By PharmaCompass

2024-11-21

Impressions: 13292

Every year, the US Food and Drug Administration (FDA) publishes the user fee amounts it will collect from manufacturers of pharmaceuticals, generic drugs, biosimilars and medical devices in the coming financial year. The fee for fiscal year 2025 under the Generic Drug User Fee Act (GDUFA) was published on July 31, 2024.

The GDUFA, established in 2012, authorizes FDA to assess and collect fees from drug manufacturers to expedite the delivery of safe, high-quality, and affordable generic drugs to the American public.

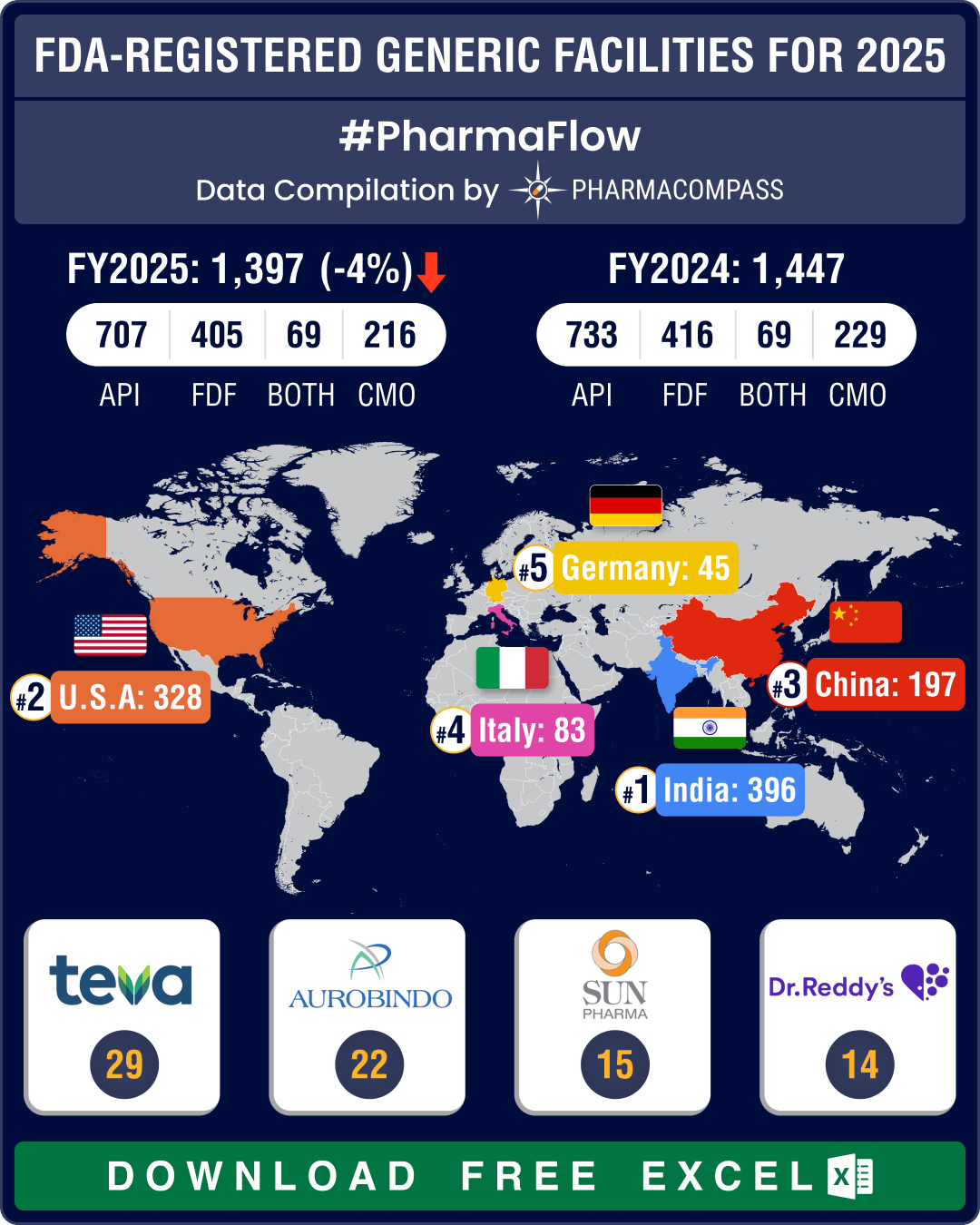

The FDA’s facility payments list under GDUFA reveals that as

of November 14, 2024, 1,397 facilities had paid their registration fees for

financial year 2025. Of these facilities, 707 or 50.6 percent are active

pharmaceutical ingredients (API) facilities, 405 or 29 percent are finished dosage

forms (FDF) facilities, 69 (4.9 percent) are facilities that produce both APIs

and FDFs, and 216 (15.5 percent) are contract manufacturing services (CMO)

sites.

Teva Pharmaceuticals, with 29 facility registrations, led the list of companies, followed by Aurobindo Pharma, Sun Pharma, and Dr. Reddy's Laboratories.

|

Fiscal year |

Facility Registrations |

|

2016 |

1,425 |

|

2017 |

1,442 |

|

2018 |

1,269 |

|

2019 |

1,286 |

|

2020 |

1,300 |

|

2021 |

1,340 |

|

2022 |

1,385 |

|

2023 |

1,394 |

|

2024 |

1,447 |

|

2025 |

1,397 |

Generic Drug Facilities Registered with the US FDA for FY2025 (Free Excel Available)

Generic Drug Facilities Registered with the US FDA for FY2025 (Free Excel Available)

India continues to lead with 396 facilities, US and China follow

India maintains its dominance in total facility registrations with the FDA, registering 396 facilities for FY2025. This includes 214 API facilities, 135 FDF facilities, 21 facilities engaged in both API and FDF activities, and 26 CMO facilities.The United States holds the second position with 328 facilities, while China strengthened its third position with 197 facilities.

With 214 API facilities, India continues to have the largest share of API manufacturing sites, outmatching the combined total of China (128) and the US (83), which together account for 211 facilities. Among European manufacturers, Italy leads with 59 API manufacturing sites, followed by Spain (30) and Germany (25).

The US has maintained its lead in FDF facilities with 143 sites, followed closely by India with 135 sites and China with 45 sites.

|

Country |

API |

FDF |

Both |

CMO |

Total |

|

India |

214 |

135 |

21 |

26 |

396 |

|

US |

83 |

143 |

13 |

89 |

328 |

|

China |

128 |

45 |

12 |

12 |

197 |

|

Italy |

59 |

3 |

2 |

19 |

83 |

|

Germany |

25 |

4 |

1 |

15 |

45 |

|

Spain |

30 |

9 |

1 |

4 |

44 |

|

Canada |

7 |

17 |

|

13 |

37 |

|

Taiwan |

9 |

6 |

5 |

4 |

24 |

|

Switzerland |

15 |

4 |

|

4 |

23 |

|

France |

16 |

|

|

6 |

22 |

|

Japan |

18 |

|

1 |

|

19 |

|

United Kingdom |

12 |

1 |

|

2 |

15 |

|

Mexico |

9 |

1 |

|

1 |

11 |

|

Ireland |

5 |

5 |

|

1 |

11 |

Generic Drug Facilities Registered with the US FDA for FY2025 (Free Excel Available)

Generic Drug Facilities Registered with the US FDA for FY2025 (Free Excel Available)

GDUFA III user fee rates increase across categories for FY25

The GDUFA, which was reauthorized on September 30, 2022 (as GDUFA III), continues with provisions that will last until September 30, 2027. In July 2024, the FDA published updated user fee rates for FY2025.

The facility fees have seen increases across all categories. API facility fees increased by 3 percent for domestic sites (to US$ 41,580) and 2 percent for foreign sites (to US$ 56,580). FDF facility fees rose by 5 percent for both domestic (to US$ 231,952) and foreign sites (to US$ 246,952). CMO facility fees increased by 5 percent for domestic sites (to US$ 55,668) and 4 percent for foreign sites (to US$ 70,668).

Additionally, the fee for large-, medium- and small-sized drug applicants has increased by over 9 percent, compared to the 7 percent increase seen in 2023.

Generic Drug Facilities Registered with the US FDA for FY2025 (Free Excel Available)

China leads new facility registrations as FDA records 41 new units in FY25

Out of the total 1,397 facilities registered for FY2025, 41 were new registrations (going by Facility FDA Establishment Identifier numbers). China led the way with 13 new facilities, followed closely by India with 11 new facilities, while the US secured the third position with eight new facilities.

The new registrations included 15 API facilities, 13 CMO facilities, 12 FDF facilities, and one facility engaged in both API and FDF activities.

Chinese companies dominated the new FDF registrations with six facilities: Chengdu Shuode Pharma, Chengdu Suncadia Medicine, Cipla (Jiangsu), GE Healthcare (Shanghai), Luoxin Aurovitas Pharma (Chengdu), and Zhejiang Xianju Pharma.

India added two new FDF facilities through Eugia Steriles and Zydus Pharma. Malaysia registered two FDF facilities through Novugen Pharma and Novugen Oncology, while Turkey’s Insud Pharma subsidiary Exeltis and US’ RK Pharma registered one FDF facility each.

The 13 new CMO facilities included, Acme Generics, Emcure, Esjay Pharma, Fordoz Pharma, Fourrts Laboratories, Laboratoires KABS, PharmaMax, Quality Packaging Specialists International, Ritsa Pharma, Shanghai Aucyun Pharma, Sichuan Huiyu Pharma, Taejoon Pharm, and Tubilux Pharma.

In the API category, the 15 new registrations included Acharya Chemicals, Hainan Poly Pharma, CBL Patras, EUROAPI, Hybio Pharma, Medilux Laboratories, Metrochem API, Purolite, Chengdu Easton Biopharma, Sionc Pharma, Smithfield Bioscience, Xttrium Laboratories, Zhejiang Hengkang Pharma, Moehs Iberica and Shilpa Pharma. Armstrong Pharmaceuticals registered the sole facility for both APIs and FDFs.

So far, 92 facilities have not renewed their registration. Among these was a facility owned by Sandoz subsidiary Eon Labs in Wilson, North Carolina (US), which is permanently closed. In fact, the geographical distribution of non-renewals shows that 30 facilities were from the US, while India and China accounted for 14 and nine non-renewals respectively.

Generic Drug Facilities Registered with the US FDA for FY2025 (Free Excel Available)

Our view

The FY 2025 GDUFA facility registration data indicates a continued strong presence of Indian manufacturers in the US generic drug market, particularly in API production. However, China's leadership in new facility registrations, especially in FDF manufacturing, suggests that the global generic drug supply chain landscape may evolve considerably in the coming years.

The PharmaCompass Newsletter – Sign Up, Stay Ahead

Feedback, help us to improve. Click here

Image Credit : FDA-REGISTERED GENERIC FACILITIES FOR 2025 by PharmaCompass license under CC BY 2.0

“ The article is based on the information available in public and which the author believes to be true. The author is not disseminating any information, which the author believes or knows, is confidential or in conflict with the privacy of any person. The views expressed or information supplied through this article is mere opinion and observation of the author. The author does not intend to defame, insult or, cause loss or damage to anyone, in any manner, through this article.”