By PharmaCompass

2023-03-02

Impressions: 2452

Endocrinology, a medicinal branch that deals with endocrine and metabolic disorders, is witnessing cutting-edge drug research to develop advanced drugs that can treat diabetes, obesity, hypoparathyroidism and other disorders.

The endocrinology market is witnessing impressive growth — it is growing at a compound annual growth rate (CAGR) of 7.82 percent. Between 2023 and 2027, the market is poised to increase by US$ 36.5 billion. It includes treatments for various medical conditions, such as type 1 and type 2 diabetes, obesity, hypogonadism (a condition where the body’s sex glands produce little or no hormones), dwarfism, hypo or hyperparathyroidism, acromegaly (abnormal growth of the hands, feet, and face, caused by the overproduction of growth hormone by the pituitary gland) and congenital adrenal hyperplasia (a genetic disorder that affects the adrenal glands).

The market is dominated by diabetes treatment drugs — valued at around US$ 48.7 billion in 2018, these are expected to generate US$ 78.3 billion by the end of 2026. The market for obesity drugs is also expected to reach US$ 50 billion by 2030.

The top companies in this segment include Novo Nordisk, Eli Lilly, Merck, Sanofi, AstraZeneca and Boehringer Ingelheim. Several biotech companies have joined the race to capture a share of the lucrative market for diabetes and obesity drugs.

Access the Endocrinology Newsmakers Dashboard (Free Excel)

Lilly’s Mounjaro, Novo’s Wegovy gear up for larger share of obesity pie

In May 2022, Lilly’s potential blockbuster Mounjaro (tirzepatide) was approved by the US Food and Drug Administration (FDA) as a once-weekly subcutaneous injection to treat adults with type 2 diabetes. Mounjaro is the first and only dual targeted glucose-dependent insulinotropic peptide (GIP) and glucagon-like peptide-1 (GLP-1) receptor agonist on the market, and has helped patients achieve a body weight loss of over 20 percent in clinical trials.

Novo Nordisk’s Wegovy (semaglutide), the first and only once-weekly GLP-1 receptor agonist approved for weight management in people with obesity, has been found to help patients lose up to 15 percent of their body weight in over 68 weeks. In late 2022, the drug received FDA approval to treat obesity in pediatric patients aged 12 years and older.

Last October, FDA granted fast track review designation to Mounjaro as a treatment for obesity. Lilly plans to go to the FDA soon and expects to get approval for the drug this year. Once approved, Mounjaro will give Wegovy a tough fight in the obesity market. Analysts predict Mounjaro to generate around US$ 8.1 billion in annual sales by 2028, while Wegovy is expected to bring in US$ 7 billion by 2030. Meanwhile, Amgen’s AMG 133 is also in early-stage trials for obesity.

Access the Endocrinology Newsmakers Dashboard (Free Excel)

‘Skinny shot’ diabetes drugs face supply shortages; Lilly plans to double capacity

Following its approval in the US in mid-2021, Wegovy quickly became the go-to “skinny shot” drug in Hollywood, thanks to its impressive weight reduction data. But the drug hit a supply shortage in late 2021 due to manufacturing issues, which the manufacturer managed to fix in the second half of 2022. Novo’s blockbuster type 2 diabetes drug Ozempic is also in limited supply, but the drugmaker expects the availability to return to normal around mid-March.

The supply constraints of Wegovy and Ozempic, coupled with the craze around using diabetes drugs for weight loss, sparked interest in Lilly’s Mounjaro. But Mounjaro, along with another Lilly drug Trulicity, began facing supply issues last December. While Lilly has fixed Mounjaro’s supply issues for the time being, it plans to double its manufacturing capacity by the year end to avoid any such shortages in the future.

Meanwhile, the American Diabetes Association and Mutual Aid Diabetes have sounded an alarm, saying the off-label use of diabetes drugs for weight loss may cause shortages and affect diabetes patients.

Access the Endocrinology Newsmakers Dashboard (Free Excel)

Provention launches treatment for type 1 diabetes; Novo retains market dominance

In November, Provention Bio’s Tzield (teplizumab) bagged FDA approval as a preventive treatment for type 1 diabetes in individuals eight years or older who are in stage 2 of the disease. The injectable drug is the first treatment in the US to delay progression of the autoimmune disease.

Novo remained the dominant player in the diabetes and obesity market, clocking sales of US$ 22.8 billion (DKK 156.4 billion) in 2022 in this segment. Ozempic’s sales increased by 77 percent to US$ 8.6 billion (DKK 59.8 billion). The Danish company consolidated its position further by purchasing Dicerna Pharma for US$ 3.3 billion in 2021 for its RNA interference (RNAi) technology.

Novo is planning to file for approval of its once-weekly insulin icodec for type 2 diabetes in the US, the EU and China in the first half of 2023. It is also running a phase 1 trial of Ozempic as a once-weekly oral treatment.

In 2022, sales of Lilly’s blockbuster drug Trulicity (dulaglutide) touched US$ 7.4 billion. Two other drugs, Humalog and Jardiance, generated US$ 2.1 billion each in sales. In addition, Lilly’s partner Boehringer Ingelheim also reported US$ 2.55 billion (€ 2.5 billion) sales of Jardiance in the first half of 2022.

Biosimilar drugmaker Biocon Biologics acquired Viatris’ biosimilars business for a total of US$ 3.34 billion, strengthening its presence in the diabetes, tumors and autoimmune diseases market. Viatris’ portfolio is expected to generate sales of over US$ 1 billion for Biocon in 2023.

Access the Endocrinology Newsmakers Dashboard (Free Excel)

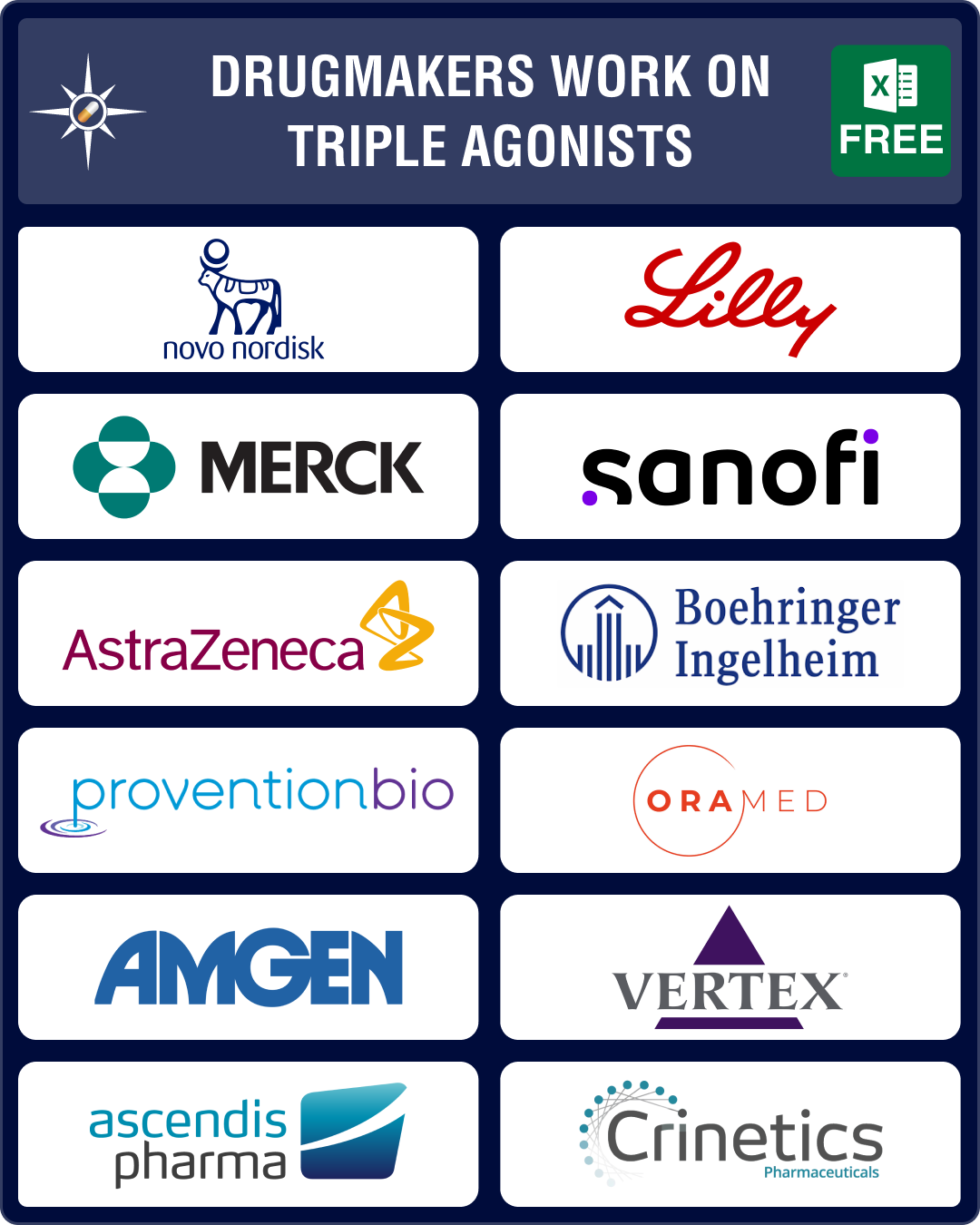

Drugmakers work on triple agonist therapies to treat diabetes, obesity

Several drugmakers are working on triple agonist therapies that target multiple receptors, such as GLP-1, GIP and glucagon (GCG). These drugs, such as Novo and partner Marcadia’s MAR423, Hanmi’s HM1521, Sanofi’s SAR441255, and Eli Lilly’s retatrutide, are currently in early- to mid-stage trials. Studies have shown that these triple agonists are more effective in reducing body weight and improving glucose control compared to mono- or dual-incretin receptor agonists.

In addition, a few triple drug combinations containing metformin, DPP4 inhibitors and SGLT2 inhibitors have recently been approved. Treatments such as Astra’s Qternmet XR and Lilly-BI’s Trijardy XR have shown significant improvement in glycemic control and are generally well tolerated by patients.

Access the Endocrinology Newsmakers Dashboard (Free Excel)

TheracosBio’s oral med for diabetes approved; gene therapies gather interest

Recently, TheracosBio’s Brenzavvy was approved by the agency as an oral medication for type 2 diabetes. And Marinus Pharmaceuticals’ oral testosterone replacement therapy Kyzatrex received FDA’s nod last year for a range of diseases in men that arise from deficiency or absence of endogenous testosterone. New York-based Oramed is currently conducting a phase 1 trial of its oral GLP-1 drug – ORMD-0901 – as a treatment for type 2 diabetes.

Meanwhile, Vertex and Arbor Biotechnologies are working on a gene therapy (VX-880) for type 1 diabetes. BridgeBio Pharma’s BBP-631 adeno-associated virus (AAV) gene therapy for congenital adrenal hyperplasia is in phase 1/2 trials. And Swedish biotech Diamyd is carrying out phase 3 trials of its type 1 diabetes vaccine.

In other medical conditions, Ascendis Pharma’s TransCon PTH, a long-acting prodrug of parathyroid hormone, has a PDUFA date in April 2023. If approved, it would become the first hormone replacement therapy to address the underlying cause of hypoparathyroidism. Crinetics Pharmaceuticals’ Paltusotine, a non-peptide somatostatin type 2 (SST2) receptor agonist, is currently in phase 3 trials for acromegaly, representing a new class of oral once-daily medication.

Access the Endocrinology Newsmakers Dashboard (Free Excel)

Our view

Diabetes and obesity have reached epidemic proportions in the recent decades, while other endocrine disorders such as hypoparathyroidism are also growing rapidly the world over.

According to the World Health Organization, around 422 million people worldwide have diabetes, and 1.5 million deaths are directly attributed to diabetes each year.

While factors such as long working hours, sedentary lifestyles, and unhealthy eating and drinking habits are contributing to the rise of these diseases, drugmakers are doing some cutting edge research for these conditions. Given this scenario, endocrinology should see a lot of pathbreaking drugs in the coming years.

The PharmaCompass Newsletter – Sign Up, Stay Ahead

Feedback, help us to improve. Click here

Image Credit : ENDOCRINOLOGY NEWSMAKERS by PharmaCompass license under CC BY 2.0

“ The article is based on the information available in public and which the author believes to be true. The author is not disseminating any information, which the author believes or knows, is confidential or in conflict with the privacy of any person. The views expressed or information supplied through this article is mere opinion and observation of the author. The author does not intend to defame, insult or, cause loss or damage to anyone, in any manner, through this article.”