28 Feb 2025

// PRESS RELEASE

11 Feb 2025

// PRESS RELEASE

07 Mar 2024

// PRESS RELEASE

KEY PRODUCTS

KEY PRODUCTS KEY SERVICES

KEY SERVICES

Aspen API. More than just an API™

About

CPhI North America CPhI North America

Industry Trade Show

Not Confirmed

20-22 May, 2025

Industry Trade Show

Booth #27, Level 2

19-22 May, 2025

Industry Trade Show

Attending

10-12 June, 2025

CONTACT DETAILS

Events

Webinars & Exhibitions

CPhI North America CPhI North America

Industry Trade Show

Not Confirmed

20-22 May, 2025

Industry Trade Show

Booth #27, Level 2

19-22 May, 2025

Industry Trade Show

Attending

10-12 June, 2025

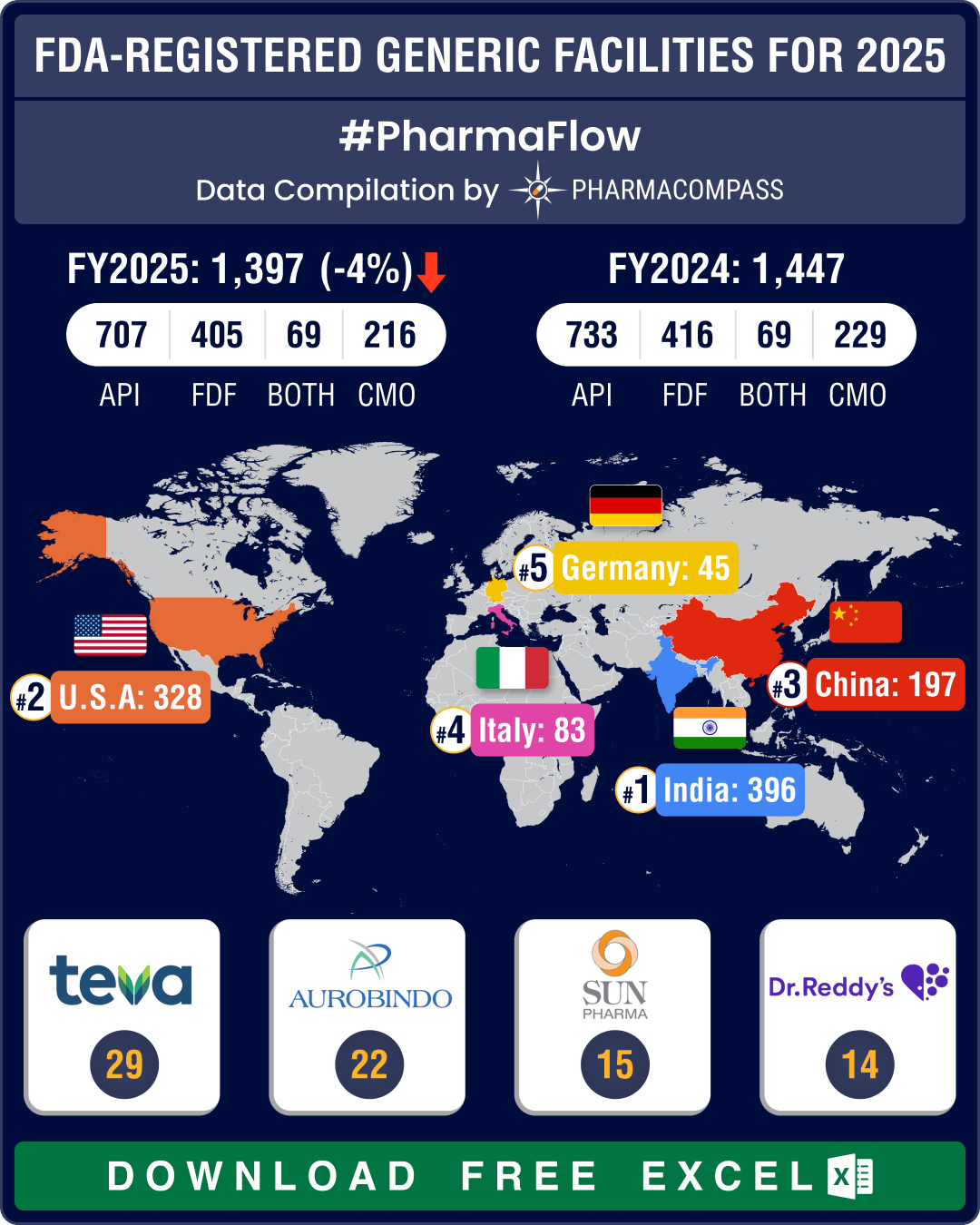

CORPORATE CONTENT #SupplierSpotlight

https://www.pharmacompass.com/radio-compass-blog/chinese-fda-registered-generic-facilities-gain-steam-india-maintains-lead-with-396-facilities

https://www.pharmacompass.com/radio-compass-blog/cdmo-activity-tracker-novo-s-parent-buys-catalent-for-us-16-5-bn-fujifilm-merck-kgaa-axplora-lonza-expand-capabilities

28 Feb 2025

// PRESS RELEASE

11 Feb 2025

// PRESS RELEASE

https://www.aspenapi.com/news/this-project-aimed-to-optimize-the-purification-process-of-desogestrel/

07 Mar 2024

// PRESS RELEASE

https://www.aspenapi.com/news/nieke-van-gils-jr-scientist-at-aspen-api-on-international-womens-day/

31 Oct 2023

// PRESS RELEASE

https://www.aspenapi.com/news/gold-medal-for-aspen-api-in-ecovadis-evaluation/

31 Oct 2023

// PRESS RELEASE

https://www.aspenapi.com/news/fine-chemicals-corporation-facility-in-cape-town-south-africa-was-inspected-by-the-pmda/

05 Jul 2023

// PRESS RELEASE

https://www.aspenapi.com/news/get-to-know-the-aspen-api-sales-managers-interview-with-ivette-cosme-sales-manager-aspen-api/

GDUFA

DMF Review : N/A

Rev. Date :

Pay. Date :

DMF Number : 8855

Submission : 1990-11-26

Status : Active

Type : II

GDUFA

DMF Review : N/A

Rev. Date :

Pay. Date :

DMF Number : 34868

Submission : 2020-06-10

Status : Active

Type : II

GDUFA

DMF Review : N/A

Rev. Date :

Pay. Date :

DMF Number : 10119

Submission : 1993-02-19

Status : Active

Type : II

GDUFA

DMF Review : N/A

Rev. Date :

Pay. Date :

DMF Number : 34647

Submission : 2020-09-18

Status : Active

Type : II

GDUFA

DMF Review : N/A

Rev. Date :

Pay. Date :

DMF Number : 6421

Submission : 1986-06-18

Status : Active

Type : II

GDUFA

DMF Review : N/A

Rev. Date :

Pay. Date :

DMF Number : 35224

Submission : 2020-10-16

Status : Active

Type : II

GDUFA

DMF Review : Complete

Rev. Date : 2012-10-25

Pay. Date : 2012-12-19

DMF Number : 6914

Submission : 1987-04-09

Status : Active

Type : II

GDUFA

DMF Review : N/A

Rev. Date :

Pay. Date :

DMF Number : 10493

Submission : 1993-09-23

Status : Active

Type : II

GDUFA

DMF Review : N/A

Rev. Date :

Pay. Date :

DMF Number : 7099

Submission : 1987-08-06

Status : Active

Type : II

GDUFA

DMF Review : N/A

Rev. Date :

Pay. Date :

DMF Number : 34883

Submission : 2020-06-09

Status : Active

Type : II

FULL SCREEN VIEW Click here to open all results in a new tab [this preview display 10 results]

FULL SCREEN VIEW Click here to open all results in a new tab [this preview display 10 results]Certificate Numbers : R1-CEP 2017-171 - Rev 00

Status : Valid

Issue Date : 2023-02-13

Type : Chemical

Substance Number : 369

Certificate Numbers : R1-CEP 2016-043 - Rev 01

Status : Valid

Issue Date : 2023-02-10

Type : Chemical

Substance Number : 1075

Certificate Numbers : R0-CEP 2021-491 - Rev 01

Status : Valid

Issue Date : 2023-02-10

Type : Chemical

Substance Number : 1075

Boost your online visibility by uploading your products, APIs, FDFs, intermediates, excipients, and services for free on PharmaCompass.

Rank higher among suppliers and expand your reach across the internet efficiently and cost-effectively.

Boost your online visibility by uploading your products, APIs, FDFs, intermediates, excipients, and services for free on PharmaCompass.

Rank higher among suppliers and expand your reach across the internet efficiently and cost-effectively.

Fine Chemicals Corporation PTY Ltd

Certificate Numbers : R1-CEP 2010-052 - Rev 01

Status : Valid

Issue Date : 2019-01-18

Type : Chemical

Substance Number : 74

Boost your online visibility by uploading your products, APIs, FDFs, intermediates, excipients, and services for free on PharmaCompass.

Rank higher among suppliers and expand your reach across the internet efficiently and cost-effectively.

Boost your online visibility by uploading your products, APIs, FDFs, intermediates, excipients, and services for free on PharmaCompass.

Rank higher among suppliers and expand your reach across the internet efficiently and cost-effectively.

Fine Chemicals Corporation PTY Ltd

Certificate Numbers : CEP 2021-385 - Rev 01

Status : Valid

Issue Date : 2024-02-06

Type : Chemical

Substance Number : 74

Certificate Numbers : R1-CEP 1999-165 - Rev 05

Status : Valid

Issue Date : 2016-03-31

Type : Chemical

Substance Number : 712

Certificate Numbers : R1-CEP 2009-300 - Rev 00

Status : Valid

Issue Date : 2016-03-16

Type : Chemical

Substance Number : 1717

Certificate Numbers : R2-CEP 1995-001 - Rev 03

Status : Valid

Issue Date : 2014-01-30

Type : Chemical

Substance Number : 821

Certificate Numbers : R1-CEP 2009-171 - Rev 01

Status : Valid

Issue Date : 2016-07-15

Type : Chemical

Substance Number : 1614

Certificate Numbers : R1-CEP 1999-179 - Rev 05

Status : Valid

Issue Date : 2017-03-29

Type : Chemical

Substance Number : 1203

FULL SCREEN VIEW Click here to open all results in a new tab [this preview display 10 results]

FULL SCREEN VIEW Click here to open all results in a new tab [this preview display 10 results]Services

Analytical

API Manufacturing

API & Drug Product Development

Excipients

Inspections and registrations

ABOUT THIS PAGE

Aspen API is a supplier offers 88 products (APIs, Excipients or Intermediates).

Find a price of Budesonide bulk with DMF, CEP, JDMF offered by Aspen API

Find a price of Desogestrel bulk with DMF, CEP, JDMF offered by Aspen API

Find a price of Estradiol bulk with DMF, CEP, JDMF offered by Aspen API

Find a price of Estriol bulk with DMF, CEP, JDMF offered by Aspen API

Find a price of Ethinyl Estradiol bulk with DMF, CEP, JDMF offered by Aspen API

Find a price of Leuprolide Acetate bulk with DMF, CEP, JDMF offered by Aspen API

Find a price of Mirtazapine bulk with DMF, CEP, JDMF offered by Aspen API

Find a price of Norethisterone bulk with DMF, CEP, JDMF offered by Aspen API

Find a price of Norethisterone Acetate bulk with DMF, CEP, JDMF offered by Aspen API

Find a price of Progesterone bulk with DMF, CEP, JDMF offered by Aspen API

Find a price of Rocuronium Bromide bulk with DMF, CEP, JDMF offered by Aspen API

Find a price of Asenapine Maleate bulk with DMF, JDMF offered by Aspen API

Find a price of Azathioprine bulk with DMF, CEP offered by Aspen API

Find a price of Budesonide bulk with CEP, JDMF offered by Aspen API

Find a price of Desmopressin Acetate bulk with DMF, CEP offered by Aspen API

Find a price of Estradiol Valerate bulk with DMF, CEP offered by Aspen API

Find a price of Gonadorelin Acetate bulk with DMF, CEP offered by Aspen API

Find a price of Naloxone Hydrochloride bulk with DMF, CEP offered by Aspen API

Find a price of Oxytocin bulk with DMF, CEP offered by Aspen API

Find a price of Ropivacaine Hydrochloride bulk with DMF, CEP offered by Aspen API

Find a price of Scopolamine bulk with DMF, CEP offered by Aspen API

Find a price of Testosterone bulk with DMF, CEP offered by Aspen API

Find a price of Baclofen bulk with DMF offered by Aspen API

Find a price of Benztropine bulk with DMF offered by Aspen API

Find a price of Buprenorphine Hydrochloride bulk with DMF offered by Aspen API

Find a price of Conjugated Estrogens bulk with DMF offered by Aspen API

Find a price of Estradiol Acetate bulk with DMF offered by Aspen API

Find a price of Estriol bulk with CEP offered by Aspen API

Find a price of Ethynodiol Diacetate bulk with DMF offered by Aspen API

Find a price of Etonogestrel bulk with DMF offered by Aspen API

Find a price of Fentanyl bulk with CEP offered by Aspen API

Find a price of Fentanyl Citrate bulk with CEP offered by Aspen API

Find a price of Fluphenazine bulk with DMF offered by Aspen API

Find a price of Fluphenazine Decanoate bulk with DMF offered by Aspen API

Find a price of Fondaparinux Sodium bulk with DMF offered by Aspen API

Find a price of Ganirelix bulk with DMF offered by Aspen API

Find a price of Gonadorelin Acetate bulk with DMF offered by Aspen API

Find a price of Heparin Sodium bulk with DMF offered by Aspen API

Find a price of Human Chorionic Gonadotropin bulk with DMF offered by Aspen API

Find a price of Hydroxyprogesterone Caproate bulk with DMF offered by Aspen API

Find a price of Leuprolide Acetate bulk with CEP offered by Aspen API

Find a price of Levalbuterol Hydrochloride bulk with DMF offered by Aspen API

Find a price of Methazolamide bulk with DMF offered by Aspen API

Find a price of Methyl Testosterone bulk with DMF offered by Aspen API

Find a price of Naltrexone Hydrochloride bulk with DMF offered by Aspen API

Find a price of Nandrolone Decanoate bulk with DMF offered by Aspen API

Find a price of Penbutolol bulk with DMF offered by Aspen API

Find a price of Prednisolone bulk with DMF offered by Aspen API

Find a price of Remifentanil bulk with DMF offered by Aspen API

Find a price of Ropivacaine Hydrochloride bulk with DMF offered by Aspen API

Find a price of Testosterone bulk with CEP offered by Aspen API

Find a price of Testosterone Cypionate bulk with DMF offered by Aspen API

Find a price of Testosterone Enanthate bulk with DMF offered by Aspen API

Find a price of Testosterone Undecanoate bulk with DMF offered by Aspen API

Find a price of Tetracosactide bulk with DMF offered by Aspen API

Find a price of Thiothixene bulk with DMF offered by Aspen API

Find a price of Tibolone bulk with CEP offered by Aspen API

Find a price of Vecuronium Bromide bulk with DMF offered by Aspen API

Find a price of Vincristine Sulfate bulk with DMF offered by Aspen API

Find a price of Danaparoid sodium bulk offered by Aspen API

Find a price of Eptifibatide bulk offered by Aspen API

Find a price of Heparin Sodium bulk offered by Aspen API

Find a price of Rimexolone bulk offered by Aspen API

Find a price of Altrenogest bulk offered by Aspen API

Find a price of Arginine Vasopressin bulk offered by Aspen API

Find a price of Cidofovir bulk offered by Aspen API

Find a price of Codeine bulk offered by Aspen API

Find a price of Codeine Phosphate bulk offered by Aspen API

Find a price of Conjugated Estrogens bulk offered by Aspen API

Find a price of Dihydrotestosterone bulk offered by Aspen API

Find a price of Estradiol bulk offered by Aspen API

Find a price of Fentanyl Hydrochloride bulk offered by Aspen API

Find a price of Gonadorelin bulk offered by Aspen API

Find a price of Goserelin Acetate bulk offered by Aspen API

Find a price of Hyoscine Butyl Bromide bulk offered by Aspen API

Find a price of Lanreotide Acetate bulk offered by Aspen API

Find a price of Leuprolide Acetate bulk offered by Aspen API

Find a price of Lynestrenol bulk offered by Aspen API

Find a price of Morphine Hydrochloride bulk offered by Aspen API

Find a price of Morphine Sulfate bulk offered by Aspen API

Find a price of Morphine Tartrate bulk offered by Aspen API

Find a price of Pegcetacoplan bulk offered by Aspen API

Find a price of Segesterone Acetate bulk offered by Aspen API

Find a price of Sugammadex Sodium bulk offered by Aspen API

Find a price of Testosterone Propionate bulk offered by Aspen API

Find a price of Vinblastine Sulfate bulk offered by Aspen API

Find a price of PREGNANT MARE SERUM GONADOTROPHIN bulk offered by Aspen API

Find a price of SERUM, HORSE bulk offered by Aspen API