Synopsis

Synopsis

0

CEP/COS

0

JDMF

0

EU WC

0

KDMF

0

VMF

0

EDQM

0

USP

0

JP

0

Others

0

Europe

0

Canada

0

Australia

0

South Africa

DRUG PRODUCT COMPOSITIONS

US Medicaid

NA

Annual Reports

NA

Regulatory FDF Prices

NA

0

FDF

0

Weekly News Recap #Phispers

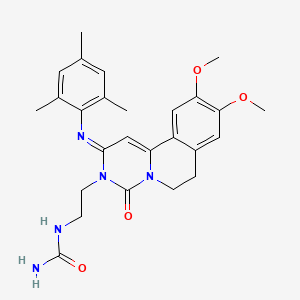

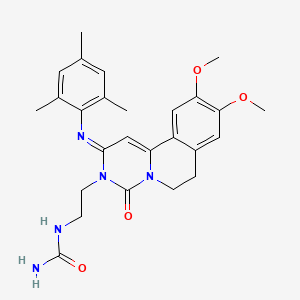

1. 9,10-dimethoxy-2-(2,4,6-trimethylphenylimino)-3-(n-carbamoyl-2-aminoethyl)-3,4,6,7-tetrahydro-2h-pyrimidino(6,1-a)isoquinolin-4-one

2. Rpl 554

3. Rpl-554

4. Rpl554

1. Rpl-554

2. 298680-25-8

3. Rpl554

4. 1884461-72-6

5. Ensifentrine [inn]

6. Ensifentrine [usan]

7. Ls-193855

8. 3e3d8t1gix

9. Ls-193,855

10. A]isoquinolin-3(4h)-yl}ethyl)urea

11. (e)-1-(2-(2-(mesitylimino)-9,10-dimethoxy-4-oxo-6,7-dihydro-2h-pyrimido[6,1-a]isoquinolin-3(4h)-yl)ethyl)urea

12. 2-[9,10-dimethoxy-4-oxo-2-(2,4,6-trimethylphenyl)imino-6,7-dihydropyrimido[6,1-a]isoquinolin-3-yl]ethylurea

13. Trimethylphenyl)imino]-6,7-dihydro-2h-pyrimido[6,1-

14. N-(2-{(2e)-9,10-dimethoxy-4-oxo-2-[(2,4,6-

15. 2-(9,10-dimethoxy-4-oxo-2-(2,4,6-trimethylphenyl)imino-6,7-dihydropyrimido(6,1-a)isoquinolin-3-yl)ethylurea

16. N-(2-((2e)-9,10-dimetoxi-4-oxo-2-((2,4,6-trimetilfenil)imino)-6,7-dihidro-2h-pirimido(6,1-a)isoquinolein-3(4h)-il)etil)urea

17. Urea, N-(2-(6,7-dihydro-9,10-dimethoxy-4-oxo-2-((2,4,6-trimethylphenyl)imino)-2h-pyrimido(6,1-a)isoquinolin-3(4h)-yl)ethyl)-

18. Unii-3e3d8t1gix

19. Vmx-554

20. Rpl-554;ensifentrinum

21. Ensifentrine (usan/inn)

22. Ensifentrine [who-dd]

23. Schembl625876

24. Chembl4594287

25. Schembl20720900

26. Gtpl11865

27. Dtxsid00183983

28. Bcp31840

29. Ex-a6633

30. Who 10726

31. Sb19810

32. D11743

33. A937318

34. Q7277486

35. Ensifentrina; Ensifentrinum;rpl-554;rpl554;rpl 554

36. 9,10-dimethoxy-2-(2,4,6-trimethylphenylimino)-3-(n-carbamoyl-2-aminoethyl)-3,4,6,7-tetrahydro-2h-pyrimidino(6,1-a)isoquinolin-4-one

37. 9,10-dimethoxy-2-(2,4,6-trimethylphenylimino)-3-(n-carbamoyl-2-aminoethyl)-3,4,6,7-tetrahydro-2h-pyrimido[6,1-a]isoquinolin-4-one

38. 9,10-dimethoxy-2-(2,4,6-trimethylphenylimino)3-(n-carbamoyl-2-aminoethyl)-3,4,6,7-tetrahydro-2h-pyrimido[6,1-a]isoquinolin-4-one

39. 9,10-dimethoxy-2-(2.4.6-trimethylphenylimino)-3-(n-carbamoyl-2-aminoethyl)-3,4,6,7-tetrahydro-2h-pyrimido[6.1-a]isoquinolin-4-one

| Molecular Weight | 477.6 g/mol |

|---|---|

| Molecular Formula | C26H31N5O4 |

| XLogP3 | 2.7 |

| Hydrogen Bond Donor Count | 2 |

| Hydrogen Bond Acceptor Count | 5 |

| Rotatable Bond Count | 6 |

| Exact Mass | 477.23760449 g/mol |

| Monoisotopic Mass | 477.23760449 g/mol |

| Topological Polar Surface Area | 110 Ų |

| Heavy Atom Count | 35 |

| Formal Charge | 0 |

| Complexity | 849 |

| Isotope Atom Count | 0 |

| Defined Atom Stereocenter Count | 0 |

| Undefined Atom Stereocenter Count | 0 |

| Defined Bond Stereocenter Count | 0 |

| Undefined Bond Stereocenter Count | 0 |

| Covalently Bonded Unit Count | 1 |

NDC Package Code : 64567-0033

Start Marketing Date : 2025-10-14

End Marketing Date : 2027-12-31

Dosage Form (Strength) : POWDER (1kg/kg)

Marketing Category : BULK INGREDIENT

Metrochem has been delivering customized volume & quality products to customers across the world, taking utmost care of their needs.

Metrochem has been delivering customized volume & quality products to customers across the world, taking utmost care of their needs.

Delivering quality and niche Active Pharmaceutical Ingredients across the global from our USFDA-approved facility.

Delivering quality and niche Active Pharmaceutical Ingredients across the global from our USFDA-approved facility.

GDUFA

DMF Review : N/A

Rev. Date :

Pay. Date :

DMF Number : 41421

Submission : 2025-03-17

Status : Active

Type : II

FULL SCREEN VIEW Click here to open all results in a new tab [this preview display 10 results]

FULL SCREEN VIEW Click here to open all results in a new tab [this preview display 10 results]

GDUFA

DMF Review : N/A

Rev. Date :

Pay. Date :

DMF Number : 41421

Submission : 2025-03-17

Status : Active

Type : II

GDUFA

DMF Review : N/A

Rev. Date :

Pay. Date :

DMF Number : 41432

Submission : 2025-03-25

Status : Active

Type : II

GDUFA

DMF Review : N/A

Rev. Date :

Pay. Date :

DMF Number : 42916

Submission : 2025-11-26

Status : Active

Type : II

FULL SCREEN VIEW Click here to open all results in a new tab [this preview display 10 results]

FULL SCREEN VIEW Click here to open all results in a new tab [this preview display 10 results]

API/FDF Prices: Book a Demo to explore the features and consider upgrading later

API Imports and Exports

| Importing Country | Total Quantity (KGS) |

Average Price (USD/KGS) |

Number of Transactions |

|---|

Upgrade, download data, analyse, strategize, subscribe with us

Boost your online visibility by uploading your products, APIs, FDFs, intermediates, excipients, and services for free on PharmaCompass.

Rank higher among suppliers and expand your reach across the internet efficiently and cost-effectively.

Boost your online visibility by uploading your products, APIs, FDFs, intermediates, excipients, and services for free on PharmaCompass.

Rank higher among suppliers and expand your reach across the internet efficiently and cost-effectively.

Details:

Through the acquisition Merck will add Ohtuvayre (ensifentrine), a first-in-class selective dual inhibitor of PDE3 and PDE4, to its growing cardio-pulmonary pipeline and portfolio.

Lead Product(s): Ensifentrine,Inapplicable

Therapeutic Area: Pulmonary/Respiratory Diseases Brand Name: Ohtuvayre

Study Phase: Approved FDFProduct Type: Miscellaneous

Sponsor: Merck & Co

Deal Size: $10,000.0 million Upfront Cash: Undisclosed

Deal Type: Acquisition October 07, 2025

Boost your online visibility by uploading your products, APIs, FDFs, intermediates, excipients, and services for free on PharmaCompass.

Rank higher among suppliers and expand your reach across the internet efficiently and cost-effectively.

Boost your online visibility by uploading your products, APIs, FDFs, intermediates, excipients, and services for free on PharmaCompass.

Rank higher among suppliers and expand your reach across the internet efficiently and cost-effectively.

Lead Product(s) : Ensifentrine,Inapplicable

Therapeutic Area : Pulmonary/Respiratory Diseases

Highest Development Status : Approved FDF

Partner/Sponsor/Collaborator : Merck & Co

Deal Size : $10,000.0 million

Deal Type : Acquisition

Merck completes acquisition of Verona Pharma

Details : Through the acquisition Merck will add Ohtuvayre (ensifentrine), a first-in-class selective dual inhibitor of PDE3 and PDE4, to its growing cardio-pulmonary pipeline and portfolio.

Product Name : Ohtuvayre

Product Type : Miscellaneous

Upfront Cash : Undisclosed

October 07, 2025

Boost your online visibility by uploading your products, APIs, FDFs, intermediates, excipients, and services for free on PharmaCompass.

Rank higher among suppliers and expand your reach across the internet efficiently and cost-effectively.

Boost your online visibility by uploading your products, APIs, FDFs, intermediates, excipients, and services for free on PharmaCompass.

Rank higher among suppliers and expand your reach across the internet efficiently and cost-effectively.

Details:

Ensifentrine is a Other Small Molecule drug candidate, which is currently being evaluated in Phase II clinical studies for the treatment of Pulmonary Disease, Chronic Obstructive.

Lead Product(s): Ensifentrine,Glycopyrronium Bromide

Therapeutic Area: Pulmonary/Respiratory Diseases Brand Name: Undisclosed

Study Phase: Phase IIProduct Type: Miscellaneous

Sponsor: Undisclosed

Deal Size: Inapplicable Upfront Cash: Inapplicable

Deal Type: Inapplicable August 20, 2025

Boost your online visibility by uploading your products, APIs, FDFs, intermediates, excipients, and services for free on PharmaCompass.

Rank higher among suppliers and expand your reach across the internet efficiently and cost-effectively.

Boost your online visibility by uploading your products, APIs, FDFs, intermediates, excipients, and services for free on PharmaCompass.

Rank higher among suppliers and expand your reach across the internet efficiently and cost-effectively.

Lead Product(s) : Ensifentrine,Glycopyrronium Bromide

Therapeutic Area : Pulmonary/Respiratory Diseases

Highest Development Status : Phase II

Partner/Sponsor/Collaborator : Undisclosed

Deal Size : Inapplicable

Deal Type : Inapplicable

Ensifentrine ± Glycopyrrolate FDC PK, PD & Safety in COPD Patients

Details : Ensifentrine is a Other Small Molecule drug candidate, which is currently being evaluated in Phase II clinical studies for the treatment of Pulmonary Disease, Chronic Obstructive.

Product Name : Undisclosed

Product Type : Miscellaneous

Upfront Cash : Inapplicable

August 20, 2025

Boost your online visibility by uploading your products, APIs, FDFs, intermediates, excipients, and services for free on PharmaCompass.

Rank higher among suppliers and expand your reach across the internet efficiently and cost-effectively.

Boost your online visibility by uploading your products, APIs, FDFs, intermediates, excipients, and services for free on PharmaCompass.

Rank higher among suppliers and expand your reach across the internet efficiently and cost-effectively.

Details:

Through this acquisition Merck will add Ohtuvayre (ensifentrine), a first-in-class selective dual inhibitor of PDE3 and PDE4, to its growing cardio-pulmonary pipeline and portfolio.

Lead Product(s): Ensifentrine

Therapeutic Area: Pulmonary/Respiratory Diseases Brand Name: Ohtuvayre

Study Phase: Approved FDFProduct Type: Miscellaneous

Sponsor: Merck & Co

Deal Size: $10,000.0 million Upfront Cash: Undisclosed

Deal Type: Acquisition July 09, 2025

Boost your online visibility by uploading your products, APIs, FDFs, intermediates, excipients, and services for free on PharmaCompass.

Rank higher among suppliers and expand your reach across the internet efficiently and cost-effectively.

Boost your online visibility by uploading your products, APIs, FDFs, intermediates, excipients, and services for free on PharmaCompass.

Rank higher among suppliers and expand your reach across the internet efficiently and cost-effectively.

Lead Product(s) : Ensifentrine

Therapeutic Area : Pulmonary/Respiratory Diseases

Highest Development Status : Approved FDF

Partner/Sponsor/Collaborator : Merck & Co

Deal Size : $10,000.0 million

Deal Type : Acquisition

Merck to Acquire Verona Pharma, Expanding its Portfolio to Include Ohtuvayre

Details : Through this acquisition Merck will add Ohtuvayre (ensifentrine), a first-in-class selective dual inhibitor of PDE3 and PDE4, to its growing cardio-pulmonary pipeline and portfolio.

Product Name : Ohtuvayre

Product Type : Miscellaneous

Upfront Cash : Undisclosed

July 09, 2025

Boost your online visibility by uploading your products, APIs, FDFs, intermediates, excipients, and services for free on PharmaCompass.

Rank higher among suppliers and expand your reach across the internet efficiently and cost-effectively.

Boost your online visibility by uploading your products, APIs, FDFs, intermediates, excipients, and services for free on PharmaCompass.

Rank higher among suppliers and expand your reach across the internet efficiently and cost-effectively.

Details:

Ensifentrine is a Other Small Molecule drug candidate, which is currently being evaluated in Phase II clinical studies for the treatment of Pulmonary Disease, Chronic Obstructive.

Lead Product(s): Ensifentrine,Glycopyrronium Bromide

Therapeutic Area: Pulmonary/Respiratory Diseases Brand Name: Undisclosed

Study Phase: Phase IIProduct Type: Miscellaneous

Sponsor: Undisclosed

Deal Size: Inapplicable Upfront Cash: Inapplicable

Deal Type: Inapplicable June 11, 2025

Boost your online visibility by uploading your products, APIs, FDFs, intermediates, excipients, and services for free on PharmaCompass.

Rank higher among suppliers and expand your reach across the internet efficiently and cost-effectively.

Boost your online visibility by uploading your products, APIs, FDFs, intermediates, excipients, and services for free on PharmaCompass.

Rank higher among suppliers and expand your reach across the internet efficiently and cost-effectively.

Lead Product(s) : Ensifentrine,Glycopyrronium Bromide

Therapeutic Area : Pulmonary/Respiratory Diseases

Highest Development Status : Phase II

Partner/Sponsor/Collaborator : Undisclosed

Deal Size : Inapplicable

Deal Type : Inapplicable

Phase IIb Study of Ensifentrine-Glycopyrrolate Fixed-dose Combo in COPD

Details : Ensifentrine is a Other Small Molecule drug candidate, which is currently being evaluated in Phase II clinical studies for the treatment of Pulmonary Disease, Chronic Obstructive.

Product Name : Undisclosed

Product Type : Miscellaneous

Upfront Cash : Inapplicable

June 11, 2025

Boost your online visibility by uploading your products, APIs, FDFs, intermediates, excipients, and services for free on PharmaCompass.

Rank higher among suppliers and expand your reach across the internet efficiently and cost-effectively.

Boost your online visibility by uploading your products, APIs, FDFs, intermediates, excipients, and services for free on PharmaCompass.

Rank higher among suppliers and expand your reach across the internet efficiently and cost-effectively.

Details:

Verona partnered with Ritedose for the development and manufacturing partner of Ohtuvayre (ensifentrine), a new novel product for Chronic Obstructive Pulmonary Disease.

Lead Product(s): Ensifentrine,Inapplicable

Therapeutic Area: Pulmonary/Respiratory Diseases Brand Name: Ohtuvayre

Study Phase: Approved FDFProduct Type: Miscellaneous

Sponsor: Verona Pharma

Deal Size: Undisclosed Upfront Cash: Undisclosed

Deal Type: Partnership September 17, 2024

Boost your online visibility by uploading your products, APIs, FDFs, intermediates, excipients, and services for free on PharmaCompass.

Rank higher among suppliers and expand your reach across the internet efficiently and cost-effectively.

Boost your online visibility by uploading your products, APIs, FDFs, intermediates, excipients, and services for free on PharmaCompass.

Rank higher among suppliers and expand your reach across the internet efficiently and cost-effectively.

Lead Product(s) : Ensifentrine,Inapplicable

Therapeutic Area : Pulmonary/Respiratory Diseases

Highest Development Status : Approved FDF

Partner/Sponsor/Collaborator : Verona Pharma

Deal Size : Undisclosed

Deal Type : Partnership

Ritedose Partners with Verona Pharma To Deliver COPD Drug Ohtuvayre

Details : Verona partnered with Ritedose for the development and manufacturing partner of Ohtuvayre (ensifentrine), a new novel product for Chronic Obstructive Pulmonary Disease.

Product Name : Ohtuvayre

Product Type : Miscellaneous

Upfront Cash : Undisclosed

September 17, 2024

Boost your online visibility by uploading your products, APIs, FDFs, intermediates, excipients, and services for free on PharmaCompass.

Rank higher among suppliers and expand your reach across the internet efficiently and cost-effectively.

Boost your online visibility by uploading your products, APIs, FDFs, intermediates, excipients, and services for free on PharmaCompass.

Rank higher among suppliers and expand your reach across the internet efficiently and cost-effectively.

Details:

Ensifentrine is a Other Small Molecule drug candidate, which is currently being evaluated in phase II clinical studies for the treatment of Bronchiectasis.

Lead Product(s): Ensifentrine,Inapplicable

Therapeutic Area: Pulmonary/Respiratory Diseases Brand Name: Undisclosed

Study Phase: Phase IIProduct Type: Miscellaneous

Sponsor: Undisclosed

Deal Size: Inapplicable Upfront Cash: Inapplicable

Deal Type: Inapplicable August 19, 2024

Boost your online visibility by uploading your products, APIs, FDFs, intermediates, excipients, and services for free on PharmaCompass.

Rank higher among suppliers and expand your reach across the internet efficiently and cost-effectively.

Boost your online visibility by uploading your products, APIs, FDFs, intermediates, excipients, and services for free on PharmaCompass.

Rank higher among suppliers and expand your reach across the internet efficiently and cost-effectively.

Lead Product(s) : Ensifentrine,Inapplicable

Therapeutic Area : Pulmonary/Respiratory Diseases

Highest Development Status : Phase II

Partner/Sponsor/Collaborator : Undisclosed

Deal Size : Inapplicable

Deal Type : Inapplicable

A Phase II Study of Ensifentrine in Non-Cystic Fibrosis Bronchiectasis

Details : Ensifentrine is a Other Small Molecule drug candidate, which is currently being evaluated in phase II clinical studies for the treatment of Bronchiectasis.

Product Name : Undisclosed

Product Type : Miscellaneous

Upfront Cash : Inapplicable

August 19, 2024

Boost your online visibility by uploading your products, APIs, FDFs, intermediates, excipients, and services for free on PharmaCompass.

Rank higher among suppliers and expand your reach across the internet efficiently and cost-effectively.

Boost your online visibility by uploading your products, APIs, FDFs, intermediates, excipients, and services for free on PharmaCompass.

Rank higher among suppliers and expand your reach across the internet efficiently and cost-effectively.

Details:

Ohtuvayre (ensifentrine), is a first-in-class PDE3/4 inhibitor product candidate, which is being evaluated for the maintenance treatment of chronic obstructive pulmonary disease.

Lead Product(s): Ensifentrine,Inapplicable

Therapeutic Area: Pulmonary/Respiratory Diseases Brand Name: Ohtuvayre

Study Phase: Approved FDFProduct Type: Miscellaneous

Sponsor: Undisclosed

Deal Size: Inapplicable Upfront Cash: Inapplicable

Deal Type: Inapplicable June 26, 2024

Boost your online visibility by uploading your products, APIs, FDFs, intermediates, excipients, and services for free on PharmaCompass.

Rank higher among suppliers and expand your reach across the internet efficiently and cost-effectively.

Boost your online visibility by uploading your products, APIs, FDFs, intermediates, excipients, and services for free on PharmaCompass.

Rank higher among suppliers and expand your reach across the internet efficiently and cost-effectively.

Lead Product(s) : Ensifentrine,Inapplicable

Therapeutic Area : Pulmonary/Respiratory Diseases

Highest Development Status : Approved FDF

Partner/Sponsor/Collaborator : Undisclosed

Deal Size : Inapplicable

Deal Type : Inapplicable

Verona Pharma Announces US FDA Approval of Ohtuvayre™ (ensifentrine)

Details : Ohtuvayre (ensifentrine), is a first-in-class PDE3/4 inhibitor product candidate, which is being evaluated for the maintenance treatment of chronic obstructive pulmonary disease.

Product Name : Ohtuvayre

Product Type : Miscellaneous

Upfront Cash : Inapplicable

June 26, 2024

Boost your online visibility by uploading your products, APIs, FDFs, intermediates, excipients, and services for free on PharmaCompass.

Rank higher among suppliers and expand your reach across the internet efficiently and cost-effectively.

Boost your online visibility by uploading your products, APIs, FDFs, intermediates, excipients, and services for free on PharmaCompass.

Rank higher among suppliers and expand your reach across the internet efficiently and cost-effectively.

Details:

Ensifentrine is a Other Small Molecule drug candidate, which is currently being evaluated in phase III clinical studies for the treatment of Pulmonary Disease, Chronic Obstructive.

Lead Product(s): Ensifentrine,Inapplicable

Therapeutic Area: Pulmonary/Respiratory Diseases Brand Name: Undisclosed

Study Phase: Phase IIIProduct Type: Miscellaneous

Sponsor: Midwest Chest Consultants

Deal Size: Inapplicable Upfront Cash: Inapplicable

Deal Type: Inapplicable June 14, 2024

Boost your online visibility by uploading your products, APIs, FDFs, intermediates, excipients, and services for free on PharmaCompass.

Rank higher among suppliers and expand your reach across the internet efficiently and cost-effectively.

Boost your online visibility by uploading your products, APIs, FDFs, intermediates, excipients, and services for free on PharmaCompass.

Rank higher among suppliers and expand your reach across the internet efficiently and cost-effectively.

Lead Product(s) : Ensifentrine,Inapplicable

Therapeutic Area : Pulmonary/Respiratory Diseases

Highest Development Status : Phase III

Partner/Sponsor/Collaborator : Midwest Chest Consultants

Deal Size : Inapplicable

Deal Type : Inapplicable

Effect of Ensifentrine Treatment on CAT Score

Details : Ensifentrine is a Other Small Molecule drug candidate, which is currently being evaluated in phase III clinical studies for the treatment of Pulmonary Disease, Chronic Obstructive.

Product Name : Undisclosed

Product Type : Miscellaneous

Upfront Cash : Inapplicable

June 14, 2024

Boost your online visibility by uploading your products, APIs, FDFs, intermediates, excipients, and services for free on PharmaCompass.

Rank higher among suppliers and expand your reach across the internet efficiently and cost-effectively.

Boost your online visibility by uploading your products, APIs, FDFs, intermediates, excipients, and services for free on PharmaCompass.

Rank higher among suppliers and expand your reach across the internet efficiently and cost-effectively.

Details:

The proceeds will support Verona’s commercial launch of RPL554 (ensifentrine), a first-in-class product under review by the US FDA for COPD maintenance treatment.

Lead Product(s): Ensifentrine,Inapplicable

Therapeutic Area: Pulmonary/Respiratory Diseases Brand Name: Ohtuvayre

Study Phase: Phase IIIProduct Type: Miscellaneous

Sponsor: Oaktree Capital

Deal Size: $650.0 million Upfront Cash: Undisclosed

Deal Type: Financing May 09, 2024

Boost your online visibility by uploading your products, APIs, FDFs, intermediates, excipients, and services for free on PharmaCompass.

Rank higher among suppliers and expand your reach across the internet efficiently and cost-effectively.

Boost your online visibility by uploading your products, APIs, FDFs, intermediates, excipients, and services for free on PharmaCompass.

Rank higher among suppliers and expand your reach across the internet efficiently and cost-effectively.

Lead Product(s) : Ensifentrine,Inapplicable

Therapeutic Area : Pulmonary/Respiratory Diseases

Highest Development Status : Phase III

Partner/Sponsor/Collaborator : Oaktree Capital

Deal Size : $650.0 million

Deal Type : Financing

Verona Pharma Announces $650 Million Strategic Financing with Oaktree and OMERS

Details : The proceeds will support Verona’s commercial launch of RPL554 (ensifentrine), a first-in-class product under review by the US FDA for COPD maintenance treatment.

Product Name : Ohtuvayre

Product Type : Miscellaneous

Upfront Cash : Undisclosed

May 09, 2024

Boost your online visibility by uploading your products, APIs, FDFs, intermediates, excipients, and services for free on PharmaCompass.

Rank higher among suppliers and expand your reach across the internet efficiently and cost-effectively.

Boost your online visibility by uploading your products, APIs, FDFs, intermediates, excipients, and services for free on PharmaCompass.

Rank higher among suppliers and expand your reach across the internet efficiently and cost-effectively.

Details:

The proceeds will support Verona’s commercial launch of RPL554 (ensifentrine), a first-in-class product under review by the US FDA for COPD maintenance treatment.

Lead Product(s): Ensifentrine,Inapplicable

Therapeutic Area: Pulmonary/Respiratory Diseases Brand Name: Ohtuvayre

Study Phase: Phase IIIProduct Type: Miscellaneous

Sponsor: Oxford Finance

Deal Size: Undisclosed Upfront Cash: Undisclosed

Deal Type: Financing January 02, 2024

Boost your online visibility by uploading your products, APIs, FDFs, intermediates, excipients, and services for free on PharmaCompass.

Rank higher among suppliers and expand your reach across the internet efficiently and cost-effectively.

Boost your online visibility by uploading your products, APIs, FDFs, intermediates, excipients, and services for free on PharmaCompass.

Rank higher among suppliers and expand your reach across the internet efficiently and cost-effectively.

Lead Product(s) : Ensifentrine,Inapplicable

Therapeutic Area : Pulmonary/Respiratory Diseases

Highest Development Status : Phase III

Partner/Sponsor/Collaborator : Oxford Finance

Deal Size : Undisclosed

Deal Type : Financing

Verona Pharma Secures Debt Facility Of Up to $400 Million

Details : The proceeds will support Verona’s commercial launch of RPL554 (ensifentrine), a first-in-class product under review by the US FDA for COPD maintenance treatment.

Product Name : Ohtuvayre

Product Type : Miscellaneous

Upfront Cash : Undisclosed

January 02, 2024

FULL SCREEN VIEW Click here to open all results in a new tab [this preview display 10 results]

FULL SCREEN VIEW Click here to open all results in a new tab [this preview display 10 results]6,7-Dihydro-9,10-dimethoxy-2-[(2,4,6-trimethylphen...

CAS Number : 76536-66-8

End Use API : Ensifentrine

About The Company : We are into manufacturing of bulk drug Intermediates and Active Pharmaceutical Ingredients (API). Our core competence is contract manufacturing for our clients ...

7-Dihydro-9,10-dimethoxy-2-[(2,4,6- trimethylpheny...

CAS Number : 76536-66-8

End Use API : Ensifentrine

About The Company : Chemvisai Labs is a dynamic pharmaceutical partner established with a clear vision: to become a leading and trusted force in the industry. We address critical u...

9,10-dimethoxy-2-(2,4,6-trimethylanilino)-6,7-dihy...

CAS Number : 76536-66-8

End Use API : Ensifentrine

About The Company : Guangzhou AANpharm Technology is a science-driven producer of key starting materials, pharmaceutical intermediates and specialty chemicals for CDMOs, API manufa...

FULL SCREEN VIEW Click here to open all results in a new tab [this preview display 10 results]

FULL SCREEN VIEW Click here to open all results in a new tab [this preview display 10 results]https://www.pharmacompass.com/radio-compass-blog/dmf-filings-surge-44-in-q1-2025-india-tops-list-with-51-rise-in-year-on-year-submissions

16 Sep 2025

// GLOBENEWSWIRE

https://www.globenewswire.com/news-release/2025/09/16/3150586/0/en/Verona-Pharma-to-Present-Additional-Analyses-of-the-Phase-3-ENHANCE-Studies-in-COPD-at-ERS-International-Congress-2025.html

10 Jul 2025

// PRESS RELEASE

https://www.merck.com/news/merck-to-acquire-verona-pharma-expanding-its-portfolio-to-include-ohtuvayre-ensifentrine-a-first-in-class-copd-maintenance-treatment-for-adults-and-expected-to-drive-growth-into-the-next-dec/

06 May 2025

// GLOBENEWSWIRE

https://www.globenewswire.com/news-release/2025/05/06/3074811/0/en/Verona-Pharma-to-Present-Seven-Analyses-of-the-Phase-3-ENHANCE-Studies-in-COPD-at-ATS-2025.html

16 Apr 2025

// PR NEWSWIRE

https://www.prnewswire.com/news-releases/ritedose-adds-seventh-syntegon-packaging-line-to-expand-single-vial-packaging-capabilities-support-production-of-new-copd-drug-ohtuvayre-302430286.html

28 Mar 2025

// GLOBENEWSWIRE

https://www.globenewswire.com/news-release/2025/03/28/3051269/0/en/Verona-Pharma-Announces-Amended-Strategic-Financing-with-Oaktree-and-OMERS.html

17 Sep 2024

// PR NEWSWIRE

https://www.prnewswire.com/news-releases/ritedose-is-proud-to-partner-with-verona-pharma-to-deliver-first-in-class-copd-drug-ohtuvayre-ensifentrine-302250313.html

Market Place

Reply

16 Dec 2025

Reply

28 Nov 2024

FULL SCREEN VIEW Click here to open all results in a new tab [this preview display 10 results]

FULL SCREEN VIEW Click here to open all results in a new tab [this preview display 10 results]

Patents & EXCLUSIVITIES

Patent Expiration Date : 2044-06-25

US Patent Number : 12251384

Drug Substance Claim :

Drug Product Claim : Y

Application Number : 217389

Patent Use Code :

Delist Requested :

Patent Use Description :

Patent Expiration Date : 2044-06-25

Patent Expiration Date : 2031-08-21

US Patent Number : 9062047

Drug Substance Claim : Y

Drug Product Claim :

Application Number : 217389

Patent Use Code : U-3962

Delist Requested :

Patent Use Description :

Patent Expiration Date : 2031-08-21

Patent Expiration Date : 2035-09-15

US Patent Number : 9956171

Drug Substance Claim :

Drug Product Claim : Y

Application Number : 217389

Patent Use Code : U-3962

Delist Requested :

Patent Use Description :

Patent Expiration Date : 2035-09-15

Patent Expiration Date : 2035-09-15

US Patent Number : 10945950

Drug Substance Claim :

Drug Product Claim : Y

Application Number : 217389

Patent Use Code :

Delist Requested :

Patent Use Description :

Patent Expiration Date : 2035-09-15

Patent Expiration Date : 2043-02-20

US Patent Number : 12409180

Drug Substance Claim :

Drug Product Claim : Y

Application Number : 217389

Patent Use Code :

Delist Requested :

Patent Use Description :

Patent Expiration Date : 2043-02-20

FULL SCREEN VIEW Click here to open all results in a new tab [this preview display 10 results]

FULL SCREEN VIEW Click here to open all results in a new tab [this preview display 10 results] Boost your online visibility by uploading your products, APIs, FDFs, intermediates, excipients, and services for free on PharmaCompass.

Rank higher among suppliers and expand your reach across the internet efficiently and cost-effectively.

Boost your online visibility by uploading your products, APIs, FDFs, intermediates, excipients, and services for free on PharmaCompass.

Rank higher among suppliers and expand your reach across the internet efficiently and cost-effectively.

Exclusivity Code : NCE

Exclusivity Expiration Date : 2029-06-26

Application Number : 217389

Product Number : 1

Exclusivity Details :

FULL SCREEN VIEW Click here to open all results in a new tab [this preview display 10 results]

FULL SCREEN VIEW Click here to open all results in a new tab [this preview display 10 results]ABOUT THIS PAGE

52

PharmaCompass offers a list of Ensifentrine API manufacturers, exporters & distributors, which can be sorted by GMP, USDMF, JDMF, KDMF, CEP (COS), WC, Price,and more, enabling you to easily find the right Ensifentrine manufacturer or Ensifentrine supplier for your needs.

Send us enquiries for free, and we will assist you in establishing a direct connection with your preferred Ensifentrine manufacturer or Ensifentrine supplier.

PharmaCompass also assists you with knowing the Ensifentrine API Price utilized in the formulation of products. Ensifentrine API Price is not always fixed or binding as the Ensifentrine Price is obtained through a variety of data sources. The Ensifentrine Price can also vary due to multiple factors, including market conditions, regulatory modifications, or negotiated pricing deals.

A Ensifentrine manufacturer is defined as any person or entity involved in the manufacture, preparation, processing, compounding or propagation of Ensifentrine, including repackagers and relabelers. The FDA regulates Ensifentrine manufacturers to ensure that their products comply with relevant laws and regulations and are safe and effective to use. Ensifentrine API Manufacturers are required to adhere to Good Manufacturing Practices (GMP) to ensure that their products are consistently manufactured to meet established quality criteria.

click here to find a list of Ensifentrine manufacturers with USDMF, JDMF, KDMF, CEP, GMP, COA and API Price related information on PhamaCompass.

A Ensifentrine supplier is an individual or a company that provides Ensifentrine active pharmaceutical ingredient (API) or Ensifentrine finished formulations upon request. The Ensifentrine suppliers may include Ensifentrine API manufacturers, exporters, distributors and traders.

click here to find a list of Ensifentrine suppliers with USDMF, JDMF, KDMF, CEP, GMP, COA and API Price related information on PharmaCompass.

A Ensifentrine DMF (Drug Master File) is a document detailing the whole manufacturing process of Ensifentrine active pharmaceutical ingredient (API) in detail. Different forms of Ensifentrine DMFs exist exist since differing nations have different regulations, such as Ensifentrine USDMF, ASMF (EDMF), JDMF, CDMF, etc.

A Ensifentrine DMF submitted to regulatory agencies in the US is known as a USDMF. Ensifentrine USDMF includes data on Ensifentrine's chemical properties, information on the facilities and procedures used, and details about packaging and storage. The Ensifentrine USDMF is kept confidential to protect the manufacturer’s intellectual property.

click here to find a list of Ensifentrine suppliers with USDMF on PharmaCompass.

National Drug Code is a comprehensive database maintained by the FDA that contains information on all drugs marketed in the US. This directory includes information about finished drug products, unfinished drug products, and compounded drug products, including those containing Ensifentrine as an active pharmaceutical ingredient (API).

The FDA updates the NDC directory daily. The NDC numbers for Ensifentrine API and other APIs are published in this directory by the FDA.

The NDC unfinished drugs database includes product listing information submitted for all unfinished drugs, such as active pharmaceutical ingredients (APIs), drugs intended for further processing and bulk drug substances for compounding.

Pharmaceutical companies that manufacture Ensifentrine as an active pharmaceutical ingredient (API) must furnish the FDA with an updated record of all drugs that they produce, prepare, propagate, compound, or process for commercial distribution in the US at their facilities.

The NDC directory also contains data on finished compounded human drug products that contain Ensifentrine and are produced by outsourcing facilities. While these outsourcing facilities are not mandated to assign a Ensifentrine NDC to their finished compounded human drug products, they may choose to do so.

click here to find a list of Ensifentrine suppliers with NDC on PharmaCompass.

Ensifentrine Active pharmaceutical ingredient (API) is produced in GMP-certified manufacturing facility.

GMP stands for Good Manufacturing Practices, which is a system used in the pharmaceutical industry to make sure that goods are regularly produced and monitored in accordance with quality standards. The FDA’s current Good Manufacturing Practices requirements are referred to as cGMP or current GMP which indicates that the company follows the most recent GMP specifications. The World Health Organization (WHO) has its own set of GMP guidelines, called the WHO GMP. Different countries can also set their own guidelines for GMP like China (Chinese GMP) or the EU (EU GMP).

PharmaCompass offers a list of Ensifentrine GMP manufacturers, exporters & distributors, which can be sorted by USDMF, JDMF, KDMF, CEP (COS), WC, API price, and more, enabling you to easily find the right Ensifentrine GMP manufacturer or Ensifentrine GMP API supplier for your needs.

A Ensifentrine CoA (Certificate of Analysis) is a formal document that attests to Ensifentrine's compliance with Ensifentrine specifications and serves as a tool for batch-level quality control.

Ensifentrine CoA mostly includes findings from lab analyses of a specific batch. For each Ensifentrine CoA document that a company creates, the USFDA specifies specific requirements, such as supplier information, material identification, transportation data, evidence of conformity and signature data.

Ensifentrine may be tested according to a variety of international standards, such as European Pharmacopoeia (Ensifentrine EP), Ensifentrine JP (Japanese Pharmacopeia) and the US Pharmacopoeia (Ensifentrine USP).