Synopsis

Synopsis

0

CEP/COS

0

JDMF

0

EU WC

0

KDMF

0

NDC API

0

VMF

0

Listed Suppliers

0

EDQM

0

USP

0

JP

0

Others

0

FDF Dossiers

0

FDA Orange Book

0

Europe

0

Canada

0

Australia

0

South Africa

0

Listed Dossiers

DRUG PRODUCT COMPOSITIONS

0

US Patents

0

US Exclusivities

0

Health Canada Patents

US Medicaid

NA

Annual Reports

NA

Regulatory FDF Prices

NA

0

API

0

FDF

0

Stock Recap #PipelineProspector

0

Weekly News Recap #Phispers

0

News #PharmaBuzz

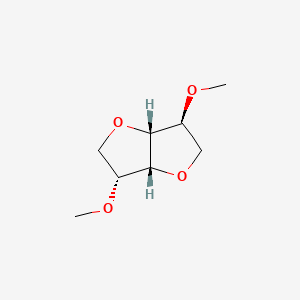

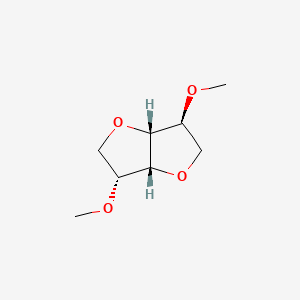

1. 2,5-dimethylisosorbide

2. 2,5-o-dimethylisosorbide

3. Arlasolve Dmi

1. 5306-85-4

2. Isosorbide Dimethyl Ether

3. (3r,3ar,6s,6ar)-3,6-dimethoxyhexahydrofuro[3,2-b]furan

4. 2,5-dimethylisosorbide

5. 1,4:3,6-dianhydro-2,5-di-o-methyl-d-glucitol

6. (3s,3ar,6r,6ar)-3,6-dimethoxy-2,3,3a,5,6,6a-hexahydrofuro[3,2-b]furan

7. Sa6a6v432s

8. D-glucitol, 1,4:3,6-dianhydro-2,5-di-o-methyl-

9. Nsc-40727

10. Nsc-44695

11. (3r,3ar,6s,6ar)-3,6-dimethoxy-hexahydrofuro[3,2-b]furan

12. Dimethyl Isosorbide Ether

13. Unii-sa6a6v432s

14. Mfcd00064828

15. 2,5-di-o-methyl-1,4:3,6-dianhydro-d-glucitol

16. Einecs 226-159-8

17. Nsc 40727

18. Nsc 44695

19. Isosorbide, Dimethyl Ether

20. Sorbitol, 1,4:3,6-dianhydro-2,5-di-o-methyl-

21. Schembl301881

22. Glucitol, 1,4:3,6-dianhydro-2,5-di-o-methyl-, D-

23. Dimethyl Isosorbide [ii]

24. Isosorbide Dimethyl Ether, 98%

25. Dimethyl Isosorbide [inci]

26. Dtxsid201019399

27. Nsc40727

28. Nsc44695

29. Zinc1849546

30. Ac8407

31. Akos016010544

32. As-17682

33. Cs-0144267

34. I0390

35. D-glucitol, 1,4:3,6-dianhydro-2,5-di-o-methyl

36. Q5807233

| Molecular Weight | 174.19 g/mol |

|---|---|

| Molecular Formula | C8H14O4 |

| XLogP3 | -0.6 |

| Hydrogen Bond Donor Count | 0 |

| Hydrogen Bond Acceptor Count | 4 |

| Rotatable Bond Count | 2 |

| Exact Mass | 174.08920892 g/mol |

| Monoisotopic Mass | 174.08920892 g/mol |

| Topological Polar Surface Area | 36.9 Ų |

| Heavy Atom Count | 12 |

| Formal Charge | 0 |

| Complexity | 143 |

| Isotope Atom Count | 0 |

| Defined Atom Stereocenter Count | 4 |

| Undefined Atom Stereocenter Count | 0 |

| Defined Bond Stereocenter Count | 0 |

| Undefined Bond Stereocenter Count | 0 |

| Covalently Bonded Unit Count | 1 |

GDUFA

DMF Review : N/A

Rev. Date :

Pay. Date :

DMF Number : 22402

Submission : 2009-01-05

Status : Active

Type : IV

GDUFA

DMF Review : N/A

Rev. Date :

Pay. Date :

DMF Number : 23571

Submission : 2010-03-16

Status : Active

Type : IV

FULL SCREEN VIEW Click here to open all results in a new tab [this preview display 10 results]

FULL SCREEN VIEW Click here to open all results in a new tab [this preview display 10 results]

API/FDF Prices: Book a Demo to explore the features and consider upgrading later

API Imports and Exports

| Importing Country | Total Quantity (KGS) |

Average Price (USD/KGS) |

Number of Transactions |

|---|

Upgrade, download data, analyse, strategize, subscribe with us

ABOUT THIS PAGE

89

PharmaCompass offers a list of Isosorbide Dimethyl Ether API manufacturers, exporters & distributors, which can be sorted by GMP, USDMF, JDMF, KDMF, CEP (COS), WC, Price,and more, enabling you to easily find the right Isosorbide Dimethyl Ether manufacturer or Isosorbide Dimethyl Ether supplier for your needs.

Send us enquiries for free, and we will assist you in establishing a direct connection with your preferred Isosorbide Dimethyl Ether manufacturer or Isosorbide Dimethyl Ether supplier.

PharmaCompass also assists you with knowing the Isosorbide Dimethyl Ether API Price utilized in the formulation of products. Isosorbide Dimethyl Ether API Price is not always fixed or binding as the Isosorbide Dimethyl Ether Price is obtained through a variety of data sources. The Isosorbide Dimethyl Ether Price can also vary due to multiple factors, including market conditions, regulatory modifications, or negotiated pricing deals.

A Isosorbide Dimethyl Ether manufacturer is defined as any person or entity involved in the manufacture, preparation, processing, compounding or propagation of Isosorbide Dimethyl Ether, including repackagers and relabelers. The FDA regulates Isosorbide Dimethyl Ether manufacturers to ensure that their products comply with relevant laws and regulations and are safe and effective to use. Isosorbide Dimethyl Ether API Manufacturers are required to adhere to Good Manufacturing Practices (GMP) to ensure that their products are consistently manufactured to meet established quality criteria.

A Isosorbide Dimethyl Ether supplier is an individual or a company that provides Isosorbide Dimethyl Ether active pharmaceutical ingredient (API) or Isosorbide Dimethyl Ether finished formulations upon request. The Isosorbide Dimethyl Ether suppliers may include Isosorbide Dimethyl Ether API manufacturers, exporters, distributors and traders.

click here to find a list of Isosorbide Dimethyl Ether suppliers with USDMF, JDMF, KDMF, CEP, GMP, COA and API Price related information on PharmaCompass.

A Isosorbide Dimethyl Ether DMF (Drug Master File) is a document detailing the whole manufacturing process of Isosorbide Dimethyl Ether active pharmaceutical ingredient (API) in detail. Different forms of Isosorbide Dimethyl Ether DMFs exist exist since differing nations have different regulations, such as Isosorbide Dimethyl Ether USDMF, ASMF (EDMF), JDMF, CDMF, etc.

A Isosorbide Dimethyl Ether DMF submitted to regulatory agencies in the US is known as a USDMF. Isosorbide Dimethyl Ether USDMF includes data on Isosorbide Dimethyl Ether's chemical properties, information on the facilities and procedures used, and details about packaging and storage. The Isosorbide Dimethyl Ether USDMF is kept confidential to protect the manufacturer’s intellectual property.

click here to find a list of Isosorbide Dimethyl Ether suppliers with USDMF on PharmaCompass.

Isosorbide Dimethyl Ether Active pharmaceutical ingredient (API) is produced in GMP-certified manufacturing facility.

GMP stands for Good Manufacturing Practices, which is a system used in the pharmaceutical industry to make sure that goods are regularly produced and monitored in accordance with quality standards. The FDA’s current Good Manufacturing Practices requirements are referred to as cGMP or current GMP which indicates that the company follows the most recent GMP specifications. The World Health Organization (WHO) has its own set of GMP guidelines, called the WHO GMP. Different countries can also set their own guidelines for GMP like China (Chinese GMP) or the EU (EU GMP).

PharmaCompass offers a list of Isosorbide Dimethyl Ether GMP manufacturers, exporters & distributors, which can be sorted by USDMF, JDMF, KDMF, CEP (COS), WC, API price, and more, enabling you to easily find the right Isosorbide Dimethyl Ether GMP manufacturer or Isosorbide Dimethyl Ether GMP API supplier for your needs.

A Isosorbide Dimethyl Ether CoA (Certificate of Analysis) is a formal document that attests to Isosorbide Dimethyl Ether's compliance with Isosorbide Dimethyl Ether specifications and serves as a tool for batch-level quality control.

Isosorbide Dimethyl Ether CoA mostly includes findings from lab analyses of a specific batch. For each Isosorbide Dimethyl Ether CoA document that a company creates, the USFDA specifies specific requirements, such as supplier information, material identification, transportation data, evidence of conformity and signature data.

Isosorbide Dimethyl Ether may be tested according to a variety of international standards, such as European Pharmacopoeia (Isosorbide Dimethyl Ether EP), Isosorbide Dimethyl Ether JP (Japanese Pharmacopeia) and the US Pharmacopoeia (Isosorbide Dimethyl Ether USP).