01 Apr 2025

// PRESS RELEASE

03 Mar 2025

// PRESS RELEASE

30 Jan 2025

// PRESS RELEASE

Latest Content by PharmaCompass

KEY PRODUCTS

KEY PRODUCTS KEY SERVICES

KEY SERVICES

EUROAPI, the leading small molecules API player, provides both API sales & CDMO services.

About

CPhI North America CPhI North America

Industry Trade Show

Booth #1212

20-22 May, 2025

Industry Trade Show

Attending

19-22 May, 2025

Industry Trade Show

Attending

11-12 June, 2025

CONTACT DETAILS

Events

Webinars & Exhibitions

CPhI North America CPhI North America

Industry Trade Show

Booth #1212

20-22 May, 2025

Industry Trade Show

Attending

19-22 May, 2025

Industry Trade Show

Attending

11-12 June, 2025

CORPORATE CONTENT #SupplierSpotlight

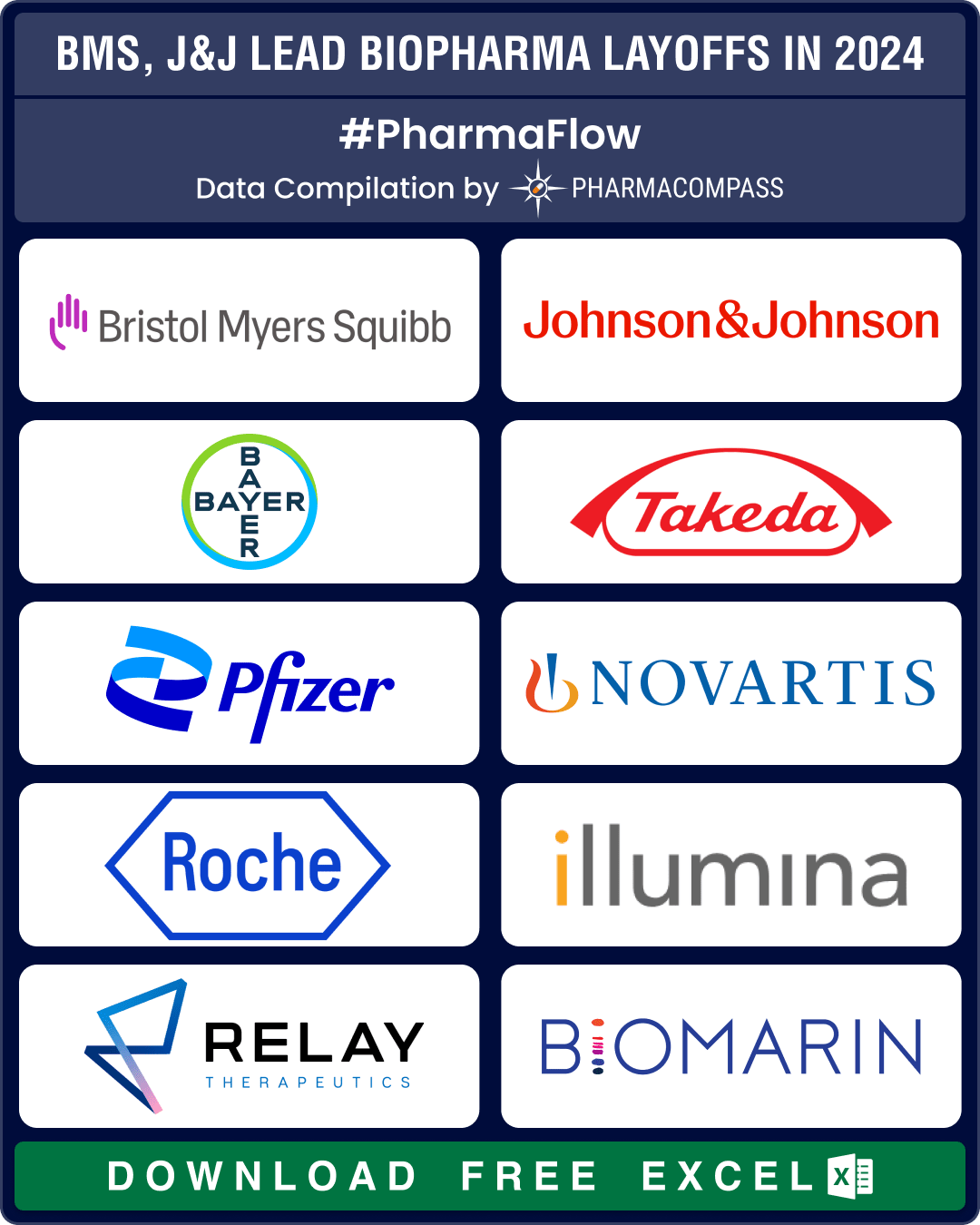

https://www.pharmacompass.com/radio-compass-blog/bms-j-j-bayer-lead-25-000-pharma-layoffs-in-2024-amylyx-fibrogen-kronos-bio-hit-by-trial-failures-cash-crunch

https://www.pharmacompass.com/radio-compass-blog/cdmo-activity-tracker-bora-polpharma-make-acquisitions-evonik-euroapi-porton-announce-technological-expansions

https://www.pharmacompass.com/radio-compass-blog/chinese-fda-registered-generic-facilities-gain-steam-india-maintains-lead-with-396-facilities

https://www.pharmacompass.com/radio-compass-blog/us-europe-turn-to-advanced-manufacturing-stockpiling-to-strengthen-drug-supply-chains

https://www.pharmacompass.com/radio-compass-blog/bms-bayer-takeda-pfizer-downsize-to-combat-cost-pressures-meet-restructuring-plans

https://www.pharmacompass.com/radio-compass-blog/cdmo-activity-tracker-novo-s-parent-buys-catalent-for-us-16-5-bn-fujifilm-merck-kgaa-axplora-lonza-expand-capabilities

https://www.pharmacompass.com/radio-compass-blog/fda-approves-four-oligonucleotide-therapies-in-2023-novartis-gsk-novo-bet-big

01 Apr 2025

// PRESS RELEASE

https://www.euroapi.com/sites/default/files/2025-04/euroapi-press-release-april-1-2025.pdf

03 Mar 2025

// PRESS RELEASE

30 Jan 2025

// PRESS RELEASE

https://www.euroapi.com/en/euroapi-and-strainchem-enter-into-collaboration-for-liquid-phase-peptides

06 Jan 2025

// PRESS RELEASE

https://www.euroapi.com/en/euroapi-welcomes-the-french-minister-for-health-and-access-to-healthcare-and-the-french-minister-for-industry-and-energy-to-its-puy-de-dome-site

10 Dec 2024

// PRESS RELEASE

https://www.euroapi.com/en/euroapi-moves-into-a-new-chapter-with-new-governance-and-leadership

09 Dec 2024

// PRESS RELEASE

https://www.euroapi.com/en/euroapi-moves-into-a-new-chapter-with-new-governance-and-leadership

Click Us!

Click Us!

GDUFA

DMF Review : N/A

Rev. Date :

Pay. Date :

DMF Number : 10948

Submission : 1994-06-20

Status : Active

Type : II

Certificate Number : R1-CEP 2015-302 - Rev 00

Issue Date : 2022-01-31

Type : Chemical

Substance Number : 1488

Status : Valid

Registration Number : 220MF10064

Registrant's Address : To(´) utca 1-5. , 1045 Budapest, Hungary

Initial Date of Registration : 2008-02-25

Latest Date of Registration :

NDC Package Code : 82231-101

Start Marketing Date : 2014-10-28

End Marketing Date : 2025-12-31

Dosage Form (Strength) : POWDER (1g/g)

Marketing Category : BULK INGREDIENT

Registrant Name : Samoh Pharmaceutical Co., Ltd.

Registration Date : 2023-02-02

Registration Number : 20230202-210-J-1440

Manufacturer Name : EUROAPI Hungary Ltd.

Manufacturer Address : To utca 1-5., Budapest, 1045, Hungary

| Available Reg. Filing : CN |

GDUFA

DMF Review : Reviewed

Rev. Date : 2013-02-27

Pay. Date : 2013-02-13

DMF Number : 18340

Submission : 2005-05-09

Status : Active

Type : II

Certificate Number : R1-CEP 2004-314 - Rev 01

Issue Date : 2022-02-08

Type : Chemical

Substance Number : 1974

Status : Valid

Registration Number : 218MF10337

Registrant's Address : Brueningstrasse 50, 65926 Frankfurt am Main, Germany

Initial Date of Registration : 2006-03-09

Latest Date of Registration :

NDC Package Code : 82348-103

Start Marketing Date : 2020-07-01

End Marketing Date : 2025-12-31

Dosage Form (Strength) : POWDER (1kg/kg)

Marketing Category : BULK INGREDIENT

GDUFA

DMF Review : Reviewed

Rev. Date : 2013-09-28

Pay. Date : 2013-09-18

DMF Number : 1748

Submission : 1971-06-21

Status : Active

Type : II

Certificate Number : CEP 1996-019 - Rev 09

Issue Date : 2024-04-12

Type : Chemical

Substance Number : 388

Status : Valid

Registration Number : 218MF10376

Registrant's Address : 15 rue Traversie(')re 75012 Paris France

Initial Date of Registration : 2006-03-20

Latest Date of Registration :

NDC Package Code : 82298-110

Start Marketing Date : 2011-02-07

End Marketing Date : 2025-12-31

Dosage Form (Strength) : POWDER (1kg/kg)

Marketing Category : BULK INGREDIENT

Registrant Name : AbbVie Korea Inc.

Registration Date : 2023-07-03

Registration Number : 20230405-209-J-1469(A)

Manufacturer Name : EUROAPI France

Manufacturer Address : 4 La Paterie, Vertolaye, 63480, France

GDUFA

DMF Review : N/A

Rev. Date :

Pay. Date :

DMF Number : 2789

Submission : 1976-11-11

Status : Active

Type : II

Certificate Number : R1-CEP 2012-163 - Rev 01

Issue Date : 2021-12-16

Type : Chemical

Substance Number : 335

Status : Valid

Registration Number : 220MF10093

Registrant's Address : 15 rue Traversie(')re 75012 Paris France

Initial Date of Registration : 2008-03-28

Latest Date of Registration :

NDC Package Code : 82298-101

Start Marketing Date : 2011-02-07

End Marketing Date : 2025-12-31

Dosage Form (Strength) : POWDER (1kg/kg)

Marketing Category : BULK INGREDIENT

Registrant Name : Novartis Korea Ltd.

Registration Date : 2023-07-25

Registration Number : 20230725-209-J-1524

Manufacturer Name : EUROAPI France

Manufacturer Address : 4 Lieu Dit La Paterie, Vertolaye, 63480, France

| Available Reg. Filing : ASMF |

GDUFA

DMF Review : Reviewed

Rev. Date : 2016-08-04

Pay. Date : 2016-04-08

DMF Number : 30373

Submission : 2016-03-03

Status : Active

Type : II

Certificate Number : CEP 2019-166 - Rev 03

Issue Date : 2024-11-25

Type : Chemical

Substance Number : 335

Status : Valid

Registration Number : 228MF10090

Registrant's Address : 15 rue Traversie(')re 75012 Paris France

Initial Date of Registration : 2016-04-15

Latest Date of Registration :

| Available Reg. Filing : ASMF |

GDUFA

DMF Review : Reviewed

Rev. Date : 2014-03-04

Pay. Date : 2013-02-27

DMF Number : 16152

Submission : 2002-09-25

Status : Active

Type : II

Certificate Number : CEP 2001-179 - Rev 09

Issue Date : 2024-08-01

Type : Chemical

Substance Number : 913

Status : Valid

Registration Number : 218MF10374

Registrant's Address : 82 Avenue Raspail 94250 Gentilly France

Initial Date of Registration : 2006-03-20

Latest Date of Registration :

NDC Package Code : 82298-920

Start Marketing Date : 2015-02-01

End Marketing Date : 2025-12-31

Dosage Form (Strength) : POWDER (1g/g)

Marketing Category : BULK INGREDIENT

GDUFA

DMF Review : Reviewed

Rev. Date : 2014-02-14

Pay. Date : 2013-02-13

DMF Number : 23600

Submission : 2010-03-03

Status : Active

Type : II

Certificate Number : R1-CEP 2009-340 - Rev 02

Issue Date : 2021-12-09

Type : Chemical

Substance Number : 922

Status : Valid

Registration Number : 222MF10169

Registrant's Address : Brueningstrasse 50, 65926 Frankfurt am Main, Germany

Initial Date of Registration : 2010-06-08

Latest Date of Registration :

NDC Package Code : 82348-102

Start Marketing Date : 2010-07-27

End Marketing Date : 2025-12-31

Dosage Form (Strength) : POWDER (1kg/kg)

Marketing Category : BULK INGREDIENT

GDUFA

DMF Review : Reviewed

Rev. Date : 2013-09-11

Pay. Date : 2013-01-16

DMF Number : 26728

Submission : 2012-12-14

Status : Active

Type : II

Certificate Number : R0-CEP 2021-352 - Rev 00

Issue Date : 2022-12-02

Type : Chemical

Substance Number : 2230

Status : Valid

Registration Number : 225MF10111

Registrant's Address : To(´) utca 1-5. , 1045 Budapest, Hungary

Initial Date of Registration : 2013-05-30

Latest Date of Registration :

Registrant Name : Samil Pharmaceutical Co., Ltd.

Registration Date : 2022-10-18

Registration Number : 20221018-211-J-1382

Manufacturer Name : EUROAPI Hungary Ltd.

Manufacturer Address : To utca 1-5., Budapest, 1045, Hungary

| Available Reg. Filing : ASMF |

GDUFA

DMF Review : Reviewed

Rev. Date : 2014-01-14

Pay. Date : 2014-01-06

DMF Number : 2922

Submission : 1977-05-02

Status : Active

Type : II

Certificate Number : R1-CEP 2005-228 - Rev 03

Issue Date : 2021-12-17

Type : Chemical

Substance Number : 1131

Status : Valid

Registration Number : 220MF10128

Registrant's Address : 82 Avenue Raspail 94250 Gentilly France

Initial Date of Registration : 2008-05-15

Latest Date of Registration :

NDC Package Code : 82298-109

Start Marketing Date : 2011-02-07

End Marketing Date : 2025-12-31

Dosage Form (Strength) : POWDER (1kg/kg)

Marketing Category : BULK INGREDIENT

| Available Reg. Filing : ASMF |

GDUFA

DMF Review : Reviewed

Rev. Date : 2013-02-15

Pay. Date : 2013-01-23

DMF Number : 23142

Submission : 2009-09-30

Status : Active

Type : II

Certificate Number : CEP 1996-050 - Rev 07

Issue Date : 2024-02-22

Type : Chemical

Substance Number : 729

Status : Valid

Registration Number : 218MF10971

Registrant's Address : 82 Avenue Raspail 94250 Gentilly France

Initial Date of Registration : 2006-12-01

Latest Date of Registration :

Registrant Name : Korea Mundi Pharma Co., Ltd.

Registration Date : 2013-06-14

Registration Number : 20130507-176-I-164-01(1)

Manufacturer Name : Sanofi Winthrop Industrie

Manufacturer Address : Route d'Avignon 30390 Aramon France

| Available Reg. Filing : CN |

FULL SCREEN VIEW Click here to open all results in a new tab [this preview display 10 results]

FULL SCREEN VIEW Click here to open all results in a new tab [this preview display 10 results]

Services

API Manufacturing

API & Drug Product Development

Excipients

Excipients by Ingredients

Excipients By applications

Inspections and registrations

ABOUT THIS PAGE

Sanofi Cepia is a supplier offers 142 products (APIs, Excipients or Intermediates).

Find a price of Alprostadil bulk with DMF, CEP, JDMF offered by Sanofi Cepia

Find a price of Clobazam bulk with DMF, CEP, JDMF offered by Sanofi Cepia

Find a price of Dexamethasone bulk with DMF, CEP, JDMF offered by Sanofi Cepia

Find a price of Dexamethasone Sodium Phosphate bulk with DMF, CEP, JDMF offered by Sanofi Cepia

Find a price of Hydrocortisone bulk with DMF, CEP, JDMF offered by Sanofi Cepia

Find a price of Hydroxocobalamin Acetate bulk with DMF, CEP, JDMF offered by Sanofi Cepia

Find a price of Ketoprofen bulk with DMF, CEP, JDMF offered by Sanofi Cepia

Find a price of Latanoprost bulk with DMF, CEP, JDMF offered by Sanofi Cepia

Find a price of Methylprednisolone Hemisuccinate bulk with DMF, CEP, JDMF offered by Sanofi Cepia

Find a price of Naloxone Hydrochloride bulk with DMF, CEP, JDMF offered by Sanofi Cepia

Find a price of Prednisolone bulk with DMF, CEP, JDMF offered by Sanofi Cepia

Find a price of Prednisolone Acetate bulk with DMF, CEP, JDMF offered by Sanofi Cepia

Find a price of Selegiline Hydrochloride bulk with DMF, CEP, JDMF offered by Sanofi Cepia

Find a price of Spironolactone bulk with DMF, CEP, JDMF offered by Sanofi Cepia

Find a price of Vitamin B12 bulk with DMF, CEP, JDMF offered by Sanofi Cepia

Find a price of Apomorphine Hydrochloride bulk with DMF, CEP offered by Sanofi Cepia

Find a price of Bimatoprost bulk with DMF, JDMF offered by Sanofi Cepia

Find a price of Dexamethasone bulk with DMF, CEP offered by Sanofi Cepia

Find a price of Dinoprostone bulk with DMF, JDMF offered by Sanofi Cepia

Find a price of Fexofenadine Hydrochloride bulk with CEP, JDMF offered by Sanofi Cepia

Find a price of Fluorometholone bulk with DMF, JDMF offered by Sanofi Cepia

Find a price of Fluticasone Propionate bulk with CEP, JDMF offered by Sanofi Cepia

Find a price of Glimepiride bulk with DMF, CEP offered by Sanofi Cepia

Find a price of Hydrocortisone Acetate bulk with CEP, JDMF offered by Sanofi Cepia

Find a price of Hydroxocobalamin bulk with DMF, JDMF offered by Sanofi Cepia

Find a price of Irbesartan bulk with DMF, CEP offered by Sanofi Cepia

Find a price of Methylprednisolone bulk with DMF, CEP offered by Sanofi Cepia

Find a price of Naltrexone Hydrochloride bulk with DMF, CEP offered by Sanofi Cepia

Find a price of Prednisone bulk with DMF, CEP offered by Sanofi Cepia

Find a price of Ramipril bulk with DMF, CEP offered by Sanofi Cepia

Find a price of Rifampicin bulk with DMF, JDMF offered by Sanofi Cepia

Find a price of Rifaximin bulk with DMF, JDMF offered by Sanofi Cepia

Find a price of Sevelamer Hydrochloride bulk with DMF, JDMF offered by Sanofi Cepia

Find a price of Sodium Cromoglicate bulk with DMF, CEP offered by Sanofi Cepia

Find a price of Travoprost bulk with DMF, JDMF offered by Sanofi Cepia

Find a price of Alprostadil Alfadex bulk with JDMF offered by Sanofi Cepia

Find a price of Beraprost Sodium bulk with JDMF offered by Sanofi Cepia

Find a price of Bimatoprost bulk with DMF offered by Sanofi Cepia

Find a price of Carboprost Tromethamine bulk with DMF offered by Sanofi Cepia

Find a price of Clobazam bulk with CEP offered by Sanofi Cepia

Find a price of Clopidogrel bulk with JDMF offered by Sanofi Cepia

Find a price of Codeine bulk with CEP offered by Sanofi Cepia

Find a price of Codeine Phosphate bulk with CEP offered by Sanofi Cepia

Find a price of Cortisone bulk with JDMF offered by Sanofi Cepia

Find a price of Desoximetasone bulk with DMF offered by Sanofi Cepia

Find a price of Dexamethasone Sodium Phosphate bulk with JDMF offered by Sanofi Cepia

Find a price of Dinoprost bulk with JDMF offered by Sanofi Cepia

Find a price of Dinoprost Tromethamine bulk with CEP offered by Sanofi Cepia

Find a price of Epoprostenol Sodium bulk with DMF offered by Sanofi Cepia

Find a price of Ethylmorphine Hydrochloride bulk with CEP offered by Sanofi Cepia

Find a price of Glimepiride bulk with CEP offered by Sanofi Cepia

Find a price of Hydrocortisone bulk with JDMF offered by Sanofi Cepia

Find a price of Hydrocortisone Acetate bulk with CEP offered by Sanofi Cepia

Find a price of Hydrocortisone Sodium Succinate bulk with CEP offered by Sanofi Cepia

Find a price of Hydroxocobalamin Acetate bulk with JDMF offered by Sanofi Cepia

Find a price of Hydroxocobalamin Hydrochloride bulk with CEP offered by Sanofi Cepia

Find a price of Hydroxychloroquine Sulphate bulk with DMF offered by Sanofi Cepia

Find a price of Iloprost bulk with DMF offered by Sanofi Cepia

Find a price of Levomepromazine Hydrochloride bulk with JDMF offered by Sanofi Cepia

Find a price of Levomepromazine Maleate bulk with CEP offered by Sanofi Cepia

Find a price of Levomethadone bulk with CEP offered by Sanofi Cepia

Find a price of Limaprost Alfadex bulk with JDMF offered by Sanofi Cepia

Find a price of Morphine Hydrochloride bulk with CEP offered by Sanofi Cepia

Find a price of Morphine Sulfate bulk with CEP offered by Sanofi Cepia

Find a price of Nalbuphine Hydrochloride bulk with DMF offered by Sanofi Cepia

Find a price of Norepinephrine bulk with CEP offered by Sanofi Cepia

Find a price of Norepinephrine Bitartrate bulk with CEP offered by Sanofi Cepia

Find a price of Oxycodone Hydrochloride bulk with CEP offered by Sanofi Cepia

Find a price of Piretanide bulk with CEP offered by Sanofi Cepia

Find a price of Prednicarbate bulk with CEP offered by Sanofi Cepia

Find a price of Prednisolone bulk with CEP offered by Sanofi Cepia

Find a price of Ramipril bulk with DMF offered by Sanofi Cepia

Find a price of Rifamycin Sodium bulk with CEP offered by Sanofi Cepia

Find a price of Teicoplanin bulk with JDMF offered by Sanofi Cepia

Find a price of Tiaprofenic Acid bulk with CEP offered by Sanofi Cepia

Find a price of Treprostinil Sodium bulk with DMF offered by Sanofi Cepia

Find a price of Triamcinolone Acetonide bulk with DMF offered by Sanofi Cepia

Find a price of Vitamin B12 bulk with CEP offered by Sanofi Cepia

Find a price of Zolpidem Tartrate bulk with JDMF offered by Sanofi Cepia

Find a price of Alimemazine bulk offered by Sanofi Cepia

Find a price of Alprostadil bulk offered by Sanofi Cepia

Find a price of Altrenogest bulk offered by Sanofi Cepia

Find a price of Amiodarone Hydrochloride bulk offered by Sanofi Cepia

Find a price of Amisulpride bulk offered by Sanofi Cepia

Find a price of Buprenorphine bulk offered by Sanofi Cepia

Find a price of Buprenorphine Hydrochloride bulk offered by Sanofi Cepia

Find a price of Canrenoate Potassium bulk offered by Sanofi Cepia

Find a price of Chlorpromazine Hydrochloride bulk offered by Sanofi Cepia

Find a price of Clonazepam bulk offered by Sanofi Cepia

Find a price of Cloprostenol Sodium bulk offered by Sanofi Cepia

Find a price of Codeine Sulfate bulk offered by Sanofi Cepia

Find a price of Cyamemazine bulk offered by Sanofi Cepia

Find a price of Cyamemazine Tartrate bulk offered by Sanofi Cepia

Find a price of Dalbavancin bulk offered by Sanofi Cepia

Find a price of Daptomycin bulk offered by Sanofi Cepia

Find a price of Dexamethasone bulk offered by Sanofi Cepia

Find a price of Dinoprost Tromethamine bulk offered by Sanofi Cepia

Find a price of Divalproex Sodium bulk offered by Sanofi Cepia

Find a price of Drotaverine bulk offered by Sanofi Cepia

Find a price of Eflornithine Hydrochloride bulk offered by Sanofi Cepia

Find a price of Enoxaparin Sodium bulk offered by Sanofi Cepia

Find a price of Epinephrine bulk offered by Sanofi Cepia

Find a price of Epinephrine Bitartrate bulk offered by Sanofi Cepia

Find a price of Fexinidazole bulk offered by Sanofi Cepia

Find a price of Fidaxomicin bulk offered by Sanofi Cepia

Find a price of Fluorometholone bulk offered by Sanofi Cepia

Find a price of Fluticasone Furoate bulk offered by Sanofi Cepia

Find a price of Furosemide bulk offered by Sanofi Cepia

Find a price of Hydrocortisone Valerate bulk offered by Sanofi Cepia

Find a price of Hydroxychloroquine Sulphate bulk offered by Sanofi Cepia

Find a price of Inclisiran bulk offered by Sanofi Cepia

Find a price of Insulin bulk offered by Sanofi Cepia

Find a price of Irbesartan bulk offered by Sanofi Cepia

Find a price of Loprazolam Mesilate bulk offered by Sanofi Cepia

Find a price of Lubiprostone bulk offered by Sanofi Cepia

Find a price of Meglumine Antimonate bulk offered by Sanofi Cepia

Find a price of Methylprednisolone Acetate bulk offered by Sanofi Cepia

Find a price of Misoprostol bulk offered by Sanofi Cepia

Find a price of Nadolol bulk offered by Sanofi Cepia

Find a price of Naloxone Hydrochloride bulk offered by Sanofi Cepia

Find a price of Naltrexone bulk offered by Sanofi Cepia

Find a price of Nedocromil Sodium bulk offered by Sanofi Cepia

Find a price of Noscapine bulk offered by Sanofi Cepia

Find a price of Olmesartan Medoxomil bulk offered by Sanofi Cepia

Find a price of Oxymorphone bulk offered by Sanofi Cepia

Find a price of Prednisolone bulk offered by Sanofi Cepia

Find a price of Prednisolone Acetate bulk offered by Sanofi Cepia

Find a price of Prednisolone Sodium Metasulfobenzoate bulk offered by Sanofi Cepia

Find a price of Promethazine Hydrochloride bulk offered by Sanofi Cepia

Find a price of Ramipril bulk offered by Sanofi Cepia

Find a price of Rifapentine bulk offered by Sanofi Cepia

Find a price of Riluzole bulk offered by Sanofi Cepia

Find a price of Roxithromycin bulk offered by Sanofi Cepia

Find a price of Selegiline Hydrochloride bulk offered by Sanofi Cepia

Find a price of Sevelamer Carbonate bulk offered by Sanofi Cepia

Find a price of Sodium Valproate bulk offered by Sanofi Cepia

Find a price of Tafluprost bulk offered by Sanofi Cepia

Find a price of Trenbolone Acetate bulk offered by Sanofi Cepia

Find a price of Treprostinil Diolamine bulk offered by Sanofi Cepia

Find a price of Tulathromycin bulk offered by Sanofi Cepia

Find a price of Vitamin B12 bulk offered by Sanofi Cepia

Find a price of Zopiclone bulk offered by Sanofi Cepia