10 Mar 2025

// CONTRACTPHARMA

09 Jan 2025

// PRESS RELEASE

17 Dec 2024

// GLOBENEWSWIRE

Latest Content by PharmaCompass

KEY SERVICES

KEY SERVICES

Evonik's CDMO solutions for APIs and HPAPIs: It specializes where the client needs it most!

About

Industry Trade Show

Not Confirmed

09-11 April, 2025

Plastics Recycling EUPlastics Recycling EU

Industry Trade Show

Attending

01-02 April, 2025

Industry Trade Show

Attending

09-11 April, 2025

CONTACT DETAILS

Events

Webinars & Exhibitions

Industry Trade Show

Not Confirmed

09-11 April, 2025

Plastics Recycling EUPlastics Recycling EU

Industry Trade Show

Attending

01-02 April, 2025

Industry Trade Show

Attending

09-11 April, 2025

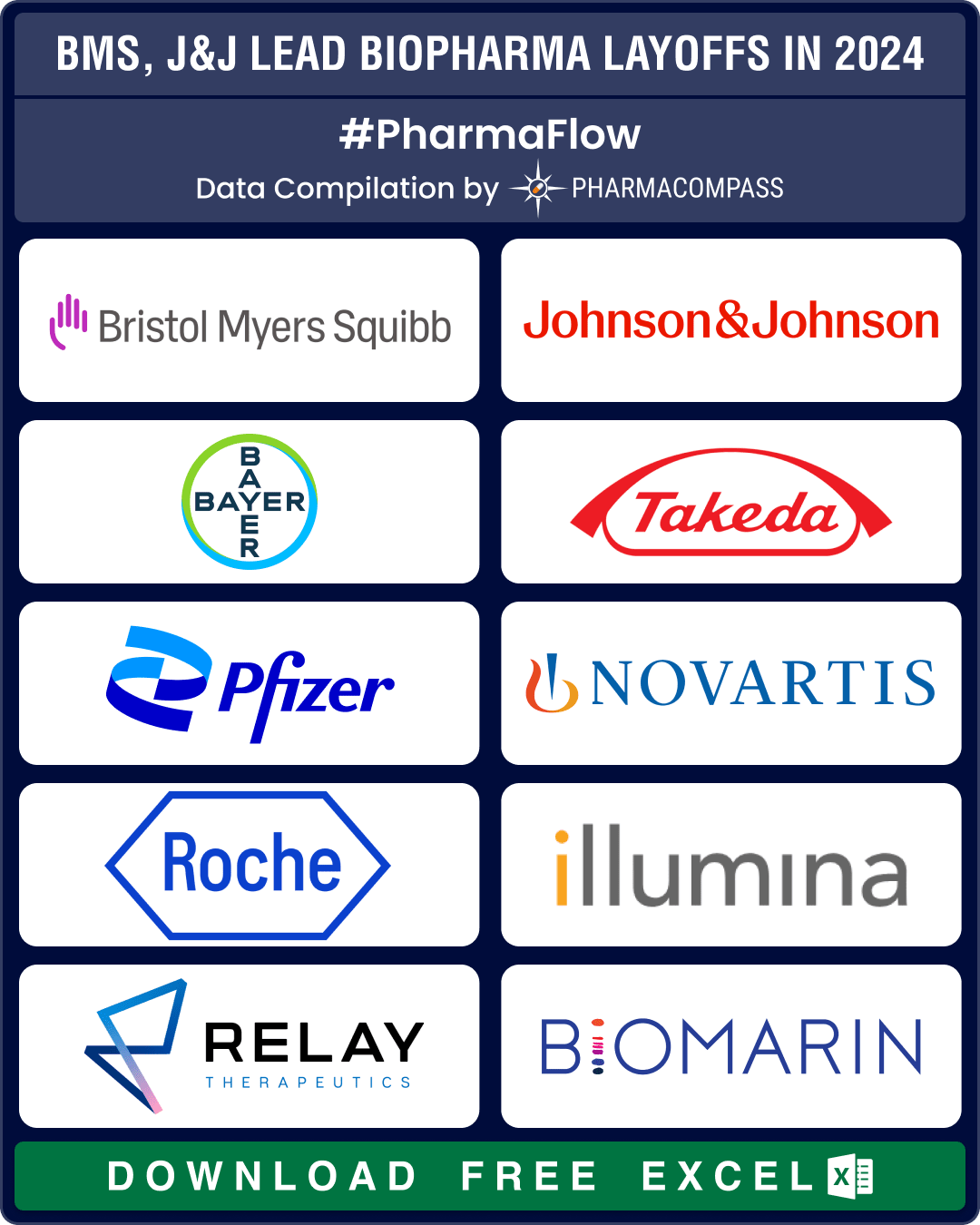

CORPORATE CONTENT #SupplierSpotlight

https://www.pharmacompass.com/radio-compass-blog/bms-j-j-bayer-lead-25-000-pharma-layoffs-in-2024-amylyx-fibrogen-kronos-bio-hit-by-trial-failures-cash-crunch

https://www.pharmacompass.com/radio-compass-blog/cdmo-activity-tracker-bora-polpharma-make-acquisitions-evonik-euroapi-porton-announce-technological-expansions

https://www.pharmacompass.com/radio-compass-blog/bms-bayer-takeda-pfizer-downsize-to-combat-cost-pressures-meet-restructuring-plans

https://www.pharmacompass.com/radio-compass-blog/excipient-market-overview-roquette-seqens-evonik-make-strategic-moves-new-guidelines-deal-with-contamination

https://www.pharmacompass.com/radio-compass-blog/cdmo-activity-tracker-novo-s-parent-buys-catalent-for-us-16-5-bn-fujifilm-merck-kgaa-axplora-lonza-expand-capabilities

10 Mar 2025

// CONTRACTPHARMA

https://www.contractpharma.com/breaking-news/azelis-enters-distribution-agreement-with-evonik/

09 Jan 2025

// PRESS RELEASE

https://healthcare.evonik.com/en/news-and-events/press-releases/evonik-partners-with-st-pharm-to-increase-its-offerings-for-rna-and-nucleic-acid-delivery-268818.html

17 Dec 2024

// GLOBENEWSWIRE

https://www.globenewswire.com/news-release/2024/12/17/2998086/0/en/Silexion-Therapeutics-collaborates-with-Evonik-on-advanced-siRNA-Formulation-Development.html

26 Oct 2024

// PRESS RELEASE

https://www.evonik.com/en/news/press-releases/2024/10/european-food-safety-authority-confirms-safety-of-silica-as-food0.html

14 Oct 2024

// FIERCE PHARMA

https://www.fiercepharma.com/pharma/evonik-telegraphs-another-260-layoffs-amid-multiyear-reorganization

11 Oct 2024

// PRESS RELEASE

https://healthcare.evonik.com/en/news-and-events/press-releases/evonik-to-restructure-its-keto-and-pharma-amino-acid-business-261654.html

GDUFA

DMF Review : N/A

Rev. Date :

Pay. Date :

DMF Number : 15440

Submission : 2001-05-15

Status : Active

Type : II

GDUFA

DMF Review : N/A

Rev. Date :

Pay. Date :

DMF Number : 5926

Submission : 1985-07-02

Status : Active

Type : II

GDUFA

DMF Review : N/A

Rev. Date :

Pay. Date :

DMF Number : 8379

Submission : 1990-01-19

Status : Active

Type : II

GDUFA

DMF Review : Complete

Rev. Date : 2017-03-31

Pay. Date : 2016-12-27

DMF Number : 30393

Submission : 2016-03-02

Status : Active

Type : II

GDUFA

DMF Review : N/A

Rev. Date :

Pay. Date :

DMF Number : 37552

Submission : 2022-10-13

Status : Active

Type : II

GDUFA

DMF Review : N/A

Rev. Date :

Pay. Date :

DMF Number : 19769

Submission : 2006-08-28

Status : Active

Type : II

GDUFA

DMF Review : N/A

Rev. Date :

Pay. Date :

DMF Number : 9486

Submission : 1992-01-03

Status : Active

Type : II

GDUFA

DMF Review : N/A

Rev. Date :

Pay. Date :

DMF Number : 19766

Submission : 2006-08-28

Status : Active

Type : II

GDUFA

DMF Review : N/A

Rev. Date :

Pay. Date :

DMF Number : 3872

Submission : 1980-07-11

Status : Active

Type : II

GDUFA

DMF Review : N/A

Rev. Date :

Pay. Date :

DMF Number : 18726

Submission : 2005-08-31

Status : Active

Type : II

FULL SCREEN VIEW Click here to open all results in a new tab [this preview display 10 results]

FULL SCREEN VIEW Click here to open all results in a new tab [this preview display 10 results]Certificate Numbers : R1-CEP 2004-086 - Rev 07

Status : Valid

Issue Date : 2023-08-24

Type : Chemical

Substance Number : 752

Certificate Numbers : R1-CEP 2010-172 - Rev 01

Status : Withdrawn by Holder

Issue Date : 2019-09-19

Type : Chemical

Substance Number : 2086

Certificate Numbers : CEP 2004-216 - Rev 04

Status : Valid

Issue Date : 2023-11-14

Type : Chemical

Substance Number : 797

Certificate Numbers : CEP 2009-333 - Rev 05

Status : Valid

Issue Date : 2024-04-24

Type : Chemical

Substance Number : 1633

Certificate Numbers : R1-CEP 2001-343 - Rev 05

Status : Valid

Issue Date : 2020-08-31

Type : Chemical

Substance Number : 658

Certificate Numbers : R1-CEP 2007-330 - Rev 02

Status : Valid

Issue Date : 2020-11-09

Type : Chemical

Substance Number : 389

Certificate Numbers : CEP 2009-311 - Rev 01

Status : Valid

Issue Date : 2024-01-29

Type : Chemical

Substance Number : 750

Certificate Numbers : CEP 2018-079 - Rev 04

Status : Valid

Issue Date : 2024-03-28

Type : Chemical

Substance Number : 396

Certificate Numbers : CEP 2008-098 - Rev 02

Status : Valid

Issue Date : 2023-10-18

Type : Chemical

Substance Number : 770

Certificate Numbers : CEP 2008-097 - Rev 02

Status : Valid

Issue Date : 2023-11-02

Type : Chemical

Substance Number : 771

FULL SCREEN VIEW Click here to open all results in a new tab [this preview display 10 results]

FULL SCREEN VIEW Click here to open all results in a new tab [this preview display 10 results]Registration Number : 222MF10123

Registrant's Address : Rellinghauser Strasse 1-11 45128 Essen, Germany

Initial Date of Registration : 2010-04-05

Latest Date of Registration : 2024-06-27

Registration Number : 220MF10113

Registrant's Address : No. 46 Wenjiang Road, Wuming District, Nanning, 530199, Guangxi, P. R. China

Initial Date of Registration : 2008-04-21

Latest Date of Registration : 2019-06-18

Registration Number : 218MF10656

Registrant's Address : 33, Rue De Verdun Ham France

Initial Date of Registration : 2006-07-24

Latest Date of Registration : 2006-07-24

Registration Number : 218MF10975

Registrant's Address : No. 46 Wenjiang Road, Wuming District, Nanning, 530199, Guangxi, P. R. China

Initial Date of Registration : 2006-12-01

Latest Date of Registration : 2019-06-18

Registration Number : 218MF10976

Registrant's Address : No. 46 Wenjiang Road, Wuming District, Nanning, 530199, Guangxi, P. R. China

Initial Date of Registration : 2006-12-01

Latest Date of Registration : 2019-10-25

Registration Number : 225MF10190

Registrant's Address : 33, Rue de Verdun Ham, France

Initial Date of Registration : 2013-10-09

Latest Date of Registration : 2013-10-09

Registration Number : 226MF10122

Registrant's Address : 33, Rue de Verdun Ham, France

Initial Date of Registration : 2014-06-18

Latest Date of Registration : 2019-07-26

Registration Number : 218MF10978

Registrant's Address : No. 10 Wenjiang Road, Wuming District, Nanning, 530100, Guangxi, P. R. China

Initial Date of Registration : 2006-12-01

Latest Date of Registration : 2011-11-07

Registration Number : 220MF10094

Registrant's Address : No. 10 Wenjiang Road, Wuming District, Nanning, 530100, Guangxi, P. R. China

Initial Date of Registration : 2008-03-28

Latest Date of Registration : 2011-11-07

Registration Number : 218MF10967

Registrant's Address : 33, Rue de Verdun Ham, France

Initial Date of Registration : 2006-12-01

Latest Date of Registration : 2019-07-19

FULL SCREEN VIEW Click here to open all results in a new tab [this preview display 10 results]

FULL SCREEN VIEW Click here to open all results in a new tab [this preview display 10 results]Registrant Name : Bukwang Pharmaceutical Co., Ltd.

Registration Date : 2008-08-29

Registration Number : 20080829-44-C-224-06

Manufacturer Name : Evonik Operations GmbH

Manufacturer Address : Rodenbacher Chaussee 4 63457 Hanau, Germany

Registrant Name : Roche Korea Co., Ltd.

Registration Date : 2025-01-23

Registration Number : Su188-5-ND

Manufacturer Name : Evonik Corporation

Manufacturer Address : Tippecanoe Laboratories, 1650 Lilly Road Lafayette, Indiana 47909, USA

Registrant Name : Korea Lily (U.S.)

Registration Date : 2007-01-25

Registration Number : Su51-3-ND

Manufacturer Name : Evonik Corporation

Manufacturer Address : Tippecanoe Laboratories1650 Lilly Road Lafayette, IN 47909

Registrant Name : Gilead Sciences Korea Ltd.

Registration Date : 2014-12-04

Registration Number : No. 4945-20-ND

Manufacturer Name : Evonik Operations GmbH

Manufacturer Address : Gutenbergstrasse 2, 69221 Dossenheim, Germany

Registrant Name : Boryeong Co., Ltd.

Registration Date : 2007-12-28

Registration Number : 20071228-86-D-24-04

Manufacturer Name : Evonik Corporation

Manufacturer Address : Tippecanoe Laboratories Lafayette, Indiana, USA (1650 Lilly Road)

Registrant Name : Hyundai Pharmaceutical Co., Ltd.

Registration Date : 2021-05-14

Registration Number : 20210514-209-J-989

Manufacturer Name : Evonik Operations GmbH@Evonik ...

Manufacturer Address : Rodenbacher Chaussee 4 63457 Hanau Germany@33 rue de Verdun 80400 Ham, FRANCE

Registrant Name : Korea Lily (U.S.)

Registration Date : 2021-10-14

Registration Number : 20211014-203-I-626-17

Manufacturer Name : Evonik Corporation@Powdersize ...

Manufacturer Address : Tippecanoe Laboratories, 1650 Lilly Road Lafayette, Indiana 47909, USA_x000D_ _x000D_...

Registrant Name : DKS Korea Co., Ltd.

Registration Date : 2003-04-18

Registration Number : 163-1-ND

Manufacturer Name : Evonik Degussa Canada Inc.

Manufacturer Address : 8045 Argyll Road, Edmonton, Alberta, T6C 4N9, Canada.

FULL SCREEN VIEW Click here to open all results in a new tab [this preview display 10 results]

FULL SCREEN VIEW Click here to open all results in a new tab [this preview display 10 results]NDC Package Code : 16947-8204

Start Marketing Date : 2006-08-28

End Marketing Date : 2025-12-31

Dosage Form (Strength) : POWDER (1kg/kg)

Marketing Category : BULK INGREDIENT

NDC Package Code : 51593-5005

Start Marketing Date : 1992-01-03

End Marketing Date : 2025-12-31

Dosage Form (Strength) : POWDER (1kg/kg)

Marketing Category : BULK INGREDIENT

NDC Package Code : 62128-0384

Start Marketing Date : 2015-12-11

End Marketing Date : 2025-12-31

Dosage Form (Strength) : POWDER (1kg/kg)

Marketing Category : BULK INGREDIENT

NDC Package Code : 49274-1101

Start Marketing Date : 2001-05-15

End Marketing Date : 2025-12-31

Dosage Form (Strength) : POWDER (1kg/kg)

Marketing Category : BULK INGREDIENT

NDC Package Code : 62128-0394

Start Marketing Date : 2021-12-02

End Marketing Date : 2025-12-31

Dosage Form (Strength) : POWDER (1kg/kg)

Marketing Category : BULK INGREDIENT

NDC Package Code : 62128-0386

Start Marketing Date : 2004-08-03

End Marketing Date : 2025-12-31

Dosage Form (Strength) : POWDER (1kg/kg)

Marketing Category : BULK INGREDIENT

NDC Package Code : 52696-0008

Start Marketing Date : 2007-10-23

End Marketing Date : 2025-12-31

Dosage Form (Strength) : POWDER (1kg/kg)

Marketing Category : BULK INGREDIENT

NDC Package Code : 62128-0388

Start Marketing Date : 2015-09-01

End Marketing Date : 2025-12-31

Dosage Form (Strength) : POWDER (1kg/kg)

Marketing Category : BULK INGREDIENT

NDC Package Code : 62128-0383

Start Marketing Date : 1996-05-01

End Marketing Date : 2025-12-31

Dosage Form (Strength) : POWDER (1kg/kg)

Marketing Category : EXPORT ONLY

NDC Package Code : 16947-8205

Start Marketing Date : 2016-03-02

End Marketing Date : 2025-12-31

Dosage Form (Strength) : POWDER (1kg/kg)

Marketing Category : BULK INGREDIENT

Details:

Through the collaboration, Evonik’s proprietary biodegradable long-acting PLGA microparticle formulation will used for SIL-204, Silexion’s siRNA candidate for KRAS mutated Pancreatic cancer.

Lead Product(s): SIL-204

Therapeutic Area: Oncology Brand Name: SIL-204

Study Phase: PreclinicalProduct Type: Oligonucleotide

Recipient: Silexion Therapeutics

Deal Size: Undisclosed Upfront Cash: Undisclosed

Deal Type: Collaboration December 17, 2024

Lead Product(s) : SIL-204

Therapeutic Area : Oncology

Highest Development Status : Preclinical

Recipient : Silexion Therapeutics

Deal Size : Undisclosed

Deal Type : Collaboration

Silexion Therapeutics collaborates with Evonik on advanced siRNA Formulation Development

Details : Through the collaboration, Evonik’s proprietary biodegradable long-acting PLGA microparticle formulation will used for SIL-204, Silexion’s siRNA candidate for KRAS mutated Pancreatic cancer.

Product Name : SIL-204

Product Type : Oligonucleotide

Upfront Cash : Undisclosed

December 17, 2024

Details:

epicite® balance is made of biosynthetic cellulose, a hydropolymer for innovative medical device applications. The dressing enables superior wound cleansing effects and reactivates the healing of slow-healing wounds.

Lead Product(s): Cellulose

Therapeutic Area: Cardiology/Vascular Diseases Brand Name: Epicite® Balance

Study Phase: ApprovedProduct Type: Large molecule

Sponsor: JeNaCell

Deal Size: Not Applicable Upfront Cash: Not Applicable

Deal Type: Not Applicable July 14, 2023

Lead Product(s) : Cellulose

Therapeutic Area : Cardiology/Vascular Diseases

Highest Development Status : Approved

Partner/Sponsor/Collaborator : JeNaCell

Deal Size : Not Applicable

Deal Type : Not Applicable

Evonik Company JenaCell Launches Wound Dressing Epicite® Balance for Chronic Wounds

Details : epicite® balance is made of biosynthetic cellulose, a hydropolymer for innovative medical device applications. The dressing enables superior wound cleansing effects and reactivates the healing of slow-healing wounds.

Product Name : Epicite® Balance

Product Type : Large molecule

Upfront Cash : Not Applicable

July 14, 2023

Details:

epicite® balance is made of biosynthetic cellulose, a hydropolymer for innovative medical device applications. The dressing enables superior wound cleansing effects and reactivates the healing of slow-healing wounds.

Lead Product(s): Cellulose

Therapeutic Area: Cardiology/Vascular Diseases Brand Name: Epicite® Balance

Study Phase: ApprovedProduct Type: Large molecule

Sponsor: JeNaCell

Deal Size: Not Applicable Upfront Cash: Not Applicable

Deal Type: Not Applicable June 13, 2023

Lead Product(s) : Cellulose

Therapeutic Area : Cardiology/Vascular Diseases

Highest Development Status : Approved

Partner/Sponsor/Collaborator : JeNaCell

Deal Size : Not Applicable

Deal Type : Not Applicable

Evonik Company JeNaCell Launches Wound Dressing Epicite® Balance for Chronic Wounds

Details : epicite® balance is made of biosynthetic cellulose, a hydropolymer for innovative medical device applications. The dressing enables superior wound cleansing effects and reactivates the healing of slow-healing wounds.

Product Name : Epicite® Balance

Product Type : Large molecule

Upfront Cash : Not Applicable

June 13, 2023

Details:

ATX-101 is a small product placed directly into the TKA surgical site in a simple, ‘place & go’ manner designed to add minimal extra complexity and time to the procedure.

Lead Product(s): Bupivacaine

Therapeutic Area: Neurology Brand Name: ATX-101

Study Phase: Phase IIProduct Type: Small molecule

Sponsor: Allay Therapeutics

Deal Size: Not Applicable Upfront Cash: Not Applicable

Deal Type: Not Applicable December 13, 2022

Lead Product(s) : Bupivacaine

Therapeutic Area : Neurology

Highest Development Status : Phase II

Partner/Sponsor/Collaborator : Allay Therapeutics

Deal Size : Not Applicable

Deal Type : Not Applicable

Details : ATX-101 is a small product placed directly into the TKA surgical site in a simple, ‘place & go’ manner designed to add minimal extra complexity and time to the procedure.

Product Name : ATX-101

Product Type : Small molecule

Upfront Cash : Not Applicable

December 13, 2022

Details:

Vonoprazan is a novel potassium-competitive acid blocker (PCAB). It inhibits gastric acid secretion by acting as a reversible competitive inhibitor against potassium ions.

Lead Product(s): Vonoprazan Fumarate,Amoxicillin Trihydrate,Clarithromycin

Therapeutic Area: Infections and Infectious Diseases Brand Name: Voquezna Triple Pack

Study Phase: ApprovedProduct Type: Small molecule

Sponsor: Phathom Pharmaceuticals

Deal Size: Undisclosed Upfront Cash: Undisclosed

Deal Type: Agreement October 24, 2022

Lead Product(s) : Vonoprazan Fumarate,Amoxicillin Trihydrate,Clarithromycin

Therapeutic Area : Infections and Infectious Diseases

Highest Development Status : Approved

Partner/Sponsor/Collaborator : Phathom Pharmaceuticals

Deal Size : Undisclosed

Deal Type : Agreement

Evonik and Phathom Pharmaceuticals Partner to Produce Novel Acid-Blocker Vonoprazan

Details : Vonoprazan is a novel potassium-competitive acid blocker (PCAB). It inhibits gastric acid secretion by acting as a reversible competitive inhibitor against potassium ions.

Product Name : Voquezna Triple Pack

Product Type : Small molecule

Upfront Cash : Undisclosed

October 24, 2022

Details:

Lipids, molecules that make up the building blocks of living cells, are critical to producing mRNA-based drugs. The mRNA is enclosed in a lipid nanoparticle (LNP) composed of specific lipids. The LNP protects the mRNA and delivers it safely into the cell, where it is released.

Lead Product(s): mRNA-based Therapy

Therapeutic Area: Infections and Infectious Diseases Brand Name: Undisclosed

Study Phase: UndisclosedProduct Type: Large molecule

Sponsor: BARDA

Deal Size: $220.0 million Upfront Cash: Undisclosed

Deal Type: Funding June 02, 2022

Lead Product(s) : mRNA-based Therapy

Therapeutic Area : Infections and Infectious Diseases

Highest Development Status : Undisclosed

Partner/Sponsor/Collaborator : BARDA

Deal Size : $220.0 million

Deal Type : Funding

Details : Lipids, molecules that make up the building blocks of living cells, are critical to producing mRNA-based drugs. The mRNA is enclosed in a lipid nanoparticle (LNP) composed of specific lipids. The LNP protects the mRNA and delivers it safely into the cell...

Product Name : Undisclosed

Product Type : Large molecule

Upfront Cash : Undisclosed

June 02, 2022

Details:

Evonik to supply commercial quantities of simufilam, a drug candidate for the treatment of Alzheimer’s disease. Simufilam is a novel drug, discovered at Cassava Sciences, that targets both neuroinflammation and neurodegeneration.

Lead Product(s): Simufilam

Therapeutic Area: Neurology Brand Name: PTI-125

Study Phase: Phase IIProduct Type: Small molecule

Sponsor: Cassava Sciences

Deal Size: Undisclosed Upfront Cash: Undisclosed

Deal Type: Agreement March 09, 2021

Lead Product(s) : Simufilam

Therapeutic Area : Neurology

Highest Development Status : Phase II

Partner/Sponsor/Collaborator : Cassava Sciences

Deal Size : Undisclosed

Deal Type : Agreement

Evonik and Cassava Sciences Join Forces to Fight Alzheimer’s Disease

Details : Evonik to supply commercial quantities of simufilam, a drug candidate for the treatment of Alzheimer’s disease. Simufilam is a novel drug, discovered at Cassava Sciences, that targets both neuroinflammation and neurodegeneration.

Product Name : PTI-125

Product Type : Small molecule

Upfront Cash : Undisclosed

March 09, 2021

Details:

Lipids are fundamental to produce highly effective mRNA-based vaccines. Only with an increase in lipid supply can the volume of vaccine be further increased. This move marks an expansion of the partnership between Evonik and the Comirnaty, vaccine manufacturer BioNTech.

Lead Product(s): Tozinameran

Therapeutic Area: Infections and Infectious Diseases Brand Name: Comirnaty

Study Phase: ApprovedProduct Type: Vaccine

Sponsor: BioNTech

Deal Size: Undisclosed Upfront Cash: Undisclosed

Deal Type: Partnership February 11, 2021

Lead Product(s) : Tozinameran

Therapeutic Area : Infections and Infectious Diseases

Highest Development Status : Approved

Partner/Sponsor/Collaborator : BioNTech

Deal Size : Undisclosed

Deal Type : Partnership

Evonik Strengthens Strategic Partnership with Biontech on Covid-19 Vaccine

Details : Lipids are fundamental to produce highly effective mRNA-based vaccines. Only with an increase in lipid supply can the volume of vaccine be further increased. This move marks an expansion of the partnership between Evonik and the Comirnaty, vaccine manufa...

Product Name : Comirnaty

Product Type : Vaccine

Upfront Cash : Undisclosed

February 11, 2021

FULL SCREEN VIEW Click here to open all results in a new tab [this preview display 10 results]

FULL SCREEN VIEW Click here to open all results in a new tab [this preview display 10 results]Services

API Manufacturing

Pharma Service : API Manufacturing

Category : Chiral Synthesis

Sub Category : Overview

Pharma Service : API Manufacturing

FULL SCREEN VIEW Click here to open all results in a new tab [this preview display 10 results]

FULL SCREEN VIEW Click here to open all results in a new tab [this preview display 10 results]Drug Product Manufacturing

API & Drug Product Development

Excipients

Excipients by Ingredients

Excipients By applications

Inspections and registrations

ABOUT THIS PAGE

Evonik Industries is a supplier offers 38 products (APIs, Excipients or Intermediates).

Find a price of Aspartic Acid API bulk with DMF, CEP, JDMF offered by Evonik Industries

Find a price of L-Alanine API bulk with DMF, CEP, JDMF offered by Evonik Industries

Find a price of Proline bulk with DMF, CEP, JDMF offered by Evonik Industries

Find a price of Serine bulk with DMF, CEP, JDMF offered by Evonik Industries

Find a price of Azelastine Hydrochloride bulk with DMF, CEP offered by Evonik Industries

Find a price of Chlorhexidine Gluconate bulk with DMF, CEP offered by Evonik Industries

Find a price of Dimercaprol bulk with CEP, JDMF offered by Evonik Industries

Find a price of Glycine bulk with DMF, JDMF offered by Evonik Industries

Find a price of Isoleucine bulk with CEP, JDMF offered by Evonik Industries

Find a price of L-Glutamic Acid bulk with CEP, JDMF offered by Evonik Industries

Find a price of L-Leucine API bulk with CEP, JDMF offered by Evonik Industries

Find a price of L-Methionine bulk with DMF, JDMF offered by Evonik Industries

Find a price of L-Threonine bulk with CEP, JDMF offered by Evonik Industries

Find a price of L-VALINE bulk with CEP, JDMF offered by Evonik Industries

Find a price of Lisinopril bulk with DMF, CEP offered by Evonik Industries

Find a price of Lorazepam bulk with DMF, CEP offered by Evonik Industries

Find a price of Lysine Acetate bulk with CEP, JDMF offered by Evonik Industries

Find a price of Lysine Hydrochloride bulk with CEP, JDMF offered by Evonik Industries

Find a price of Serine bulk with CEP, JDMF offered by Evonik Industries

Find a price of Chlorhexidine bulk with DMF offered by Evonik Industries

Find a price of DL-Valine API bulk with JDMF offered by Evonik Industries

Find a price of Hydrogen Peroxide bulk with CEP offered by Evonik Industries

Find a price of L-Alanine API bulk with JDMF offered by Evonik Industries

Find a price of L-Glutamic Acid bulk with JDMF offered by Evonik Industries

Find a price of L-Glutamine bulk with DMF offered by Evonik Industries

Find a price of L-Ornithine L-aspartate bulk with DMF offered by Evonik Industries

Find a price of L-Threonine bulk with JDMF offered by Evonik Industries

Find a price of Lormetazepam bulk with JDMF offered by Evonik Industries

Find a price of Lysine bulk with DMF offered by Evonik Industries

Find a price of Lysine Hydrochloride bulk with JDMF offered by Evonik Industries

Find a price of Methionine bulk with CEP offered by Evonik Industries

Find a price of Phenylalanine bulk with JDMF offered by Evonik Industries

Find a price of Proline bulk with JDMF offered by Evonik Industries

Find a price of Serine bulk with JDMF offered by Evonik Industries

Find a price of Asparagine bulk offered by Evonik Industries

Find a price of Tryptophan bulk offered by Evonik Industries

Find a price of Alpha Hydroxymethionine Calcium bulk offered by Evonik Industries

Find a price of Alpha-Ketovaline Calcium bulk offered by Evonik Industries