07 Oct 2024

// PRESS RELEASE

18 Jun 2024

// PRESS RELEASE

15 May 2024

// PRESS RELEASE

Latest Content by PharmaCompass

KEY PRODUCTS

KEY PRODUCTS

Moehs Group, a reference company in the production of pharmaceutical active ingredients.

About

Industry Trade Show

Not Confirmed

17-20 March, 2025

CPhI WW FrankfurtCPhI WW Frankfurt

Industry Trade Show

Booth #11.0C6

28-30 October, 2025

Pharma, Lab & Chemical...Pharma, Lab & Chemical Expo

Industry Trade Show

Not Confirmed

03-05 January, 2025

CONTACT DETAILS

Events

Webinars & Exhibitions

Industry Trade Show

Not Confirmed

17-20 March, 2025

CPhI WW FrankfurtCPhI WW Frankfurt

Industry Trade Show

Booth #11.0C6

28-30 October, 2025

Pharma, Lab & Chemical...Pharma, Lab & Chemical Expo

Industry Trade Show

Not Confirmed

03-05 January, 2025

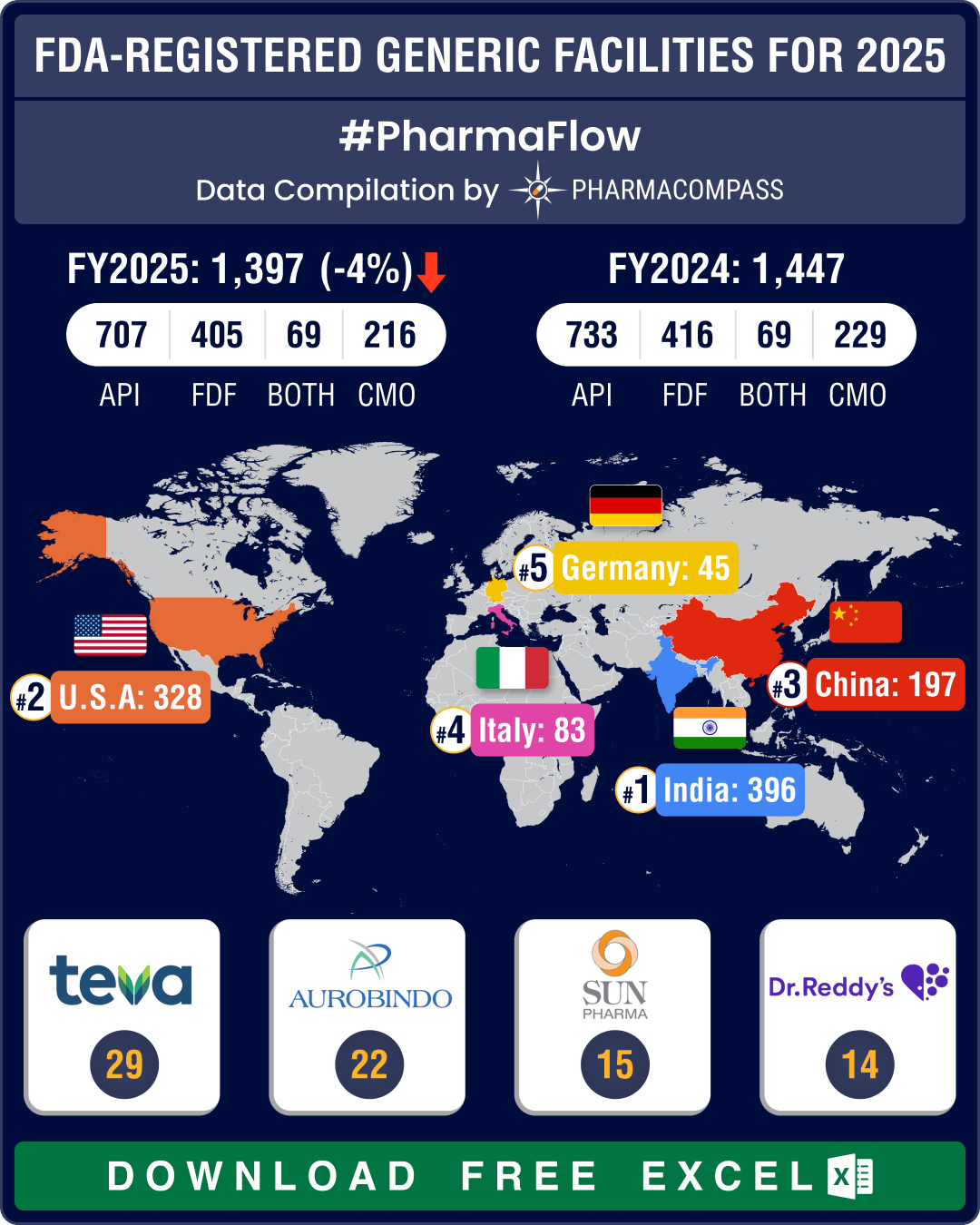

CORPORATE CONTENT #SupplierSpotlight

https://www.pharmacompass.com/radio-compass-blog/chinese-fda-registered-generic-facilities-gain-steam-india-maintains-lead-with-396-facilities

https://www.pharmacompass.com/radio-compass-blog/dmf-filings-hit-all-time-high-in-q3-2024-china-tops-list-with-58-increase-in-type-ii-submissions

07 Oct 2024

// PRESS RELEASE

https://moehs.com/moehs-group-and-euroapi-sign-an-exclusive-agreement-for-the-production-of-metamizole-in-europe/

18 Jun 2024

// PRESS RELEASE

https://moehs.com/2grants-from-centro-para-el-desarrollo-tecnologico-y-la-innovacion/

15 May 2024

// PRESS RELEASE

25 Apr 2024

// PRESS RELEASE

04 Apr 2024

// PRESS RELEASE

07 Mar 2024

// PRESS RELEASE

GDUFA

DMF Review : N/A

Rev. Date :

Pay. Date :

DMF Number : 38879

Submission : 2023-09-15

Status : Active

Type : II

GDUFA

DMF Review : Complete

Rev. Date : 2020-10-05

Pay. Date : 2020-09-29

DMF Number : 14420

Submission : 1999-09-22

Status : Active

Type : II

GDUFA

DMF Review : Complete

Rev. Date : 2013-01-22

Pay. Date : 2013-01-07

DMF Number : 14304

Submission : 1999-07-21

Status : Active

Type : II

GDUFA

DMF Review : Complete

Rev. Date : 2014-05-16

Pay. Date : 2014-05-13

DMF Number : 6924

Submission : 1987-04-08

Status : Active

Type : II

GDUFA

DMF Review : N/A

Rev. Date :

Pay. Date :

DMF Number : 17070

Submission : 2003-12-29

Status : Active

Type : II

GDUFA

DMF Review : N/A

Rev. Date :

Pay. Date :

DMF Number : 25068

Submission : 2011-06-22

Status : Active

Type : II

GDUFA

DMF Review : Complete

Rev. Date : 2015-09-11

Pay. Date : 2015-09-04

DMF Number : 15083

Submission : 2000-10-10

Status : Active

Type : II

GDUFA

DMF Review : Complete

Rev. Date : 2013-01-29

Pay. Date : 2013-01-07

DMF Number : 22228

Submission : 2008-11-24

Status : Active

Type : II

GDUFA

DMF Review : Complete

Rev. Date : 2013-03-06

Pay. Date : 2013-02-20

DMF Number : 4395

Submission : 1981-11-25

Status : Active

Type : II

GDUFA

DMF Review : Complete

Rev. Date : 2017-01-19

Pay. Date : 2016-12-02

DMF Number : 16044

Submission : 2002-07-08

Status : Active

Type : II

FULL SCREEN VIEW Click here to open all results in a new tab [this preview display 10 results]

FULL SCREEN VIEW Click here to open all results in a new tab [this preview display 10 results]Inspections and registrations

ABOUT THIS PAGE

Moehs Iberica is a supplier offers 92 products (APIs, Excipients or Intermediates).

Find a price of Amlodipine Besylate bulk with DMF, CEP, JDMF offered by Moehs Iberica

Find a price of Articaine Hydrochloride bulk with DMF, CEP, JDMF offered by Moehs Iberica

Find a price of Bisoprolol Fumarate bulk with DMF, CEP, JDMF offered by Moehs Iberica

Find a price of Carvedilol bulk with DMF, CEP, JDMF offered by Moehs Iberica

Find a price of Celiprolol Hydrochloride bulk with DMF, CEP, JDMF offered by Moehs Iberica

Find a price of Duloxetine Hydrochloride bulk with DMF, CEP, JDMF offered by Moehs Iberica

Find a price of Lansoprazole bulk with DMF, CEP, JDMF offered by Moehs Iberica

Find a price of Lidocaine bulk with DMF, CEP, JDMF offered by Moehs Iberica

Find a price of Lidocaine Hydrochloride bulk with DMF, CEP, JDMF offered by Moehs Iberica

Find a price of Mepivacaine Hydrochloride bulk with DMF, CEP, JDMF offered by Moehs Iberica

Find a price of Metoprolol Tartrate bulk with DMF, CEP, JDMF offered by Moehs Iberica

Find a price of Nifedipine bulk with DMF, CEP, JDMF offered by Moehs Iberica

Find a price of Acebutolol Hydrochloride bulk with DMF, CEP offered by Moehs Iberica

Find a price of Acetylcysteine bulk with DMF, CEP offered by Moehs Iberica

Find a price of Amantadine Hydrochloride bulk with DMF, CEP offered by Moehs Iberica

Find a price of Amlodipine Besylate bulk with CEP, JDMF offered by Moehs Iberica

Find a price of Bupivacaine Hydrochloride bulk with DMF, CEP offered by Moehs Iberica

Find a price of Carbocisteine bulk with CEP, JDMF offered by Moehs Iberica

Find a price of Fenofibrate bulk with DMF, CEP offered by Moehs Iberica

Find a price of Metoprolol Succinate bulk with DMF, CEP offered by Moehs Iberica

Find a price of Pantoprazole Sodium bulk with DMF, CEP offered by Moehs Iberica

Find a price of Quetiapine Hemifumarate bulk with DMF, CEP offered by Moehs Iberica

Find a price of Rabeprazole bulk with DMF, CEP offered by Moehs Iberica

Find a price of Sotalol Hydrochloride bulk with DMF, CEP offered by Moehs Iberica

Find a price of Triamterene bulk with DMF, CEP offered by Moehs Iberica

Find a price of Trimebutine Maleate bulk with CEP, JDMF offered by Moehs Iberica

Find a price of Venlafaxine Hydrochloride bulk with DMF, CEP offered by Moehs Iberica

Find a price of Abrocitinib bulk with DMF offered by Moehs Iberica

Find a price of Amlodipine Besylate bulk with JDMF offered by Moehs Iberica

Find a price of Carbocisteine bulk with JDMF offered by Moehs Iberica

Find a price of Celiprolol Hydrochloride bulk with JDMF offered by Moehs Iberica

Find a price of Choline Fenofibrate bulk with DMF offered by Moehs Iberica

Find a price of Dexmedetomidine Hydrochloride bulk with DMF offered by Moehs Iberica

Find a price of Elagolix Sodium bulk with DMF offered by Moehs Iberica

Find a price of Fenofibrate bulk with DMF offered by Moehs Iberica

Find a price of Fezolinetant bulk with DMF offered by Moehs Iberica

Find a price of Lasmiditan bulk with DMF offered by Moehs Iberica

Find a price of Lemborexant bulk with DMF offered by Moehs Iberica

Find a price of Mavacamten bulk with DMF offered by Moehs Iberica

Find a price of Obeticholic Acid bulk with DMF offered by Moehs Iberica

Find a price of Prilocaine bulk with DMF offered by Moehs Iberica

Find a price of Prilocaine Hydrochloride bulk with DMF offered by Moehs Iberica

Find a price of Quetiapine Hemifumarate bulk with CEP offered by Moehs Iberica

Find a price of Relugolix bulk with DMF offered by Moehs Iberica

Find a price of Remimazolam Besylate bulk with DMF offered by Moehs Iberica

Find a price of Rimegepant Sulfate bulk with DMF offered by Moehs Iberica

Find a price of Rivaroxaban bulk with CEP offered by Moehs Iberica

Find a price of Ropivacaine Hydrochloride bulk with DMF offered by Moehs Iberica

Find a price of Sertraline Hydrochloride bulk with CEP offered by Moehs Iberica

Find a price of Sitagliptin Phosphate bulk with DMF offered by Moehs Iberica

Find a price of Sumatriptan bulk with DMF offered by Moehs Iberica

Find a price of Tirbanibulin bulk with DMF offered by Moehs Iberica

Find a price of Vericiguat bulk with DMF offered by Moehs Iberica

Find a price of Acetylleucine bulk offered by Moehs Iberica

Find a price of Amantadine Sulphate bulk offered by Moehs Iberica

Find a price of Blarcamesine bulk offered by Moehs Iberica

Find a price of Butalbital bulk offered by Moehs Iberica

Find a price of Carbocysteine Lysine bulk offered by Moehs Iberica

Find a price of Chloral Hydrate bulk offered by Moehs Iberica

Find a price of Cloperastine Fendizoate bulk offered by Moehs Iberica

Find a price of Daridorexant bulk offered by Moehs Iberica

Find a price of Deucravacitinib bulk offered by Moehs Iberica

Find a price of Domiphen Bromide bulk offered by Moehs Iberica

Find a price of Doxazosin Mesylate bulk offered by Moehs Iberica

Find a price of Edoxaban Tosylate bulk offered by Moehs Iberica

Find a price of Empagliflozin bulk offered by Moehs Iberica

Find a price of Levobupivacaine bulk offered by Moehs Iberica

Find a price of Levocloperastine Fendizoate bulk offered by Moehs Iberica

Find a price of Linzagolix bulk offered by Moehs Iberica

Find a price of Linzagolix Choline bulk offered by Moehs Iberica

Find a price of Magnesium Lactate Dihydrate bulk offered by Moehs Iberica

Find a price of Mebeverine bulk offered by Moehs Iberica

Find a price of Methenamine Hippurate bulk offered by Moehs Iberica

Find a price of Nifuroxazide bulk offered by Moehs Iberica

Find a price of Nikethamide bulk offered by Moehs Iberica

Find a price of Norepinephrine Bitartrate bulk offered by Moehs Iberica

Find a price of Pentobarbital Sodium bulk offered by Moehs Iberica

Find a price of Phenobarbital bulk offered by Moehs Iberica

Find a price of Phenobarbital Sodium bulk offered by Moehs Iberica

Find a price of Phentermine Hydrochloride bulk offered by Moehs Iberica

Find a price of Picloxydine Dihydrochloride bulk offered by Moehs Iberica

Find a price of Propylthiouracil bulk offered by Moehs Iberica

Find a price of Pyrantel Pamoate bulk offered by Moehs Iberica

Find a price of Secobarbital Sodium bulk offered by Moehs Iberica

Find a price of Sitagliptin Hydrochloride bulk offered by Moehs Iberica

Find a price of Sotagliflozin bulk offered by Moehs Iberica

Find a price of Tamoxifen Citrate bulk offered by Moehs Iberica

Find a price of Terazosin HCl bulk offered by Moehs Iberica

Find a price of Thiopental Sodium bulk offered by Moehs Iberica

Find a price of Vildagliptin bulk offered by Moehs Iberica

Find a price of Xylometazoline Hydrochloride bulk offered by Moehs Iberica

Find a price of Zavegepant HCl bulk offered by Moehs Iberica

LOOKING FOR A SUPPLIER?