12 Jun 2024

// PRESS RELEASE

09 Jun 2024

// PRESS RELEASE

06 Jun 2024

// PRESS RELEASE

Latest Content by PharmaCompass

KEY PRODUCTS

KEY PRODUCTS

Phyton is a World Leader in Plant Cell Fermentation Technology and Commercial Manufacturing.

About

CPhI North America CPhI North America

Industry Trade Show

Not Confirmed

20-22 May, 2025

Industry Trade Show

Attending

05-08 May, 2025

Industry Trade Show

Attending

08-10 October, 2025

CONTACT DETAILS

Events

Webinars & Exhibitions

CPhI North America CPhI North America

Industry Trade Show

Not Confirmed

20-22 May, 2025

Industry Trade Show

Attending

05-08 May, 2025

Industry Trade Show

Attending

08-10 October, 2025

https://www.pharmacompass.com/speak-pharma/our-pcf-technology-makes-us-have-a-minimal-environmental-footprint-while-ensuring-a-sustainable-supply-of-drugs-speakpharma-with-phyton-biotech

CORPORATE CONTENT #SupplierSpotlight

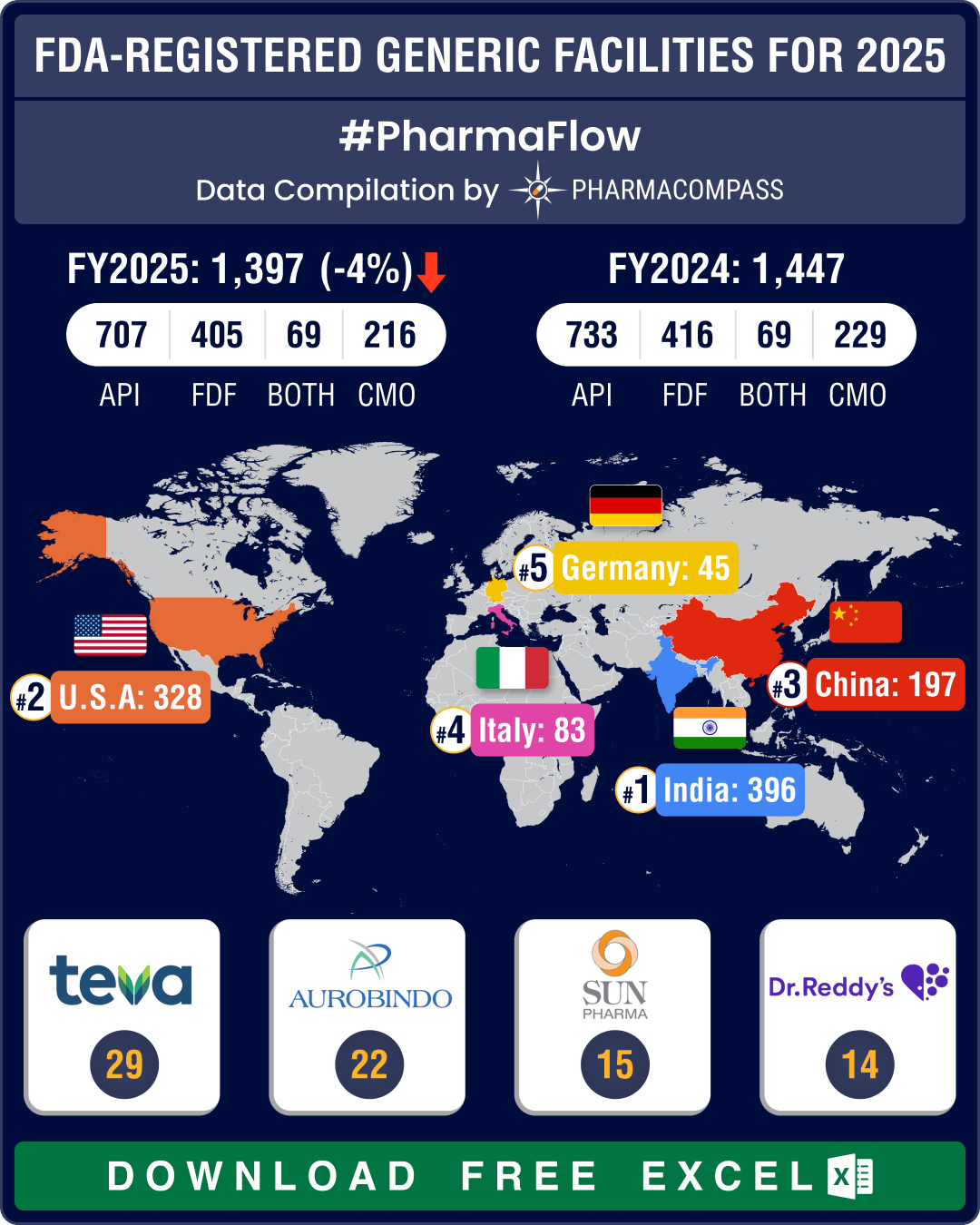

https://www.pharmacompass.com/radio-compass-blog/chinese-fda-registered-generic-facilities-gain-steam-india-maintains-lead-with-396-facilities

12 Jun 2024

// PRESS RELEASE

https://phytonbiotech.com/phyton-biotech-to-attend-cphi-china-shanghai-2/

09 Jun 2024

// PRESS RELEASE

https://phytonbiotech.com/phyton-biotech-to-present-2024-world-congress-in-vitro-biology/

06 Jun 2024

// PRESS RELEASE

https://phytonbiotech.com/phyton-biotech-to-attend-bio-international-convention/

06 May 2024

// PRESS RELEASE

https://phytonbiotech.com/phyton-biotech-to-attend-global-synthetic-biology-conference/

14 Mar 2024

// PRESS RELEASE

https://phytonbiotech.com/phyton-produces-qs-21-via-plant-cell-culture/

29 Nov 2023

// PRESS RELEASE

https://phytonbiotech.com/phyton-controlled-substances-dealers-license-health-canada/

Services

API Manufacturing

API & Drug Product Development

REF. STANDARDS & IMPURITIES

Inspections and registrations

ABOUT THIS PAGE

Phyton Biotech LLC is a supplier offers 4 products (APIs, Excipients or Intermediates).

Find a price of Docetaxel bulk with DMF, CEP, JDMF offered by Phyton Biotech LLC

Find a price of Paclitaxel bulk with DMF, CEP, JDMF offered by Phyton Biotech LLC

Find a price of Paclitaxel bulk with DMF, CEP offered by Phyton Biotech LLC

Find a price of Paclitaxel bulk offered by Phyton Biotech LLC