10 Mar 2025

// CONTRACTPHARMA

09 Jan 2025

// PRESS RELEASE

17 Dec 2024

// GLOBENEWSWIRE

Latest Content by PharmaCompass

KEY SERVICES

KEY SERVICES

Evonik's CDMO solutions for APIs and HPAPIs: It specializes where the client needs it most!

About

CPhI North America CPhI North America

Industry Trade Show

Not Confirmed

20-22 May, 2025

China Battery FairChina Battery Fair

Industry Trade Show

Attending

17-19 May, 2025

The Battery Show Europ...The Battery Show Europe

Industry Trade Show

Attending

03-05 June, 2025

CONTACT DETAILS

Events

Webinars & Exhibitions

CPhI North America CPhI North America

Industry Trade Show

Not Confirmed

20-22 May, 2025

China Battery FairChina Battery Fair

Industry Trade Show

Attending

17-19 May, 2025

The Battery Show Europ...The Battery Show Europe

Industry Trade Show

Attending

03-05 June, 2025

CORPORATE CONTENT #SupplierSpotlight

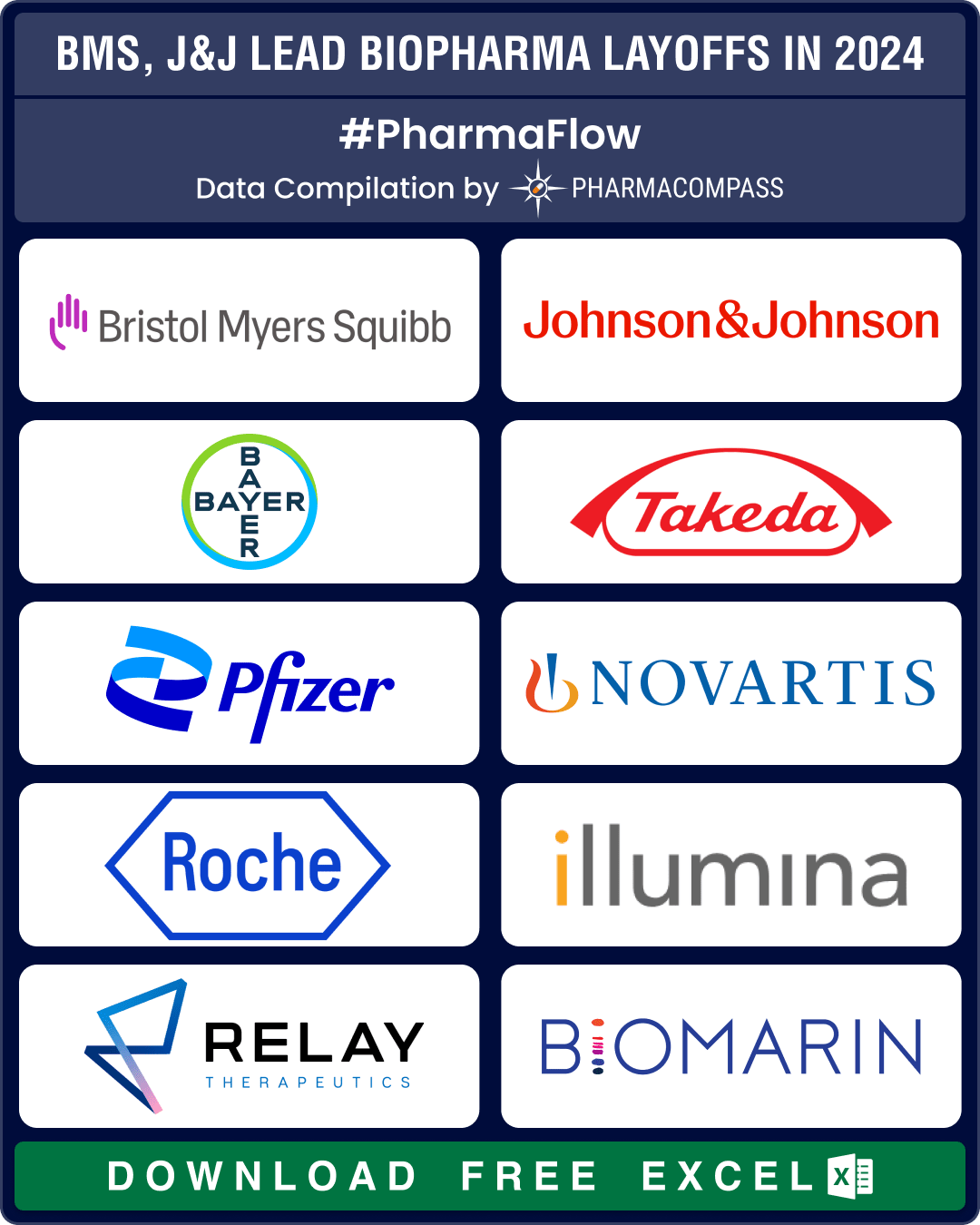

https://www.pharmacompass.com/radio-compass-blog/bms-j-j-bayer-lead-25-000-pharma-layoffs-in-2024-amylyx-fibrogen-kronos-bio-hit-by-trial-failures-cash-crunch

https://www.pharmacompass.com/radio-compass-blog/cdmo-activity-tracker-bora-polpharma-make-acquisitions-evonik-euroapi-porton-announce-technological-expansions

https://www.pharmacompass.com/radio-compass-blog/bms-bayer-takeda-pfizer-downsize-to-combat-cost-pressures-meet-restructuring-plans

https://www.pharmacompass.com/radio-compass-blog/excipient-market-overview-roquette-seqens-evonik-make-strategic-moves-new-guidelines-deal-with-contamination

https://www.pharmacompass.com/radio-compass-blog/cdmo-activity-tracker-novo-s-parent-buys-catalent-for-us-16-5-bn-fujifilm-merck-kgaa-axplora-lonza-expand-capabilities

10 Mar 2025

// CONTRACTPHARMA

https://www.contractpharma.com/breaking-news/azelis-enters-distribution-agreement-with-evonik/

09 Jan 2025

// PRESS RELEASE

https://healthcare.evonik.com/en/news-and-events/press-releases/evonik-partners-with-st-pharm-to-increase-its-offerings-for-rna-and-nucleic-acid-delivery-268818.html

17 Dec 2024

// GLOBENEWSWIRE

https://www.globenewswire.com/news-release/2024/12/17/2998086/0/en/Silexion-Therapeutics-collaborates-with-Evonik-on-advanced-siRNA-Formulation-Development.html

26 Oct 2024

// PRESS RELEASE

https://www.evonik.com/en/news/press-releases/2024/10/european-food-safety-authority-confirms-safety-of-silica-as-food0.html

14 Oct 2024

// FIERCE PHARMA

https://www.fiercepharma.com/pharma/evonik-telegraphs-another-260-layoffs-amid-multiyear-reorganization

11 Oct 2024

// PRESS RELEASE

https://healthcare.evonik.com/en/news-and-events/press-releases/evonik-to-restructure-its-keto-and-pharma-amino-acid-business-261654.html

Services

API Manufacturing

FULL SCREEN VIEW Click here to open all results in a new tab [this preview display 10 results]

FULL SCREEN VIEW Click here to open all results in a new tab [this preview display 10 results]Pharma Service : API Manufacturing

Category : Chiral Synthesis

Sub Category : Overview

Pharma Service : API Manufacturing

FULL SCREEN VIEW Click here to open all results in a new tab [this preview display 10 results]

FULL SCREEN VIEW Click here to open all results in a new tab [this preview display 10 results]Pharma Service : API Manufacturing

Category : High Potency APIs (HPAPIs)

Sub Category : Overview

Pharma Service : API Manufacturing

FULL SCREEN VIEW Click here to open all results in a new tab [this preview display 10 results]

FULL SCREEN VIEW Click here to open all results in a new tab [this preview display 10 results]Pharma Service : API Manufacturing

Category : Oligosaccharides & Polysaccharides

Sub Category : Overview

Pharma Service : API Manufacturing

FULL SCREEN VIEW Click here to open all results in a new tab [this preview display 10 results]

FULL SCREEN VIEW Click here to open all results in a new tab [this preview display 10 results]Drug Product Manufacturing

API & Drug Product Development

Excipients

Excipients by Ingredients

Excipients By applications

Inspections and registrations

ABOUT THIS PAGE

Evonik is a supplier offers 55 products (APIs, Excipients or Intermediates).

Find a price of Aspartic Acid API bulk with DMF, CEP, JDMF offered by Evonik

Find a price of L-Alanine API bulk with DMF, CEP, JDMF offered by Evonik

Find a price of Proline bulk with DMF, CEP, JDMF offered by Evonik

Find a price of Serine bulk with DMF, CEP, JDMF offered by Evonik

Find a price of Azelastine Hydrochloride bulk with DMF, CEP offered by Evonik

Find a price of Chlorhexidine Gluconate bulk with DMF, CEP offered by Evonik

Find a price of Dimercaprol bulk with CEP, JDMF offered by Evonik

Find a price of Glycine bulk with DMF, JDMF offered by Evonik

Find a price of Isoleucine bulk with CEP, JDMF offered by Evonik

Find a price of L-Glutamic Acid bulk with CEP, JDMF offered by Evonik

Find a price of L-Leucine API bulk with CEP, JDMF offered by Evonik

Find a price of L-Methionine bulk with DMF, JDMF offered by Evonik

Find a price of L-Threonine bulk with CEP, JDMF offered by Evonik

Find a price of L-VALINE bulk with CEP, JDMF offered by Evonik

Find a price of Lisinopril bulk with DMF, CEP offered by Evonik

Find a price of Lorazepam bulk with DMF, CEP offered by Evonik

Find a price of Lysine Acetate bulk with CEP, JDMF offered by Evonik

Find a price of Lysine Hydrochloride bulk with CEP, JDMF offered by Evonik

Find a price of Serine bulk with CEP, JDMF offered by Evonik

Find a price of Chlorhexidine bulk with DMF offered by Evonik

Find a price of DL-Valine API bulk with JDMF offered by Evonik

Find a price of Hydrogen Peroxide bulk with CEP offered by Evonik

Find a price of L-Alanine API bulk with JDMF offered by Evonik

Find a price of L-Glutamic Acid bulk with JDMF offered by Evonik

Find a price of L-Glutamine bulk with DMF offered by Evonik

Find a price of L-Ornithine L-aspartate bulk with DMF offered by Evonik

Find a price of L-Threonine bulk with JDMF offered by Evonik

Find a price of Lormetazepam bulk with JDMF offered by Evonik

Find a price of Lysine bulk with DMF offered by Evonik

Find a price of Lysine Hydrochloride bulk with JDMF offered by Evonik

Find a price of Methionine bulk with CEP offered by Evonik

Find a price of Phenylalanine bulk with JDMF offered by Evonik

Find a price of Proline bulk with JDMF offered by Evonik

Find a price of Serine bulk with JDMF offered by Evonik

Find a price of Asparagine bulk offered by Evonik

Find a price of Tryptophan bulk offered by Evonik

Find a price of Alanyl Glutamine bulk offered by Evonik

Find a price of Alectinib Hydrochloride bulk offered by Evonik

Find a price of Alpha Hydroxymethionine Calcium bulk offered by Evonik

Find a price of Alpha-Ketovaline Calcium bulk offered by Evonik

Find a price of Baloxavir Marboxil bulk offered by Evonik

Find a price of Clorsulon bulk offered by Evonik

Find a price of Duloxetine Hydrochloride bulk offered by Evonik

Find a price of Emtricitabine bulk offered by Evonik

Find a price of Enzalutamide bulk offered by Evonik

Find a price of Flupirtine bulk offered by Evonik

Find a price of Gemcitabine bulk offered by Evonik

Find a price of Linzagolix Choline bulk offered by Evonik

Find a price of Lubabegron fumarate bulk offered by Evonik

Find a price of Resmetirom bulk offered by Evonik

Find a price of Tadalafil bulk offered by Evonik

Find a price of Tilmicosin bulk offered by Evonik

Find a price of Verteporfin bulk offered by Evonik

Find a price of Vonoprazan Fumarate bulk offered by Evonik

Find a price of POLYMERS bulk offered by Evonik