25 Jan 2025

// PRESS RELEASE

28 Nov 2024

// PRESS RELEASE

11 Oct 2024

// PRESS RELEASE

Latest Content by PharmaCompass

KEY PRODUCTS

KEY PRODUCTS KEY EXCIPIENTS

KEY EXCIPIENTS

Pfanstiehl, a global leader in the manufacture of cGMP high purity, low endotoxin, low metals (HPLE-LM)TM injectable grade excipients.

About

CPhI North America CPhI North America

Industry Trade Show

Not Confirmed

20-22 May, 2025

German Wound CongressGerman Wound Congress

Industry Trade Show

Not Confirmed

07 April-09 May, 2025

Industry Trade Show

Not Confirmed

08 April-11 May, 2025

CONTACT DETAILS

Events

Webinars & Exhibitions

CPhI North America CPhI North America

Industry Trade Show

Not Confirmed

20-22 May, 2025

German Wound CongressGerman Wound Congress

Industry Trade Show

Not Confirmed

07 April-09 May, 2025

Industry Trade Show

Not Confirmed

08 April-11 May, 2025

CORPORATE CONTENT #SupplierSpotlight

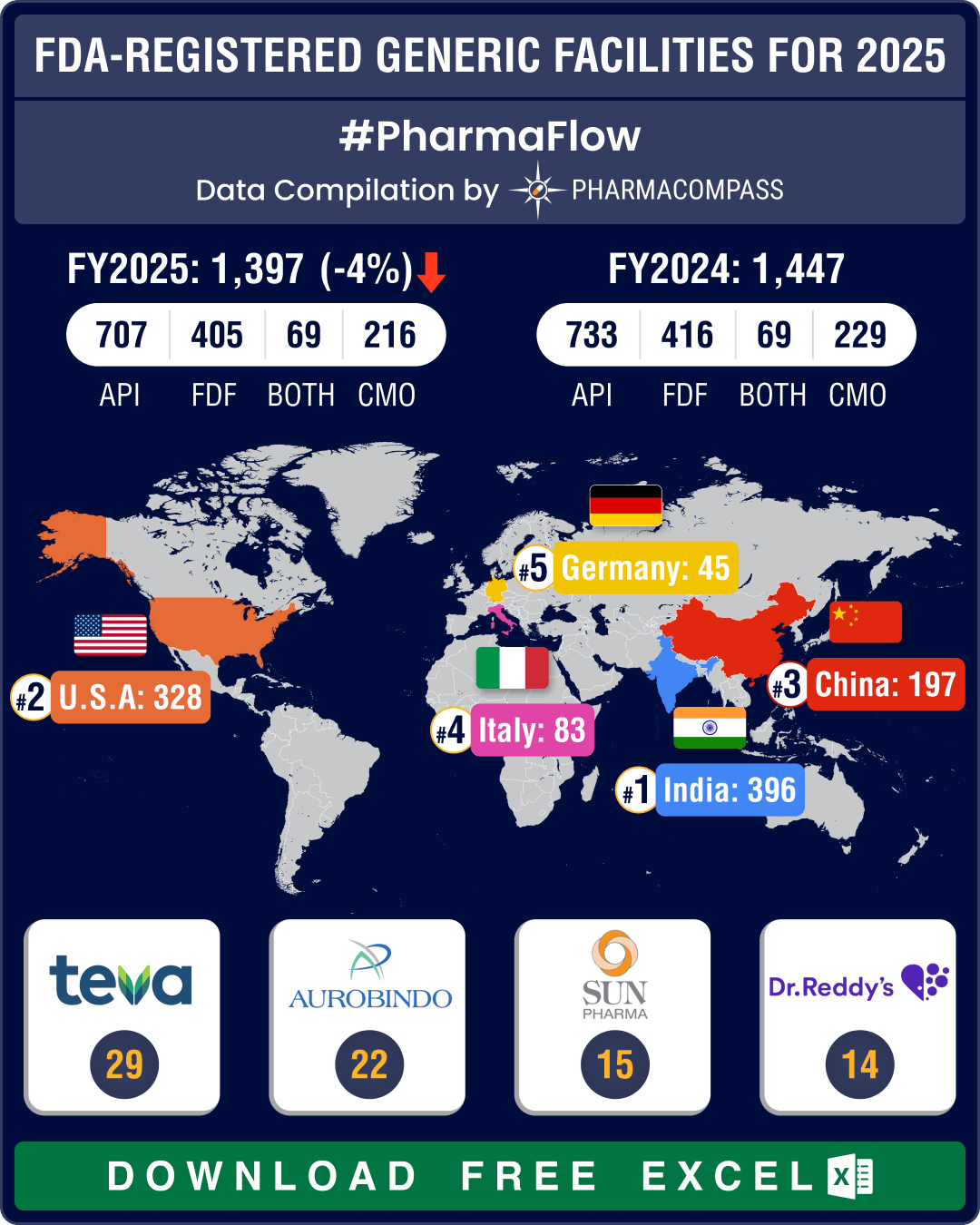

https://www.pharmacompass.com/radio-compass-blog/chinese-fda-registered-generic-facilities-gain-steam-india-maintains-lead-with-396-facilities

https://www.pharmacompass.com/radio-compass-blog/dmf-filings-hit-all-time-high-in-q3-2024-china-tops-list-with-58-increase-in-type-ii-submissions

https://www.pharmacompass.com/radio-compass-blog/excipient-market-overview-roquette-seqens-evonik-make-strategic-moves-new-guidelines-deal-with-contamination

25 Jan 2025

// PRESS RELEASE

https://pfanstiehl.com/wp-content/uploads/2025/01/Glycine-GMP-Excipient-High-Purity-Low-Endotoxin-Low-Metals-Press-Release-012125.pdf

28 Nov 2024

// PRESS RELEASE

https://pfanstiehl.com/wp-content/uploads/2025/01/Glucose-Dextrose-Press-Release-JTM-102524.pdf

11 Oct 2024

// PRESS RELEASE

https://pfanstiehl.com/wp-content/uploads/2025/01/Succinic-Acid-GMP-Excipient-Grade-High-Purity-Low-Endotoxin-Low-Metals-JTM-101125.pdf

25 Jun 2020

// PHARMA EXCIPIENTS

https://www.pharmaexcipients.com/wp-content/uploads/2020/07/Histidine-Pfanstiehl.pdf

04 Sep 2018

// PHARMACEUTICAL-BUSINESS

https://www.pharmaceutical-business-review.com/contractors/pfanstiehl/news/pfanstiehl-launches-parenteral-grade-sodium-succinate/

20 Jul 2018

// PHARMACEUTICAL-TECHNOLOGY

https://www.pharmaceutical-technology.com/contractors/excipients/pfanstiehl/pressreleases/pfanstiehl-launches-new-cgmp-produced-parenteral-grade-arginine/

Services

API Manufacturing

API & Drug Product Development

Excipients

Excipients by Ingredients

Excipients By applications

Inspections and registrations

ABOUT THIS PAGE

Pfanstiehl is a supplier offers 25 products (APIs, Excipients or Intermediates).

Find a price of Ammonium Lactate bulk with DMF offered by Pfanstiehl

Find a price of Methotrexate bulk with DMF offered by Pfanstiehl

Find a price of Podophyllotoxin bulk with DMF offered by Pfanstiehl

Find a price of Sodium Gluconate bulk with DMF offered by Pfanstiehl

Find a price of Sodium Lactate bulk with DMF offered by Pfanstiehl

Find a price of Streptozocin bulk with DMF offered by Pfanstiehl

Find a price of Trehalose Dihydrate API bulk with DMF offered by Pfanstiehl

Find a price of D-MANNOSE, HIGH PURITY, LOW ENDOTOXIN LOW METALS (M-164-2) bulk with DMF offered by Pfanstiehl

Find a price of Alpha-D-Galactose bulk offered by Pfanstiehl

Find a price of Clofarabine bulk offered by Pfanstiehl

Find a price of Cytarabine bulk offered by Pfanstiehl

Find a price of Decitabine bulk offered by Pfanstiehl

Find a price of Disodium Succinate bulk offered by Pfanstiehl

Find a price of Dl-Histidine Monohydrochloride Monohydrate bulk offered by Pfanstiehl

Find a price of L-Arginine bulk offered by Pfanstiehl

Find a price of L-Arginine Hydrochloride API bulk offered by Pfanstiehl

Find a price of L-Glutamine bulk offered by Pfanstiehl

Find a price of L-Histidine bulk offered by Pfanstiehl

Find a price of L-Methionine bulk offered by Pfanstiehl

Find a price of Maltose bulk offered by Pfanstiehl

Find a price of Mannitol API bulk offered by Pfanstiehl

Find a price of Streptozocin bulk offered by Pfanstiehl

Find a price of Sucrose API bulk offered by Pfanstiehl

Find a price of Tris Hydrochloride API bulk offered by Pfanstiehl

Find a price of Tromethamine API bulk offered by Pfanstiehl