Synopsis

Synopsis

0

USDMF

0

CEP/COS

0

JDMF

0

EU WC

0

KDMF

0

VMF

0

EDQM

0

USP

0

JP

0

Others

0

Europe

0

Canada

0

Australia

0

South Africa

0

Listed Dossiers

DRUG PRODUCT COMPOSITIONS

US Medicaid

NA

Annual Reports

NA

Regulatory FDF Prices

NA

0

FDF

0

Stock Recap #PipelineProspector

0

Weekly News Recap #Phispers

1. Mbx-8025 Lysine

2. Seladelpar Lysine Dihydrate

3. Mbx-8025 Lysine Dihydrate

4. 928821-40-3

5. Seladelpar Lysine [usan]

6. Mbx-8025 Lysine Salt, Dihydrate

7. N1429130kr

8. Seladelpar (lysine Dihydrate)

9. Unii-n1429130kr

10. Seladelpar Lysine (usan)

11. Chembl3989960

12. Wtkswpygzdcunq-jzxfcxspsa-n

13. Hy-19522c

14. Akos040747473

15. Cs-1068545

16. D11257

17. Q27284370

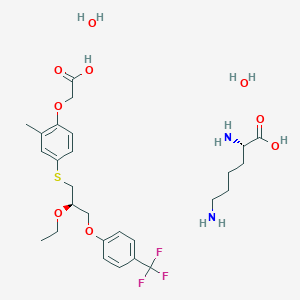

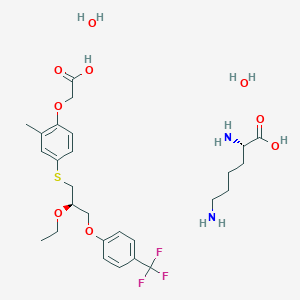

18. (2s)-2,6-diaminohexanoic Acid;2-[4-[(2r)-2-ethoxy-3-[4-(trifluoromethyl)phenoxy]propyl]sulfanyl-2-methylphenoxy]acetic Acid;dihydrate

19. (r)-2-(4-((2-ethoxy-3-(4-(trifluoromethyl)phenoxy)propyl)thio)-2-methylphenoxy)acetic Acid Compound With (s)-2,6-diaminohexanoic Acid Dihydrate

20. L-lysine (4-(((2r)-2-ethoxy-3-(4-(trifluoromethyl)phenoxy)propyl)sulfanyl)-2-methylphenoxy)acetate Dihydrate

21. L-lysine, 2-(4-(((2r)-2-ethoxy-3-(4-(trifluoromethyl)phenoxy)propyl)thio)-2-methylphenoxy)acetate, Hydrate (1:1:2)

1. 851528-79-5

2. Mbx-8025

3. Mbx-8025 (seladelpar)

4. Seladelpar

| Molecular Weight | 626.7 g/mol |

|---|---|

| Molecular Formula | C27H41F3N2O9S |

| Hydrogen Bond Donor Count | 6 |

| Hydrogen Bond Acceptor Count | 15 |

| Rotatable Bond Count | 16 |

| Exact Mass | g/mol |

| Monoisotopic Mass | g/mol |

| Topological Polar Surface Area | 182 |

| Heavy Atom Count | 42 |

| Formal Charge | 0 |

| Complexity | 617 |

| Isotope Atom Count | 0 |

| Defined Atom Stereocenter Count | 2 |

| Undefined Atom Stereocenter Count | 0 |

| Defined Bond Stereocenter Count | 0 |

| Undefined Bond Stereocenter Count | 0 |

| Covalently Bonded Unit Count | 4 |

NDC Package Code : 48957-0106

Start Marketing Date : 2024-08-14

End Marketing Date : 2025-12-31

Dosage Form (Strength) : POWDER (1kg/kg)

Marketing Category : BULK INGREDIENT

FULL SCREEN VIEW Click here to open all results in a new tab [this preview display 10 results]

FULL SCREEN VIEW Click here to open all results in a new tab [this preview display 10 results]

Market Place

Patents & EXCLUSIVITIES

ABOUT THIS PAGE