10 Dec 2024

// PRESS RELEASE

16 Oct 2024

// PRESS RELEASE

15 Oct 2024

// PRESS RELEASE

Latest Content by PharmaCompass

KEY PRODUCTS

KEY PRODUCTS KEY SERVICES

KEY SERVICES

EUROAPI, the leading small molecules API player, provides both API sales & CDMO services.

About

Industry Trade Show

Not Confirmed

17-20 March, 2025

Antibody EngineeringAntibody Engineering

Industry Trade Show

Not Confirmed

15-19 December, 2024

Pharma, Lab & Chemical...Pharma, Lab & Chemical Expo

Industry Trade Show

Not Confirmed

03-05 January, 2025

CONTACT DETAILS

Events

Webinars & Exhibitions

Industry Trade Show

Not Confirmed

17-20 March, 2025

Antibody EngineeringAntibody Engineering

Industry Trade Show

Not Confirmed

15-19 December, 2024

Pharma, Lab & Chemical...Pharma, Lab & Chemical Expo

Industry Trade Show

Not Confirmed

03-05 January, 2025

https://www.pharmacompass.com/speak-pharma/euroapi-is-a-growth-story-based-on-fast-growing-cdmo-activity-and-greater-focus-on-existing-portfolio

CORPORATE CONTENT #SupplierSpotlight

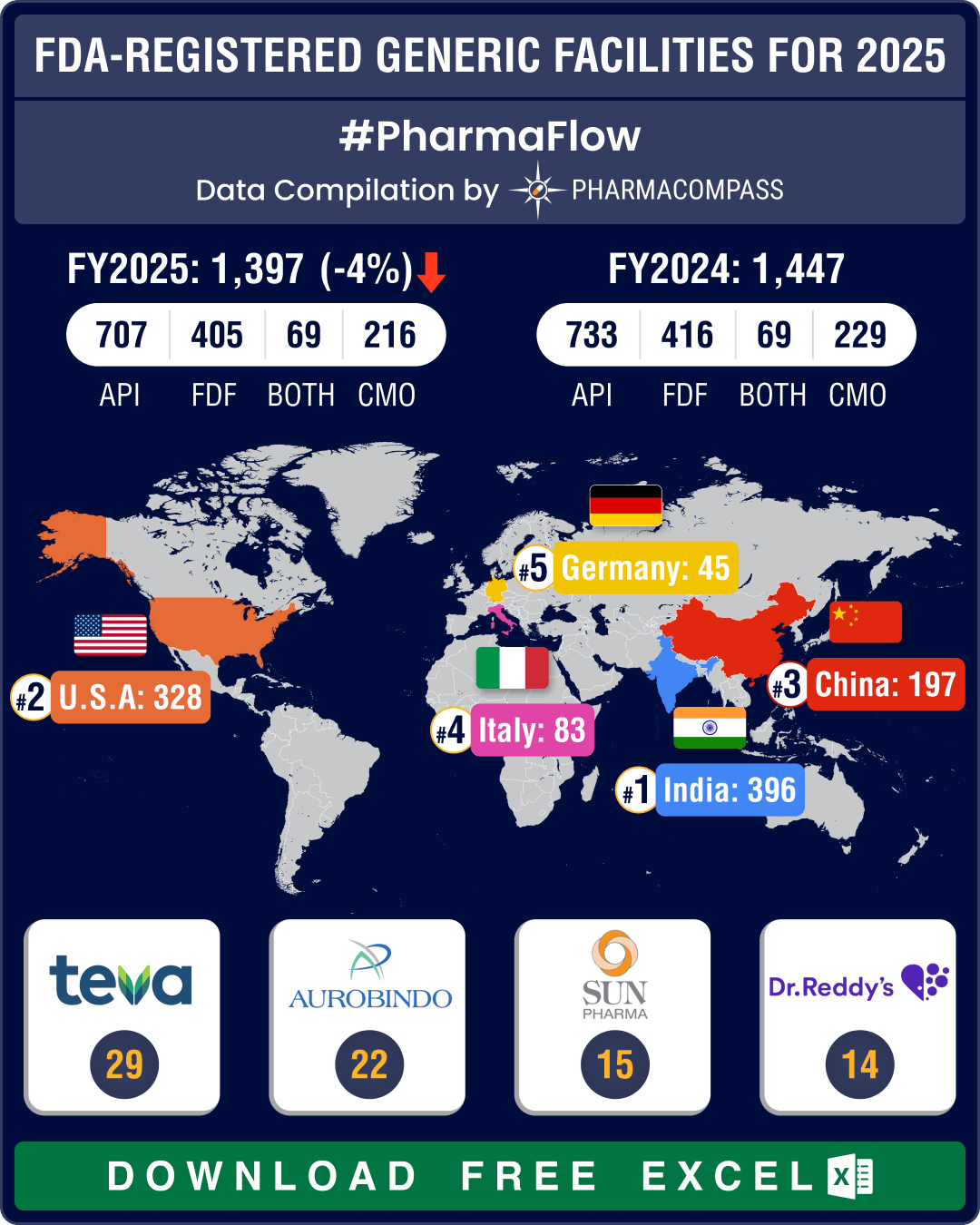

https://www.pharmacompass.com/radio-compass-blog/chinese-fda-registered-generic-facilities-gain-steam-india-maintains-lead-with-396-facilities

https://www.pharmacompass.com/radio-compass-blog/us-europe-turn-to-advanced-manufacturing-stockpiling-to-strengthen-drug-supply-chains

https://www.pharmacompass.com/radio-compass-blog/bms-bayer-takeda-pfizer-downsize-to-combat-cost-pressures-meet-restructuring-plans

https://www.pharmacompass.com/radio-compass-blog/cdmo-activity-tracker-novo-s-parent-buys-catalent-for-us-16-5-bn-fujifilm-merck-kgaa-axplora-lonza-expand-capabilities

https://www.pharmacompass.com/radio-compass-blog/fda-approves-four-oligonucleotide-therapies-in-2023-novartis-gsk-novo-bet-big

10 Dec 2024

// PRESS RELEASE

https://www.euroapi.com/en/euroapi-moves-into-a-new-chapter-with-new-governance-and-leadership

16 Oct 2024

// PRESS RELEASE

https://www.euroapi.com/en/olivier-falut-appointed-euroapi-chief-financial-officer

15 Oct 2024

// PRESS RELEASE

https://www.euroapi.com/en/EUROAPI-closes-the-financing-of-its-FOCUS-27-plan

11 Oct 2024

// PRESS RELEASE

https://www.euroapi.com/en/EUROAPI-completes-the-financing-of-its-FOCUS-27-plan-and-moves-forward-with-its-execution

07 Oct 2024

// PRESS RELEASE

https://moehs.com/moehs-group-and-euroapi-sign-an-exclusive-agreement-for-the-production-of-metamizole-in-europe/

03 Oct 2024

// PRESS RELAESE

https://www.euroapi.com/en/research-article-advancing-sustainability-in-peptide-synthesis

Registrant Name : Handok Co., Ltd.

Registration Date : 2022-10-05

Registration Number : 20221005-209-J-1372

Manufacturer Name : Sanofi Chimie

Manufacturer Address : 45 Chemin de Meteline BP 15, Sisteron Cedex, 04201, France

Registrant Name : Samoh Pharmaceutical Co., Ltd.

Registration Date : 2023-02-02

Registration Number : 20230202-210-J-1440

Manufacturer Name : EUROAPI Hungary Ltd.

Manufacturer Address : To utca 1-5., Budapest, 1045, Hungary

Registrant Name : Sanofi-Aventis Korea Co., Ltd.

Registration Date : 2022-09-22

Registration Number : 20220922-209-J-1388

Manufacturer Name : Sanofi Chimie

Manufacturer Address : 45, chemin de Météline, BP 15, Sisteron, 04201, France

Registrant Name : Samoh Pharmaceutical Co., Ltd.

Registration Date : 2021-06-09

Registration Number : 20210609-209-J-1017

Manufacturer Name : EUROAPI Hungary Ltd.

Manufacturer Address : To utca 1-5., Budapest, 1045, Hungary

Registrant Name : Shin Poong Pharmaceutical Co., Ltd.

Registration Date : 2024-09-04

Registration Number : 20210609-209-J-1017(1)

Manufacturer Name : EUROAPI Hungary Ltd.

Manufacturer Address : To utca 1-5., Budapest, 1045, Hungary

Registrant Name : Handok Co., Ltd.

Registration Date : 2010-11-30

Registration Number : 20101130-129-H-39-07

Manufacturer Name : Sanofi Chimie

Manufacturer Address : 45, chemin de Météline, BP 15, 04201 Sisteron Cedex, France

Registrant Name : Nosa Chemical Co., Ltd.

Registration Date : 2020-06-16

Registration Number : 20200616-209-J-616

Manufacturer Name : Saneca Pharmaceuticals as

Manufacturer Address : Nitrianska 100, 920 27 Hlohovec, Slovak Republic

Registrant Name : AbbVie Korea Inc.

Registration Date : 2023-07-03

Registration Number : 20230405-209-J-1469(A)

Manufacturer Name : EUROAPI France

Manufacturer Address : 4 Lieu Dit La Paterie, Vertolaye, 63480, France

Registrant Name : Novartis Korea Ltd.

Registration Date : 2023-04-05

Registration Number : 20230405-209-J-1469

Manufacturer Name : EUROAPI France

Manufacturer Address : 4 Lieu Dit La Paterie, Vertolaye, 63480, France

Registrant Name : BASH HEALTH KOREA CORP.

Registration Date : 2023-01-06

Registration Number : 20230106-209-J-1432

Manufacturer Name : EUROAPI France

Manufacturer Address : 4 La Paterie, 63480 VERTOLAYE, France

FULL SCREEN VIEW Click here to open all results in a new tab [this preview display 10 results]

FULL SCREEN VIEW Click here to open all results in a new tab [this preview display 10 results]Services

API Manufacturing

API & Drug Product Development

Pharma Service : API & Drug Product Development

Category : API Development

Sub Category : Organometallic Chemistry

Pharma Service : API & Drug Product Development

Pharma Service : API & Drug Product Development

Category : API Development

Sub Category : Route Evaluation & Development

Pharma Service : API & Drug Product Development

Pharma Service : API & Drug Product Development

Category : API Development

Sub Category : Oligosaccharides & Polysaccharides

Pharma Service : API & Drug Product Development

Pharma Service : API & Drug Product Development

Category : API Development

Sub Category : Steroid / Hormone

Pharma Service : API & Drug Product Development

Pharma Service : API & Drug Product Development

Category : API Development

Sub Category : Separation & Purification

Pharma Service : API & Drug Product Development

Pharma Service : API & Drug Product Development

Category : API Development

Sub Category : Oligosaccharides & Polysaccharides

Pharma Service : API & Drug Product Development

Pharma Service : API & Drug Product Development

Category : API Development

Sub Category : Custom Synthesis

Pharma Service : API & Drug Product Development

Pharma Service : API & Drug Product Development

Category : API Development

Sub Category : Hydrogenation

Pharma Service : API & Drug Product Development

Pharma Service : API & Drug Product Development

Category : API Development

Sub Category : Small Molecules

Pharma Service : API & Drug Product Development

Pharma Service : API & Drug Product Development

Category : API Development

Sub Category : Controlled Substance

Pharma Service : API & Drug Product Development

FULL SCREEN VIEW Click here to open all results in a new tab [this preview display 10 results]

FULL SCREEN VIEW Click here to open all results in a new tab [this preview display 10 results]Inspections and registrations

ABOUT THIS PAGE

EUROAPI is a supplier offers 127 products (APIs, Excipients or Intermediates).

Find a price of Alprostadil bulk with DMF, CEP, JDMF offered by EUROAPI

Find a price of Clobazam bulk with DMF, CEP, JDMF offered by EUROAPI

Find a price of Dexamethasone bulk with DMF, CEP, JDMF offered by EUROAPI

Find a price of Dexamethasone Sodium Phosphate bulk with DMF, CEP, JDMF offered by EUROAPI

Find a price of Furosemide bulk with DMF, CEP, JDMF offered by EUROAPI

Find a price of Hydrocortisone bulk with DMF, CEP, JDMF offered by EUROAPI

Find a price of Hydroxocobalamin Acetate bulk with DMF, CEP, JDMF offered by EUROAPI

Find a price of Latanoprost bulk with DMF, CEP, JDMF offered by EUROAPI

Find a price of Methylprednisolone Hemisuccinate bulk with DMF, CEP, JDMF offered by EUROAPI

Find a price of Naloxone Hydrochloride bulk with DMF, CEP, JDMF offered by EUROAPI

Find a price of Prednisolone bulk with DMF, CEP, JDMF offered by EUROAPI

Find a price of Prednisolone Acetate bulk with DMF, CEP, JDMF offered by EUROAPI

Find a price of Selegiline Hydrochloride bulk with DMF, CEP, JDMF offered by EUROAPI

Find a price of Spironolactone bulk with DMF, CEP, JDMF offered by EUROAPI

Find a price of Apomorphine Hydrochloride bulk with DMF, CEP offered by EUROAPI

Find a price of Bimatoprost bulk with DMF, JDMF offered by EUROAPI

Find a price of Dexamethasone bulk with DMF, CEP offered by EUROAPI

Find a price of Dinoprostone bulk with DMF, JDMF offered by EUROAPI

Find a price of Fexofenadine Hydrochloride bulk with CEP, JDMF offered by EUROAPI

Find a price of Fluorometholone bulk with DMF, JDMF offered by EUROAPI

Find a price of Fluticasone Propionate bulk with CEP, JDMF offered by EUROAPI

Find a price of Glimepiride bulk with DMF, CEP offered by EUROAPI

Find a price of Hydrocortisone bulk with CEP, JDMF offered by EUROAPI

Find a price of Hydrocortisone Acetate bulk with CEP, JDMF offered by EUROAPI

Find a price of Hydroxocobalamin bulk with DMF, JDMF offered by EUROAPI

Find a price of Irbesartan bulk with DMF, CEP offered by EUROAPI

Find a price of Methylprednisolone bulk with DMF, CEP offered by EUROAPI

Find a price of Naltrexone Hydrochloride bulk with DMF, CEP offered by EUROAPI

Find a price of Prednisone bulk with DMF, CEP offered by EUROAPI

Find a price of Rifampicin bulk with DMF, JDMF offered by EUROAPI

Find a price of Rifaximin bulk with DMF, JDMF offered by EUROAPI

Find a price of Sevelamer Hydrochloride bulk with DMF, JDMF offered by EUROAPI

Find a price of Sodium Cromoglicate bulk with DMF, CEP offered by EUROAPI

Find a price of Travoprost bulk with JDMF offered by EUROAPI

Find a price of Alprostadil Alfadex bulk with JDMF offered by EUROAPI

Find a price of Beraprost Sodium bulk with JDMF offered by EUROAPI

Find a price of Bimatoprost bulk with DMF offered by EUROAPI

Find a price of Carboprost Tromethamine bulk with DMF offered by EUROAPI

Find a price of Chlorpromazine Hydrochloride bulk with JDMF offered by EUROAPI

Find a price of Clobazam bulk with CEP offered by EUROAPI

Find a price of Clopidogrel bulk with JDMF offered by EUROAPI

Find a price of Codeine bulk with CEP offered by EUROAPI

Find a price of Codeine Phosphate bulk with CEP offered by EUROAPI

Find a price of Cortisone bulk with JDMF offered by EUROAPI

Find a price of Desoximetasone bulk with DMF offered by EUROAPI

Find a price of Dexamethasone Sodium Phosphate bulk with JDMF offered by EUROAPI

Find a price of Dinoprost bulk with JDMF offered by EUROAPI

Find a price of Dinoprost Tromethamine bulk with CEP offered by EUROAPI

Find a price of Epoprostenol Sodium bulk with DMF offered by EUROAPI

Find a price of Ethylmorphine Hydrochloride bulk with CEP offered by EUROAPI

Find a price of Glimepiride bulk with CEP offered by EUROAPI

Find a price of Gonadorelin Acetate bulk with CEP offered by EUROAPI

Find a price of Hydrocortisone Acetate bulk with CEP offered by EUROAPI

Find a price of Hydrocortisone Sodium Succinate bulk with CEP offered by EUROAPI

Find a price of Hydroxocobalamin Acetate bulk with JDMF offered by EUROAPI

Find a price of Hydroxocobalamin Hydrochloride bulk with CEP offered by EUROAPI

Find a price of Hydroxychloroquine Sulphate bulk with DMF offered by EUROAPI

Find a price of Iloprost bulk with DMF offered by EUROAPI

Find a price of Levomepromazine Hydrochloride bulk with JDMF offered by EUROAPI

Find a price of Levomepromazine Maleate bulk with CEP offered by EUROAPI

Find a price of Levomethadone bulk with CEP offered by EUROAPI

Find a price of Limaprost Alfadex bulk with JDMF offered by EUROAPI

Find a price of Morphine Hydrochloride bulk with CEP offered by EUROAPI

Find a price of Morphine Sulfate bulk with CEP offered by EUROAPI

Find a price of Nadolol bulk with CEP offered by EUROAPI

Find a price of Nalbuphine Hydrochloride bulk with DMF offered by EUROAPI

Find a price of Norepinephrine bulk with CEP offered by EUROAPI

Find a price of Norepinephrine Bitartrate bulk with CEP offered by EUROAPI

Find a price of Olmesartan Medoxomil bulk with DMF offered by EUROAPI

Find a price of Oxycodone Hydrochloride bulk with CEP offered by EUROAPI

Find a price of Pethidine Hydrochloride bulk with CEP offered by EUROAPI

Find a price of Piretanide bulk with CEP offered by EUROAPI

Find a price of Prednicarbate bulk with CEP offered by EUROAPI

Find a price of Prednisolone bulk with CEP offered by EUROAPI

Find a price of Prednisolone Sodium Phosphate bulk with DMF offered by EUROAPI

Find a price of Promethazine Hydrochloride bulk with JDMF offered by EUROAPI

Find a price of Ramipril bulk with CEP offered by EUROAPI

Find a price of Rifamycin Sodium bulk with CEP offered by EUROAPI

Find a price of Succinate bulk with JDMF offered by EUROAPI

Find a price of Tamsulosin bulk with JDMF offered by EUROAPI

Find a price of Teicoplanin bulk with JDMF offered by EUROAPI

Find a price of Tiaprofenic Acid bulk with CEP offered by EUROAPI

Find a price of Travoprost bulk with DMF offered by EUROAPI

Find a price of Treprostinil Sodium bulk with DMF offered by EUROAPI

Find a price of Triamcinolone Acetonide bulk with DMF offered by EUROAPI

Find a price of Trimipramine bulk with JDMF offered by EUROAPI

Find a price of Zolpidem Tartrate bulk with JDMF offered by EUROAPI

Find a price of Abiraterone Acetate bulk offered by EUROAPI

Find a price of Alimemazine bulk offered by EUROAPI

Find a price of Altrenogest bulk offered by EUROAPI

Find a price of Amiodarone Hydrochloride bulk offered by EUROAPI

Find a price of Amisulpride bulk offered by EUROAPI

Find a price of Buprenorphine bulk offered by EUROAPI

Find a price of Buprenorphine Hydrochloride bulk offered by EUROAPI

Find a price of Canrenoate Potassium bulk offered by EUROAPI

Find a price of Cloprostenol Sodium bulk offered by EUROAPI

Find a price of Cyamemazine bulk offered by EUROAPI

Find a price of Cyamemazine Tartrate bulk offered by EUROAPI

Find a price of Daptomycin bulk offered by EUROAPI

Find a price of Divalproex Sodium bulk offered by EUROAPI

Find a price of Drotaverine bulk offered by EUROAPI

Find a price of Eflornithine Hydrochloride bulk offered by EUROAPI

Find a price of Epinephrine bulk offered by EUROAPI

Find a price of Epinephrine Bitartrate bulk offered by EUROAPI

Find a price of Estradiol bulk offered by EUROAPI

Find a price of Estradiol Valerate bulk offered by EUROAPI

Find a price of Ethinyl Estradiol bulk offered by EUROAPI

Find a price of Fidaxomicin bulk offered by EUROAPI

Find a price of Fluticasone Furoate bulk offered by EUROAPI

Find a price of Hydrocortisone Butyrate bulk offered by EUROAPI

Find a price of Hydrocortisone Valerate bulk offered by EUROAPI

Find a price of Loprazolam Mesilate bulk offered by EUROAPI

Find a price of Lubiprostone bulk offered by EUROAPI

Find a price of Meglumine Antimonate bulk offered by EUROAPI

Find a price of Methylprednisolone Acetate bulk offered by EUROAPI

Find a price of Misoprostol bulk offered by EUROAPI

Find a price of Noscapine bulk offered by EUROAPI

Find a price of Prednisolone Sodium Metasulfobenzoate bulk offered by EUROAPI

Find a price of Rifapentine bulk offered by EUROAPI

Find a price of Riluzole bulk offered by EUROAPI

Find a price of Roxithromycin bulk offered by EUROAPI

Find a price of Sevelamer Carbonate bulk offered by EUROAPI

Find a price of Sodium Valproate bulk offered by EUROAPI

Find a price of Tafluprost bulk offered by EUROAPI

Find a price of Trenbolone Acetate bulk offered by EUROAPI

Find a price of Tulathromycin bulk offered by EUROAPI

Find a price of Zopiclone bulk offered by EUROAPI

LOOKING FOR A SUPPLIER?