AbbVie Inc

AbbVie Inc

03 Mar 2025

// PRESS RELEASE

20 Feb 2025

// GLOBENEWSWIRE

14 Feb 2025

// FIERCE PHARMA

Latest Content by PharmaCompass

About

Industry Trade Show

Attending

17-20 March, 2025

American Biomanufactur...American Biomanufacturing Summit

Industry Trade Show

Attending

15-16 April, 2025

Industry Trade Show

Attending

04-08 May, 2025

CONTACT DETAILS

Events

Webinars & Exhibitions

Industry Trade Show

Attending

17-20 March, 2025

American Biomanufactur...American Biomanufacturing Summit

Industry Trade Show

Attending

15-16 April, 2025

Industry Trade Show

Attending

04-08 May, 2025

CORPORATE CONTENT #SupplierSpotlight

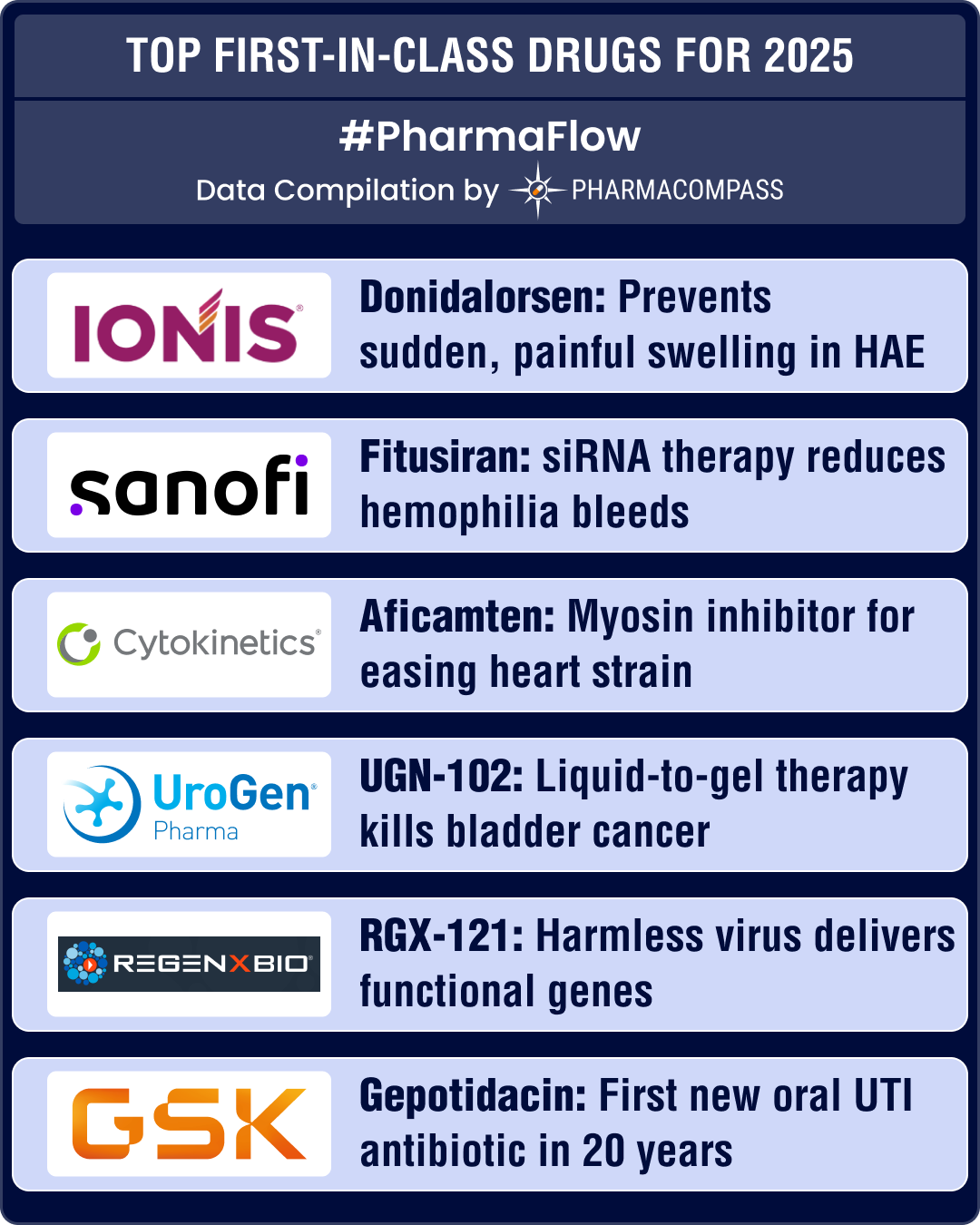

https://www.pharmacompass.com/radio-compass-blog/top-first-in-class-drug-candidates-of-2025-ionis-donidalorsen-sanofi-s-fitusiran-cytokinetics-aficamten-await-fda-approval

https://www.pharmacompass.com/radio-compass-blog/fda-okays-50-new-drugs-in-2024-bms-cobenfy-lilly-s-kisunla-lead-pack-of-breakthrough-therapies

https://www.pharmacompass.com/radio-compass-blog/fda-s-landmark-approvals-of-bms-schizo-med-madrigal-s-mash-drug-us-16-5-bn-catalent-buyout-make-it-to-top-10-news-of-2024

https://www.pharmacompass.com/radio-compass-blog/chinese-fda-registered-generic-facilities-gain-steam-india-maintains-lead-with-396-facilities

https://www.pharmacompass.com/radio-compass-blog/novartis-gsk-sanofi-bms-shell-out-over-us-10-bn-in-dealmaking-as-mid-size-deals-take-centerstage-in-2024

https://www.pharmacompass.com/radio-compass-blog/fda-s-june-2024-list-of-off-patent-off-exclusivity-drugs-sees-rise-in-cancer-hiv-treatments

https://www.pharmacompass.com/radio-compass-blog/fda-approves-record-eight-biosimilars-in-h1-2024-okays-first-interchangeable-biosimilars-for-eylea

https://www.pharmacompass.com/radio-compass-blog/top-pharma-companies-drugs-in-2023-merck-s-keytruda-emerges-as-top-selling-drug-novo-lilly-sales-skyrocket-due-to-glp-1-drugs

https://www.pharmacompass.com/radio-compass-blog/fda-approvals-rise-49-in-2023-crispr-s-gene-editing-therapy-sees-light-of-day

https://www.pharmacompass.com/radio-compass-blog/pfizer-s-buyout-of-seagen-drugmakers-suing-us-govt-obesity-drugs-make-it-to-top-10-phispers-of-2023

https://www.pharmacompass.com/radio-compass-blog/fda-reports-62-5-growth-in-new-drug-approvals-in-h1-2023-ema-health-canada-see-drop

03 Mar 2025

// PRESS RELEASE

https://news.abbvie.com/2025-03-03-AbbVie-and-Gubra-Announce-License-Agreement-to-Develop-an-Amylin-Analog-for-the-Treatment-of-Obesity

20 Feb 2025

// GLOBENEWSWIRE

https://www.globenewswire.com/news-release/2025/02/20/3029562/0/en/EPKINLY-epcoritamab-Approved-by-Japan-Ministry-of-Health-Labour-and-Welfare-for-Additional-Indication-as-a-Treatment-for-Relapsed-or-Refractory-Follicular-Lymphoma.html

14 Feb 2025

// FIERCE PHARMA

https://www.fiercepharma.com/marketing/ucbs-bimzelx-outpacing-abbvies-rinvoq-skyrizi-awareness-early-launch-survey

13 Feb 2025

// PRESS RELEASE

https://news.abbvie.com/2025-02-12-AbbVie-and-Xilio-Therapeutics-Announce-Collaboration-and-Option-Agreement-to-Develop-Novel-Tumor-Activated-Immunotherapies

13 Feb 2025

// PR NEWSWIRE

https://www.prnewswire.com/news-releases/abbvie-declares-quarterly-dividend-302376276.html

08 Feb 2025

// REUTERS

https://www.reuters.com/business/healthcare-pharmaceuticals/us-fda-approves-abbvies-treatment-intra-abdominal-infections-2025-02-07/

Boost your online visibility by uploading your products, APIs, FDFs, intermediates, excipients, and services for free on PharmaCompass.

Rank higher among suppliers and expand your reach across the internet efficiently and cost-effectively.

Boost your online visibility by uploading your products, APIs, FDFs, intermediates, excipients, and services for free on PharmaCompass.

Rank higher among suppliers and expand your reach across the internet efficiently and cost-effectively.

Details:

Under the licensing agreement, Abbvie will hold the exclusive rights to develop GUBamy (GUB014295), a potential best-in-class, long-acting amylin analog for the treatment of obesity.

Lead Product(s): GUB014295

Therapeutic Area: Nutrition and Weight Loss Brand Name: GUBamy

Study Phase: Phase IProduct Type: Peptide

Recipient: Gubra

Deal Size: $2,225.0 million Upfront Cash: $350.0 million

Deal Type: Licensing Agreement March 03, 2025

Boost your online visibility by uploading your products, APIs, FDFs, intermediates, excipients, and services for free on PharmaCompass.

Rank higher among suppliers and expand your reach across the internet efficiently and cost-effectively.

Boost your online visibility by uploading your products, APIs, FDFs, intermediates, excipients, and services for free on PharmaCompass.

Rank higher among suppliers and expand your reach across the internet efficiently and cost-effectively.

Lead Product(s) : GUB014295

Therapeutic Area : Nutrition and Weight Loss

Highest Development Status : Phase I

Recipient : Gubra

Deal Size : $2,225.0 million

Deal Type : Licensing Agreement

AbbVie, Gubra Sign License Deal to Develop Amylin Analog for Obesity

Details : Under the licensing agreement, Abbvie will hold the exclusive rights to develop GUBamy (GUB014295), a potential best-in-class, long-acting amylin analog for the treatment of obesity.

Product Name : GUBamy

Product Type : Peptide

Upfront Cash : $350.0 million

March 03, 2025

Boost your online visibility by uploading your products, APIs, FDFs, intermediates, excipients, and services for free on PharmaCompass.

Rank higher among suppliers and expand your reach across the internet efficiently and cost-effectively.

Boost your online visibility by uploading your products, APIs, FDFs, intermediates, excipients, and services for free on PharmaCompass.

Rank higher among suppliers and expand your reach across the internet efficiently and cost-effectively.

Details:

Rinvoq (upadacitinib) is a FDA approved selective JAK inhibitor that is being investigated in adult patients with giant cell arteritis in a Phase 3 clinical trial.

Lead Product(s): Upadacitinib,Corticosteroid

Therapeutic Area: Immunology Brand Name: Rinvoq

Study Phase: Phase IIIProduct Type: Other Small Molecule

Sponsor: Inapplicable

Deal Size: Inapplicable Upfront Cash: Inapplicable

Deal Type: Inapplicable February 28, 2025

Boost your online visibility by uploading your products, APIs, FDFs, intermediates, excipients, and services for free on PharmaCompass.

Rank higher among suppliers and expand your reach across the internet efficiently and cost-effectively.

Boost your online visibility by uploading your products, APIs, FDFs, intermediates, excipients, and services for free on PharmaCompass.

Rank higher among suppliers and expand your reach across the internet efficiently and cost-effectively.

Lead Product(s) : Upadacitinib,Corticosteroid

Therapeutic Area : Immunology

Highest Development Status : Phase III

Partner/Sponsor/Collaborator : Inapplicable

Deal Size : Inapplicable

Deal Type : Inapplicable

AbbVie gets Positive CHMP Opinion for RINVOQ® in Giant Cell Arteritis Treatment

Details : Rinvoq (upadacitinib) is a FDA approved selective JAK inhibitor that is being investigated in adult patients with giant cell arteritis in a Phase 3 clinical trial.

Product Name : Rinvoq

Product Type : Other Small Molecule

Upfront Cash : Inapplicable

February 28, 2025

Boost your online visibility by uploading your products, APIs, FDFs, intermediates, excipients, and services for free on PharmaCompass.

Rank higher among suppliers and expand your reach across the internet efficiently and cost-effectively.

Boost your online visibility by uploading your products, APIs, FDFs, intermediates, excipients, and services for free on PharmaCompass.

Rank higher among suppliers and expand your reach across the internet efficiently and cost-effectively.

Details:

The collaboration will combine AbbVie's oncology expertise and Xilio's proprietary tumor-activation technology to develop novel immunotherapies, including masked T-cell engagers.

Lead Product(s): Undisclosed

Therapeutic Area: Oncology Brand Name: Undisclosed

Study Phase: Discovery PlatformProduct Type: Antibody

Recipient: Xilio Therapeutics

Deal Size: $2,152.0 million Upfront Cash: $52.0 million

Deal Type: Collaboration February 12, 2025

Boost your online visibility by uploading your products, APIs, FDFs, intermediates, excipients, and services for free on PharmaCompass.

Rank higher among suppliers and expand your reach across the internet efficiently and cost-effectively.

Boost your online visibility by uploading your products, APIs, FDFs, intermediates, excipients, and services for free on PharmaCompass.

Rank higher among suppliers and expand your reach across the internet efficiently and cost-effectively.

Lead Product(s) : Undisclosed

Therapeutic Area : Oncology

Highest Development Status : Discovery Platform

Recipient : Xilio Therapeutics

Deal Size : $2,152.0 million

Deal Type : Collaboration

AbbVie, Xilio Partner to Develop Tumor-Activated Immunotherapies

Details : The collaboration will combine AbbVie's oncology expertise and Xilio's proprietary tumor-activation technology to develop novel immunotherapies, including masked T-cell engagers.

Product Name : Undisclosed

Product Type : Antibody

Upfront Cash : $52.0 million

February 12, 2025

Boost your online visibility by uploading your products, APIs, FDFs, intermediates, excipients, and services for free on PharmaCompass.

Rank higher among suppliers and expand your reach across the internet efficiently and cost-effectively.

Boost your online visibility by uploading your products, APIs, FDFs, intermediates, excipients, and services for free on PharmaCompass.

Rank higher among suppliers and expand your reach across the internet efficiently and cost-effectively.

Details:

Emblaveo (aztreonam-avibactam), a beta-lactamase inhibitor, has been FDA approved for the treatment of adult patients with complicated intra-abdominal infections in patients 18 years and older.

Lead Product(s): Aztreonam,Avibactam,Metronidazole

Therapeutic Area: Infections and Infectious Diseases Brand Name: Emblaveo

Study Phase: Approved FDFProduct Type: Antibiotic

Sponsor: Pfizer Inc

Deal Size: Inapplicable Upfront Cash: Inapplicable

Deal Type: Inapplicable February 07, 2025

Boost your online visibility by uploading your products, APIs, FDFs, intermediates, excipients, and services for free on PharmaCompass.

Rank higher among suppliers and expand your reach across the internet efficiently and cost-effectively.

Boost your online visibility by uploading your products, APIs, FDFs, intermediates, excipients, and services for free on PharmaCompass.

Rank higher among suppliers and expand your reach across the internet efficiently and cost-effectively.

Lead Product(s) : Aztreonam,Avibactam,Metronidazole

Therapeutic Area : Infections and Infectious Diseases

Highest Development Status : Approved FDF

Partner/Sponsor/Collaborator : Pfizer Inc

Deal Size : Inapplicable

Deal Type : Inapplicable

U.S. FDA Approves EMBLAVEO™ for Complicated Intra-Abdominal Infections

Details : Emblaveo (aztreonam-avibactam), a beta-lactamase inhibitor, has been FDA approved for the treatment of adult patients with complicated intra-abdominal infections in patients 18 years and older.

Product Name : Emblaveo

Product Type : Antibiotic

Upfront Cash : Inapplicable

February 07, 2025

Boost your online visibility by uploading your products, APIs, FDFs, intermediates, excipients, and services for free on PharmaCompass.

Rank higher among suppliers and expand your reach across the internet efficiently and cost-effectively.

Boost your online visibility by uploading your products, APIs, FDFs, intermediates, excipients, and services for free on PharmaCompass.

Rank higher among suppliers and expand your reach across the internet efficiently and cost-effectively.

Details:

AbbVie acquires Nimble, including its lead asset, an investigational oral peptide IL23R inhibitor in preclinical development for the treatment of psoriasis.

Lead Product(s): Undisclosed

Therapeutic Area: Dermatology Brand Name: Undisclosed

Study Phase: PreclinicalProduct Type: Peptide

Recipient: Nimble Therapeutics

Deal Size: $200.0 million Upfront Cash: $200.0 million

Deal Type: Acquisition January 23, 2025

Boost your online visibility by uploading your products, APIs, FDFs, intermediates, excipients, and services for free on PharmaCompass.

Rank higher among suppliers and expand your reach across the internet efficiently and cost-effectively.

Boost your online visibility by uploading your products, APIs, FDFs, intermediates, excipients, and services for free on PharmaCompass.

Rank higher among suppliers and expand your reach across the internet efficiently and cost-effectively.

Lead Product(s) : Undisclosed

Therapeutic Area : Dermatology

Highest Development Status : Preclinical

Recipient : Nimble Therapeutics

Deal Size : $200.0 million

Deal Type : Acquisition

AbbVie Completes Acquisition of Nimble Therapeutics

Details : AbbVie acquires Nimble, including its lead asset, an investigational oral peptide IL23R inhibitor in preclinical development for the treatment of psoriasis.

Product Name : Undisclosed

Product Type : Peptide

Upfront Cash : $200.0 million

January 23, 2025

Boost your online visibility by uploading your products, APIs, FDFs, intermediates, excipients, and services for free on PharmaCompass.

Rank higher among suppliers and expand your reach across the internet efficiently and cost-effectively.

Boost your online visibility by uploading your products, APIs, FDFs, intermediates, excipients, and services for free on PharmaCompass.

Rank higher among suppliers and expand your reach across the internet efficiently and cost-effectively.

Details:

The collaboration leverages AbbVie's oncology and immunology drug development expertise and Neomorph's leading molecular glue discovery platform.

Lead Product(s): Undisclosed

Therapeutic Area: Oncology Brand Name: Undisclosed

Study Phase: Discovery PlatformProduct Type: Other Small Molecule

Recipient: Neomorph

Deal Size: $1,640.0 million Upfront Cash: Undisclosed

Deal Type: Collaboration January 23, 2025

Boost your online visibility by uploading your products, APIs, FDFs, intermediates, excipients, and services for free on PharmaCompass.

Rank higher among suppliers and expand your reach across the internet efficiently and cost-effectively.

Boost your online visibility by uploading your products, APIs, FDFs, intermediates, excipients, and services for free on PharmaCompass.

Rank higher among suppliers and expand your reach across the internet efficiently and cost-effectively.

Lead Product(s) : Undisclosed

Therapeutic Area : Oncology

Highest Development Status : Discovery Platform

Recipient : Neomorph

Deal Size : $1,640.0 million

Deal Type : Collaboration

AbbVie Crafts $1.6B Deal with Molecular Glue Biotech Neomorph

Details : The collaboration leverages AbbVie's oncology and immunology drug development expertise and Neomorph's leading molecular glue discovery platform.

Product Name : Undisclosed

Product Type : Other Small Molecule

Upfront Cash : Undisclosed

January 23, 2025

Boost your online visibility by uploading your products, APIs, FDFs, intermediates, excipients, and services for free on PharmaCompass.

Rank higher among suppliers and expand your reach across the internet efficiently and cost-effectively.

Boost your online visibility by uploading your products, APIs, FDFs, intermediates, excipients, and services for free on PharmaCompass.

Rank higher among suppliers and expand your reach across the internet efficiently and cost-effectively.

Details:

Simcere has option to license agreement with Abbvie to develop SIM0500, an investigational new drug candidate. It is being evaluated in patients with relapsed or refractory multiple myeloma.

Lead Product(s): SIM0500

Therapeutic Area: Oncology Brand Name: SIM0500

Study Phase: Phase IProduct Type: Cell and Gene therapy

Recipient: Jiangsu Simcere Pharmaceutical

Deal Size: $1,055.0 million Upfront Cash: Undisclosed

Deal Type: Licensing Agreement January 13, 2025

Boost your online visibility by uploading your products, APIs, FDFs, intermediates, excipients, and services for free on PharmaCompass.

Rank higher among suppliers and expand your reach across the internet efficiently and cost-effectively.

Boost your online visibility by uploading your products, APIs, FDFs, intermediates, excipients, and services for free on PharmaCompass.

Rank higher among suppliers and expand your reach across the internet efficiently and cost-effectively.

Lead Product(s) : SIM0500

Therapeutic Area : Oncology

Highest Development Status : Phase I

Recipient : Jiangsu Simcere Pharmaceutical

Deal Size : $1,055.0 million

Deal Type : Licensing Agreement

AbbVie Pens $1B deal for Simcere’s Phase 1 T-Cell Engager

Details : Simcere has option to license agreement with Abbvie to develop SIM0500, an investigational new drug candidate. It is being evaluated in patients with relapsed or refractory multiple myeloma.

Product Name : SIM0500

Product Type : Cell and Gene therapy

Upfront Cash : Undisclosed

January 13, 2025

Boost your online visibility by uploading your products, APIs, FDFs, intermediates, excipients, and services for free on PharmaCompass.

Rank higher among suppliers and expand your reach across the internet efficiently and cost-effectively.

Boost your online visibility by uploading your products, APIs, FDFs, intermediates, excipients, and services for free on PharmaCompass.

Rank higher among suppliers and expand your reach across the internet efficiently and cost-effectively.

Details:

Under the terms of the agreement, AbCellera will lead discovery activities and AbbVie has the right to develop and commercialize therapeutic antibodies resulting from the expanded collaboration.

Lead Product(s): Undisclosed

Therapeutic Area: Oncology Brand Name: Undisclosed

Study Phase: Discovery PlatformProduct Type: Antibody

Recipient: AbCellera

Deal Size: Undisclosed Upfront Cash: Undisclosed

Deal Type: Expanded Collaboration January 13, 2025

Boost your online visibility by uploading your products, APIs, FDFs, intermediates, excipients, and services for free on PharmaCompass.

Rank higher among suppliers and expand your reach across the internet efficiently and cost-effectively.

Boost your online visibility by uploading your products, APIs, FDFs, intermediates, excipients, and services for free on PharmaCompass.

Rank higher among suppliers and expand your reach across the internet efficiently and cost-effectively.

Lead Product(s) : Undisclosed

Therapeutic Area : Oncology

Highest Development Status : Discovery Platform

Recipient : AbCellera

Deal Size : Undisclosed

Deal Type : Expanded Collaboration

AbCellera Expands Collaboration with AbbVie to Develop Novel T-Cell Engagers for Oncology

Details : Under the terms of the agreement, AbCellera will lead discovery activities and AbbVie has the right to develop and commercialize therapeutic antibodies resulting from the expanded collaboration.

Product Name : Undisclosed

Product Type : Antibody

Upfront Cash : Undisclosed

January 13, 2025

Boost your online visibility by uploading your products, APIs, FDFs, intermediates, excipients, and services for free on PharmaCompass.

Rank higher among suppliers and expand your reach across the internet efficiently and cost-effectively.

Boost your online visibility by uploading your products, APIs, FDFs, intermediates, excipients, and services for free on PharmaCompass.

Rank higher among suppliers and expand your reach across the internet efficiently and cost-effectively.

Details:

Through its collaboration with Capsida, AbbVie leverages the platform to identify and develop clinically translatable capsids, combined with innovative therapeutics, to address three CNS diseases.

Lead Product(s): Undisclosed

Therapeutic Area: Neurology Brand Name: Undisclosed

Study Phase: PreclinicalProduct Type: Cell and Gene therapy

Recipient: Capsida

Deal Size: $620.0 million Upfront Cash: $90.0 million

Deal Type: Collaboration January 07, 2025

Boost your online visibility by uploading your products, APIs, FDFs, intermediates, excipients, and services for free on PharmaCompass.

Rank higher among suppliers and expand your reach across the internet efficiently and cost-effectively.

Boost your online visibility by uploading your products, APIs, FDFs, intermediates, excipients, and services for free on PharmaCompass.

Rank higher among suppliers and expand your reach across the internet efficiently and cost-effectively.

Lead Product(s) : Undisclosed

Therapeutic Area : Neurology

Highest Development Status : Preclinical

Recipient : Capsida

Deal Size : $620.0 million

Deal Type : Collaboration

AbbVie Exercises first $40 Million Option to Advance Capsida-Partnered Cns Gene Therapy

Details : Through its collaboration with Capsida, AbbVie leverages the platform to identify and develop clinically translatable capsids, combined with innovative therapeutics, to address three CNS diseases.

Product Name : Undisclosed

Product Type : Cell and Gene therapy

Upfront Cash : $90.0 million

January 07, 2025

Boost your online visibility by uploading your products, APIs, FDFs, intermediates, excipients, and services for free on PharmaCompass.

Rank higher among suppliers and expand your reach across the internet efficiently and cost-effectively.

Boost your online visibility by uploading your products, APIs, FDFs, intermediates, excipients, and services for free on PharmaCompass.

Rank higher among suppliers and expand your reach across the internet efficiently and cost-effectively.

Details:

AbbVie will acquire Nimble, including its lead asset, an investigational oral peptide IL23R inhibitor in preclinical development for the treatment of psoriasis.

Lead Product(s): Peptide

Therapeutic Area: Dermatology Brand Name: Undisclosed

Study Phase: PreclinicalProduct Type: Peptide

Recipient: Nimble Therapeutics

Deal Size: $200.0 million Upfront Cash: $200.0 million

Deal Type: Acquisition December 13, 2024

Boost your online visibility by uploading your products, APIs, FDFs, intermediates, excipients, and services for free on PharmaCompass.

Rank higher among suppliers and expand your reach across the internet efficiently and cost-effectively.

Boost your online visibility by uploading your products, APIs, FDFs, intermediates, excipients, and services for free on PharmaCompass.

Rank higher among suppliers and expand your reach across the internet efficiently and cost-effectively.

Lead Product(s) : Peptide

Therapeutic Area : Dermatology

Highest Development Status : Preclinical

Recipient : Nimble Therapeutics

Deal Size : $200.0 million

Deal Type : Acquisition

AbbVie Buys Roche Spinout Nimble Therapeutics for $200M

Details : AbbVie will acquire Nimble, including its lead asset, an investigational oral peptide IL23R inhibitor in preclinical development for the treatment of psoriasis.

Product Name : Undisclosed

Product Type : Peptide

Upfront Cash : $200.0 million

December 13, 2024

FULL SCREEN VIEW Click here to open all results in a new tab [this preview display 10 results]

FULL SCREEN VIEW Click here to open all results in a new tab [this preview display 10 results] Boost your online visibility by uploading your products, APIs, FDFs, intermediates, excipients, and services for free on PharmaCompass.

Rank higher among suppliers and expand your reach across the internet efficiently and cost-effectively.

Boost your online visibility by uploading your products, APIs, FDFs, intermediates, excipients, and services for free on PharmaCompass.

Rank higher among suppliers and expand your reach across the internet efficiently and cost-effectively.

RLD : No

TE Code :

ACETAMINOPHEN; HYDROCODONE BITARTRATE

Dosage Form : TABLET; ORAL

Proprietary Name : VICODIN HP

Dosage Strength : 660MG;10MG

Approval Date : 1996-09-23

Application Number : 40117

RX/OTC/DISCN : DISCN

RLD : No

TE Code :

Boost your online visibility by uploading your products, APIs, FDFs, intermediates, excipients, and services for free on PharmaCompass.

Rank higher among suppliers and expand your reach across the internet efficiently and cost-effectively.

Boost your online visibility by uploading your products, APIs, FDFs, intermediates, excipients, and services for free on PharmaCompass.

Rank higher among suppliers and expand your reach across the internet efficiently and cost-effectively.

RLD : No

TE Code :

ACETAMINOPHEN; HYDROCODONE BITARTRATE

Dosage Form : TABLET; ORAL

Proprietary Name : VICODIN

Dosage Strength : 500MG;5MG

Approval Date : 1983-01-07

Application Number : 88058

RX/OTC/DISCN : DISCN

RLD : No

TE Code :

Boost your online visibility by uploading your products, APIs, FDFs, intermediates, excipients, and services for free on PharmaCompass.

Rank higher among suppliers and expand your reach across the internet efficiently and cost-effectively.

Boost your online visibility by uploading your products, APIs, FDFs, intermediates, excipients, and services for free on PharmaCompass.

Rank higher among suppliers and expand your reach across the internet efficiently and cost-effectively.

RLD : No

TE Code :

ACETAMINOPHEN; HYDROCODONE BITARTRATE

Dosage Form : TABLET; ORAL

Proprietary Name : VICODIN ES

Dosage Strength : 750MG;7.5MG

Approval Date : 1988-12-09

Application Number : 89736

RX/OTC/DISCN : DISCN

RLD : No

TE Code :

Boost your online visibility by uploading your products, APIs, FDFs, intermediates, excipients, and services for free on PharmaCompass.

Rank higher among suppliers and expand your reach across the internet efficiently and cost-effectively.

Boost your online visibility by uploading your products, APIs, FDFs, intermediates, excipients, and services for free on PharmaCompass.

Rank higher among suppliers and expand your reach across the internet efficiently and cost-effectively.

RLD : No

TE Code :

Dosage Form : INJECTABLE; INJECTION

Proprietary Name : ACYCLOVIR

Dosage Strength : EQ 50MG BASE/ML

Approval Date : 1999-07-26

Application Number : 75114

RX/OTC/DISCN : DISCN

RLD : No

TE Code :

Boost your online visibility by uploading your products, APIs, FDFs, intermediates, excipients, and services for free on PharmaCompass.

Rank higher among suppliers and expand your reach across the internet efficiently and cost-effectively.

Boost your online visibility by uploading your products, APIs, FDFs, intermediates, excipients, and services for free on PharmaCompass.

Rank higher among suppliers and expand your reach across the internet efficiently and cost-effectively.

RLD :

TE Code :

Dosage Form : SYRINGE

Proprietary Name : HUMIRA

Dosage Strength : 40MG/0.8ML

Approval Date :

Application Number : 125057

RX/OTC/DISCN :

RLD :

TE Code :

Boost your online visibility by uploading your products, APIs, FDFs, intermediates, excipients, and services for free on PharmaCompass.

Rank higher among suppliers and expand your reach across the internet efficiently and cost-effectively.

Boost your online visibility by uploading your products, APIs, FDFs, intermediates, excipients, and services for free on PharmaCompass.

Rank higher among suppliers and expand your reach across the internet efficiently and cost-effectively.

RLD :

TE Code :

Dosage Form : VIAL

Proprietary Name : HUMIRA

Dosage Strength : 40MG/0.8ML

Approval Date :

Application Number : 125057

RX/OTC/DISCN :

RLD :

TE Code :

Boost your online visibility by uploading your products, APIs, FDFs, intermediates, excipients, and services for free on PharmaCompass.

Rank higher among suppliers and expand your reach across the internet efficiently and cost-effectively.

Boost your online visibility by uploading your products, APIs, FDFs, intermediates, excipients, and services for free on PharmaCompass.

Rank higher among suppliers and expand your reach across the internet efficiently and cost-effectively.

RLD : Yes

TE Code :

Dosage Form : SOLUTION/DROPS; OPHTHALMIC

Proprietary Name : LASTACAFT

Dosage Strength : 0.25%

Approval Date : 2010-07-28

Application Number : 22134

RX/OTC/DISCN : OTC

RLD : Yes

TE Code :

Boost your online visibility by uploading your products, APIs, FDFs, intermediates, excipients, and services for free on PharmaCompass.

Rank higher among suppliers and expand your reach across the internet efficiently and cost-effectively.

Boost your online visibility by uploading your products, APIs, FDFs, intermediates, excipients, and services for free on PharmaCompass.

Rank higher among suppliers and expand your reach across the internet efficiently and cost-effectively.

RLD : Yes

TE Code :

Dosage Form : TABLET; ORAL

Proprietary Name : QULIPTA

Dosage Strength : 10MG

Approval Date : 2021-09-28

Application Number : 215206

RX/OTC/DISCN : RX

RLD : Yes

TE Code :

Boost your online visibility by uploading your products, APIs, FDFs, intermediates, excipients, and services for free on PharmaCompass.

Rank higher among suppliers and expand your reach across the internet efficiently and cost-effectively.

Boost your online visibility by uploading your products, APIs, FDFs, intermediates, excipients, and services for free on PharmaCompass.

Rank higher among suppliers and expand your reach across the internet efficiently and cost-effectively.

RLD : Yes

TE Code :

Dosage Form : TABLET; ORAL

Proprietary Name : QULIPTA

Dosage Strength : 30MG

Approval Date : 2021-09-28

Application Number : 215206

RX/OTC/DISCN : RX

RLD : Yes

TE Code :

Boost your online visibility by uploading your products, APIs, FDFs, intermediates, excipients, and services for free on PharmaCompass.

Rank higher among suppliers and expand your reach across the internet efficiently and cost-effectively.

Boost your online visibility by uploading your products, APIs, FDFs, intermediates, excipients, and services for free on PharmaCompass.

Rank higher among suppliers and expand your reach across the internet efficiently and cost-effectively.

RLD : Yes

TE Code :

Dosage Form : TABLET; ORAL

Proprietary Name : QULIPTA

Dosage Strength : 60MG

Approval Date : 2021-09-28

Application Number : 215206

RX/OTC/DISCN : RX

RLD : Yes

TE Code :

Inspections and registrations

ABOUT THIS PAGE

AbbVie Inc is a supplier offers 12 products (APIs, Excipients or Intermediates).

Find a price of Cyclosporine bulk with DMF, CEP offered by AbbVie Inc

Find a price of Erythromycin bulk with DMF, CEP offered by AbbVie Inc

Find a price of Biperiden Hydrochloride bulk with CEP offered by AbbVie Inc

Find a price of Butorphanol Tartrate bulk with DMF offered by AbbVie Inc

Find a price of Erythromycin Ethyl Succinate bulk with DMF offered by AbbVie Inc

Find a price of Erythromycin Stearate bulk with DMF offered by AbbVie Inc

Find a price of Isoflurane bulk with CEP offered by AbbVie Inc

Find a price of Paricalcitol bulk with DMF offered by AbbVie Inc

Find a price of Ritonavir bulk with CEP offered by AbbVie Inc

Find a price of Divalproex Sodium bulk offered by AbbVie Inc

Find a price of Enflurane bulk offered by AbbVie Inc

Find a price of Erythromycin Thiocyanate bulk offered by AbbVie Inc