Synopsis

Synopsis

0

CEP/COS

0

JDMF

0

VMF

0

EDQM

0

USP

0

JP

0

Others

0

Listed Dossiers

DRUG PRODUCT COMPOSITIONS

Regulatory FDF Prices

NA

0

Stock Recap #PipelineProspector

0

Weekly News Recap #Phispers

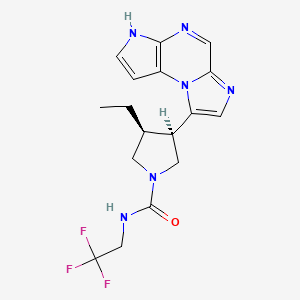

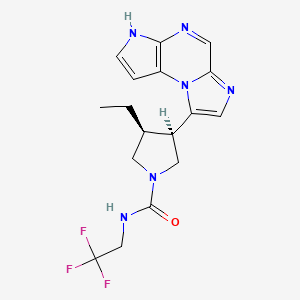

1. (3s,4r)-3-ethyl-4-(3h-imidazo(1,2-a)pyrrolo(2,3-e)pyrazin-8-yl)-n-(2,2,2-trifluoroethyl)-1-pyrrolidinecarboxamide

2. Abt-494

3. Rinvoq

1. 1310726-60-3

2. Abt-494

3. Rinvoq

4. Upadacitinib Anhydrous

5. 4ra0kn46e0

6. (3s,4r)-3-ethyl-4-(1,5,7,10-tetrazatricyclo[7.3.0.02,6]dodeca-2(6),3,7,9,11-pentaen-12-yl)-n-(2,2,2-trifluoroethyl)pyrrolidine-1-carboxamide

7. (3s,4r)-3-ethyl-4-(3h-imidazo(1,2-a)pyrrolo(2,3-e)pyrazin-8-yl)-n-(2,2,2-trifluoroethyl)-1-pyrrolidinecarboxamide

8. (3s,4r)-3-ethyl-4-(3h-imidazo[1,2-a]pyrrolo[2,3-e]pyrazin-8-yl)-n-(2,2,2-trifluoroethyl)pyrrolidine-1-carboxamide

9. 1-pyrrolidinecarboxamide, 3-ethyl-4-(3h-imidazo(1,2-a)pyrrolo(2,3-e)pyrazin-8-yl)-n-(2,2,2-trifluoroethyl)-, (3s,4r)-

10. Mfcd30502663

11. Upadacitinib [usan]

12. Upadacitinib [mi]

13. Upadacitinib, Abt-494

14. Upadacitinib (usan/inn)

15. Upadacitinib [inn]

16. Upadacitinib [usan:inn]

17. Upadacitinib (abt-494)

18. Unii-4ra0kn46e0

19. Upadacitinib [who-dd]

20. Gtpl9246

21. Schembl9991056

22. Chembl3622821

23. Abt 494

24. Dtxsid901027919

25. Upadacitinib [orange Book]

26. Amy16528

27. Bcp19011

28. Ex-a1628

29. Bdbm50503287

30. S8162

31. Cs-6150

32. Db15091

33. Abbv-599 Component Upadacitinib

34. Abt494;abt-494;abt 494

35. Ncgc00588874-01

36. Ac-30326

37. As-56379

38. Hy-19569

39. Upadacitinib Component Of Abbv-599

40. J3.590.729g

41. C72237

42. D10994

43. Q27074125

44. (3s,4r)-3-ethyl-4-(3h-imidazo(1,2-a)pyrrolo(2,3-e)pyrazin- 8-yl)-n-(2,2,2-trifluoroethyl)pyrrolidine-1-carboxamide Tyrosine Kinase Inhibitor

45. (3s,4r)-3-ethyl-4-(3h-imidazo(1,2-a)pyrrolo(2,3-e)pyrazin-8-yl)-n-(2,2,2- Trifluoroethyl)pyrrolidine-1-carboxamide

46. Rel-(-)-(3s,4r)-3-ethyl-4-(3h-imidazo(1,2-a)pyrrolo(2,3-e)pyrazin-8-yl)-n-(2,2,2-trifluoroethyl)pyrrolidine-1-carboxamide

| Molecular Weight | 380.4 g/mol |

|---|---|

| Molecular Formula | C17H19F3N6O |

| XLogP3 | 2.7 |

| Hydrogen Bond Donor Count | 2 |

| Hydrogen Bond Acceptor Count | 6 |

| Rotatable Bond Count | 3 |

| Exact Mass | 380.15724374 g/mol |

| Monoisotopic Mass | 380.15724374 g/mol |

| Topological Polar Surface Area | 78.3 Ų |

| Heavy Atom Count | 27 |

| Formal Charge | 0 |

| Complexity | 561 |

| Isotope Atom Count | 0 |

| Defined Atom Stereocenter Count | 2 |

| Undefined Atom Stereocenter Count | 0 |

| Defined Bond Stereocenter Count | 0 |

| Undefined Bond Stereocenter Count | 0 |

| Covalently Bonded Unit Count | 1 |

Upadacitinib is indicated for the treatment of moderately to severely active rheumatoid arthritis or active psoriatic arthritis in adult patients who have had an inadequate response or intolerance to one or more disease-modifying anti-rheumatic drugs (DMARDs), such as methotrexate or TNF blockers. For these indications, upadacitinib may be used as monotherapy or in combination with methotrexate. Upadacitinib is also indicated for the treatment of active ankylosing spondylitis in adult patients who have an inadequate response to conventional therapy and for the treatment of moderate to severe atopic dermatitis in patients aged 12 years and older who are candidates for systemic therapy. Combining upadacitinib with other JAK inhibitors, biologic DMARDs, or other potent immunosuppressive agents is not recommended.

FDA Label

Rheumatoid arthritis

RINVOQ is indicated for the treatment of moderate to severe active rheumatoid arthritis in adult patients who have responded inadequately to, or who are intolerant to one or more disease-modifying anti-rheumatic drugs (DMARDs). RINVOQ may be used as monotherapy or in combination with methotrexate.

Psoriatic arthritis

RINVOQ is indicated for the treatment of active psoriatic arthritis in adult patients who have responded inadequately to, or who are intolerant to one or more DMARDs. RINVOQ may be used as monotherapy or in combination with methotrexate.

Axial spondyloarthritis

Non-radiographic axial spondyloarthritis (nr-axSpA)

RINVOQ is indicated for the treatment of active non-radiographic axial spondyloarthritis in adult patients with objective signs of inflammation as indicated by elevated C-reactive protein (CRP) and/or magnetic resonance imaging (MRI), who have responded inadequately to nonsteroidal anti-inflammatory drugs (NSAIDs).

Ankylosing spondylitis (AS, radiographic axial spondyloarthritis )

RINVOQ is indicated for the treatment of active ankylosing spondylitis in adult patients who have responded inadequately to conventional therapy.

Atopic dermatitis

RINVOQ is indicated for the treatment of moderate to severe atopic dermatitis in adults and adolescents 12 years and older who are candidates for systemic therapy.

Ulcerative colitis

RINVOQ is indicated for the treatment of adult patients with moderately to severely active ulcerative colitis who have had an inadequate response, lost response or were intolerant to either conventional therapy or a biologic agent.

Treatment of ulcerative colitis

Treatment of Crohn's disease

Treatment of vasculitides

Treatment of vasculitides

Treatment of atopic dermatitis

Treatment of chronic idiopathic arthritis (including rheumatoid arthritis , psoriatic arthritis , spondyloarthritis and juvenile idiopathic arthritis )

Upadacitinib is a DMARD that works by inhibiting the Janus Kinases (JAKs), which are essential downstream cell signalling mediators of pro-inflammatory cytokines. It is believed that these pro-inflammatory cytokines play a role in many autoimmune inflammatory conditions, such as rheumatoid arthritis. In clinical trials, upadacitinib decreased the activity of pro-inflammatory interleukins, transiently increased the levels of lymphocytes, and insignificantly decreased the levels of immunoglobulins from the baseline.

Antirheumatic Agents

Drugs that are used to treat RHEUMATOID ARTHRITIS. (See all compounds classified as Antirheumatic Agents.)

Janus Kinase Inhibitors

Agents that inhibit JANUS KINASES. (See all compounds classified as Janus Kinase Inhibitors.)

L04AA

L - Antineoplastic and immunomodulating agents

L04 - Immunosuppressants

L04A - Immunosuppressants

L04AA - Selective immunosuppressants

L04AA44 - Upadacitinib

Absorption

Upadacitinib displays a dose-proportional pharmacokinetic profile over the therapeutic dose range. Following oral administration, the median time to reach Cmax (Tmax) ranges from 2 to 4 hours. The steady-state plasma concentrations of upadacitinib are reached within 4 days following multiple once-daily administrations, with minimal accumulation. Food intake has no clinically relevant effect on the AUC, Cmax, and Cmin of upadacitinib from the extended-release formulation.

Route of Elimination

Following administration of a single radio-labelled dose from the immediate-release formulation, approximately 53% of the total dose was excreted in the feces where 38% of the excreted dose was an unchanged parent drug. About 43% of the total dose was excreted in the urine, where 24% of that dose was in the unchanged parent drug form. Approximately 34% of the total dose of upadacitinib dose was excreted as metabolites.

Volume of Distribution

The volume of distribution of upadacitinib in a patient with rheumatoid arthritis and a body weight of 74 kg is estimated to be 224 L following oral administration of an extended-release formula. In a pharmacokinetic study consisting of healthy volunteers receiving the extended-release formulation, the steady-state volume of distribution was 294 L. Upadacitinib partitions similarly between plasma and blood cellular components with a blood to plasma ratio of 1.0.

Clearance

The apparent oral clearance of upadacitinib in healthy volunteers receiving the extended-release formulation was 53.7 L/h.

Upadacitinib predominantly undergoes CYP3A4-mediated metabolism; however, upadacitinib is a nonsensitive substrate of CYP3A4. It is also metabolized by CYP2D6 to a lesser extent. In a human radio-labelled study, about 79% of the total plasma radioactivity accounted for the parent drug, and about 13% of the total plasma radioactivity accounted for the main metabolite produced from mono-oxidation, followed by glucuronidation. There are no known active metabolites of upadacitinib.

The mean terminal elimination half-life of upadacitinib ranged from 8 to 14 hours following administration of the extended-release formulation. In clinical trials, approximately 90% of upadacitinib in the systemic circulation was eliminated within 24 hours of dosing.

Rheumatoid arthritis (RA) is a chronic autoimmune inflammatory disease that involves the interplay of several mediators, including the immune cells (mainly T- and B-lymphocytes) and pro-inflammatory cytokines, such as the tumour necrosis factor (TNF), transforming growth factor (TGF), and interleukin 6 (IL-6). The Janus Kinase (JAK) family plays an essential role in the normal physiological functions (such as erythropoiesis), but also the signalling of pro-inflammatory cytokines that are implicated in many immune-mediated diseases. The JAK family consists of four isoforms (JAK1, JAK2, JAK3, and Tyrosine Kinase 2) that each interacts with different cytokine receptors and uniquely associates with the intracellular domains of Type I/II cytokine receptors. JAK1 is primarily involved in the signalling transduction pathways of IL-6, IFN and the common -chain cytokines, including IL-2 and IL-15. IL-6 has been closely studied in particular, as it is a major cytokine involved in B- and T-cell differentiation and the acute phase response in inflammation. Upon interaction of cytokines with their cytokine receptors, the JAKs mediate the JAK-STAT signal transduction pathway in response to receptor activation. JAKs are tyrosine kinases that cause phosphorylation of several proteins, including cytokine receptors and JAKs themselves. Phosphorylation of JAKs promotes the phosphorylation and activation of the signalling molecules called STATs, leading to their nuclear translocation, binding to DNA promoters, and target gene transcription. JAK1-mediated signalling pathways ultimately promote pro-inflammatory events, such as increased proliferation and survival of immune cells, T cell differentiation, and macrophage activation. Upadacitinib is a selective JAK1 inhibitor that has a negligible effect on JAK3, leading to an improved drug safety profile. Upadacitinib blocks the cellular processes that contribute to the inflammatory conditions in rheumatoid arthritis. In human leukocytes cellular assays, upadacitinib inhibited JAK1/3-induced phosphorylation of STAT3/5 mediated by IL-6/7.

API/FDF Prices: Book a Demo to explore the features and consider upgrading later

API Imports and Exports

| Importing Country | Total Quantity (KGS) |

Average Price (USD/KGS) |

Number of Transactions |

|---|

Upgrade, download data, analyse, strategize, subscribe with us

Global Sales Information

Main Therapeutic Indication : Immunology

Currency : USD

2020 Revenue in Millions : 731

2019 Revenue in Millions : 47

Growth (%) : 1,455

Main Therapeutic Indication : Immunology

Currency : USD

2021 Revenue in Millions : 1,651

2020 Revenue in Millions : 731

Growth (%) : 126

Main Therapeutic Indication : Immunology

Currency : USD

2022 Revenue in Millions : 2,522

2021 Revenue in Millions : 1,651

Growth (%) : 53

Main Therapeutic Indication : Immunology

Currency : USD

2023 Revenue in Millions : 3,969

2022 Revenue in Millions : 2,522

Growth (%) : 57

Main Therapeutic Indication : Immunology

Currency : USD

2024 Revenue in Millions : 5,971

2023 Revenue in Millions : 3,969

Growth (%) : 50

Main Therapeutic Indication : Immunology

Currency : USD

2019 Revenue in Millions : 47

2018 Revenue in Millions : 0

Growth (%) : New launch

FULL SCREEN VIEW Click here to open all results in a new tab [this preview display 10 results]

FULL SCREEN VIEW Click here to open all results in a new tab [this preview display 10 results]Market Place

Patents & EXCLUSIVITIES

ABOUT THIS PAGE

75

PharmaCompass offers a list of Upadacitinib API manufacturers, exporters & distributors, which can be sorted by GMP, USDMF, JDMF, KDMF, CEP (COS), WC, Price,and more, enabling you to easily find the right Upadacitinib manufacturer or Upadacitinib supplier for your needs.

Send us enquiries for free, and we will assist you in establishing a direct connection with your preferred Upadacitinib manufacturer or Upadacitinib supplier.

PharmaCompass also assists you with knowing the Upadacitinib API Price utilized in the formulation of products. Upadacitinib API Price is not always fixed or binding as the Upadacitinib Price is obtained through a variety of data sources. The Upadacitinib Price can also vary due to multiple factors, including market conditions, regulatory modifications, or negotiated pricing deals.

A Upadacitinib manufacturer is defined as any person or entity involved in the manufacture, preparation, processing, compounding or propagation of Upadacitinib, including repackagers and relabelers. The FDA regulates Upadacitinib manufacturers to ensure that their products comply with relevant laws and regulations and are safe and effective to use. Upadacitinib API Manufacturers are required to adhere to Good Manufacturing Practices (GMP) to ensure that their products are consistently manufactured to meet established quality criteria.

click here to find a list of Upadacitinib manufacturers with USDMF, JDMF, KDMF, CEP, GMP, COA and API Price related information on PhamaCompass.

A Upadacitinib supplier is an individual or a company that provides Upadacitinib active pharmaceutical ingredient (API) or Upadacitinib finished formulations upon request. The Upadacitinib suppliers may include Upadacitinib API manufacturers, exporters, distributors and traders.

click here to find a list of Upadacitinib suppliers with USDMF, JDMF, KDMF, CEP, GMP, COA and API Price related information on PharmaCompass.

A Upadacitinib DMF (Drug Master File) is a document detailing the whole manufacturing process of Upadacitinib active pharmaceutical ingredient (API) in detail. Different forms of Upadacitinib DMFs exist exist since differing nations have different regulations, such as Upadacitinib USDMF, ASMF (EDMF), JDMF, CDMF, etc.

A Upadacitinib DMF submitted to regulatory agencies in the US is known as a USDMF. Upadacitinib USDMF includes data on Upadacitinib's chemical properties, information on the facilities and procedures used, and details about packaging and storage. The Upadacitinib USDMF is kept confidential to protect the manufacturer’s intellectual property.

click here to find a list of Upadacitinib suppliers with USDMF on PharmaCompass.

In Korea, the Ministry of Food and Drug Safety (MFDS) is in charge of regulating pharmaceutical products and services.

Pharmaceutical companies submit a Upadacitinib Drug Master File in Korea (Upadacitinib KDMF) to the MFDS, which includes comprehensive information about the production, processing, facilities, materials, packaging, and testing of Upadacitinib. The MFDS reviews the Upadacitinib KDMF as part of the drug registration process and uses the information provided in the Upadacitinib KDMF to evaluate the safety and efficacy of the drug.

After submitting a Upadacitinib KDMF to the MFDS, the registered manufacturer can provide importers or distributors with the registration number without revealing confidential information to Korean business partners. Applicants seeking to register their Upadacitinib API can apply through the Korea Drug Master File (KDMF).

click here to find a list of Upadacitinib suppliers with KDMF on PharmaCompass.

A Upadacitinib written confirmation (Upadacitinib WC) is an official document issued by a regulatory agency to a Upadacitinib manufacturer, verifying that the manufacturing facility of a Upadacitinib active pharmaceutical ingredient (API) adheres to the Good Manufacturing Practices (GMP) regulations of the importing country. When exporting Upadacitinib APIs or Upadacitinib finished pharmaceutical products to another nation, regulatory agencies frequently require a Upadacitinib WC (written confirmation) as part of the regulatory process.

click here to find a list of Upadacitinib suppliers with Written Confirmation (WC) on PharmaCompass.

National Drug Code is a comprehensive database maintained by the FDA that contains information on all drugs marketed in the US. This directory includes information about finished drug products, unfinished drug products, and compounded drug products, including those containing Upadacitinib as an active pharmaceutical ingredient (API).

The FDA updates the NDC directory daily. The NDC numbers for Upadacitinib API and other APIs are published in this directory by the FDA.

The NDC unfinished drugs database includes product listing information submitted for all unfinished drugs, such as active pharmaceutical ingredients (APIs), drugs intended for further processing and bulk drug substances for compounding.

Pharmaceutical companies that manufacture Upadacitinib as an active pharmaceutical ingredient (API) must furnish the FDA with an updated record of all drugs that they produce, prepare, propagate, compound, or process for commercial distribution in the US at their facilities.

The NDC directory also contains data on finished compounded human drug products that contain Upadacitinib and are produced by outsourcing facilities. While these outsourcing facilities are not mandated to assign a Upadacitinib NDC to their finished compounded human drug products, they may choose to do so.

click here to find a list of Upadacitinib suppliers with NDC on PharmaCompass.

Upadacitinib Active pharmaceutical ingredient (API) is produced in GMP-certified manufacturing facility.

GMP stands for Good Manufacturing Practices, which is a system used in the pharmaceutical industry to make sure that goods are regularly produced and monitored in accordance with quality standards. The FDA’s current Good Manufacturing Practices requirements are referred to as cGMP or current GMP which indicates that the company follows the most recent GMP specifications. The World Health Organization (WHO) has its own set of GMP guidelines, called the WHO GMP. Different countries can also set their own guidelines for GMP like China (Chinese GMP) or the EU (EU GMP).

PharmaCompass offers a list of Upadacitinib GMP manufacturers, exporters & distributors, which can be sorted by USDMF, JDMF, KDMF, CEP (COS), WC, API price, and more, enabling you to easily find the right Upadacitinib GMP manufacturer or Upadacitinib GMP API supplier for your needs.

A Upadacitinib CoA (Certificate of Analysis) is a formal document that attests to Upadacitinib's compliance with Upadacitinib specifications and serves as a tool for batch-level quality control.

Upadacitinib CoA mostly includes findings from lab analyses of a specific batch. For each Upadacitinib CoA document that a company creates, the USFDA specifies specific requirements, such as supplier information, material identification, transportation data, evidence of conformity and signature data.

Upadacitinib may be tested according to a variety of international standards, such as European Pharmacopoeia (Upadacitinib EP), Upadacitinib JP (Japanese Pharmacopeia) and the US Pharmacopoeia (Upadacitinib USP).