers and expand your reach across the internet efficiently and cost-effectively.

Boost your online visibility by uploading your products, APIs, FDFs, intermediates, excipients, and services for free on PharmaCompass.

Rank higher among suppliers and expand your reach across the internet efficiently and cost-effectively.

Regulatory Info : Generic

Registration Country : South Africa

Brand Name : Rizene

Dosage Form : FCT

Dosage Strength : 300mg

Packaging : 30X1mg

Approval Date :

Application Number :

Regulatory Info : Generic

Registration Country : South Africa

Boost your online visibility by uploading your products, APIs, FDFs, intermediates, excipients, and services for free on PharmaCompass.

Rank higher among suppliers and expand your reach across the internet efficiently and cost-effectively.

Boost your online visibility by uploading your products, APIs, FDFs, intermediates, excipients, and services for free on PharmaCompass.

Rank higher among suppliers and expand your reach across the internet efficiently and cost-effectively.

Regulatory Info : Generic

Registration Country : South Africa

Brand Name : Altaeda

Dosage Form : FCT

Dosage Strength : 200mg

Packaging : 30X1mg

Approval Date :

Application Number :

Regulatory Info : Generic

Registration Country : South Africa

Boost your online visibility by uploading your products, APIs, FDFs, intermediates, excipients, and services for free on PharmaCompass.

Rank higher among suppliers and expand your reach across the internet efficiently and cost-effectively.

Boost your online visibility by uploading your products, APIs, FDFs, intermediates, excipients, and services for free on PharmaCompass.

Rank higher among suppliers and expand your reach across the internet efficiently and cost-effectively.

Regulatory Info : Generic

Registration Country : South Africa

Brand Name : TABEX

Dosage Form : FCT

Dosage Strength : 200mg

Packaging : 30X1mg

Approval Date :

Application Number :

Regulatory Info : Generic

Registration Country : South Africa

Boost your online visibility by uploading your products, APIs, FDFs, intermediates, excipients, and services for free on PharmaCompass.

Rank higher among suppliers and expand your reach across the internet efficiently and cost-effectively.

Boost your online visibility by uploading your products, APIs, FDFs, intermediates, excipients, and services for free on PharmaCompass.

Rank higher among suppliers and expand your reach across the internet efficiently and cost-effectively.

Regulatory Info : Generic

Registration Country : South Africa

Brand Name : HETRIPCO

Dosage Form : FCT

Dosage Strength : 200mg

Packaging : 90X1mg

Approval Date :

Application Number :

Regulatory Info : Generic

Registration Country : South Africa

Boost your online visibility by uploading your products, APIs, FDFs, intermediates, excipients, and services for free on PharmaCompass.

Rank higher among suppliers and expand your reach across the internet efficiently and cost-effectively.

Boost your online visibility by uploading your products, APIs, FDFs, intermediates, excipients, and services for free on PharmaCompass.

Rank higher among suppliers and expand your reach across the internet efficiently and cost-effectively.

Regulatory Info : Generic

Registration Country : South Africa

Brand Name : Triemta Tablets

Dosage Form : FCT

Dosage Strength : 200mg

Packaging : 30X1mg

Approval Date :

Application Number :

Regulatory Info : Generic

Registration Country : South Africa

FULL SCREEN VIEW Click here to open all results in a new tab [this preview display 10 results]

FULL SCREEN VIEW Click here to open all results in a new tab [this preview display 10 results]DRUG PRODUCT COMPOSITIONS

Related Excipient Companies

Excipients by Applications

Global Sales Information

Elvitegravir, Cobicistat, Emtricitabine, Tenofovir Alafenamide

Elvitegravir, Cobicistat, Emtricitabine, Tenofovir Alafenamide

Main Therapeutic Indication : Infectious Diseases

Currency : USD

2020 Revenue in Millions : 196

2019 Revenue in Millions : 369

Growth (%) : -47

Bictegravir, Emtricitabine, Tenofovir Alafenamide

Main Therapeutic Indication : Infectious Diseases

Currency : USD

2020 Revenue in Millions : 3,338

2019 Revenue in Millions : 3,931

Growth (%) : -15

Elvitegravir, Cobicistat, Emtricitabine, Tenofovir Alafenamide

Elvitegravir, Cobicistat, Emtricitabine, Tenofovir Alafenamide

Main Therapeutic Indication : Infectious Diseases

Currency : USD

2020 Revenue in Millions : 2,184

2019 Revenue in Millions : 2,110

Growth (%) : 4

Main Therapeutic Indication : Infectious Diseases

Currency : USD

2020 Revenue in Millions : 349

2019 Revenue in Millions : 600

Growth (%) : -42

Main Therapeutic Indication : Infectious Diseases

Currency : USD

2020 Revenue in Millions : 269

2019 Revenue in Millions : 406

Growth (%) : -34

Elvitegravir, Cobicistat, Emtricitabine, Tenofovir Alafenamide

Elvitegravir, Cobicistat, Emtricitabine, Tenofovir Alafenamide

Main Therapeutic Indication : Infectious Diseases

Currency : USD

2020 Revenue in Millions : 3,338

2019 Revenue in Millions : 3,931

Growth (%) : -15

Main Therapeutic Indication : Infectious Diseases

Currency : USD

2020 Revenue in Millions : 3,338

2019 Revenue in Millions : 3,931

Growth (%) : -15

Bictegravir, Emtricitabine, Tenofovir Alafenamide

Main Therapeutic Indication : Infectious Diseases

Currency : USD

2020 Revenue in Millions : 488

2019 Revenue in Millions : 379

Growth (%) : 29

Bictegravir, Emtricitabine, Tenofovir Alafenamide

Main Therapeutic Indication : Infectious Diseases

Currency : USD

2020 Revenue in Millions : 1,861

2019 Revenue in Millions : 1,500

Growth (%) : 24

Main Therapeutic Indication : Infectious Diseases

Currency : USD

2020 Revenue in Millions : 488

2019 Revenue in Millions : 379

Growth (%) : 29

FULL SCREEN VIEW Click here to open all results in a new tab [this preview display 10 results]

FULL SCREEN VIEW Click here to open all results in a new tab [this preview display 10 results]Market Place

Reply

20 Jun 2023

Reply

25 Jul 2022

Reply

14 Jul 2022

Reply

29 Jun 2022

Reply

25 Nov 2019

Reply

13 Jul 2019

Reply

21 Oct 2018

Reply

31 Jul 2018

FULL SCREEN VIEW Click here to open all results in a new tab [this preview display 10 results]

FULL SCREEN VIEW Click here to open all results in a new tab [this preview display 10 results]

Patents & EXCLUSIVITIES

Patent Expiration Date : 2033-12-19

BICTEGRAVIR SODIUM; EMTRICITABINE; TENOFOVIR ALAFENAMIDE FUMARATE

US Patent Number : 9216996

Drug Substance Claim : Y

Drug Product Claim : Y

Application Number : 210251

Patent Use Code :

Delist Requested :

Patent Use Description :

Patent Expiration Date : 2033-12-19

Patent Expiration Date : 2025-12-09

EMTRICITABINE; RILPIVIRINE HYDROCHLORIDE; TENOFOVIR DISOPROXIL FUMARATE

US Patent Number : 8841310

Drug Substance Claim :

Drug Product Claim : Y

Application Number : 202123

Patent Use Code : U-257

Delist Requested :

Patent Use Description : TREATMENT OF HIV INFEC...

Patent Expiration Date : 2025-12-09

Patent Expiration Date : 2025-07-07

EMTRICITABINE; TENOFOVIR ALAFENAMIDE FUMARATE

US Patent Number : 7390791*PED

Drug Substance Claim :

Drug Product Claim :

Application Number : 208215

Patent Use Code :

Delist Requested :

Patent Use Description :

Patent Expiration Date : 2025-07-07

Patent Expiration Date : 2027-02-27

COBICISTAT; ELVITEGRAVIR; EMTRICITABINE; TENOFOVIR ALAFENAMIDE FUMARATE

US Patent Number : 7176220*PED

Drug Substance Claim :

Drug Product Claim :

Application Number : 207561

Patent Use Code :

Delist Requested :

Patent Use Description :

Patent Expiration Date : 2027-02-27

Patent Expiration Date : 2025-07-07

BICTEGRAVIR SODIUM; EMTRICITABINE; TENOFOVIR ALAFENAMIDE FUMARATE

US Patent Number : 7390791*PED

Drug Substance Claim :

Drug Product Claim :

Application Number : 210251

Patent Use Code :

Delist Requested :

Patent Use Description :

Patent Expiration Date : 2025-07-07

Patent Expiration Date : 2030-10-30

COBICISTAT; ELVITEGRAVIR; EMTRICITABINE; TENOFOVIR DISOPROXIL FUMARATE

US Patent Number : 8633219*PED

Drug Substance Claim :

Drug Product Claim :

Application Number : 203100

Patent Use Code :

Delist Requested :

Patent Use Description :

Patent Expiration Date : 2030-10-30

Patent Expiration Date : 2025-04-21

EMTRICITABINE; RILPIVIRINE HYDROCHLORIDE; TENOFOVIR DISOPROXIL FUMARATE

US Patent Number : 7125879

Drug Substance Claim : Y

Drug Product Claim : Y

Application Number : 202123

Patent Use Code : U-257

Delist Requested :

Patent Use Description : TREATMENT OF HIV INFEC...

Patent Expiration Date : 2025-04-21

Patent Expiration Date : 2032-08-15

EMTRICITABINE; TENOFOVIR ALAFENAMIDE FUMARATE

US Patent Number : 9296769

Drug Substance Claim : Y

Drug Product Claim : Y

Application Number : 208215

Patent Use Code : U-1663

Delist Requested :

Patent Use Description : TREATMENT OF HIV-1 INF...

Patent Expiration Date : 2032-08-15

Patent Expiration Date : 2033-12-19

BICTEGRAVIR SODIUM; EMTRICITABINE; TENOFOVIR ALAFENAMIDE FUMARATE

US Patent Number : 9216996

Drug Substance Claim : Y

Drug Product Claim : Y

Application Number : 210251

Patent Use Code :

Delist Requested :

Patent Use Description :

Patent Expiration Date : 2033-12-19

Patent Expiration Date : 2030-04-30

COBICISTAT; ELVITEGRAVIR; EMTRICITABINE; TENOFOVIR ALAFENAMIDE FUMARATE

US Patent Number : 8633219

Drug Substance Claim :

Drug Product Claim : Y

Application Number : 207561

Patent Use Code : U-257

Delist Requested :

Patent Use Description : TREATMENT OF HIV INFEC...

Patent Expiration Date : 2030-04-30

FULL SCREEN VIEW Click here to open all results in a new tab [this preview display 10 results]

FULL SCREEN VIEW Click here to open all results in a new tab [this preview display 10 results]REF. STANDARDS & IMPURITIES

ABOUT THIS PAGE

100

PharmaCompass offers a list of Emtricitabine API manufacturers, exporters & distributors, which can be sorted by GMP, USDMF, JDMF, KDMF, CEP (COS), WC, Price,and more, enabling you to easily find the right Emtricitabine manufacturer or Emtricitabine supplier for your needs.

Send us enquiries for free, and we will assist you in establishing a direct connection with your preferred Emtricitabine manufacturer or Emtricitabine supplier.

PharmaCompass also assists you with knowing the Emtricitabine API Price utilized in the formulation of products. Emtricitabine API Price is not always fixed or binding as the Emtricitabine Price is obtained through a variety of data sources. The Emtricitabine Price can also vary due to multiple factors, including market conditions, regulatory modifications, or negotiated pricing deals.

A Emtricitabine manufacturer is defined as any person or entity involved in the manufacture, preparation, processing, compounding or propagation of Emtricitabine, including repackagers and relabelers. The FDA regulates Emtricitabine manufacturers to ensure that their products comply with relevant laws and regulations and are safe and effective to use. Emtricitabine API Manufacturers are required to adhere to Good Manufacturing Practices (GMP) to ensure that their products are consistently manufactured to meet established quality criteria.

click here to find a list of Emtricitabine manufacturers with USDMF, JDMF, KDMF, CEP, GMP, COA and API Price related information on PhamaCompass.

A Emtricitabine supplier is an individual or a company that provides Emtricitabine active pharmaceutical ingredient (API) or Emtricitabine finished formulations upon request. The Emtricitabine suppliers may include Emtricitabine API manufacturers, exporters, distributors and traders.

click here to find a list of Emtricitabine suppliers with USDMF, JDMF, KDMF, CEP, GMP, COA and API Price related information on PharmaCompass.

A Emtricitabine DMF (Drug Master File) is a document detailing the whole manufacturing process of Emtricitabine active pharmaceutical ingredient (API) in detail. Different forms of Emtricitabine DMFs exist exist since differing nations have different regulations, such as Emtricitabine USDMF, ASMF (EDMF), JDMF, CDMF, etc.

A Emtricitabine DMF submitted to regulatory agencies in the US is known as a USDMF. Emtricitabine USDMF includes data on Emtricitabine's chemical properties, information on the facilities and procedures used, and details about packaging and storage. The Emtricitabine USDMF is kept confidential to protect the manufacturer’s intellectual property.

click here to find a list of Emtricitabine suppliers with USDMF on PharmaCompass.

The Pharmaceuticals and Medical Devices Agency (PMDA) established the Japan Drug Master File (JDMF), also known as the Master File (MF), to permit Japanese and foreign manufacturers of drug substances, intermediates, excipients, raw materials, and packaging materials (‘Products’) to voluntarily register confidential information about the production and management of their products in Japan.

The Emtricitabine Drug Master File in Japan (Emtricitabine JDMF) empowers Emtricitabine API manufacturers to present comprehensive information (e.g., production methods, data, etc.) to the review authority, i.e., PMDA (Pharmaceuticals & Medical Devices Agency).

PMDA reviews the Emtricitabine JDMF during the approval evaluation for pharmaceutical products. At the time of Emtricitabine JDMF registration, PMDA checks if the format is accurate, if the necessary items have been included (application), and if data has been attached.

click here to find a list of Emtricitabine suppliers with JDMF on PharmaCompass.

In Korea, the Ministry of Food and Drug Safety (MFDS) is in charge of regulating pharmaceutical products and services.

Pharmaceutical companies submit a Emtricitabine Drug Master File in Korea (Emtricitabine KDMF) to the MFDS, which includes comprehensive information about the production, processing, facilities, materials, packaging, and testing of Emtricitabine. The MFDS reviews the Emtricitabine KDMF as part of the drug registration process and uses the information provided in the Emtricitabine KDMF to evaluate the safety and efficacy of the drug.

After submitting a Emtricitabine KDMF to the MFDS, the registered manufacturer can provide importers or distributors with the registration number without revealing confidential information to Korean business partners. Applicants seeking to register their Emtricitabine API can apply through the Korea Drug Master File (KDMF).

click here to find a list of Emtricitabine suppliers with KDMF on PharmaCompass.

A Emtricitabine written confirmation (Emtricitabine WC) is an official document issued by a regulatory agency to a Emtricitabine manufacturer, verifying that the manufacturing facility of a Emtricitabine active pharmaceutical ingredient (API) adheres to the Good Manufacturing Practices (GMP) regulations of the importing country. When exporting Emtricitabine APIs or Emtricitabine finished pharmaceutical products to another nation, regulatory agencies frequently require a Emtricitabine WC (written confirmation) as part of the regulatory process.

click here to find a list of Emtricitabine suppliers with Written Confirmation (WC) on PharmaCompass.

National Drug Code is a comprehensive database maintained by the FDA that contains information on all drugs marketed in the US. This directory includes information about finished drug products, unfinished drug products, and compounded drug products, including those containing Emtricitabine as an active pharmaceutical ingredient (API).

The FDA updates the NDC directory daily. The NDC numbers for Emtricitabine API and other APIs are published in this directory by the FDA.

The NDC unfinished drugs database includes product listing information submitted for all unfinished drugs, such as active pharmaceutical ingredients (APIs), drugs intended for further processing and bulk drug substances for compounding.

Pharmaceutical companies that manufacture Emtricitabine as an active pharmaceutical ingredient (API) must furnish the FDA with an updated record of all drugs that they produce, prepare, propagate, compound, or process for commercial distribution in the US at their facilities.

The NDC directory also contains data on finished compounded human drug products that contain Emtricitabine and are produced by outsourcing facilities. While these outsourcing facilities are not mandated to assign a Emtricitabine NDC to their finished compounded human drug products, they may choose to do so.

click here to find a list of Emtricitabine suppliers with NDC on PharmaCompass.

Emtricitabine Active pharmaceutical ingredient (API) is produced in GMP-certified manufacturing facility.

GMP stands for Good Manufacturing Practices, which is a system used in the pharmaceutical industry to make sure that goods are regularly produced and monitored in accordance with quality standards. The FDA’s current Good Manufacturing Practices requirements are referred to as cGMP or current GMP which indicates that the company follows the most recent GMP specifications. The World Health Organization (WHO) has its own set of GMP guidelines, called the WHO GMP. Different countries can also set their own guidelines for GMP like China (Chinese GMP) or the EU (EU GMP).

PharmaCompass offers a list of Emtricitabine GMP manufacturers, exporters & distributors, which can be sorted by USDMF, JDMF, KDMF, CEP (COS), WC, API price, and more, enabling you to easily find the right Emtricitabine GMP manufacturer or Emtricitabine GMP API supplier for your needs.

A Emtricitabine CoA (Certificate of Analysis) is a formal document that attests to Emtricitabine's compliance with Emtricitabine specifications and serves as a tool for batch-level quality control.

Emtricitabine CoA mostly includes findings from lab analyses of a specific batch. For each Emtricitabine CoA document that a company creates, the USFDA specifies specific requirements, such as supplier information, material identification, transportation data, evidence of conformity and signature data.

Emtricitabine may be tested according to a variety of international standards, such as European Pharmacopoeia (Emtricitabine EP), Emtricitabine JP (Japanese Pharmacopeia) and the US Pharmacopoeia (Emtricitabine USP).