12 Apr 2025

// ECONOMICTIMES

15 Apr 2025

// ECONOMICTIMES

14 Apr 2025

// ECONOMICTIMES

12 Apr 2025

// ECONOMICTIMES

15 Apr 2025

// ECONOMICTIMES

Latest Content by PharmaCompass

KEY PRODUCTS

KEY PRODUCTS

Digital content

VLOG #PharmaReel

CORPORATE CONTENT #SupplierSpotlight

https://www.pharmacompass.com/radio-compass-blog/fda-s-first-generic-approvals-slump-21-in-2024-novartis-top-seller-entresto-cancer-blockbuster-tasigna-lead-2024-patent-cliff

https://www.pharmacompass.com/radio-compass-blog/fda-okays-50-new-drugs-in-2024-bms-cobenfy-lilly-s-kisunla-lead-pack-of-breakthrough-therapies

https://www.pharmacompass.com/radio-compass-blog/cdmo-activity-tracker-bora-polpharma-make-acquisitions-evonik-euroapi-porton-announce-technological-expansions

https://www.pharmacompass.com/radio-compass-blog/chinese-fda-registered-generic-facilities-gain-steam-india-maintains-lead-with-396-facilities

https://www.pharmacompass.com/radio-compass-blog/dmf-filings-hit-all-time-high-in-q3-2024-china-tops-list-with-58-increase-in-type-ii-submissions

https://www.pharmacompass.com/radio-compass-blog/cdmo-activity-tracker-novo-s-parent-buys-catalent-for-us-16-5-bn-fujifilm-merck-kgaa-axplora-lonza-expand-capabilities

https://www.pharmacompass.com/radio-compass-blog/fda-approves-record-eight-biosimilars-in-h1-2024-okays-first-interchangeable-biosimilars-for-eylea

https://www.pharmacompass.com/radio-compass-blog/dmf-submissions-from-china-jump-42-as-india-continues-to-top-list-in-q1-2024

15 Apr 2025

// ECONOMICTIMES

https://economictimes.indiatimes.com/industry/healthcare/biotech/pharmaceuticals/sweet-surrender-sanofi-puts-star-insulin-brand-lantus-up-for-sale-eyes-rs-2000-crore-from-indian-pharma-giants/articleshow/120289524.cms

14 Apr 2025

// ECONOMICTIMES

https://economictimes.indiatimes.com/industry/healthcare/biotech/pharmaceuticals/dr-reddys-slashing-jobs-to-cut-costs-by-25-asks-several-rs-1-crore-earners-to-resign/articleshow/120277193.cms

12 Apr 2025

// ECONOMICTIMES

https://economictimes.indiatimes.com/industry/healthcare/biotech/pharmaceuticals/weight-is-over-pharma-companies-race-to-make-weight-loss-drug-semaglutide/articleshow/120215666.cms

09 Apr 2025

// REUTERS

https://www.reuters.com/business/healthcare-pharmaceuticals/indian-pharma-stocks-decline-after-trump-again-threatens-tariffs-2025-04-09/https://www.reuters.com/business/healthcare-pharmaceuticals/indian-pharma-stocks-decline-after-trump-again-threatens-tariffs-2025-04-09/

08 Apr 2025

// INDPHARMAPOST

https://www.indianpharmapost.com/news/dr-reddys-laboratories-gets-rs-2395-crore-show-cause-notice-from-it-authority-16983

03 Apr 2025

// REUTERS

https://www.reuters.com/world/india/indian-pharma-stocks-defy-market-slump-us-tariffs-exemption-2025-04-03/

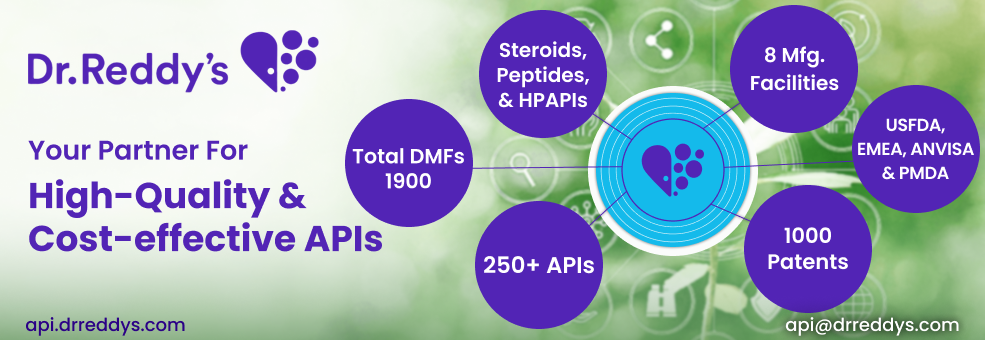

Dr. Reddy's Laboratories is a supplier offers 208 products (APIs, Excipients or Intermediates).

Find a price of Atorvastatin bulk with DMF, CEP, JDMF, WC offered by Dr. Reddy's Laboratories

Find a price of Capecitabine bulk with DMF, CEP, JDMF, WC offered by Dr. Reddy's Laboratories

Find a price of Cetirizine Dihydrochloride bulk with DMF, CEP, JDMF, WC offered by Dr. Reddy's Laboratories

Find a price of Clopidogrel bulk with DMF, CEP, JDMF, WC offered by Dr. Reddy's Laboratories

Find a price of Fexofenadine Hydrochloride bulk with DMF, CEP, JDMF, WC offered by Dr. Reddy's Laboratories

Find a price of Finasteride bulk with DMF, CEP, JDMF, WC offered by Dr. Reddy's Laboratories

Find a price of Gemcitabine bulk with DMF, CEP, JDMF, WC offered by Dr. Reddy's Laboratories

Find a price of Levetiracetam bulk with DMF, CEP, JDMF, WC offered by Dr. Reddy's Laboratories

Find a price of Montelukast Sodium bulk with DMF, CEP, JDMF, WC offered by Dr. Reddy's Laboratories

Find a price of Nizatidine bulk with DMF, CEP, JDMF, WC offered by Dr. Reddy's Laboratories

Find a price of Ondansetron Hydrochloride bulk with DMF, CEP, JDMF, WC offered by Dr. Reddy's Laboratories

Find a price of Quetiapine Hemifumarate bulk with DMF, CEP, JDMF, WC offered by Dr. Reddy's Laboratories

Find a price of Rabeprazole Sodium bulk with DMF, CEP, JDMF, WC offered by Dr. Reddy's Laboratories

Find a price of Risperidone bulk with DMF, CEP, JDMF, WC offered by Dr. Reddy's Laboratories

Find a price of Rivaroxaban bulk with DMF, CEP, JDMF, WC offered by Dr. Reddy's Laboratories

Find a price of Valsartan bulk with DMF, CEP, JDMF, WC offered by Dr. Reddy's Laboratories

Find a price of Amlodipine Besylate bulk with DMF, CEP, JDMF offered by Dr. Reddy's Laboratories

Find a price of Atorvastatin bulk with DMF, CEP, JDMF offered by Dr. Reddy's Laboratories

Find a price of Azacitidine bulk with DMF, JDMF, WC offered by Dr. Reddy's Laboratories

Find a price of Dasatinib bulk with DMF, JDMF, WC offered by Dr. Reddy's Laboratories

Find a price of Desloratadine bulk with DMF, CEP, WC offered by Dr. Reddy's Laboratories

Find a price of Esomeprazole Magnesium bulk with DMF, CEP, WC offered by Dr. Reddy's Laboratories

Find a price of Famotidine bulk with DMF, CEP, WC offered by Dr. Reddy's Laboratories

Find a price of Glimepiride bulk with DMF, CEP, WC offered by Dr. Reddy's Laboratories

Find a price of Ketorolac Trometamol bulk with DMF, CEP, WC offered by Dr. Reddy's Laboratories

Find a price of Lenalidomide bulk with DMF, JDMF, WC offered by Dr. Reddy's Laboratories

Find a price of Levofloxacin Hemihydrate bulk with DMF, CEP, WC offered by Dr. Reddy's Laboratories

Find a price of Losartan Potassium bulk with DMF, JDMF, WC offered by Dr. Reddy's Laboratories

Find a price of Naproxen bulk with DMF, CEP, JDMF offered by Dr. Reddy's Laboratories

Find a price of Naratriptan Hydrochloride bulk with DMF, JDMF, WC offered by Dr. Reddy's Laboratories

Find a price of Omeprazole bulk with DMF, CEP, WC offered by Dr. Reddy's Laboratories

Find a price of Omeprazole Magnesium bulk with DMF, CEP, WC offered by Dr. Reddy's Laboratories

Find a price of Pantoprazole Sodium bulk with DMF, CEP, WC offered by Dr. Reddy's Laboratories

Find a price of Pioglitazone Hydrochloride bulk with DMF, JDMF, WC offered by Dr. Reddy's Laboratories

Find a price of Rabeprazole Sodium bulk with DMF, CEP, WC offered by Dr. Reddy's Laboratories

Find a price of Raloxifene Hydrochloride bulk with DMF, CEP, WC offered by Dr. Reddy's Laboratories

Find a price of Rivastigmine Tartrate bulk with DMF, CEP, WC offered by Dr. Reddy's Laboratories

Find a price of Sitagliptin Phosphate bulk with DMF, CEP, WC offered by Dr. Reddy's Laboratories

Find a price of Sugammadex Sodium bulk with DMF, JDMF, WC offered by Dr. Reddy's Laboratories

Find a price of Terbinafine Hydrochloride bulk with DMF, CEP, WC offered by Dr. Reddy's Laboratories

Find a price of Ticagrelor bulk with DMF, CEP, WC offered by Dr. Reddy's Laboratories

Find a price of Abiraterone Acetate bulk with DMF, JDMF offered by Dr. Reddy's Laboratories

Find a price of Apalutamide bulk with DMF, WC offered by Dr. Reddy's Laboratories

Find a price of Apixaban bulk with DMF, WC offered by Dr. Reddy's Laboratories

Find a price of Apremilast bulk with DMF, WC offered by Dr. Reddy's Laboratories

Find a price of Atomoxetin Hydrochloride bulk with DMF, WC offered by Dr. Reddy's Laboratories

Find a price of Atorvastatin bulk with DMF, JDMF offered by Dr. Reddy's Laboratories

Find a price of Bendamustine Hydrochloride bulk with DMF, WC offered by Dr. Reddy's Laboratories

Find a price of Bortezomib bulk with DMF, WC offered by Dr. Reddy's Laboratories

Find a price of Cabazitaxel bulk with DMF, WC offered by Dr. Reddy's Laboratories

Find a price of Carfilzomib bulk with DMF, WC offered by Dr. Reddy's Laboratories

Find a price of Cinacalcet Hydrochloride bulk with DMF, WC offered by Dr. Reddy's Laboratories

Find a price of Dabigatran Etexilate Mesylate bulk with DMF, WC offered by Dr. Reddy's Laboratories

Find a price of Dapagliflozin bulk with DMF, WC offered by Dr. Reddy's Laboratories

Find a price of Dapagliflozin Propanediol Monohydrate bulk with DMF, WC offered by Dr. Reddy's Laboratories

Find a price of Decitabine bulk with DMF, WC offered by Dr. Reddy's Laboratories

Find a price of Dutasteride bulk with DMF, WC offered by Dr. Reddy's Laboratories

Find a price of Edaravone bulk with DMF, WC offered by Dr. Reddy's Laboratories

Find a price of Elagolix Sodium bulk with DMF, WC offered by Dr. Reddy's Laboratories

Find a price of Enzalutamide bulk with DMF, WC offered by Dr. Reddy's Laboratories

Find a price of Eslicarbazepine Acetate bulk with DMF, WC offered by Dr. Reddy's Laboratories

Find a price of Eszopiclone bulk with DMF, WC offered by Dr. Reddy's Laboratories

Find a price of Fondaparinux Sodium bulk with DMF, WC offered by Dr. Reddy's Laboratories

Find a price of Gatifloxacin bulk with DMF, WC offered by Dr. Reddy's Laboratories

Find a price of Glatiramer Acetate bulk with DMF, WC offered by Dr. Reddy's Laboratories

Find a price of Granisetron bulk with DMF, WC offered by Dr. Reddy's Laboratories

Find a price of Iron Sucrose bulk with DMF, WC offered by Dr. Reddy's Laboratories

Find a price of Lenvatinib Mesylate bulk with DMF, WC offered by Dr. Reddy's Laboratories

Find a price of Levocetirizine Dihydrochloride bulk with DMF, WC offered by Dr. Reddy's Laboratories

Find a price of Linagliptin bulk with DMF, WC offered by Dr. Reddy's Laboratories

Find a price of Lomustine bulk with DMF, WC offered by Dr. Reddy's Laboratories

Find a price of Losartan Potassium bulk with DMF, JDMF offered by Dr. Reddy's Laboratories

Find a price of Lurasidone Hydrochloride bulk with DMF, WC offered by Dr. Reddy's Laboratories

Find a price of Metoprolol Succinate bulk with DMF, WC offered by Dr. Reddy's Laboratories

Find a price of Mirabegron bulk with DMF, WC offered by Dr. Reddy's Laboratories

Find a price of Moxifloxacin Hydrochloride bulk with DMF, WC offered by Dr. Reddy's Laboratories

Find a price of Naproxen bulk with DMF, CEP offered by Dr. Reddy's Laboratories

Find a price of Naproxen Sodium bulk with DMF, CEP offered by Dr. Reddy's Laboratories

Find a price of Nilotinib bulk with DMF, WC offered by Dr. Reddy's Laboratories

Find a price of Omeprazole Magnesium bulk with DMF, WC offered by Dr. Reddy's Laboratories

Find a price of Ondansetron bulk with DMF, WC offered by Dr. Reddy's Laboratories

Find a price of Palonosetron bulk with DMF, WC offered by Dr. Reddy's Laboratories

Find a price of Pantoprazole Sodium bulk with DMF, WC offered by Dr. Reddy's Laboratories

Find a price of Pemetrexed Disodium bulk with DMF, CEP offered by Dr. Reddy's Laboratories

Find a price of Permethrin bulk with DMF, CEP offered by Dr. Reddy's Laboratories

Find a price of Pomalidomide bulk with DMF, WC offered by Dr. Reddy's Laboratories

Find a price of Posaconazole bulk with DMF, WC offered by Dr. Reddy's Laboratories

Find a price of Pregabalin bulk with DMF, WC offered by Dr. Reddy's Laboratories

Find a price of Ramipril bulk with DMF, WC offered by Dr. Reddy's Laboratories

Find a price of Ranolazine bulk with DMF, WC offered by Dr. Reddy's Laboratories

Find a price of Roxadustat bulk with DMF, WC offered by Dr. Reddy's Laboratories

Find a price of Sacubitril-Valsartan bulk with DMF, WC offered by Dr. Reddy's Laboratories

Find a price of Sitagliptin Hydrochloride bulk with DMF, WC offered by Dr. Reddy's Laboratories

Find a price of Sumatriptan bulk with DMF, CEP offered by Dr. Reddy's Laboratories

Find a price of Tizanidine HCl bulk with DMF, WC offered by Dr. Reddy's Laboratories

Find a price of Ziprasidone Hydrochloride bulk with DMF, WC offered by Dr. Reddy's Laboratories

Find a price of Zoledronic Acid bulk with DMF, WC offered by Dr. Reddy's Laboratories

Find a price of Apalutamide bulk with DMF offered by Dr. Reddy's Laboratories

Find a price of Apremilast bulk with DMF offered by Dr. Reddy's Laboratories

Find a price of Atomoxetin Hydrochloride bulk with WC offered by Dr. Reddy's Laboratories

Find a price of Atorvastatin bulk with DMF offered by Dr. Reddy's Laboratories

Find a price of Bempedoic Acid bulk with DMF offered by Dr. Reddy's Laboratories

Find a price of Benztropine bulk with DMF offered by Dr. Reddy's Laboratories

Find a price of Cabozantinib bulk with DMF offered by Dr. Reddy's Laboratories

Find a price of Capecitabine bulk with CEP offered by Dr. Reddy's Laboratories

Find a price of Cetirizine Dihydrochloride bulk with CEP offered by Dr. Reddy's Laboratories

Find a price of Dabigatran Etexilate Mesylate bulk with DMF offered by Dr. Reddy's Laboratories

Find a price of Dasatinib bulk with DMF offered by Dr. Reddy's Laboratories

Find a price of Decitabine bulk with WC offered by Dr. Reddy's Laboratories

Find a price of Donepezil bulk with DMF offered by Dr. Reddy's Laboratories

Find a price of Doxazosin Mesylate bulk with DMF offered by Dr. Reddy's Laboratories

Find a price of Eliglustat bulk with DMF offered by Dr. Reddy's Laboratories

Find a price of Empagliflozin bulk with DMF offered by Dr. Reddy's Laboratories

Find a price of Eribulin bulk with DMF offered by Dr. Reddy's Laboratories

Find a price of Esomeprazole Magnesium bulk with WC offered by Dr. Reddy's Laboratories

Find a price of Ezetimibe bulk with WC offered by Dr. Reddy's Laboratories

Find a price of Ferric Carboxymaltose bulk with DMF offered by Dr. Reddy's Laboratories

Find a price of Fexofenadine Hydrochloride bulk with DMF offered by Dr. Reddy's Laboratories

Find a price of Fosaprepitant bulk with DMF offered by Dr. Reddy's Laboratories

Find a price of Ketorolac Trometamol bulk with WC offered by Dr. Reddy's Laboratories

Find a price of Lacidipine bulk with WC offered by Dr. Reddy's Laboratories

Find a price of Lenalidomide bulk with DMF offered by Dr. Reddy's Laboratories

Find a price of Lifitegrast bulk with DMF offered by Dr. Reddy's Laboratories

Find a price of Lubiprostone bulk with DMF offered by Dr. Reddy's Laboratories

Find a price of Lumateperone Tosylate bulk with DMF offered by Dr. Reddy's Laboratories

Find a price of Memantine Hydrochloride bulk with DMF offered by Dr. Reddy's Laboratories

Find a price of Metoprolol Succinate bulk with WC offered by Dr. Reddy's Laboratories

Find a price of Midostaurin bulk with DMF offered by Dr. Reddy's Laboratories

Find a price of Mirabegron bulk with DMF offered by Dr. Reddy's Laboratories

Find a price of Naproxen bulk with DMF offered by Dr. Reddy's Laboratories

Find a price of Nilotinib bulk with DMF offered by Dr. Reddy's Laboratories

Find a price of Olaparib bulk with DMF offered by Dr. Reddy's Laboratories

Find a price of Omeprazole bulk with DMF offered by Dr. Reddy's Laboratories

Find a price of Ondansetron Hydrochloride bulk with JDMF offered by Dr. Reddy's Laboratories

Find a price of Oxaprozin bulk with WC offered by Dr. Reddy's Laboratories

Find a price of Palbociclib bulk with DMF offered by Dr. Reddy's Laboratories

Find a price of Pazopanib Hydrochloride bulk with DMF offered by Dr. Reddy's Laboratories

Find a price of Pemetrexed Ditromethamine bulk with WC offered by Dr. Reddy's Laboratories

Find a price of Pregabalin bulk with DMF offered by Dr. Reddy's Laboratories

Find a price of Rabeprazole Sodium bulk with CEP offered by Dr. Reddy's Laboratories

Find a price of Relugolix bulk with DMF offered by Dr. Reddy's Laboratories

Find a price of Ripretinib bulk with DMF offered by Dr. Reddy's Laboratories

Find a price of Roxadustat bulk with DMF offered by Dr. Reddy's Laboratories

Find a price of Sitagliptin Hydrochloride bulk with WC offered by Dr. Reddy's Laboratories

Find a price of Sitagliptin Phosphate bulk with DMF offered by Dr. Reddy's Laboratories

Find a price of Sumatriptan bulk with DMF offered by Dr. Reddy's Laboratories

Find a price of Tafamidis Meglumine bulk with DMF offered by Dr. Reddy's Laboratories

Find a price of Testosterone bulk with DMF offered by Dr. Reddy's Laboratories

Find a price of Tofacitinib Citrate bulk with DMF offered by Dr. Reddy's Laboratories

Find a price of Travoprost bulk with DMF offered by Dr. Reddy's Laboratories

Find a price of Valsartan bulk with JDMF offered by Dr. Reddy's Laboratories

Find a price of Varenicline Tartrate bulk with DMF offered by Dr. Reddy's Laboratories

Find a price of Venetoclax bulk with DMF offered by Dr. Reddy's Laboratories

Find a price of Vonoprazan Fumarate bulk with DMF offered by Dr. Reddy's Laboratories

Find a price of Zoledronic Acid bulk with WC offered by Dr. Reddy's Laboratories

Find a price of Acalabrutinib bulk offered by Dr. Reddy's Laboratories

Find a price of Adagrasib bulk offered by Dr. Reddy's Laboratories

Find a price of Amlodipine Besylate bulk offered by Dr. Reddy's Laboratories

Find a price of Apixaban bulk offered by Dr. Reddy's Laboratories

Find a price of Atorvastatin bulk offered by Dr. Reddy's Laboratories

Find a price of Brigatinib bulk offered by Dr. Reddy's Laboratories

Find a price of Cetirizine Dihydrochloride bulk offered by Dr. Reddy's Laboratories

Find a price of Ciprofloxacin Hydrochloride bulk offered by Dr. Reddy's Laboratories

Find a price of Clopidogrel bulk offered by Dr. Reddy's Laboratories

Find a price of Dapagliflozin Propanediol Monohydrate bulk offered by Dr. Reddy's Laboratories

Find a price of Darolutamide bulk offered by Dr. Reddy's Laboratories

Find a price of Deucravacitinib bulk offered by Dr. Reddy's Laboratories

Find a price of Dimethyl Fumarate bulk offered by Dr. Reddy's Laboratories

Find a price of Dutasteride bulk offered by Dr. Reddy's Laboratories

Find a price of Edoxaban Tosylate bulk offered by Dr. Reddy's Laboratories

Find a price of Empagliflozin bulk offered by Dr. Reddy's Laboratories

Find a price of Etrasimod bulk offered by Dr. Reddy's Laboratories

Find a price of Fezolinetant bulk offered by Dr. Reddy's Laboratories

Find a price of Finerenone bulk offered by Dr. Reddy's Laboratories

Find a price of Fruquintinib bulk offered by Dr. Reddy's Laboratories

Find a price of Gemcitabine bulk offered by Dr. Reddy's Laboratories

Find a price of Ketorolac Trometamol bulk offered by Dr. Reddy's Laboratories

Find a price of Liraglutide bulk offered by Dr. Reddy's Laboratories

Find a price of Mavacamten bulk offered by Dr. Reddy's Laboratories

Find a price of Mirogabalin Besylate bulk offered by Dr. Reddy's Laboratories

Find a price of Moxifloxacin Hydrochloride bulk offered by Dr. Reddy's Laboratories

Find a price of Naproxen bulk offered by Dr. Reddy's Laboratories

Find a price of Naproxen Sodium bulk offered by Dr. Reddy's Laboratories

Find a price of Naratriptan bulk offered by Dr. Reddy's Laboratories

Find a price of Niraparib Tosylate bulk offered by Dr. Reddy's Laboratories

Find a price of Nizatidine bulk offered by Dr. Reddy's Laboratories

Find a price of Omeprazole bulk offered by Dr. Reddy's Laboratories

Find a price of Perfluorohexyloctane bulk offered by Dr. Reddy's Laboratories

Find a price of Pirtobrutinib bulk offered by Dr. Reddy's Laboratories

Find a price of Pregabalin bulk offered by Dr. Reddy's Laboratories

Find a price of Resmetirom bulk offered by Dr. Reddy's Laboratories

Find a price of Risperidone bulk offered by Dr. Reddy's Laboratories

Find a price of Ritlecitinib bulk offered by Dr. Reddy's Laboratories

Find a price of Ropinirole bulk offered by Dr. Reddy's Laboratories

Find a price of Sacubitril-Valsartan bulk offered by Dr. Reddy's Laboratories

Find a price of Salcaprozate Sodium bulk offered by Dr. Reddy's Laboratories

Find a price of Siponimod bulk offered by Dr. Reddy's Laboratories

Find a price of Siponimod fumarate bulk offered by Dr. Reddy's Laboratories

Find a price of Sitagliptin Malate bulk offered by Dr. Reddy's Laboratories

Find a price of Sugammadex Sodium bulk offered by Dr. Reddy's Laboratories

Find a price of Terbinafine Hydrochloride bulk offered by Dr. Reddy's Laboratories

Find a price of Ticagrelor bulk offered by Dr. Reddy's Laboratories

Find a price of Treprostinil Diolamine bulk offered by Dr. Reddy's Laboratories

Find a price of Treprostinil Sodium bulk offered by Dr. Reddy's Laboratories

Find a price of Tucatinib bulk offered by Dr. Reddy's Laboratories

Find a price of Valsartan bulk offered by Dr. Reddy's Laboratories

Find a price of Voclosporin bulk offered by Dr. Reddy's Laboratories

Find a price of Zafirlukast bulk offered by Dr. Reddy's Laboratories