By PharmaCompass

2019-12-12

Impressions: 2681

This week in Phispers, we bring you the major announcements made by Sanofi’s new CEO Paul Hudson at its strategy meet.

The French drugmaker has decided to give up finding new cures for diabetes and heart diseases, and focus on cancer cures.

In the US, FDA’s overseas drug inspections have fallen by 10 percent, despite rising concerns about the safety and quality of drugs sourced from other countries.

After sartans and ranitidine, regulators across the world are looking into whether formulations of the diabetes drug metformin contain cancer-causing impurities.

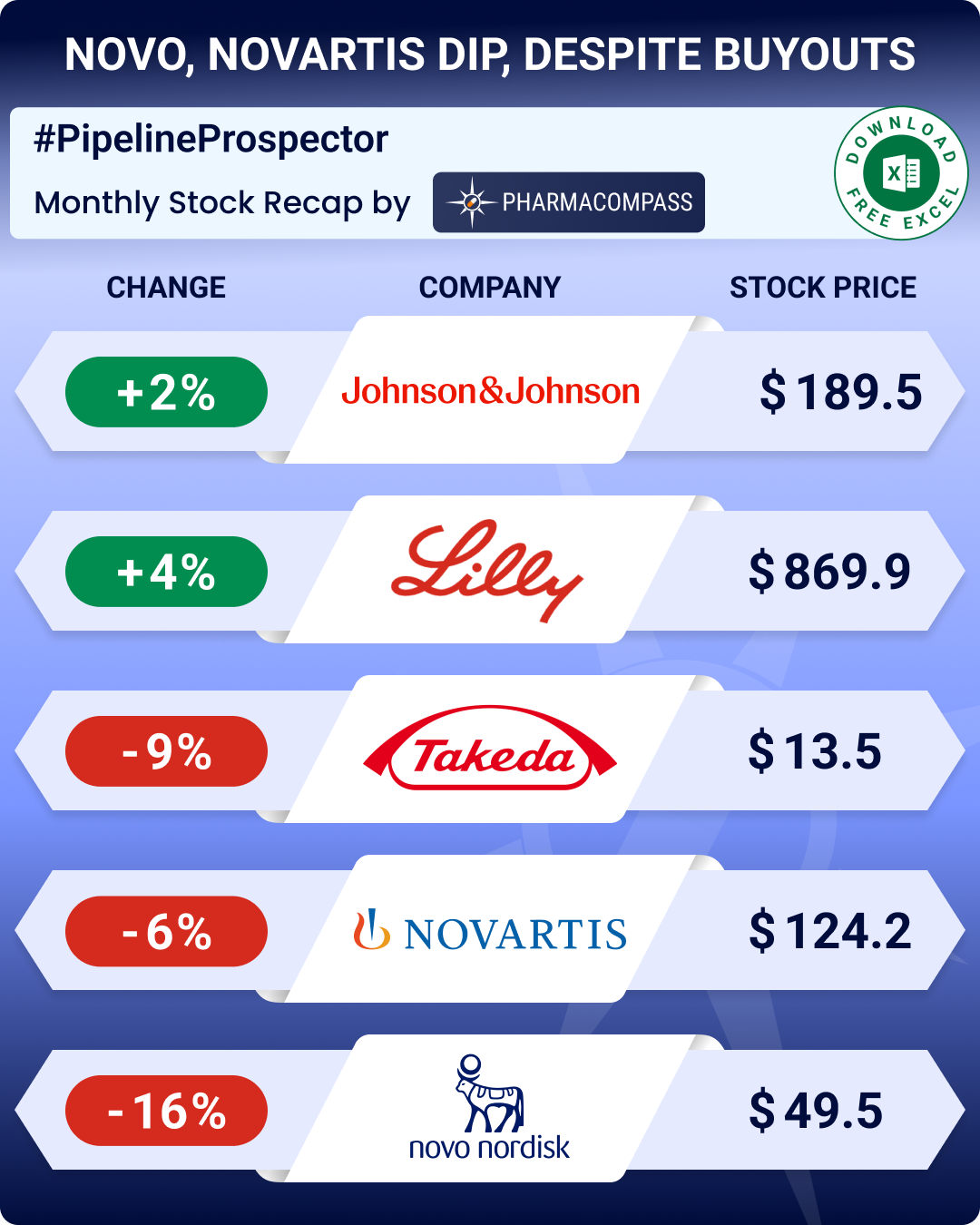

Novartis CEO Vas Narasimhan spoke of the firm’s drug pipeline which includes over 80 major submissions in the next two years, even as the FDA approved three generic versions of its top selling multiple sclerosis drug Gilenya.

Meanwhile, Merck bought ArQule’s kinase inhibitor for US$ 2.7 billion and experimental drugs from Ipsen, Sage and Enzyvant faced setbacks.

Sanofi to give

up finding new diabetes drugs; buys US-based biotech for US$ 2.5 billion

The new CEO of French drug giant Sanofi — Paul Hudson — announced the company’s new strategy this week. A major announcement in its strategy was that the manufacturer of the world’s top-selling insulin — Lantus — is giving up finding new diabetes drugs.

While Sanofi’s top rivals in diabetes, Novo Nordisk and Eli Lilly, are investing heavily in new classes of diabetes drug, the French drugmaker is abandoning its attempts after years of failed endeavors at bringing a new blockbuster to the market. Moreover, in recent years, uproar from patients about the price of insulin, and tough actions from insurers and pharmacy-benefit managers, have hurt revenue from Lantus.

As part of Hudson’s broad strategic overhaul, Sanofi is also ending research into cardiovascular diseases. This is another area that Sanofi has found challenging, with sales of its cholesterol-lowering drug — Praluent — taking a hit over pricing concerns.

“To be out of cardiovascular and diabetes is not easy for a company like ours with an incredibly proud history,” Hudson said. “As tough a choice as that is, we’re making that choice.”

Sanofi also announced the US$ 2.5 billion acquisition of biotech Synthorx Inc, a deal that will boost its pipeline of cancer immunotherapies.

Sanofi is investing in its more buoyant businesses like rare diseases and making a further push in the cancer market. The company would focus on vaccines and treatments like its promising eczema medicine Dupixent. Hudson also said growing sales of Dupixent, which is sold with the US biotech Regeneron, would be Sanofi’s top priority. Annual sales of Dupixent could surpass US$ 10 billion, said Hudson, who joined Sanofi as its CEO in September. The drugmaker is also planning to cut costs by US$ 2.23 billion (€2 billion) by 2022.

FDA’s overseas drug inspections drop by 10 percent, despite concerns over safety, quality

While America’s reliance on imported pharmaceuticals and ingredients has increased, congressional investigators have said inspections of foreign drugmakers by the US Food and Drug Administration (FDA) have fallen in recent years. This is despite the rise in concerns over the safety and quality of generic drugs.

According to a report by the Government Accountability Office (GAO), FDA inspections of overseas drug manufacturers declined by 10 percent from 2016 to 2018. A key reason for this decline is that the FDA has fewer inspectors. The agency has also struggled to fill jobs abroad.

Similarly, drug-plant inspections in the US dropped 13 percent.

Over the last year, numerous drugs and APIs made overseas, including widely used heart and stomach medicines, have been recalled amid growing evidence and concern over them being tainted with potential carcinogens.

“Many establishments manufacturing drugs for the US market may never have been inspected by the FDA,” said Mary Denigan-Macauley, director of health care for the GAO, in prepared testimony for the hearing.

Janet Woodcock, director of FDA’s Center for Drug Evaluation and Research, defended FDA’s approach. She also discussed the vulnerabilities of FDA’s foreign inspection program. She said FDA is looking to hire 50 new inspectors, but there are difficulties.

“Even if the agency succeeds in hiring a new investigator, it can take 1.5 to 2 years of training to bring them to a fully proficient level,” Woodcock said in her written testimony. At present, FDA has only 12 foreign-based drug investigators and 90 percent of its foreign inspections are conducted by US-based inspectors.

Earlier, FDA used to conduct unannounced foreign drug manufacturing inspections. However, the agency discontinued that initiative in 2015. Pre-announcement of foreign inspections gives time to companies to correct mistakes before they are spotted by the regulators, says the GAO report.

A Bloomberg investigation this year documented how drugmakers in China, India and the US frequently ignored test results, and their pills failed to meet US standards.

After sartans,

diabetes drug metformin being tested for cancer causing impurities

Last week, Singapore’s Health Sciences Authority (HSA) recalled three out of 46 locally marketed formulations of the popular diabetes drug metformin after determining they contained N-nitrosodimethylamine (NDMA) “above the internationally acceptable level.” The three drugs were marketed by Singapore-based Glorious Dexa Singapore and Pharmazen Medicals Pte Limited.

According to HSA, the risk posed by the three medicines is low as they “have only been supplied locally for a short period of time since last year.”

Post the HSA announcement, several regulators including the US Food and Drug Administration (FDA), European Medicines Agency (EMA), Health Canada and the UK’s Medicines and Healthcare products Regulatory Agency (MHRA) said they are looking into whether formulations of metformin contain NDMA impurities.

The FDA, EMA, Health Canada and MHRA also said there is no evidence that any metformin medicines distributed in their respective jurisdictions are affected. They advised patients to continue taking their medicine as prescribed.

An EMA statement said, “the levels of NDMA in the affected non-EU metformin medicines are very low and appear to be within or even below the range that people can be exposed to from other sources, including certain foods and water”.

The FDA is also telling companies to test their drugs for NDMA before making them available. The move is part of the FDA’s broader push to investigate a range of drugs for the presence of NDMA.

As generics of

Gilenya get FDA nod, Novartis CEO talks of blockbusters in its pipeline

Last week, the FDA approved three generic versions of Swiss drugmaker Novartis AG’s top-selling multiple sclerosis (MS) medicine Gilenya. Novartis had been defending patents on Gilenya in the United States to block generic rivals.

The approval allows HEC Pharm Co Limited, Biocon Limited and Sun Pharmaceutical Industries Limited to produce the drug for the treatment of relapsing forms of MS in adult patients.

Meanwhile, the Novartis CEO Vas Narasimhan has said the Swiss drug giant is planning more than 80 major submissions to regulators for drug approvals from 2020-2022 in the US, Europe, Japan and China. The submission figure is up from the 60 that the Swiss drugmaker had said it was planning for the 2019-2021 period.

Out of those 80 drugs, 25 could become new blockbuster drugs that could eventually top US$ 1 billion in sales. In China, Novartis is planning 50 submissions between 2019 and 2023.

In 2019, Novartis bagged approvals for several potential blockbusters such as multiple sclerosis drug Mayzent, spinal muscular atrophy gene therapy Zolgensma, breast cancer medicine Piqray, wet AMD drug Beovu and sickle cell disease drug Adakveo.

The company is planning new submissions in its core disease areas of oncology, neuroscience, ophthalmology, respiratory, CRM (cardiovascular, renal and metabolism), and IHD (immunology, hepatology and dermatology). The drugmaker has more than 160 projects in clinical development and more than 500 ongoing clinical trials.

Merck buys

ArQule for US$ 2.7 billion to strengthen its oncology pipeline

US-headquartered Merck, which is known as MSD (short for Merck Sharp & Dohme) outside the United States and Canada, has entered into a definitive agreement to acquire ArQule through its subsidiary for US$ 2.7 billion.

ArQule is a publicly traded biopharmaceutical company focused on kinase inhibitor discovery and development for the treatment of patients with cancer and other diseases.

The deal is expected to close in the first quarter of 2020. It would give Merck access to ArQule’s experimental treatment ARQ 531 — a novel, oral Bruton’s tyrosine kinase (BTK) inhibitor currently in a Phase 2 dose expansion study for the treatment of B-cell malignancies.

BTK inhibition has been shown to prevent B-cell receptor signaling that is critical for the survival and proliferation of leukemic cells in many B-cell malignancies.

After Pfizer’s acquisition of Array BioPharma for US$ 11.4 billion and Eli Lilly’s purchase of Loxo Oncology for US$ 8 billion over the last one year, Merck’s US$ 2.7 billion bid for ArQule is yet another instance of a large drug company increasing its focus on oral kinase inhibitors for treating cancer.

Merck has a strong focus in cancer immunotherapy, and its blockbuster drug Keytruda crossed US$ 3 billion in sales in the latest quarter.

Experimental

drugs of Ipsen, Sage, Enzyvant face setbacks

In April this year, Ipsen completed the US$ 1 billion acquisition of Clementia Pharmaceuticals. And last week, there was news that the FDA has placed two trials of palovarotene — Clementia’s key late-stage clinical asset — on partial clinical hold.

Palovarotene is an investigational retinoic acid receptor gamma (RARγ) selective agonist, for the treatment of two rare bone disorders — fibrodysplasia ossificans progressiva (FOP) and multiple osteochondromas (MO) — and other diseases.

FDA staff took the action in response to cases of early growth plate closure in children on the retinoic acid receptor gamma agonist.

“The partial clinical hold was issued following recent safety reports submitted by the company to the FDA of cases of early growth plate closure in pediatric patients with FOP treated with palovarotene,” Ipsen said in a statement.

Enzyvant’s therapy rejected by FDA: The FDA has cited manufacturing concerns in a complete response letter (CRL) rejecting Enzyvant’s therapy RVT-802. Enzyvant is a subsidiary of Roivance Sciences. It received the CRL this week.

RVT-802 is a tissue-based therapy in development for congenital athymia.

While there were no questions about the therapy’s safety or efficacy, the agency raised questions about how it is produced.

CEO Rachelle Jacques said the questions raised can be resolved and the FDA’s rejection does not affect the firm’s plans to pursue approval in Europe, or to develop the therapy for other T-cell disorders.

Meanwhile, Sage Therapeutics Inc said last week that its experimental fast-acting drug aimed at treating severe depression failed a closely-watched study. The trial data shocked investors who were betting on the success of SAGE-217.

“Expectations were so high for a positive outcome... this is going to be a painful setback for many,” said JP Morgan analyst Cory Kasimov.

The PharmaCompass Newsletter – Sign Up, Stay Ahead

Feedback, help us to improve. Click here

Image Credit : #Phisper Infographic by SCORR MARKETING & PharmaCompass is licensed under CC BY 2.0

“ The article is based on the information available in public and which the author believes to be true. The author is not disseminating any information, which the author believes or knows, is confidential or in conflict with the privacy of any person. The views expressed or information supplied through this article is mere opinion and observation of the author. The author does not intend to defame, insult or, cause loss or damage to anyone, in any manner, through this article.”