By PharmaCompass

2018-11-22

Impressions: 2428

Last year, we saw one in six facilities failing to pay the US Food and Drug Administration’s user fee, which comes under the Generic Drug User Fee Act (GDUFA). The law had been designed to accelerate the access to safe and effective generic drugs to the people of United States, while reducing the costs for the industry.

The law mandated all firms that manufactured human generic drug products and active pharmaceutical ingredients (APIs) for human generic drug products distributed in the US to be subject to FDA’s user fees.

As US generic businesses continue to face headwinds of increased competition, pricing pressure, channel consolidation and concerns over non-compliance, this week PharmaCompass reviews a list posted on FDA’s website that contains GDUFA facility payments received by the agency.

Click here to access our list of all GDUFA facility payments - Excel analysis available for FREE!

Almost

Ninety facilities worldwide fail to pay GDUFA fee

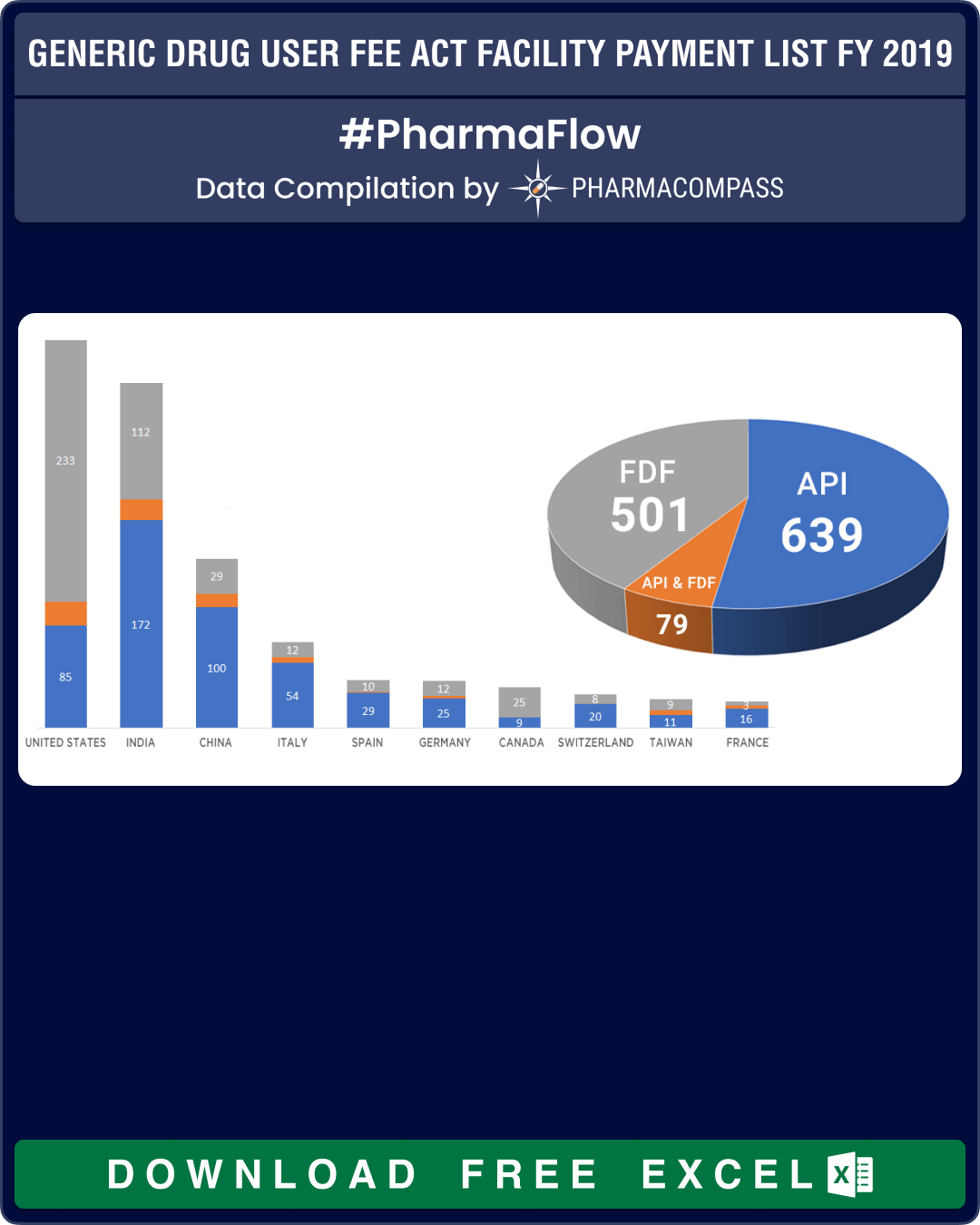

The GDUFA fee was due no later than October 1, 2018. More than a month later (as of payments listed on November 9, 2018), we notice that as opposed to 1,264 facilities that paid user fee last fiscal, this year the number is down by almost 50 facilities — at 1,219.

Moreover, the current FDA list shows 89 facilities that paid the fee last year have not paid the fee so far. Non-payment by API facilities (48) was significantly higher than non-payment by finished drug formulation (FDF) facilities (41).

While some of the omissions could be due to administrative reasons, there were others that didn’t pay the fee as they failed to comply with FDA’s good manufacturing practices (GMPs). This includes the Indian facilities of Aarti Drugs, Alchymars and Vista Pharmaceutical along with companies like Ei LLC (USA), Tai Heng (China) and Teva’s Hungary plant.

Click here to access our list of all GDUFA facility payments - Excel analysis available for FREE!

However, companies that did not register due of a failure to comply with current GMP requirements is a small fraction of the 89 facilities that did not pay the user fees.

On a positive note, 50 facilities that were not part of the FY2018 list did pay the fee and seem likely to provide generic APIs or drugs to the United States in 2019. India leads the list with 16 new facilities followed by China and the United States at 11 each.

In the overall country-wise

list of facilities which paid for FY2019, the US leads with 338 facilities, followed

by India (301) and China (140). While the US leads with the maximum number of

FDF facilities, India has the highest number of facilities which can produce

APIs with almost 200 facilities paying their fees this year.

|

Country |

API |

API & FDF |

FDF |

TOTAL FACILITIES |

|

United States |

85 |

20 |

233 |

338 |

|

India |

172 |

17 |

112 |

301 |

|

China |

100 |

11 |

29 |

140 |

|

Italy |

54 |

5 |

12 |

71 |

|

Spain |

29 |

1 |

10 |

40 |

|

Germany |

25 |

2 |

12 |

39 |

|

Canada |

9 |

|

25 |

34 |

|

France |

16 |

3 |

3 |

22 |

|

Switzerland |

20 |

8 |

28 |

|

|

Taiwan |

11 |

4 |

9 |

24 |

|

Japan |

19 |

19 |

||

|

United Kingdom |

13 |

1 |

3 |

17 |

|

Israel |

6 |

1 |

5 |

12 |

|

Mexico |

9 |

1 |

10 |

Click here to access our list of all GDUFA facility payments - Excel analysis available for FREE!

No major change in GDUFA Fees

The reduced participation of generic facilities is happening at a time when GDUFA fees have effectively remained unchanged over the past year and in some cases the fee burden has even reduced.

|

Generic Drug User Fee Act (GDUFA) (in US$) |

||||

|

Abbreviated New Drug Application (ANDA) |

178,799 |

171,823 |

70,480 |

76,030 |

|

Drug Master File (DMF) |

55,013 |

47,829 |

51,140 |

42,170 |

|

Finished Dosage Form Facility (Domestic) |

211,305 |

211,087 |

258,646 |

243,905 |

|

Finished Dosage Form Facility (Foreign) |

226,305 |

226,087 |

273,647 |

258,905 |

|

Active Pharmaceutical Ingredient Facility (Domestic) |

44,226 |

45,367 |

44,234 |

40,867 |

|

Active Pharmaceutical Ingredient Facility (Foreign) |

59,226 |

60,367 |

59,234 |

55,867 |

While the facility fees have not changed dramatically, the ANDA holder fee, also known as program fee, saw a significant increase of 17 percent over the previous year.

Click here to access our list of all GDUFA facility payments - Excel analysis available for FREE!

|

Recurring GDUFA program fee (in US$) |

||

|

(20+ANDAs) Large size operation generic drug applicant program |

1,862,167 |

1,590,792 |

|

(6-19 ANDAs) Medium size operation drug applicant program |

744,867 |

636,317 |

|

(1-5 ANDAs) Small business generic drug applicant program |

186,217 |

159,079 |

Click here to access our list of all GDUFA facility payments - Excel analysis available for FREE!

Our view

Leading generic pharmaceutical manufacturers such as Teva, Mylan and Sandoz have dominated headlines due to the challenges they have been facing with their US generic business over the last year or so.

At a time when there is so much rhetoric around ‘lowering the drug prices’, the number of facilities registered with the FDA has been reducing continuously and the cost of filing DMFs and ANDAs has been on the rise. Under such circumstances, it is highly unlikely that capacity rationalization has bottomed out in the industry.

Pharmaceutical manufacturing facilities don’t get created overnight. It takes years for them to refine their practices and comply with FDA’s stringent compliance standards.

Over 80 percent of all prescriptions filled in the United States are for generic drugs. If the US wants continued access to safe and affordable generic drugs, it is important to investigate whether the firms are simply delaying payments or is the business climate preventing companies from wanting to manufacture generic drugs for the US.

Click here to access our list of all GDUFA facility payments - Excel analysis available for FREE!

The PharmaCompass Newsletter – Sign Up, Stay Ahead

Feedback, help us to improve. Click here

Image Credit : Generic Drug User Fee Act Facility Payment List FY 2019 by PharmaCompass is licensed under CC BY 2.0

“ The article is based on the information available in public and which the author believes to be true. The author is not disseminating any information, which the author believes or knows, is confidential or in conflict with the privacy of any person. The views expressed or information supplied through this article is mere opinion and observation of the author. The author does not intend to defame, insult or, cause loss or damage to anyone, in any manner, through this article.”