Data Compilation #PharmaFlow

CDMO Activity Tracker: Axplora enhances ADC capacities, Quotient beefs up HPAPI capabilities; Evonik, EUROAPI forge deals

The contract development and

manufacturing organization (CDMO) sector witnessed significant activit

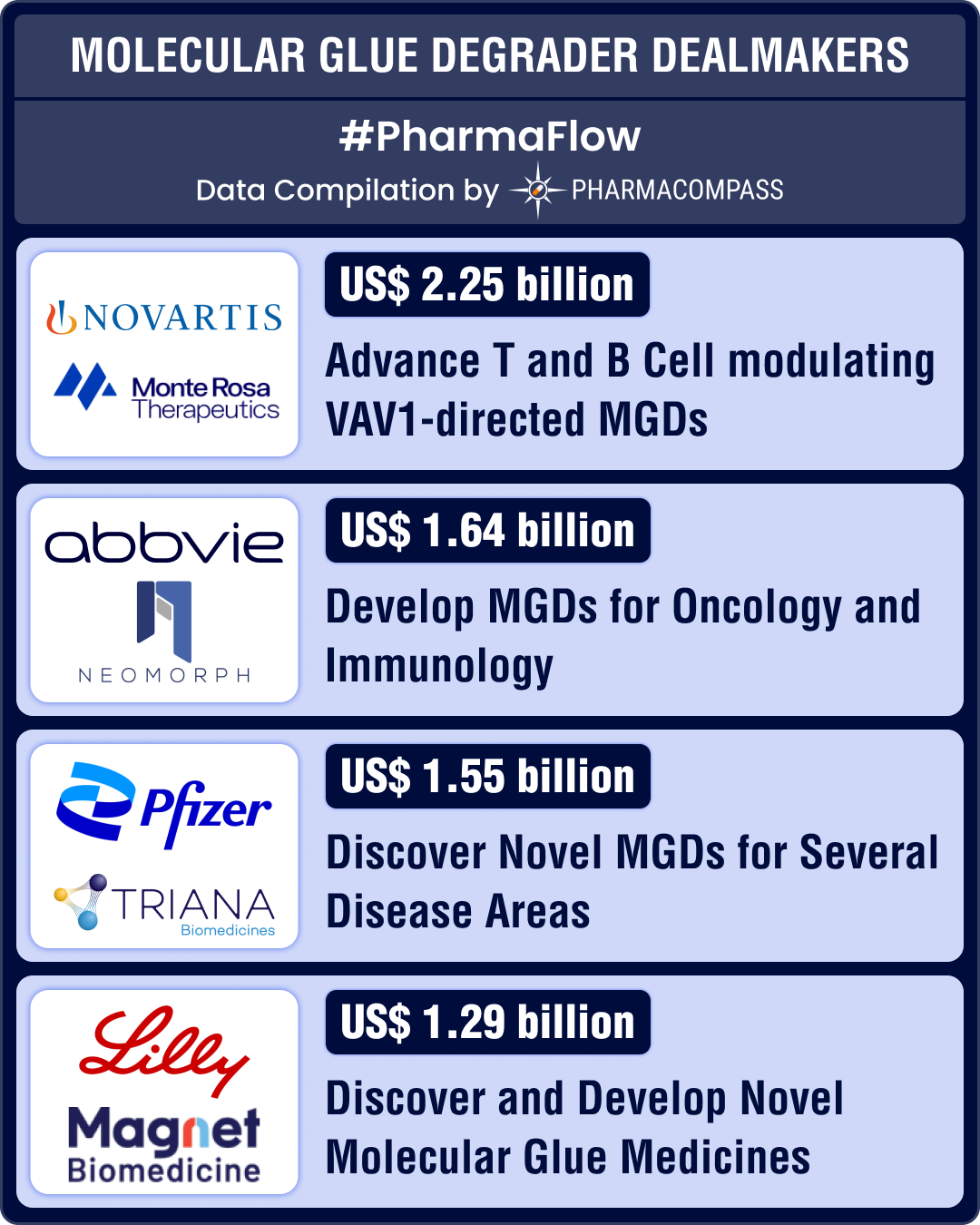

Molecular glue degraders: Lilly, AbbVie sign billion-dollar deals; BMS leads with three late-stage drugs

This week, we delve into molecular glue degraders (MGDs), one of the most promising frontiers in dru

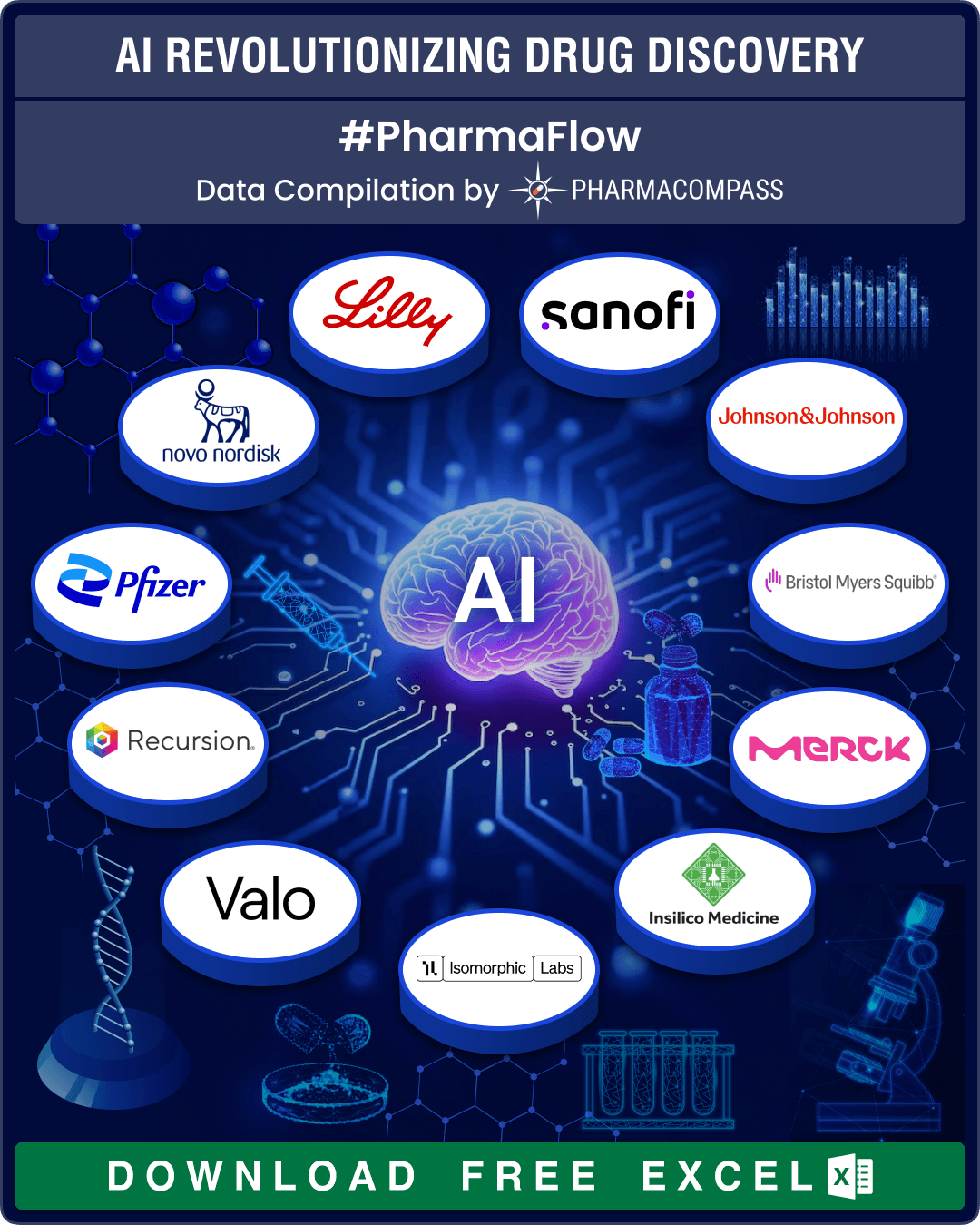

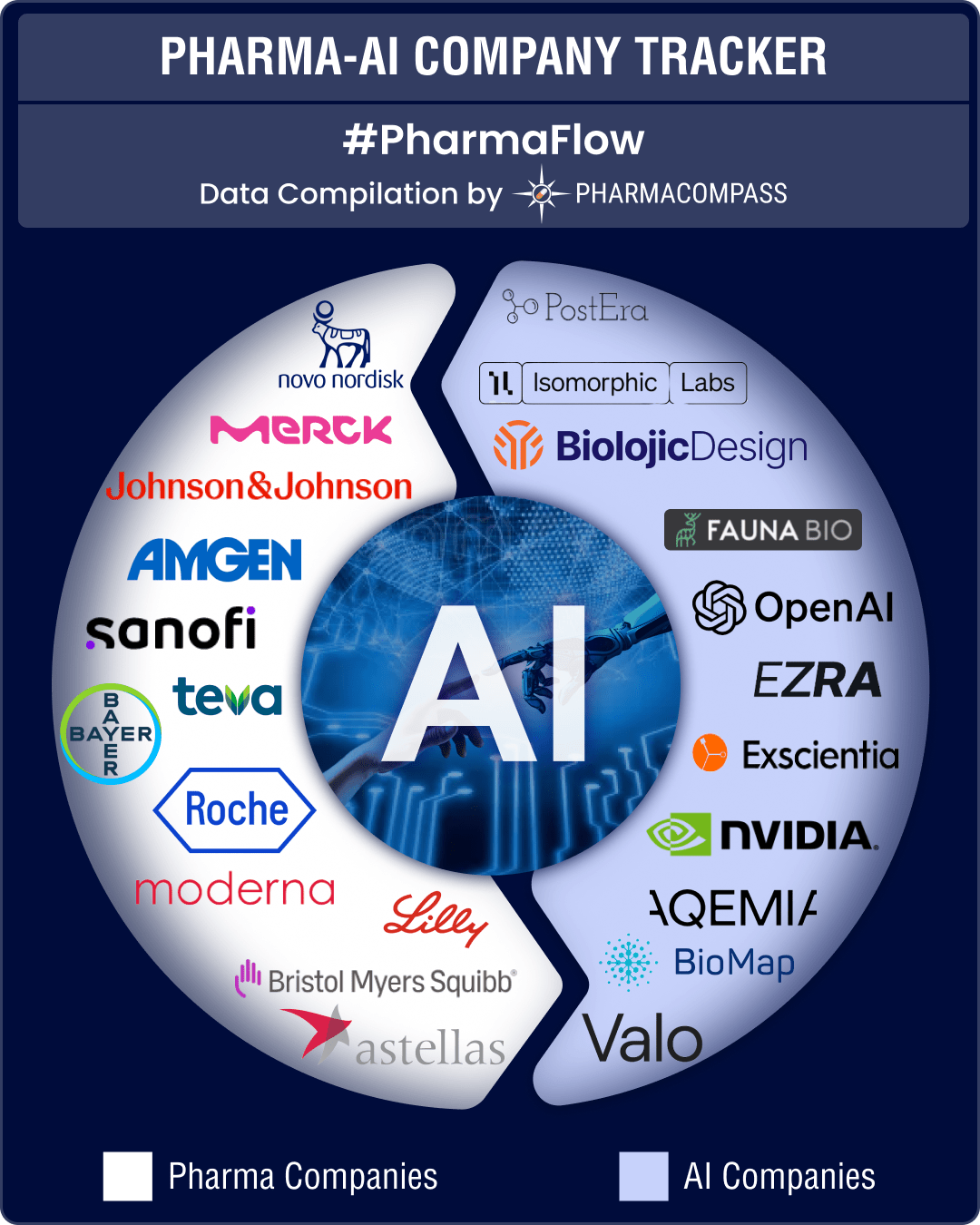

AI drug discovery market to grow 30% CAGR, to reach US$ 35 bn by 2034; Novo, Lilly, BMS forge deals

Artificial intelligence (AI) is emerging

as a transformative force in drug discovery and developmen

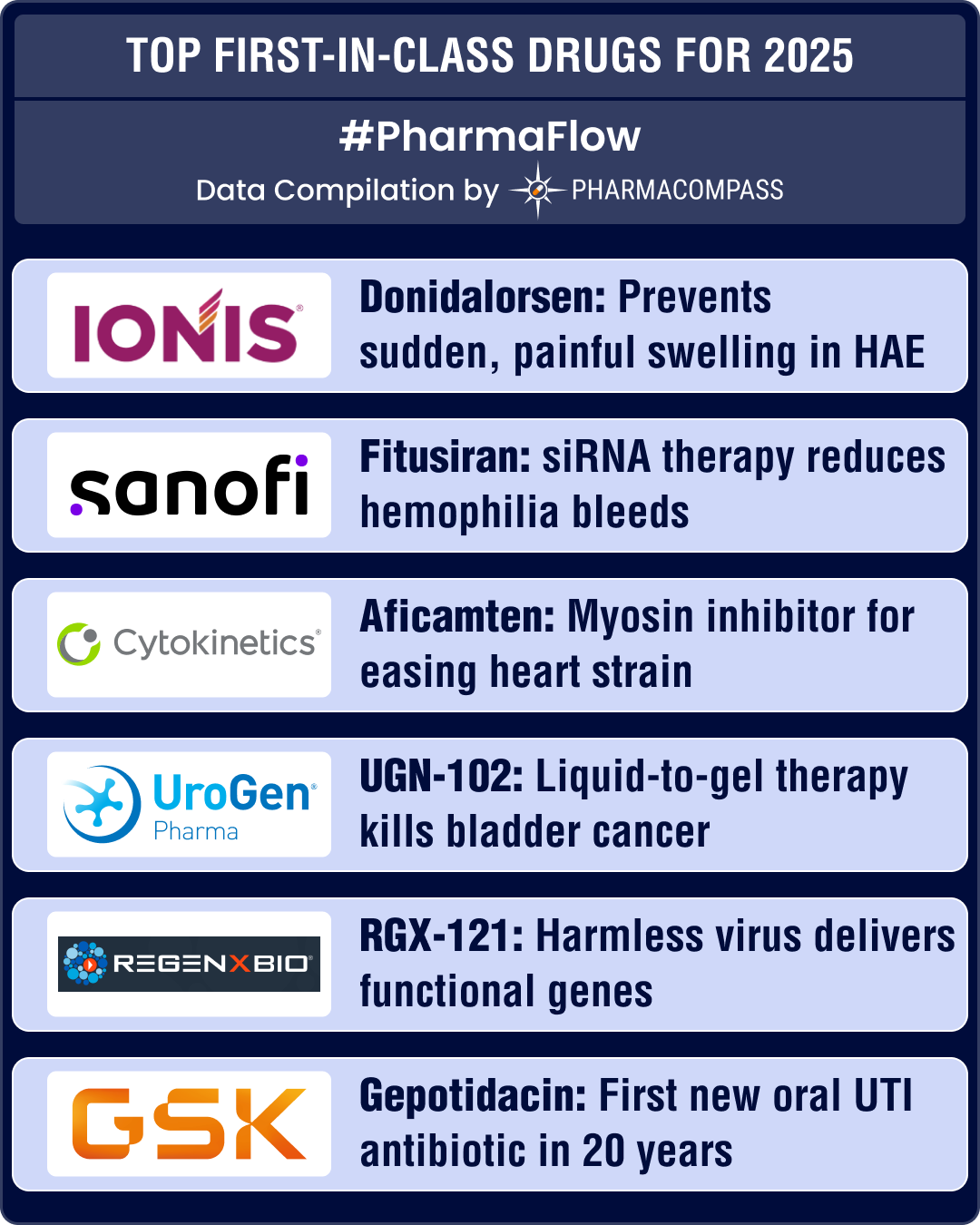

Top first-in-class drug candidates of 2025: Ionis’ donidalorsen, Sanofi’s fitusiran, Cytokinetics’ aficamten await FDA approval

First‑in‑class drugs are therapies with entirely new approaches that improve patient out

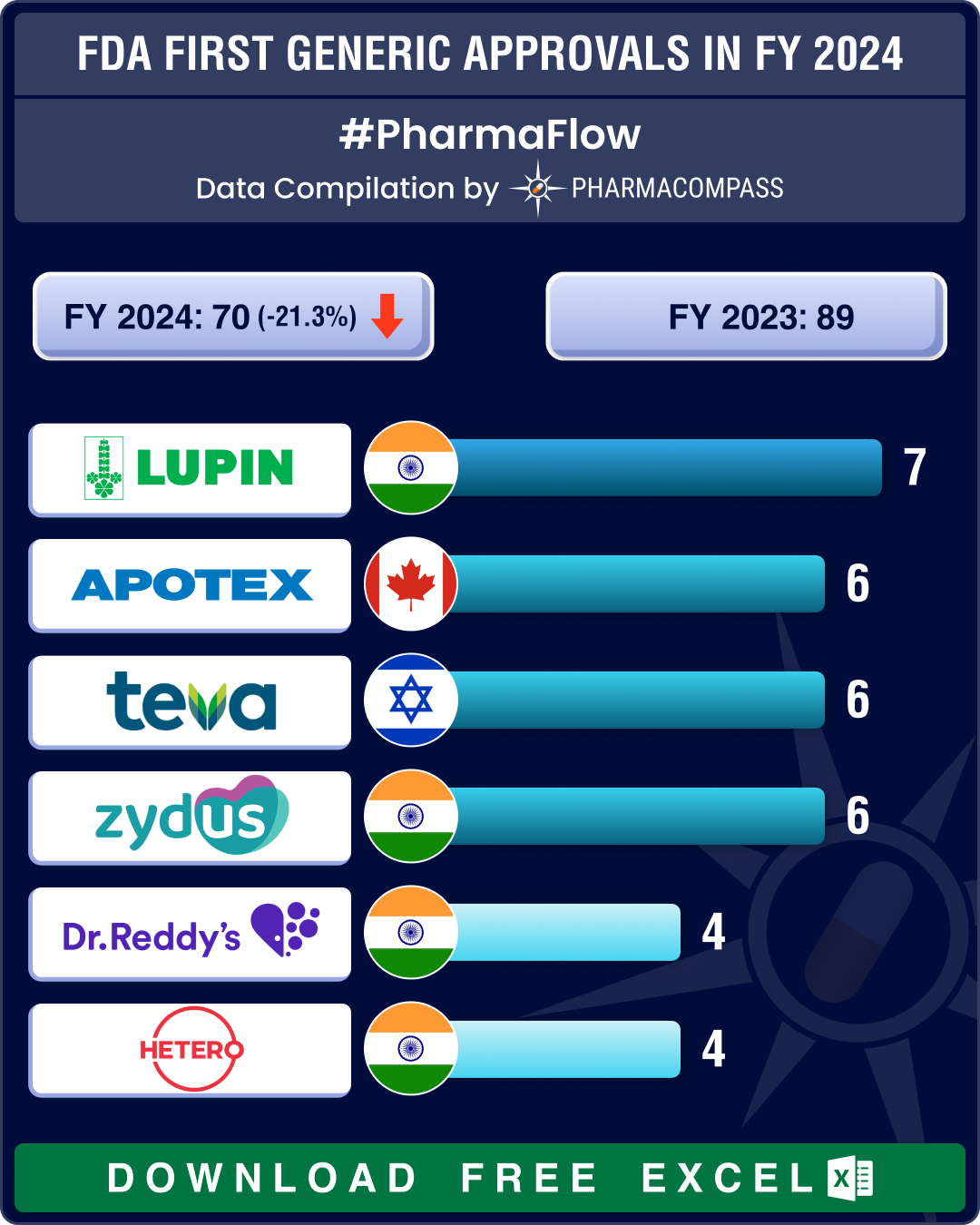

FDA’s first generic approvals slump 21% in 2024; Novartis’ top seller Entresto, cancer blockbuster Tasigna lead 2024 patent cliff

A watershed moment in the journey of a drug is when it transitions from being a patented, high‐

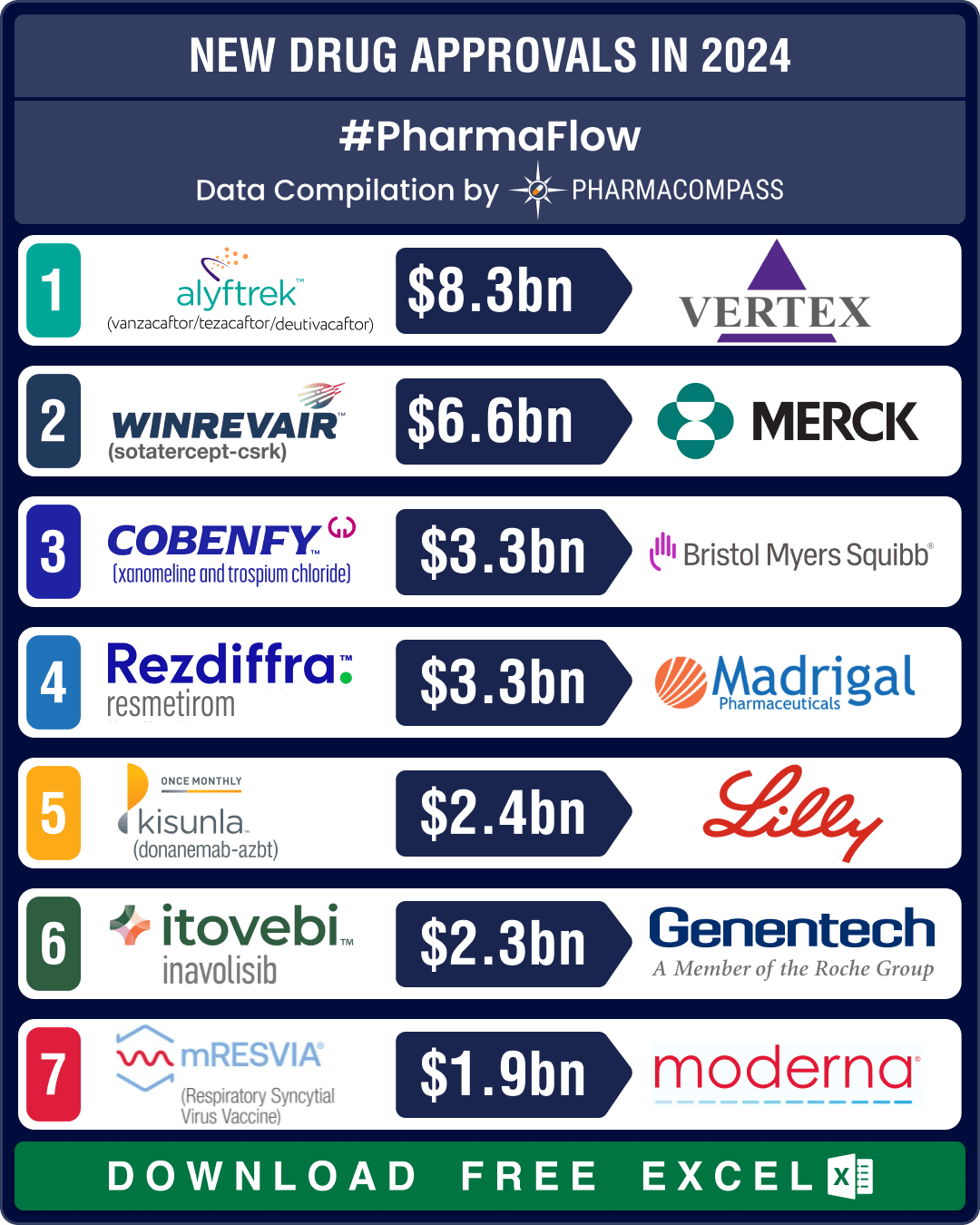

FDA okays 50 new drugs in 2024; BMS’ Cobenfy, Lilly’s Kisunla lead pack of breakthrough therapies

In 2024, the biopharma industry continued to advance on its robust trajectory of innovation. Though

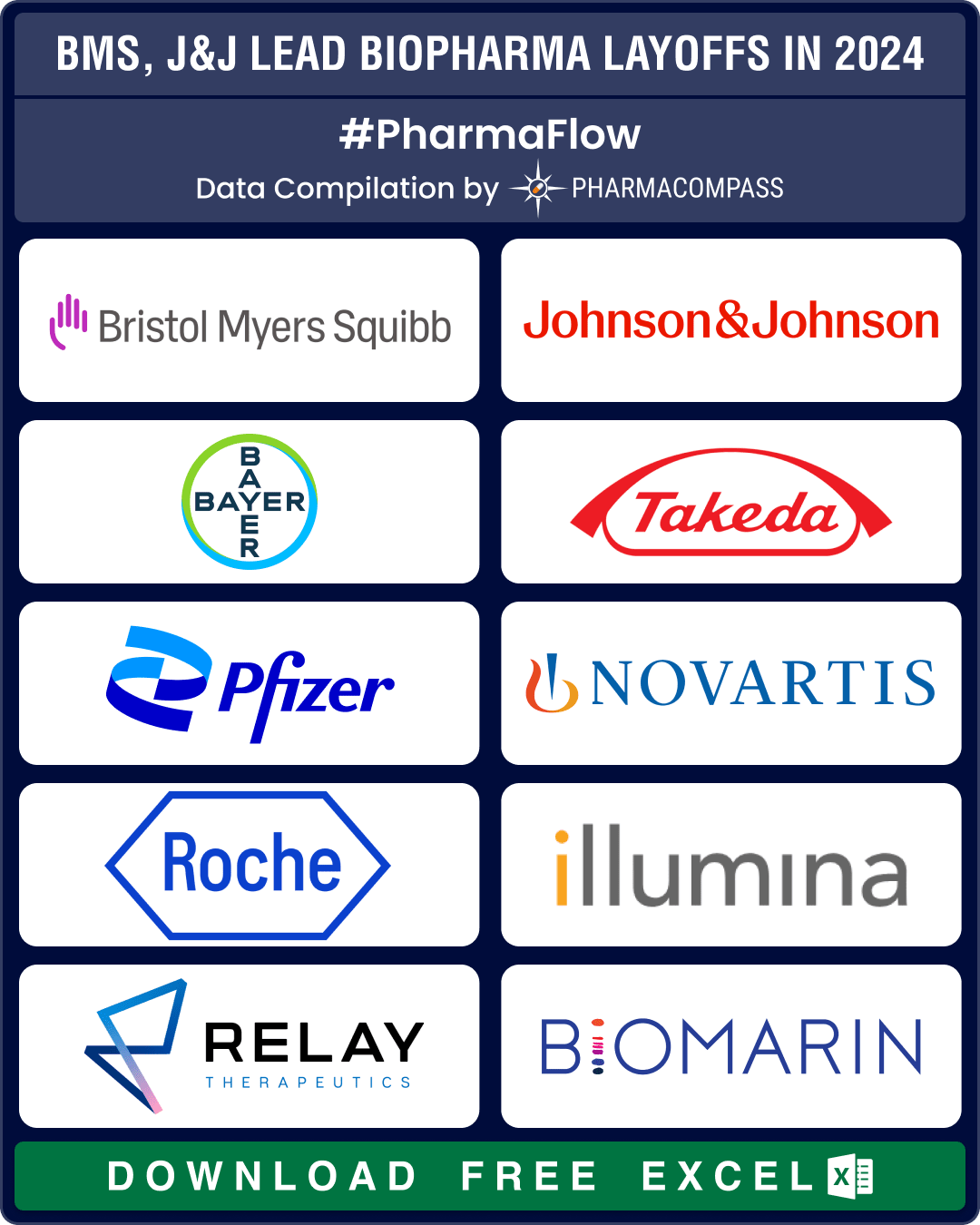

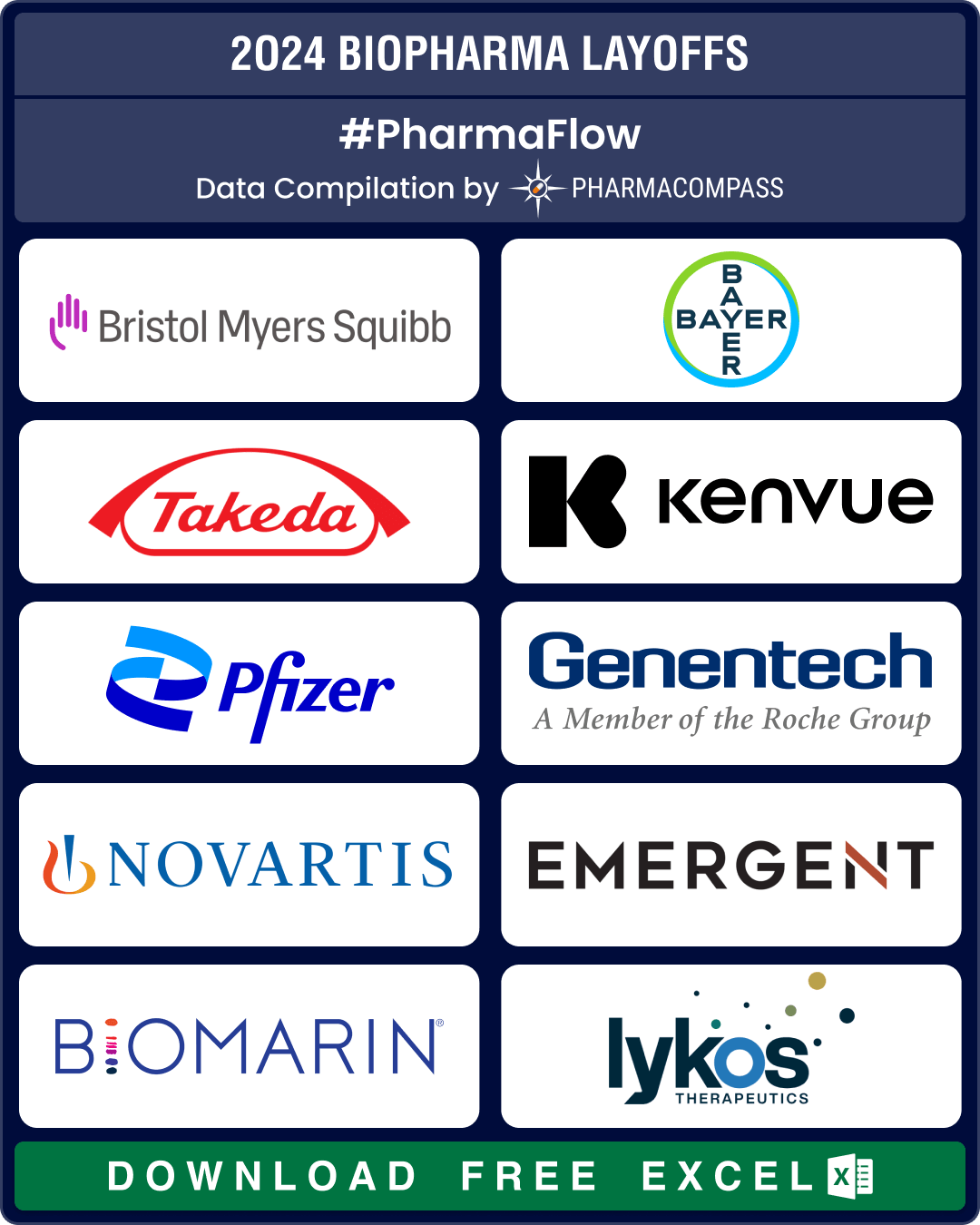

BMS, J&J, Bayer lead 25,000+ pharma layoffs in 2024; Amylyx, FibroGen, Kronos Bio hit by trial failures, cash crunch

Since 2022, there has been a significant surge in layoffs by pharmaceutical and biotech companies. W

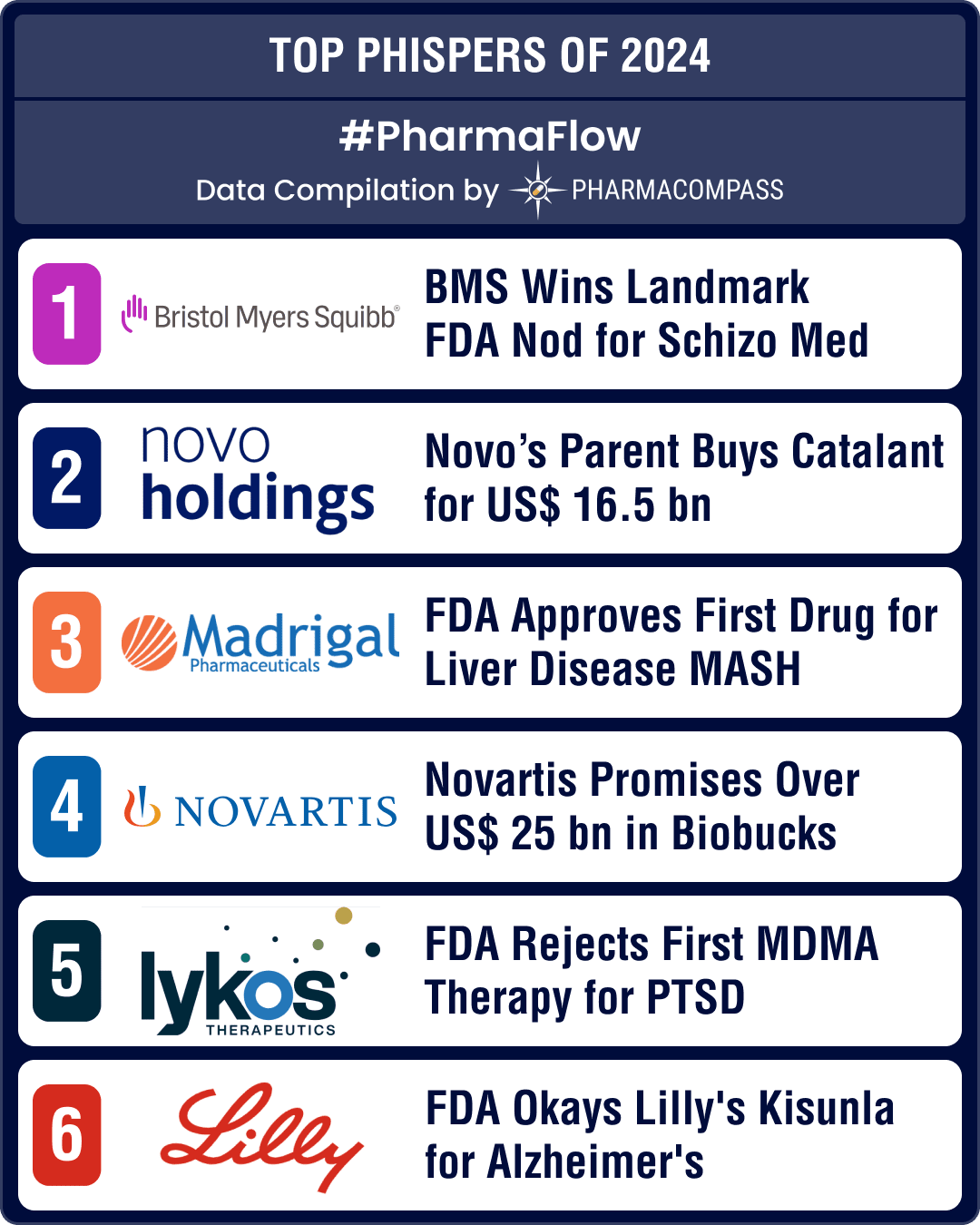

FDA’s landmark approvals of BMS’ schizo med, Madrigal’s MASH drug, US$ 16.5 bn Catalent buyout make it to top 10 news of 2024

The year 2024 was marked by some landmark drug approvals in the areas of schizophrenia, metabolic dy

CDMO Activity Tracker: Bora, PolPharma make acquisitions; Evonik, EUROAPI, Porton announce technological expansions

The contract development and

manufacturing organization (CDMO) space continued to grow at an impres

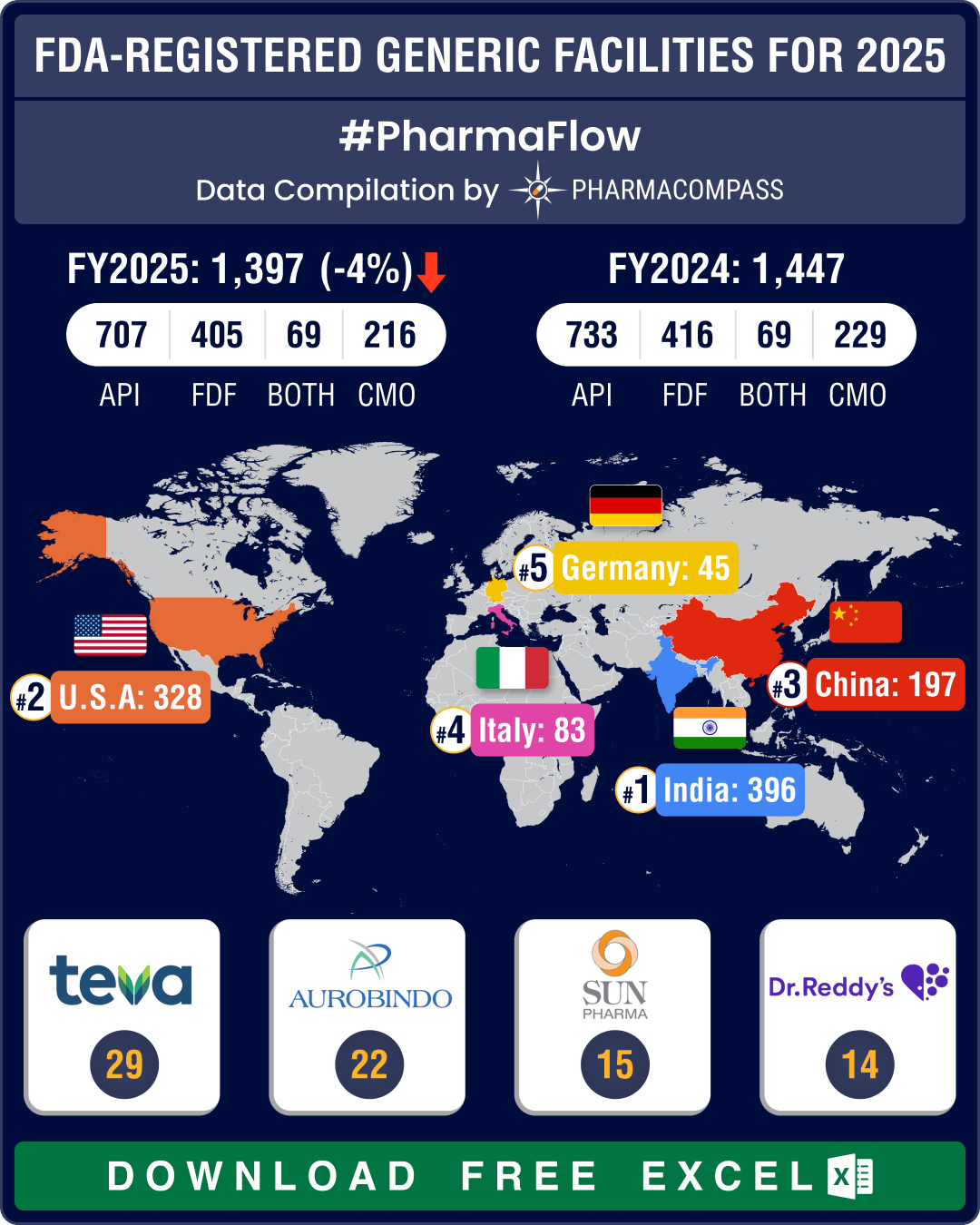

Chinese FDA-registered generic facilities gain steam, India maintains lead with 396 facilities

Every year, the US Food and Drug Administration (FDA) publishes the user fee amounts it will collect

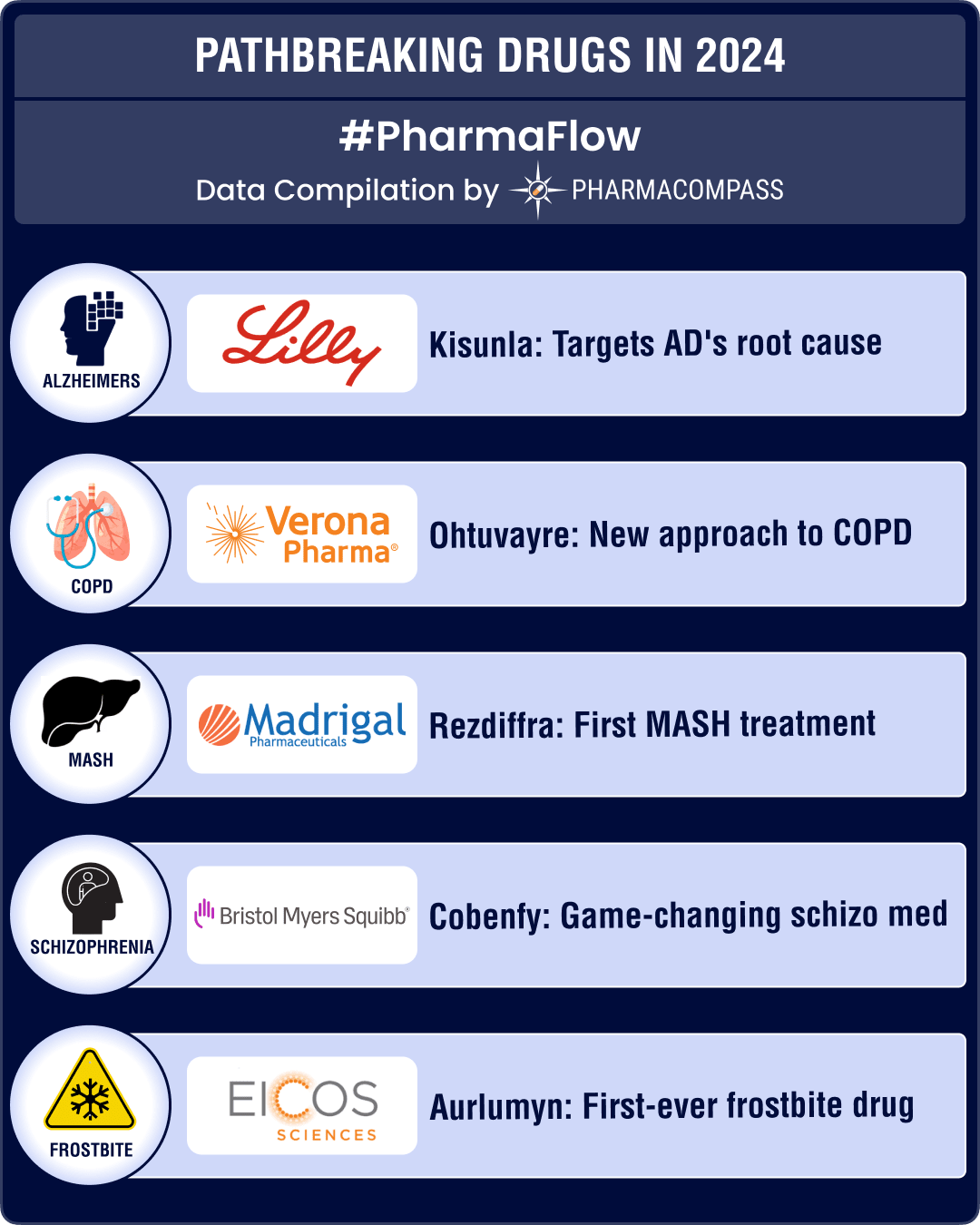

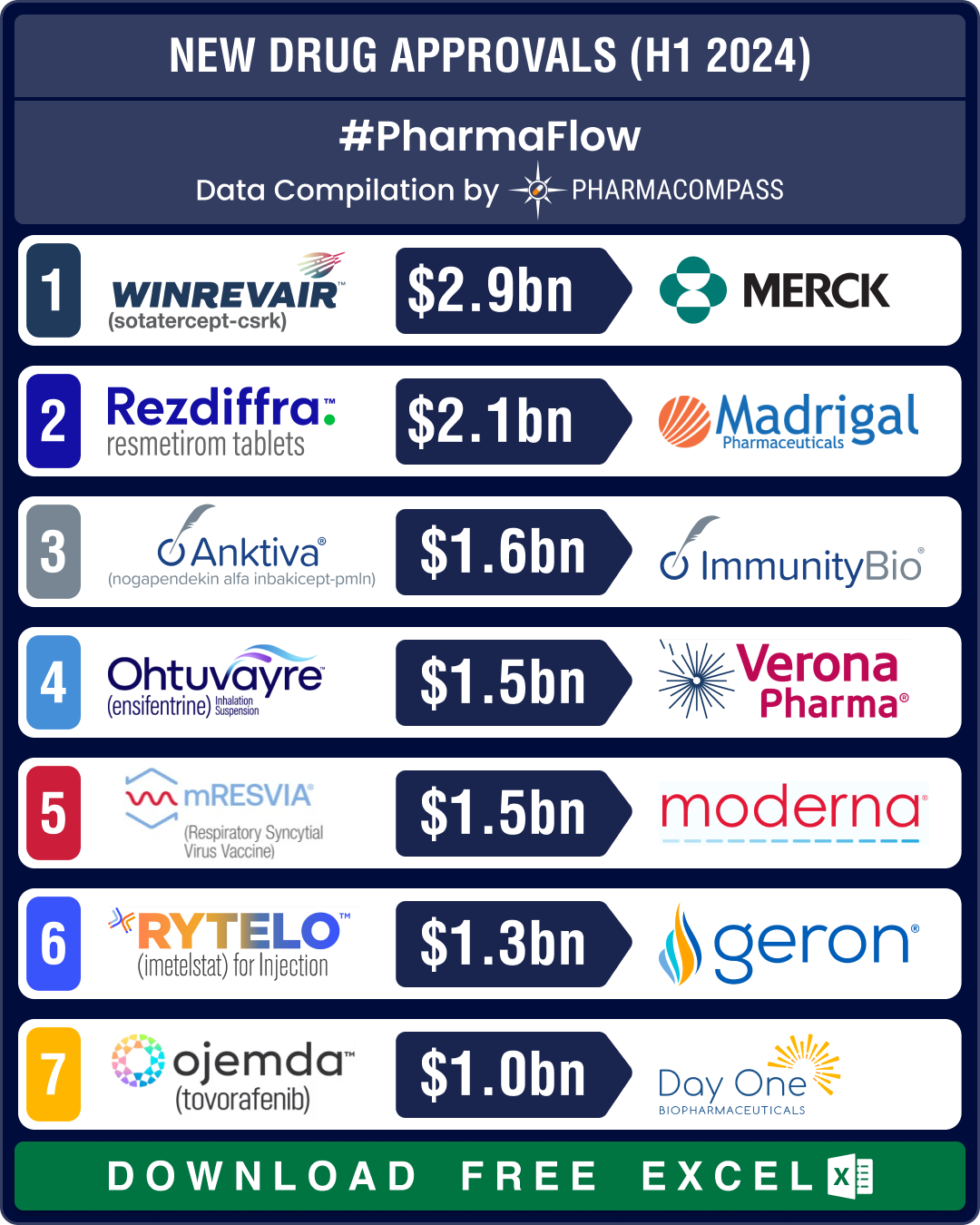

Medical Breakthroughs in 2024: Alzheimer’s, schizophrenia, COPD, MASH see pathbreaking treatments

This year has seen pivotal advancements in medical innovation. The US Food and Drug Administration (

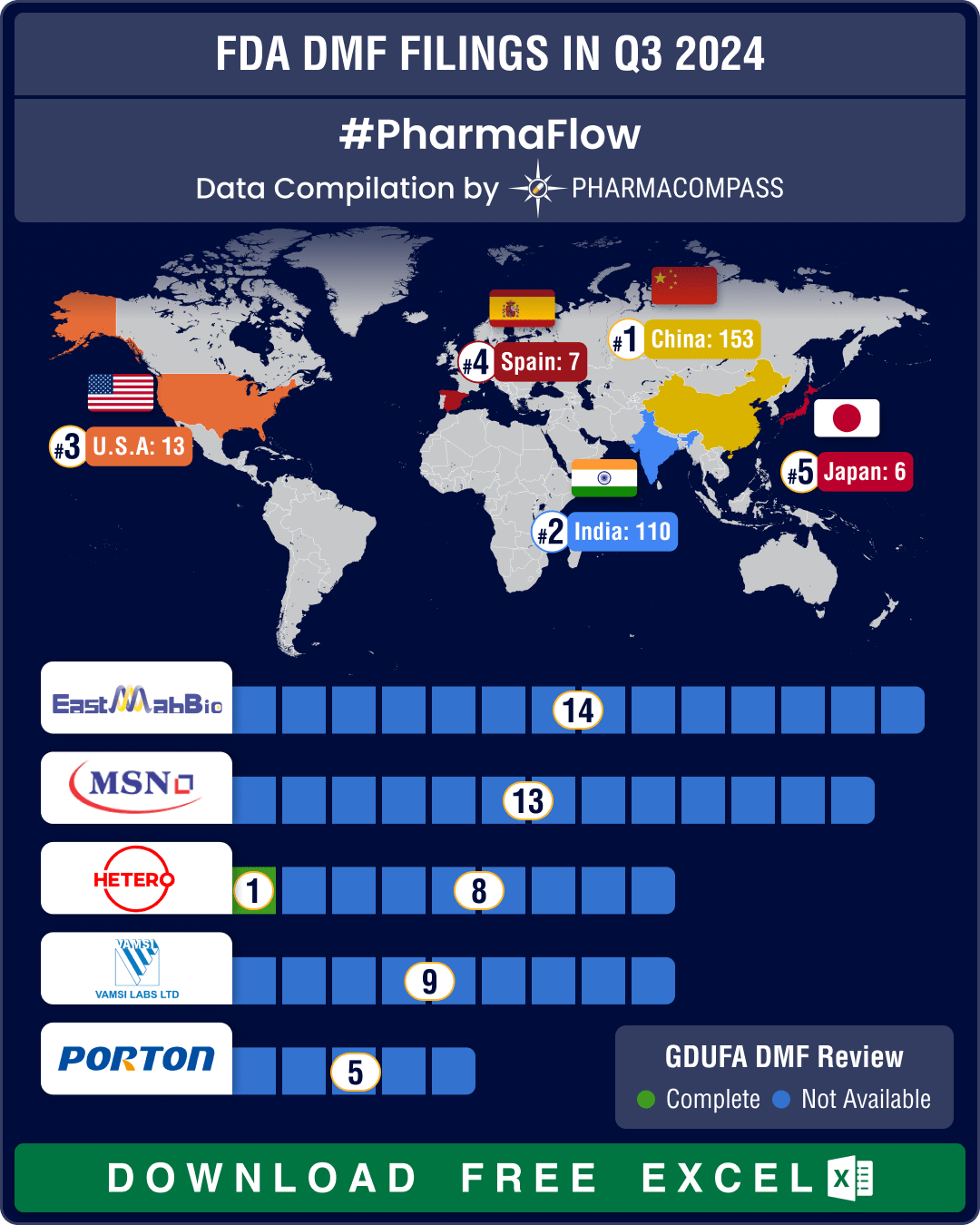

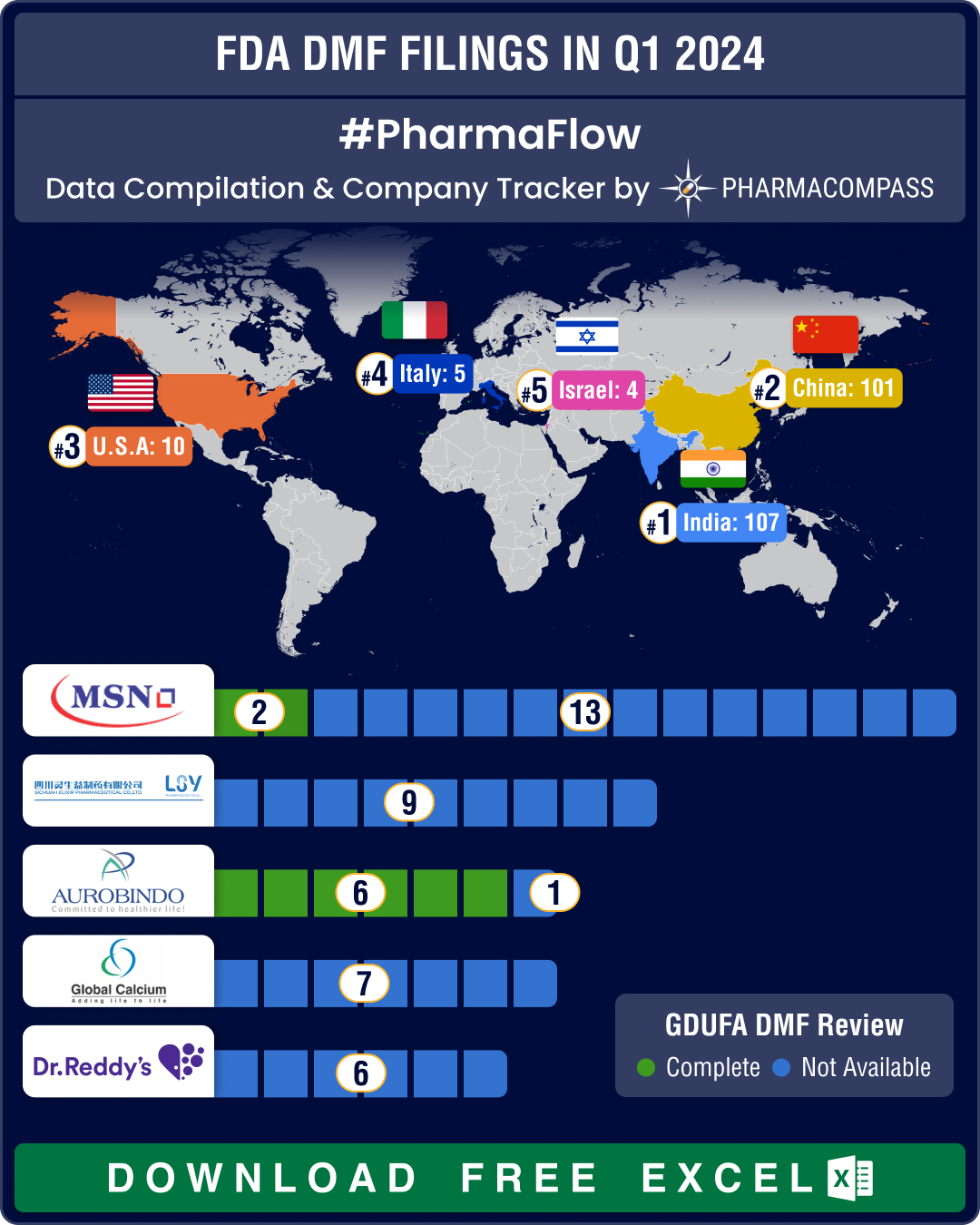

DMF filings hit all-time high in Q3 2024; China tops list with 58% increase in Type II submissions

Drug Master Files, or DMFs, are confidential documents that play a crucial role in the pharmaceutica

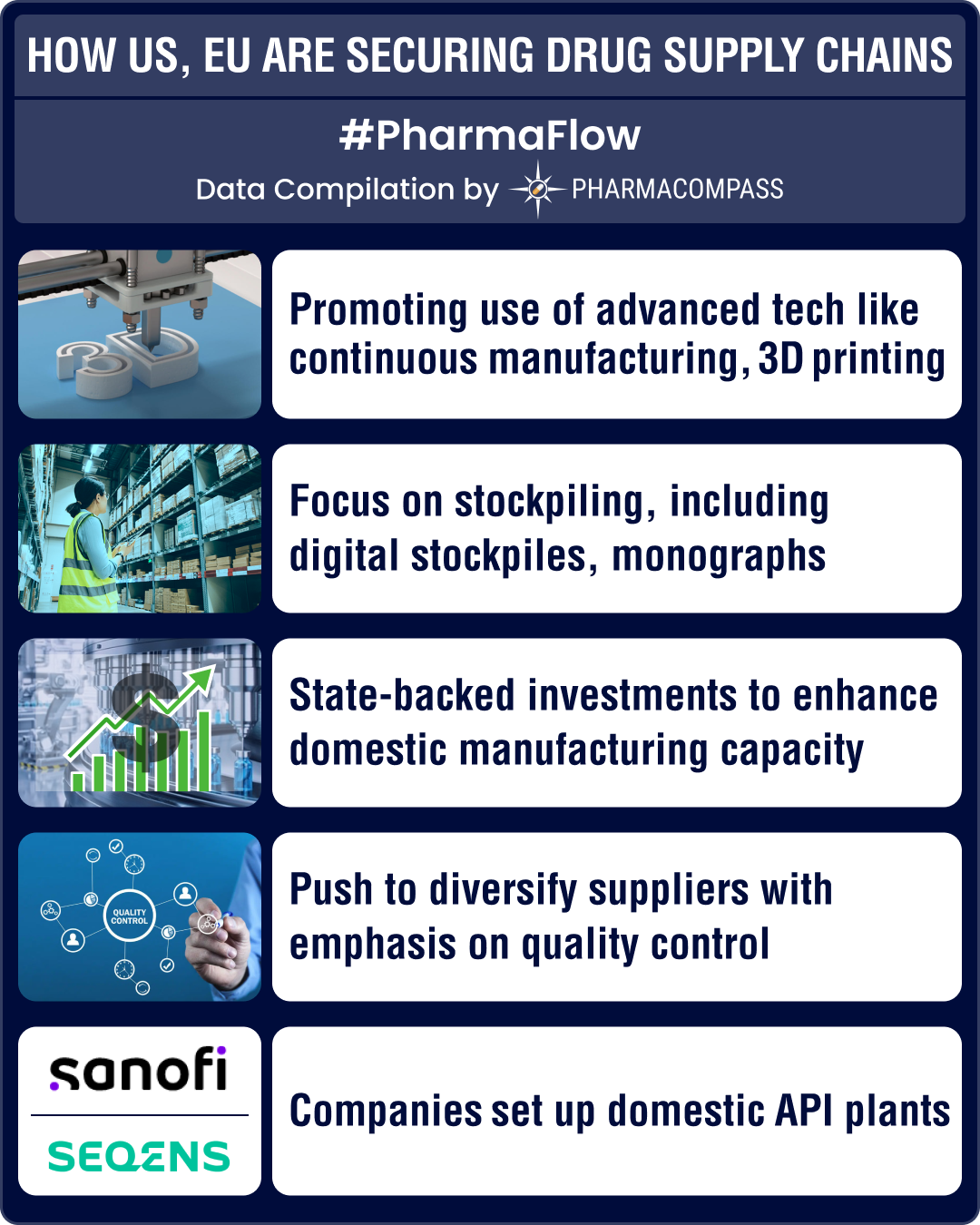

US, Europe turn to advanced manufacturing, stockpiling to strengthen drug supply chains

Over the last few decades, the United States and Europe have saved trillions of dollars by importing

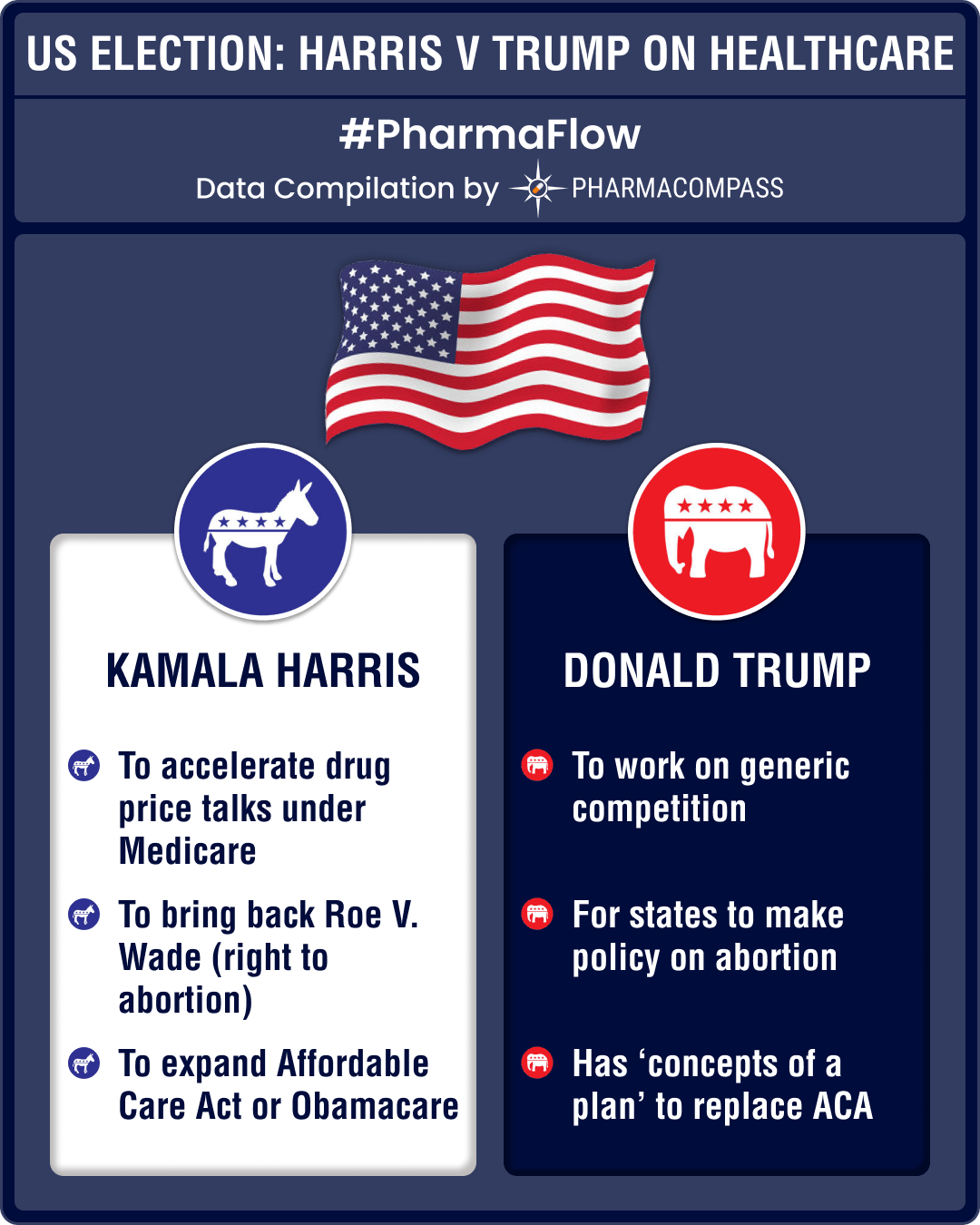

2024 US Elections: Harris, Trump differ on abortion rights, ACA, public health spends; agree on need to cut drug prices

The US is in the

midst of yet another, or perhaps the most, polarizing Presidential election.

The

BMS, Bayer, Takeda, Pfizer downsize to combat cost pressures, meet restructuring plans

Over

the last two years, there has been a significant surge in layoffs by

pharmaceutical and biote

Excipient Market Overview: Roquette, Seqens, Evonik make strategic moves; new guidelines deal with contamination

The pharmaceutical industry has long recognized the critical role

excipients or inactive ingredient

US drug shortages hit record high in Q1 2024, impacts cancer, ADHD drugs; Lilly, Novo ramp up production

Drug shortages are threatening healthcare systems the world over.

Be it the US, Canada, Europe or A

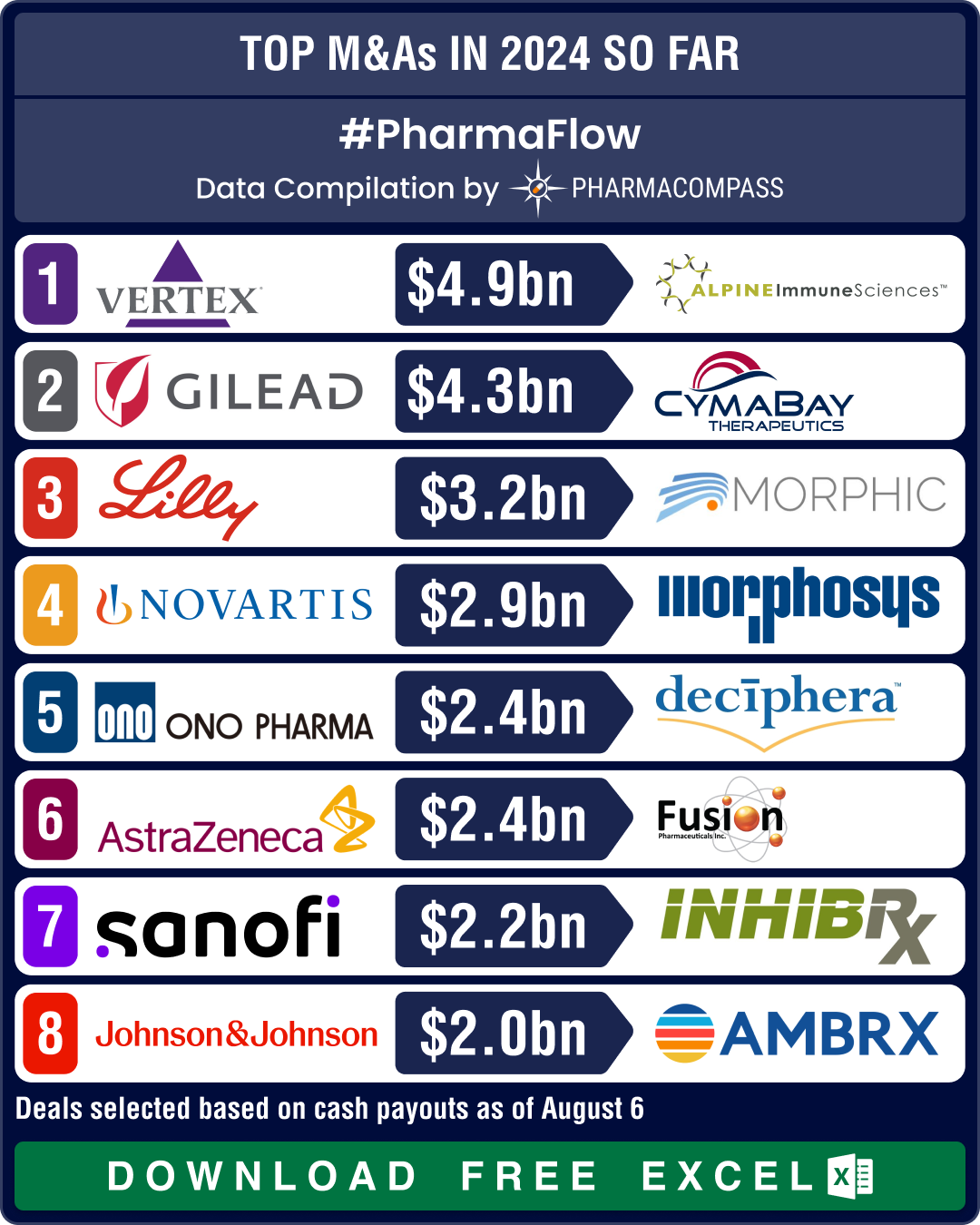

Novartis, GSK, Sanofi, BMS shell out over US$ 10 bn in dealmaking, as mid-size deals take centerstage in 2024

The world of pharmaceuticals and biotechnology continued to evolve

this year with strategic allianc

CDMO Activity Tracker: Novo’s parent buys Catalent for US$ 16.5 bn; Fujifilm, Merck KGaA, Axplora expand capabilities

During the first half (H1) of 2024, the global contract development and manufacturing organization (

FDA approvals slump 19% in H1 2024; NASH, COPD, PAH get new treatment options

The first half of 2024 saw a significant slowdown in approvals of new drugs and biologics by the US

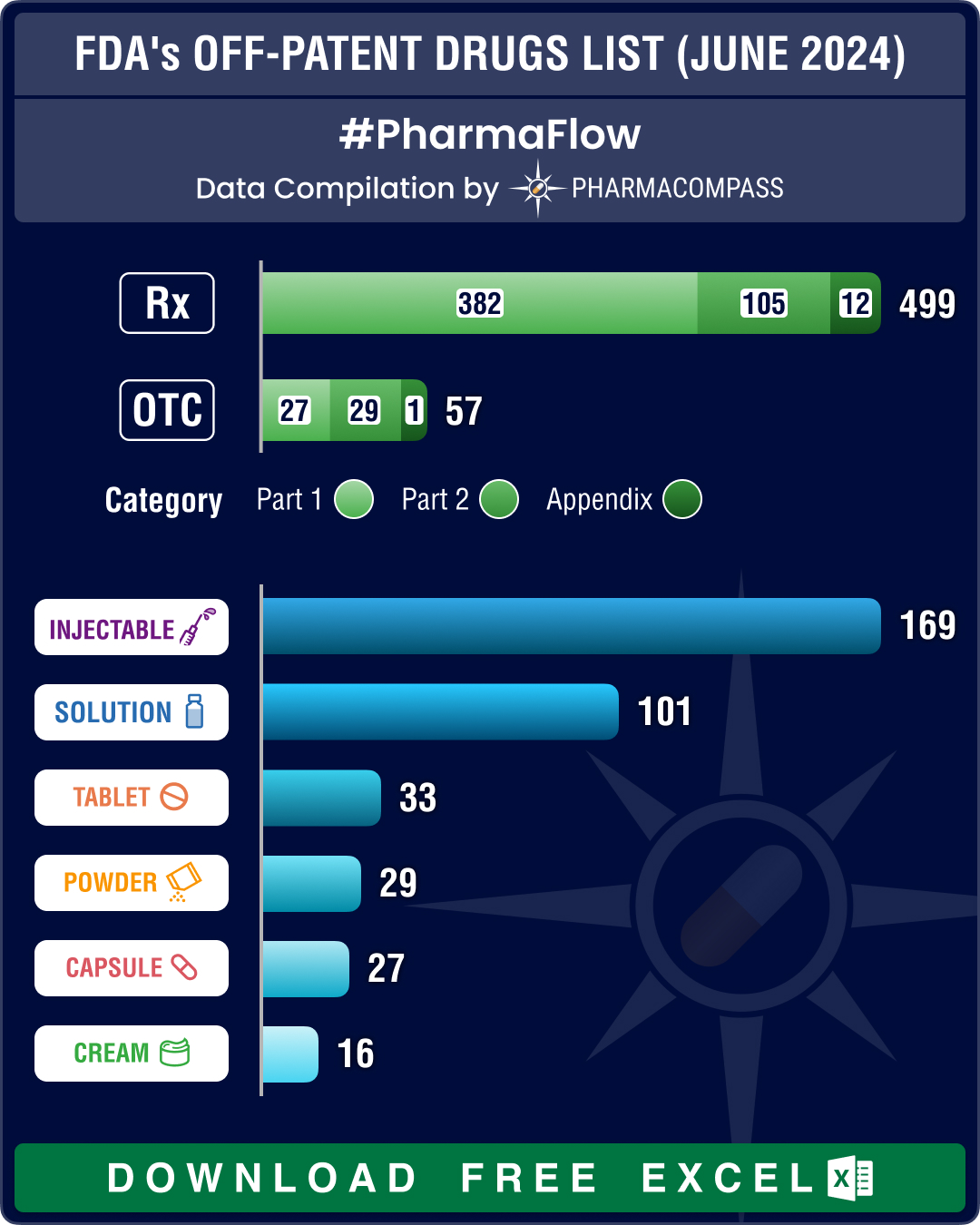

FDA’s June 2024 list of off-patent, off-exclusivity drugs sees rise in cancer, HIV treatments

This week PharmaCompass brings to you key highlights of the US Food and Drug Administration’s

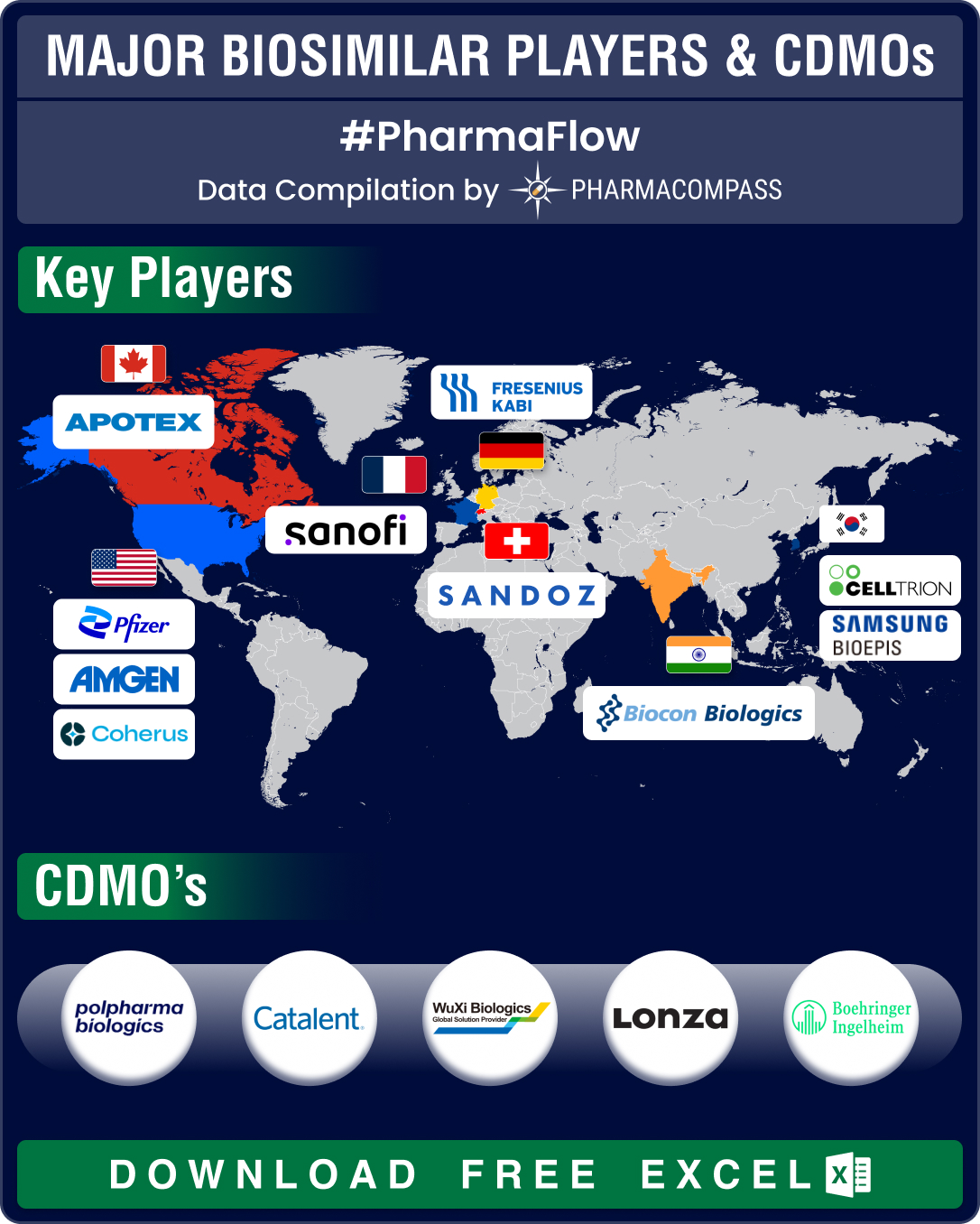

FDA approves record eight biosimilars in H1 2024; okays first interchangeable biosimilars for Eylea

Biologics, or complex drugs that are derived from living organisms, have revolutionized treatment of

Big Pharma bets big on AI’s US$ 148 bn potential to revolutionize healthcare industry

Artificial intelligence (AI) is changing the world and bringing

efficiencies across all industries.

DMF submissions from China jump 42% as India continues to top list in Q1 2024

Generic drugs play a crucial role in providing access to life-saving drugs at affordable prices. To

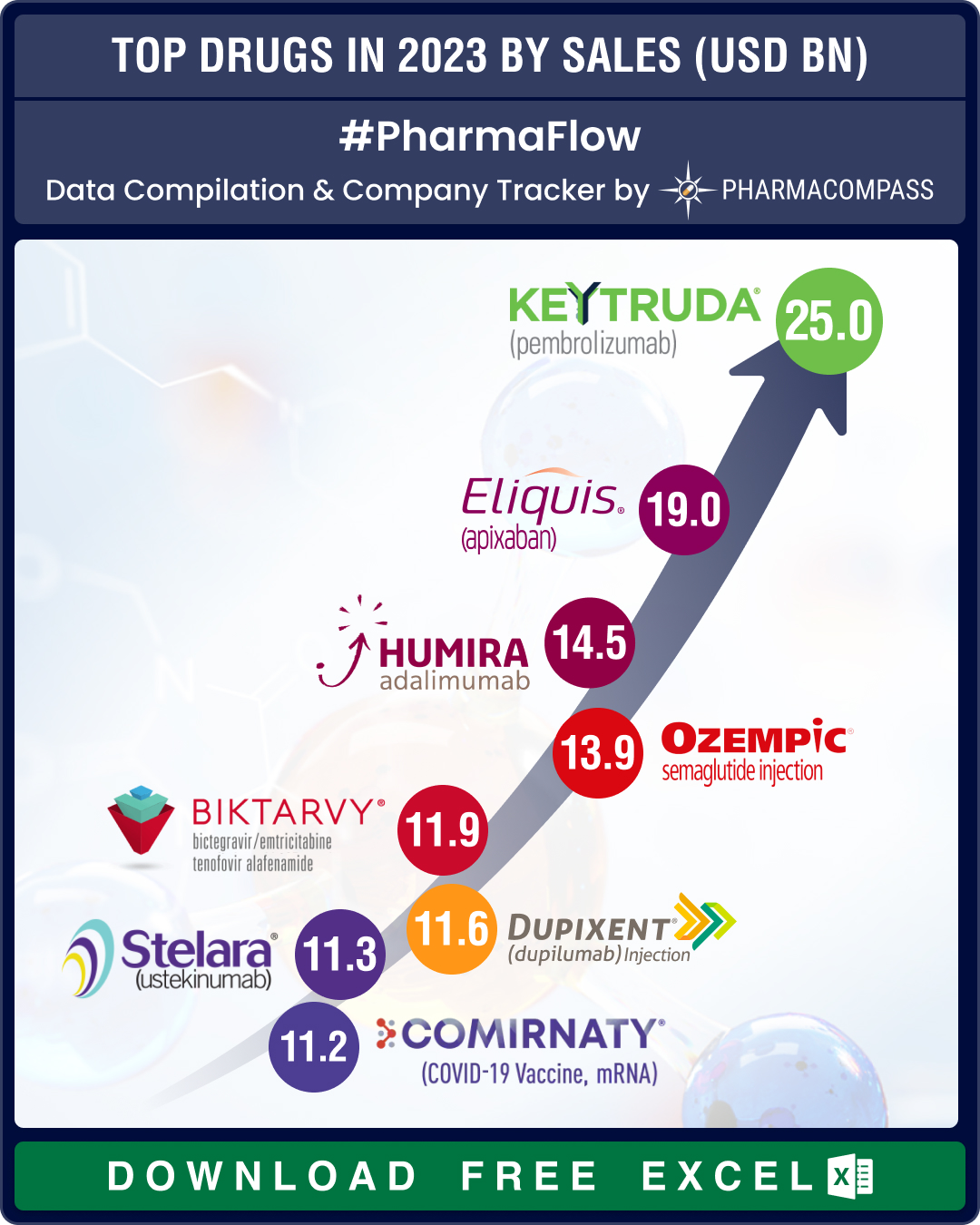

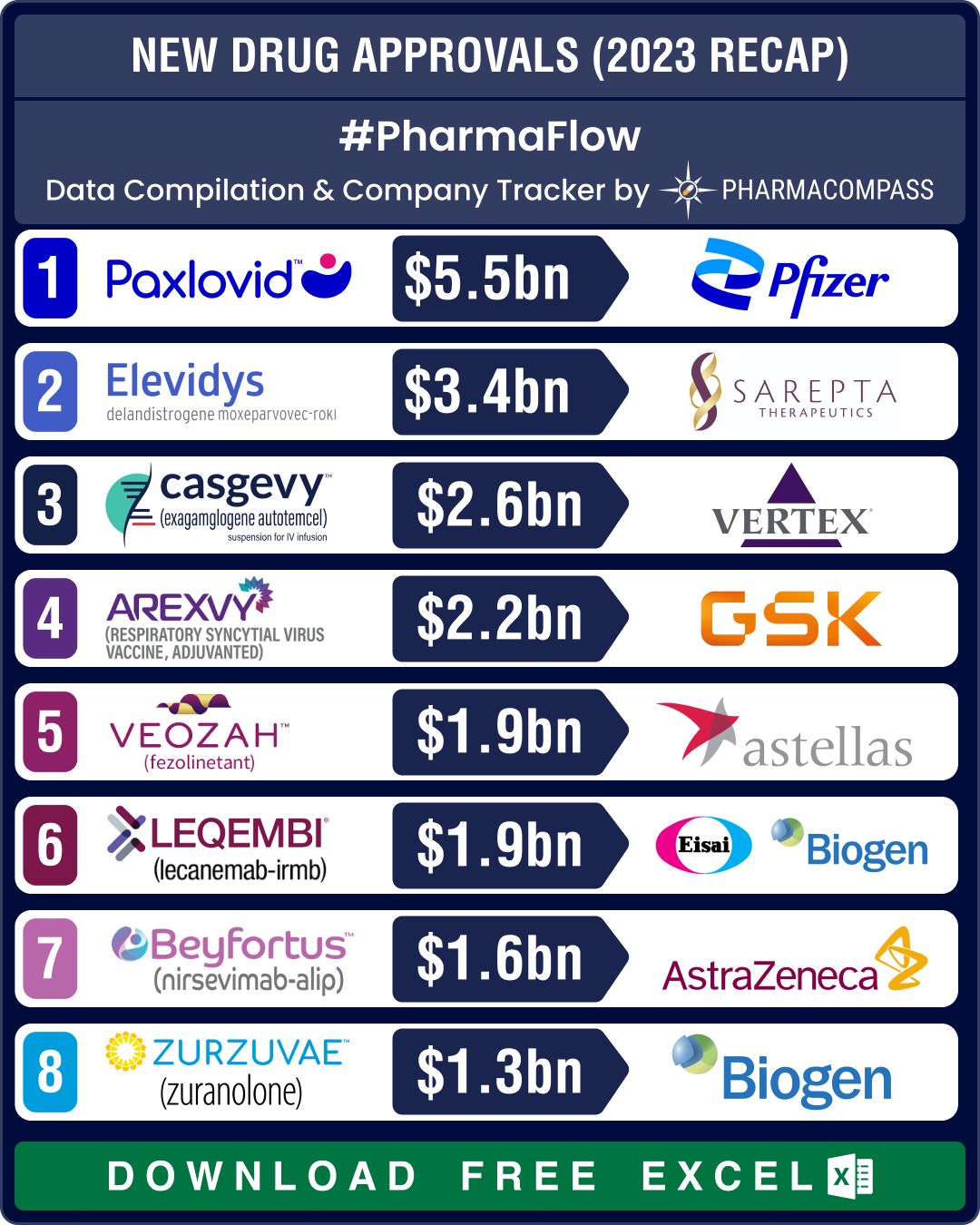

Top Pharma Companies & Drugs in 2023: Merck’s Keytruda emerges as top-selling drug; Novo, Lilly sales skyrocket

The pharma industry clearly recalibrated itself in 2023, turning its focus away from Covid and onto

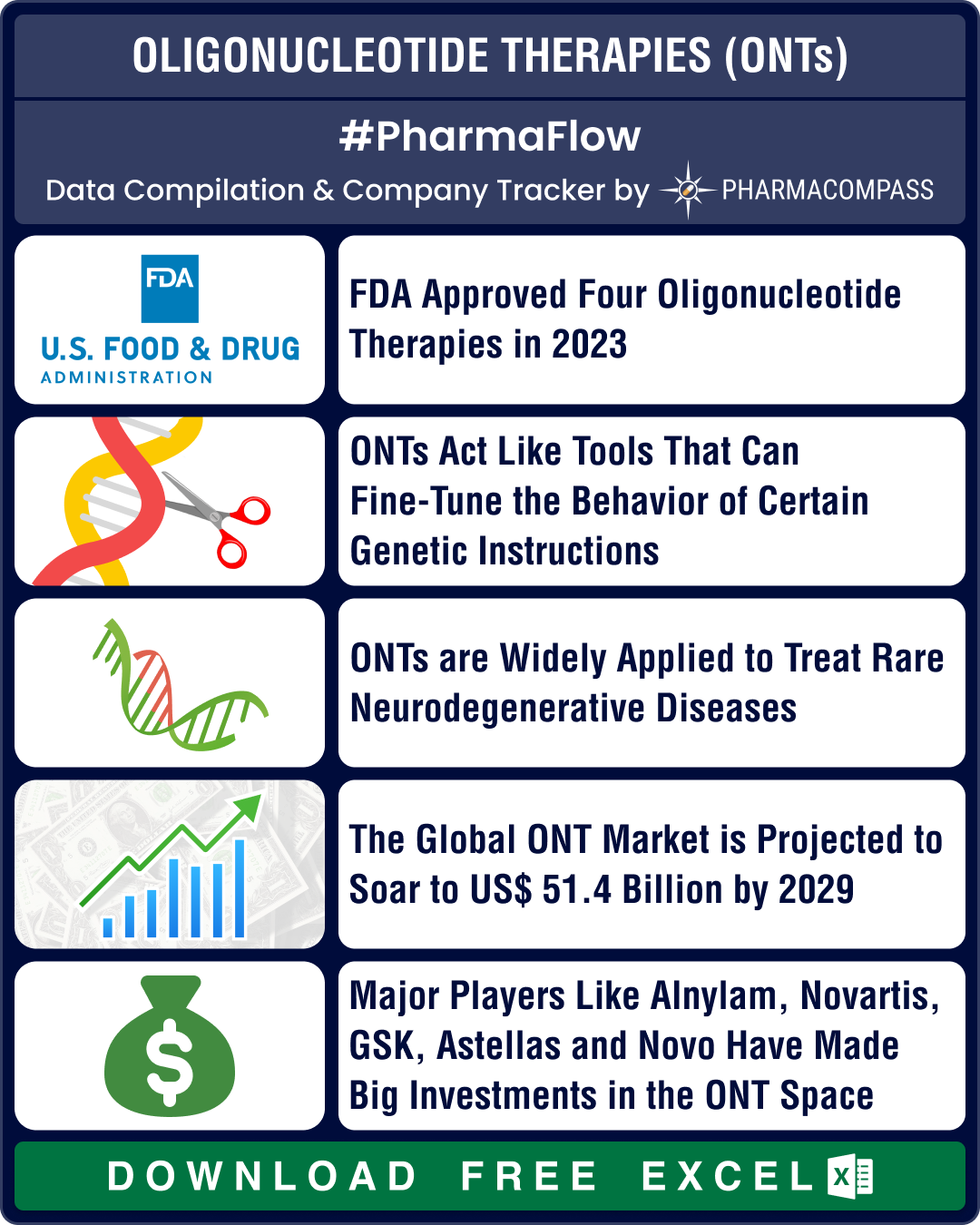

FDA approves four oligonucleotide therapies in 2023; Novartis, GSK, Novo bet big

In the intricate world of molecular biology, oligonucleotides stand out as versatile, powerful molec

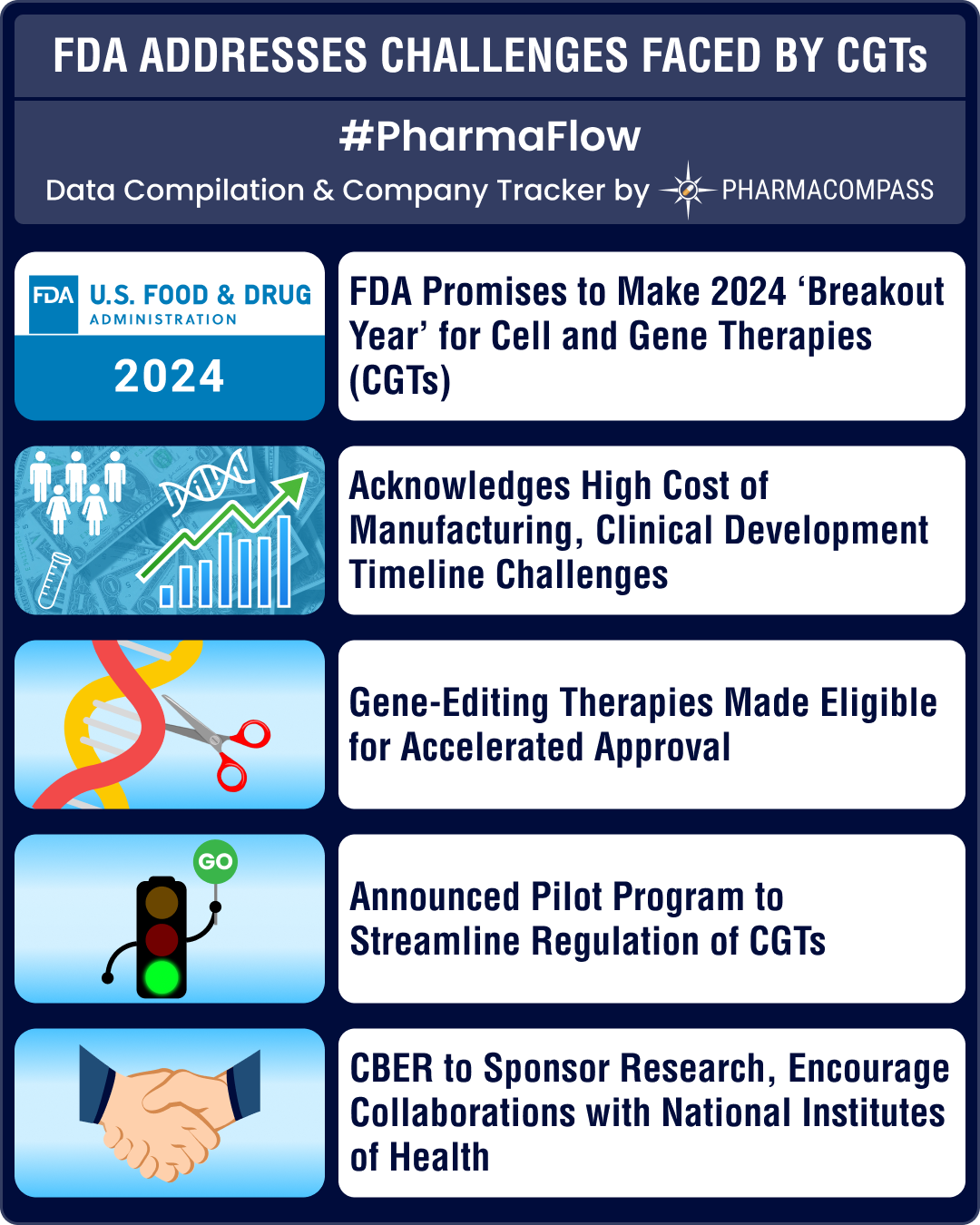

FDA steps in to address challenges faced by cell and gene therapies

The year 2023 was a rather

tough one for cell and gene therapy (CGT) companies. There was news abou

Market Place

Market Place Sourcing Support

Sourcing Support