By PharmaCompass

2021-09-29

Impressions: 4879

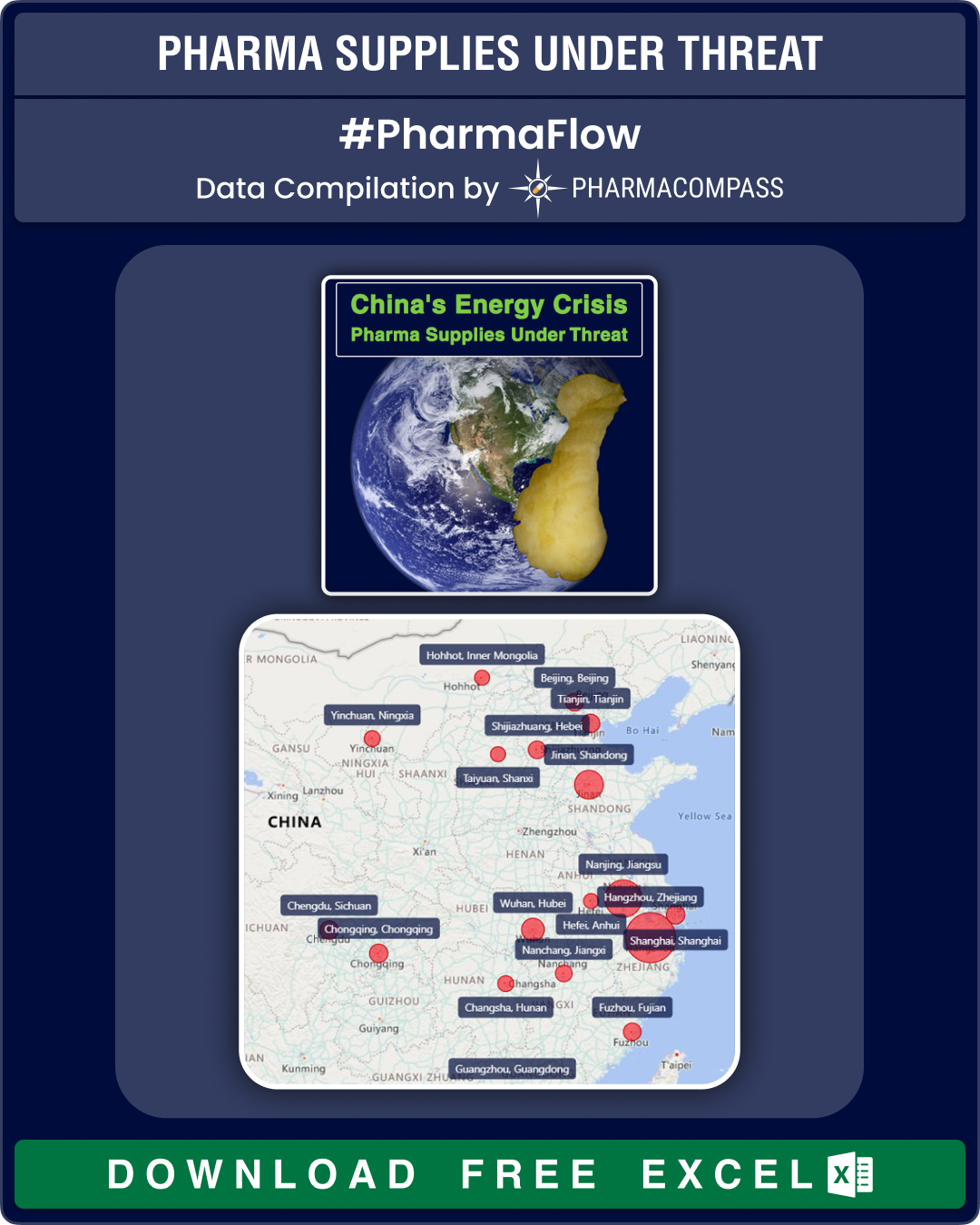

This week, PharmaCompass looks at the energy crunch in China and its likely fallout on the global pharmaceutical supply chains.

Till not so long ago, there was an adage — ‘when America sneezes, the world catches a cold’. These days, the same holds true of China, which is today the world’s second largest economy. It is also the largest exporter of goods in the world, supplying consumer electronics, cars, textiles, chemicals and a plethora of other goods to several countries across the world. The country is striving to emerge as the world’s next superpower by dethroning the US.

The pandemic has shown us that the interconnectedness of supply chains can lead to widespread shortages and interruptions in production across the world. Today, China is in the midst of a serious energy crunch. The blackouts may be limited to China, but their impact will be felt along the global supply chains for all products, including pharmaceuticals.

Chinese Generic Drug Facilities Registered with the USFDA (Free Excel Available)

Curbs on power usage

The energy crunch in China is triggered by factors such as a shortage of coal supplies, tougher emissions standards and strong demand from manufacturers and industry. These factors have led to widespread curbs on the usage of electricity.

China is the world’s top-most consumer of electricity. As the world’s top producer of carbon dioxide and other polluting gases, China’s ability to cut emissions is seen as critical in the global fight against climate change. The country has said it aims to bring carbon emissions to a peak by 2030 and to net zero by 2060. Recently, the country banned cryptocurrency mining, a highly energy-intensive activity that has stoked a surge in illicit coal extraction.

According to the country’s main planning agency, the National Development and Reform Commission (NDRC), only 10 out of 30 mainland Chinese regions achieved their energy reduction targets in the first six months of 2021.

To make matters worse, Beijing is contending with an ongoing trade dispute with Australia, the world’s second-largest coal exporter, which has greatly curbed coal shipments to China.

“The electricity shortages in China are worsening, and widening geographically. It’s getting so bad Beijing is now asking some food processors (like soybean crushing plants) to shut down,” Bloomberg’s chief energy correspondent said on Twitter.

Chinese Generic Drug Facilities Registered with the USFDA (Free Excel Available)

Factories halts production

Since mid-August, 20 provinces have implemented power cuts, including the manufacturing hubs of Guangdong, Zhejiang and Jiangsu, putting pressure on companies’ earnings. The impact on industries is broad and includes power-intensive sectors like aluminum smelting, steel-making, cement manufacturing and fertilizer production.

According to Reuters, China’s factory activity unexpectedly shrank in September due to wider curbs on electricity use and elevated input prices. According to data from the National Bureau of Statistics, the official manufacturing Purchasing Manager's Index (PMI) was at 49.6 in September as against 50.1 in August, slipping into contraction for the first time since February 2020.

According to Morgan Stanley, about 7 percent of aluminum production capacity has been suspended and 29 percent of cement production has been affected by the power crunch. Paper and glass could be the next industries to face supply disruptions, they said.

Numerous factories have halted production, including many supplying Apple and Tesla. Some shops in the northeast are relying on candles, while malls are closing early to save energy.

China is already grappling with curbs on the property and tech sectors, and there are concerns around the future of its cash-strapped real estate giant — Evergrande.

As a result, Goldman Sachs and Nomura have revised downwards their projections for China’s economic growth. For Q3, Goldman’s new growth forecasts has shrunk to 0 percent quarter-on-quarter (4.8 percent year-on-year). Nomura has cut its Q3 and Q4 China GDP growth forecasts to 4.7 percent and 3.0 percent, respectively, from 5.1 percent and 4.4 percent previously, and its full-year forecast to 7.7 percent (from 8.2 percent).

Chinese Generic Drug Facilities Registered with the USFDA (Free Excel Available)

Pharma supply chain concerns

According to Fitch Ratings, China is the world’s largest exporter of active pharmaceutical ingredients (APIs) exporter and its two largest export destinations — India and the US — accounted for 16.8 percent and 12.5 percent of China’s total API export value, respectively, in 2019.

Over the last few years, both India and the US have been concerned about their high dependence on China for APIs and other drug inputs. Back in December 2019, Chuck Schumer (who is currently the Senate majority leader) had expressed serious concern over the grave national security and public health risks posed by the United States’ growing reliance on China for production of a wide range of life-saving drugs used by the US military and hospitals across the country. Schumer had requested the Government Accountability Office (GAO) to investigate the capability of the US to manufacture finished drug products and APIs.

India too has repeatedly expressed concerns over its huge dependence on China for APIs — nearly 70 percent of the country’s APIs are imported from China with dependence as high as 90 percent for certain life-saving drugs. This year, in February, the Indian government had rolled out the Production Linked Incentive (PLI) scheme for drugs and had chosen 11 pharmaceutical companies to make key starting materials, drug intermediates and APIs to reduce its dependence on Chinese imports.

Since then, India has levied anti-dumping duties on various chemicals and APIs being imported from China. In March, India had imposed anti-dumping duty on the antibacterial drug — ciprofloxacin hydrochloride and in August an anti-dumping probe was initiated against a chemical (ATS-8) used to produce the commonly used cholesterol lowering drug atorvastatin. And just this month, India recommended the imposition of anti-dumping duty on vitamin C being imported from China.

Chinese Generic Drug Facilities Registered with the USFDA (Free Excel Available)

Our view

PharmaCompass’ database on generic drug manufacturers registered with US Food and Drug Administration (FDA) tells us that there are 155 generic facilities in China that supply generic drugs to the US. Out of this, over half, or 80 facilities are situated in the three provinces of Jiangsu, Zhejiang and Guangdong that are worst hit by the power crunch. Given this, the energy crunch in China definitely poses a risk to the global supply chains for drugs and APIs.

The PharmaCompass compilation does not include many Chinese companies that manufacture key intermediates that are used by companies around the world to produce APIs.

In October-end, Glasgow (Scotland) would host the 26th United Nations Climate Change Conference (COP26). According to news reports, none of the largest greenhouse gas emitting countries are on track to meet their climate goals.

In this scenario, coupled with rising instances of extreme weather conditions and fears of more pandemics in the future, the power crunch in China might just be another reason after Covid-19 for countries to rework their pharma supply chains. Given the volatilities and uncertainties, nations have realized they need to reduce their dependence on countries like China and India in order to keep their economic growth engine moving.

Chinese Generic Drug Facilities Registered with the USFDA (Free Excel Available)

The PharmaCompass Newsletter – Sign Up, Stay Ahead

Feedback, help us to improve. Click here

Image Credit : Apple Earth by JD Hancock is licensed under CC BY 2.0 // Modification: text was added to the original image

“ The article is based on the information available in public and which the author believes to be true. The author is not disseminating any information, which the author believes or knows, is confidential or in conflict with the privacy of any person. The views expressed or information supplied through this article is mere opinion and observation of the author. The author does not intend to defame, insult or, cause loss or damage to anyone, in any manner, through this article.”