By PharmaCompass

2018-11-15

Impressions: 2189

This week, Phispers brings you news on Moderna, which filed papers to list on the NASDAQ with an IPO of US$ 500 million.

This would be biotech’s biggest IPO yet.

There is an update on Amarin’s fish oil drug, which had made history in September when a study had revealed its astounding benefits to heart patients.

Now, it seems there was some problem with the study’s design, as the placebo may have caused harm to patients in the control arm.

The FDA hopes to address drug shortages and doubts over sterility of drug products by modernizing its inspections protocol program.

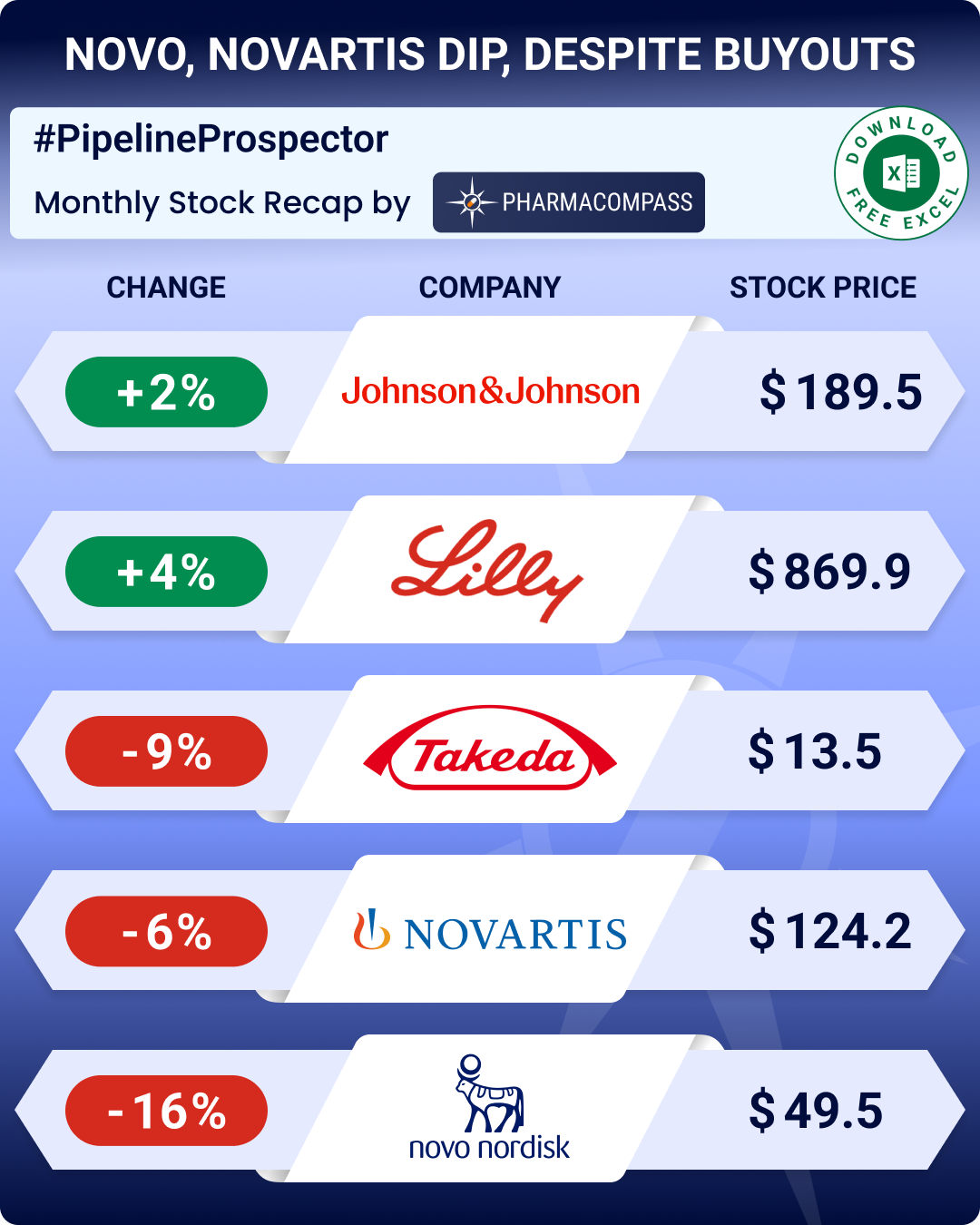

The CEO of Japanese drug major Takeda said he is confident about securing investor backing for its US$ 62 billion acquisition of British drug maker Shire.

After Allergan, Pfizer plans to put its women’s healthcare unit on the block.

But Allergan’s CEO recently shared a gloomy update on the progress made on selling this unit. Could Pfizer’s women’s health unit have a better fate?

FDA announces new initiatives for inspections and clinical

trials

The US Food and Drug Administration (FDA) is modernizing its inspections program with a new way of assessing, recording and reporting data from surveillance and pre-approval inspections for sterile drugs. With this measure, the agency hopes to avert drug shortages and question marks over sterility of drug products.

“This New Inspection Protocol Project (NIPP) uses standardized electronic inspection protocols to collect data in a structured manner for more consistent oversight of facilities and faster and more efficient analysis of our findings. The protocols also include additional questions related to quality culture observed in facilities,” FDA Commissioner Scott Gottlieb said.

The FDA conducted multiple pilots of the NIPP protocols to ensure they would be consistent with the current program objectives and can be integrated into the way investigators conduct inspections.

Meanwhile, the FDA has also released an open source code app — MyStudies — that can be used to collect real-world data directly from patients, including from their mobile devices.

The MyStudies app is a digital platform that can be used to collect data from a “variety of sources, such as electronic health records, claims and billing activities, product and disease registries, as well as patient-generated data including in home-use settings, as well as data gathered from other sources, such as mobile devices,” an FDA announcement said. The app can be customized and used to administer questionnaires assessing patient-reported outcomes, symptom scales or patient reports of medication use.

“There are a lot of new ways that we can use real world evidence to help inform regulatory decisions around medical products as the collection of this data gets more widespread and reliable. Better capture of real world data, collected from a variety of sources, has the potential to make our new drug development process more efficient, improve safety and help lower the cost of product development,” Gottlieb said.

Takeda on track to close US$ 62 billion Shire deal, says CEO

Last week, Christophe Weber, President and CEO of Japan’s Takeda Pharmaceutical, said he was confident of securing investor backing for the company’s US$ 62 billion acquisition of London-listed Shire, despite fears expressed by some shareholders about the concomitant debt burden.

In May this year, Takeda had struck a deal to take over Shire. The deal will propel Takeda into the top 10 rankings of global drugmakers, in terms of sales. With a market value of around US$ 32 billion, Takeda has secured a US$ 30.9 billion bridge loan to help finance the Shire acquisition. As a result, some investors were concerned over how well it will cope with debt repayments.

“We are quite satisfied with our current progress at Takeda. Our business is doing well,” he said at a conference. Weber was buoyed by strong quarterly results of Takeda, as well as strong demand for its existing products. He insisted that acquiring rare diseases specialist Shire was not a defensive move.

Takeda needs two-thirds support from its shareholders in order to close the deal. The company has scheduled a shareholder meeting for December 5 for investors to vote on the takeover.

The acquisition of Shire will increase Takeda’s exposure to the world’s largest drug market — the United States. Takeda has gained approval for what would be the biggest-ever overseas acquisition by a Japanese company from regulators in US, Japan and China. However, it is awaiting an okay from European authorities.

Meanwhile, Takeda’s Shire takeover is set to bring in a US$ 963 million fee bonanza for banks, law firms and other advisers in the form of fee.

Takeda expects to spend around US$ 733.4 million in fees and expenses, while Shire’s costs will range between US$ 216.5 million and US$ 229.5 million,

Takeda’s team of advisers includes investment banks Evercore, JP Morgan and Nomura while Shire’s line-up includes Citigroup, Goldman Sachs and Morgan Stanley.

After Allergan, Pfizer plans to sell its women’s health unit. Will it succeed?

Pfizer Inc. is considering selling off its women’s health lineup, according to Bloomberg. It is learnt that the New York-headquartered pharma giant would rather focus on developing therapies with more potential for growth.

The drugmaker is reportedly working with financial advisers to gauge the interest of potential buyers. A sale of the division, which has annual sales of roughly US$ 1.2 billion, could fetch around US$ 2 billion. It could draw bids from both private equity firms and rival pharmaceutical companies.

However, it may not be all that easy for Pfizer to sell off this unit, given Allergan’s recent struggles with selling its women’s health business.

Last week, Allergan CEO Brent Saunders had a gloomy update for investors on the company’s women’s health business, which had been put on the block in May this year.

“We have received now the preliminary expression of interest for some of these businesses and they are below what I believe the value of these businesses are,” Saunders said. If the offers don’t go up, Allergan will drop the idea of selling it, he added.

Pfizer certainly knows what the M&A market is like. In March, the top two bidders for its consumer healthcare unit withdrew from the sale process which was expected to generate US$ 20 billion for Pfizer. As a result, Pfizer decided to hang onto the unit, at least for the time being. Given Allergan’s recent experience, there is every possibility that Pfizer too may decide to drop the idea of selling its women’s health lineup.

Last year, Teva managed to sell its women’s health division in separate transactions for about US$ 2.5 billion, in order to lower its debt burden.

Amarin’s ‘breakthrough’ fish oil drug for heart patients comes with big caveats

In late September, we had carried news on Amarin’s fish oil drug, which made history in the field of heart medicines with its proprietary, prescription formulation of fish oil known as Vascepa (ethyl eicosapentaenoic acid). The clinical trial results had revealed that Vascepa, which contains omega-3 fatty acids, reduced the risk of deaths, heart attacks, strokes and other serious cardiovascular outcomes quite significantly. The claim was astounding — a 25 percent relative risk reduction for deaths related to heart attacks, strokes and other conditions.

Though the drug did cut heart risks significantly, the choice of placebo and the effect it had on the results has now stirred up a debate. After reviewing the results of the REDUCE-IT study, some analysts had a problem with the study’s design. They say the placebo might have caused harm and in turn inflated Vascepa’s effectiveness profile.

Patients on the dummy pill saw their bad cholesterol levels up by 10 percent in the first year versus less than 3 percent changes in the Vascepa group. Level of high-sensitivity C-reactive protein (hsCRP) — an indication of inflammation — also increased 30 percent in the placebo group.

Commenting on the 8,179-subject trial, Jefferies analyst Michael Yee said patients in the control arm received a mineral oil-filled pill, which looked like Amarin’s purified fish-oil drug. And that these patients saw some key cardiovascular biomarkers trending in a bad way. That should not have been the case with normal placebos.

Vascepa isn’t a new drug — it was approved in 2012 as a remedy for extremely high triglyceride levels, which can put patients at the risk for pancreatic problems. As of December 2017, Vascepa retailed in the US for about US$ 280 for a month’s supply.

Meanwhile, late last month, Amarin sued two dietary supplement firms after releasing results of the REDUCE-IT study. In the lawsuits, Amarin claimed that the two dietary supplement firms have used results from the REDUCE-IT study to deceptively and falsely claim their omega-3 products are effective in reducing the risk of cardiovascular disease.

Moderna to list on Wall Street with US$ 500 million IPO — biotech’s biggest yet

Last week, Moderna Therapeutics, a developer of messenger RNA (mRNA) therapeutics, filed papers for its long-awaited IPO. This is one of the biggest gambles on Wall Street, and biotech’s biggest IPO that would raise US$ 500 million.

Once it completes the offering, Moderna will trade on NASDAQ under the symbol ‘MRNA’.

In February, Moderna had raised US$ 500 million through a series G funding. And then in May 2018, it had grabbed another US$ 125 million in preferred equity as it expanded a cancer vaccine partnership with Merck & Co.

So far, Moderna has secured US$ 1.8 billion in venture financing, and another US$ 800 million or so through partnerships with Merck, Vertex Pharmaceuticals, AstraZeneca and Alexion Pharmaceuticals. Earlier this year, its valuation had been estimated at over US$ 7 billion.

In its SEC filing, Moderna said the proceeds from the IPO will go toward “drug discovery and clinical development, further expansion of our manufacturing platform and capabilities and infrastructure to support our pipeline.”

It will also use the funds to support further development of its mRNA technology platform and the creation of new modalities. So far, the company has developed six “modalities”— prophylactic vaccines, cancer vaccines, intratumoral immuno-oncology, localized regenerative therapeutics, systemic secreted therapeutics and systemic intracellular therapeutics.

The PharmaCompass Newsletter – Sign Up, Stay Ahead

Feedback, help us to improve. Click here

Image Credit : #Phisper Infographic by SCORR MARKETING & PharmaCompass is licensed under CC BY 2.0

“ The article is based on the information available in public and which the author believes to be true. The author is not disseminating any information, which the author believes or knows, is confidential or in conflict with the privacy of any person. The views expressed or information supplied through this article is mere opinion and observation of the author. The author does not intend to defame, insult or, cause loss or damage to anyone, in any manner, through this article.”