By PharmaCompass

2020-02-13

Impressions: 3920

We at PharmaCompass are pleased to announce the launch of Pipeline Prospector, in collaboration with SCORR Marketing, a leading health science marketing agency.

The Pipeline Prospector is a free-access database of global drug development deals and updates designed for executives in the drug development industry. Our database will be updated every month. The first of this two-part rollout of the initial version of the Pipeline Prospector delivers access to a database of current deals and developments. In the second phase, we will add pipeline data to provide more in-depth therapeutic information.

Access the Pipeline Prospector Dashboard for All Deals & Development Updates

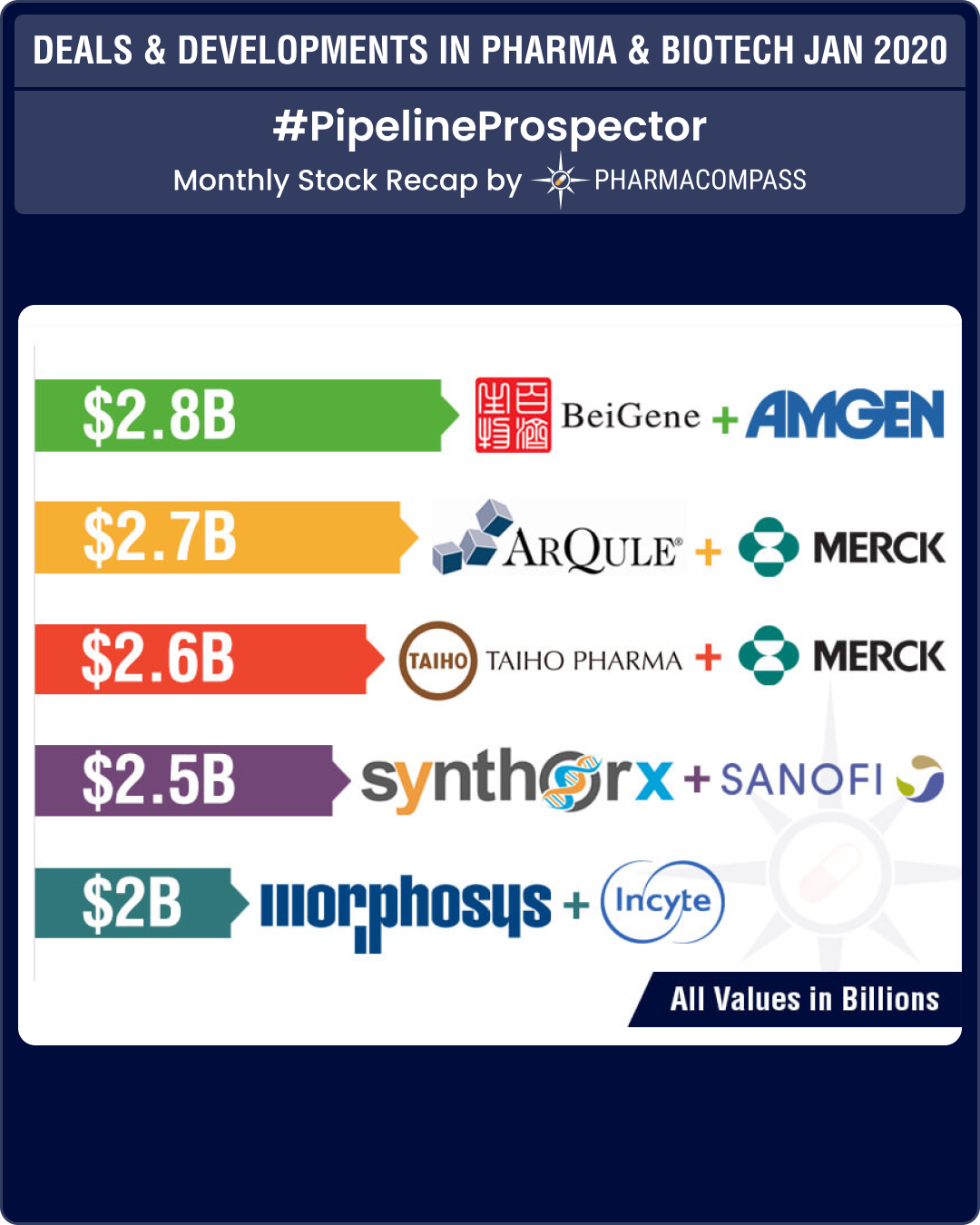

We begin 2020 with a compilation of all the major deals and developments which were announced in January.

Dealmakers at JPMorgan

Historically, January is the month of the annual JPMorgan Healthcare Conference in San Francisco — a platform where drug majors tend to announce significant deals and strategic shifts. Last year witnessed the US$ 74 billion acquisition of New Jersey-based cancer drug company Celgene by Bristol-Myers Squibb. After factoring in debt, the value of the deal ballooned to about US$ 95 billion, which according to data compiled by Refinitiv, was the largest healthcare deal on record.

This year started on a muted note with Eli Lilly’s all-cash acquisition of California-based Dermira Inc being one of the only major deals. The acquisition will allow Eli Lilly to expand its immunology pipeline with a late-stage treatment for atopic dermatitis.

The acquisition gives Lilly two key Dermira assets — lebrikizumab and Qbrexza (glycopyrronium) cloth. Lebrikizumab is a novel, investigational, monoclonal antibody designed to bind IL-13, which is believed to be a driver of signs and symptoms of atopic dermatitis. It is currently in two Phase III trials for the treatment of moderate-to-severe atopic dermatitis in adolescent and adult patients, aged 12 years and older.

In late 2019, FDA granted fast-track designation to lebrikizumab, and analysts are of the view that the drug could be a challenger to Dupixent, a skin drug made by Regeneron and Sanofi that is expected to bring in over US$ 11 billion in annual sales.

Access the Pipeline Prospector Dashboard for All Deals & Development Updates

At the JPMorgan conference, Incyte and MorphoSys announced a collaboration and licensing agreement to further develop and commercialize MorphoSys’ proprietary anti-CD19 antibody tafasitamab (MOR208) globally.

Tafasitamab is an Fc-engineered antibody against CD19 currently in clinical development for the treatment of B cell malignancies. MorphoSys and Incyte will co-commercialize tafasitamab in the US, while Incyte has exclusive commercialization rights outside of the US.

As per the agreement, MorphoSys will receive an upfront payment of US$ 750 million. In addition, Incyte will make an equity investment into MorphoSys to the tune of US$ 150 million. Depending on the achievement of certain developmental, regulatory and commercial milestones, MorphoSys will be eligible to receive milestone payments amounting to nearly US$ 1.1 billion. MorphoSys will also receive tiered royalties on ex-US net sales of tafasitamab in a mid-teens to mid-twenties percentage range of net sales.

An approval for tafasitimab could come as soon as mid-2020, according to MorphoSys, which submitted the drug to the US Food and Drug Administration in late 2019.

Around the same time as these deals were announced, Biogen placed another bet on Alzheimer’s R&D by paying Pfizer US$ 75 million upfront for a candidate currently in Phase I trials.

Access the Pipeline Prospector Dashboard for All Deals & Development Updates

Amgen’s China bet

January also saw the completion of two previously announced US$ 2.7 billion deals. As China, the world’s second largest pharmaceutical market, continues to remain a key growth area for Big Pharma, Amgen completed its acquisition of a 20.5 percent stake in the Chinese biotechnology firm Beigene worth approximately US$ 2.7 billion. The deal will give Amgen’s cancer drugs greater exposure to the Chinese market and also allow the firm to profit if BeiGene’s pipeline of molecularly targeted and immuno-oncology products prove to be effective and ready for commercialization.

A month after Amgen had announced its investment in BeiGene, the FDA approved BeiGene’s cancer therapy zanubrutinib (branded as Brukinsa) months ahead of schedule. This was the first-ever FDA approval for a cancer therapy developed by a Chinese biotech.

Access the Pipeline Prospector Dashboard for All Deals & Development Updates

Merck’s oncology focus

US-headquartered Merck, which is known as MSD (short for Merck Sharp & Dohme) outside the United States and Canada, completed its acquisition of ArQule through its subsidiary for US$ 2.7 billion.

ArQule focusses on kinase inhibitor discovery and development for the treatment of patients with cancer and other diseases. The deal gives Merck access to ArQule’s experimental treatment ARQ 531 — a novel, oral Bruton’s tyrosine kinase (BTK) inhibitor currently in a Phase 2 dose expansion study for the treatment of B-cell malignancies.

In January, Merck also announced an alliance with Japanese drugmakers Taiho Pharmaceutical and Astex Pharmaceuticals (a wholly owned subsidiary of Otsuka Pharmaceutical). The American drugmaker said it is willing to invest up to US$ 2.5 billion in order to gain access to small-molecule inhibitors against several drug targets, including the KRAS oncogene, from Taiho and Astex.

Access the Pipeline Prospector Dashboard for All Deals & Development Updates

According to a statement, Taiho, Astex and Merck will combine preclinical candidates and their data “with knowledge and expertise from their respective research programs.”

In exchange for giving Merck an exclusive global license to their small-molecule inhibitor candidates, Taiho and Astex will get US$ 50 million upfront, with the US$ 2.5 billion “contingent upon the achievement of preclinical, clinical, regulatory and sales milestones for multiple products arising from the agreement, as well as tiered royalties on sales.”

“Merck will fund research and development and will be responsible for commercialization of products globally,” the statement said. Taiho has retained co-commercialization rights in Japan and an option to promote the drugs (coming out of this alliance) in specific areas of South East Asia.

KRAS is short for the gene Kirsten rat sarcoma viral oncogene homolog, which makes a protein (KRAS protein) that is critical in promoting cell growth and survival in non-cancerous cells. Cancers driven by KRAS mutations are both common and deadly.

The year 2019 was a big one for KRAS, when several players — such as Amgen, Boehringer Ingelheim, Eli Lilly and Mirati — had reported progress in the field. For instance, Amgen had reported encouraging anti-tumor activity with its AMG 510 candidate, which targets a KRAS mutation known as G12C.

In September last year, Boehringer Ingelheim (BI) had licensed an MEK inhibitor from Indian drugmaker Lupin that it intends to pair with its lineup of KRAS inhibitors. BI had also entered into a partnership with MD Anderson Cancer Centre in the US for another KRAS inhibitor.

Access the Pipeline Prospector Dashboard for All Deals & Development Updates

Acceleron’s shares skyrocket

The share price of Boston-based Acceleron almost doubled in the month of January when new Phase 2 data on the success of an experimental heart drug, sotatercept, found a statistically significant decrease in pulmonary vascular resistance in patients with pulmonary arterial hypertension(PAH).

Pulmonary arterial hypertension (PAH) is a rare, progressive disorder characterized by high blood pressure (hypertension) in the arteries of the lungs (pulmonary artery) for no apparent reason. The pulmonary arteries are the blood vessels that carry blood from the right side of the heart through the lungs.

In November 2019, the FDA approved Acceleron’s luspatercept (brand name Reblozyl) for the treatment of anemia among patients with beta-thalassemia who require regular red blood cell transfusions. The approval provides patients with a therapy that, for the first time, will help decrease the number of blood transfusions.

Access the Pipeline Prospector Dashboard for All Deals & Development Updates

Setback for France’s Ipsen and Nektar Therapeutics

French drugmaker Ipsen announced it was pausing a phase III trial of palovarotene, an experimental rare bone disease drug, after an interim analysis found it is unlikely to meet its primary efficacy endpoint. The decision to pause the trial is based on the results of a futility analysis reviewed by the Independent Data Monitoring Committee (IDMC).

The announcement marked yet another blow for palovarotene, which had run into safety and efficacy problems since Ipsen acquired it in a US$ 1.3 billion (€1.1 billion) takeover of Clementia Pharmaceuticals. In December, a safety concern prompted the FDA to halt dosing in children.

At the time of acquiring Clementia last year, David Meek, the then CEO of Ipsen, had called the drug “a largely derisked asset”. Since then, palovarotene has been the subject of a safety signal that led the FDA to stop the trial in children, a key population. The drug has now been rocked by an analysis that questions its efficacy.

Access the Pipeline Prospector Dashboard for All Deals & Development Updates

Last month, we also witnessed a major setback for Nektar Therapeutics as a joint FDA advisory committee voted 27-0 against the approval of oxycodegol for chronic low back pain.

Oxycodegol’s key selling point was that its central nervous system absorption rate was much slower than that of the other often abused opioid drugs.

The focus on drug development is constantly evolving and the Pipeline Prospector, our free access database of global drug development deals and development updates, is designed to provide the insights necessary for professionals to drive their business forward.

Email us at support@pipelineprospector.com to learn more.

Access the Pipeline Prospector Dashboard for All Deals & Development Updates

The PharmaCompass Newsletter – Sign Up, Stay Ahead

Feedback, help us to improve. Click here

Image Credit : Deals & Developments in Pharma & Biotech january 2020 by PharmaCompass is licensed under CC BY 2.0

“ The article is based on the information available in public and which the author believes to be true. The author is not disseminating any information, which the author believes or knows, is confidential or in conflict with the privacy of any person. The views expressed or information supplied through this article is mere opinion and observation of the author. The author does not intend to defame, insult or, cause loss or damage to anyone, in any manner, through this article.”