By PharmaCompass

2021-11-03

Impressions: 4012

Over the last few years, both India and the United States have voiced concerns about their high dependence on China for active pharmaceutical ingredients (APIs) and drug intermediates. A shortfall of APIs and drugs during the coronavirus pandemic exposed America’s heavy reliance on India and China for a wide range of life-saving drugs.

The situation, which is a national security and public health risk, has been further exacerbated by the ongoing serious energy crunch in China, the world’s largest API exporter. The US accounted for 12.5 percent of China’s total API export value in 2019. China is also the largest supplier of intermediates to India, which in turn is a crucial supplier of APIs for life saving drugs to the US.

Our latest compilation of facilities registered with the US Food and Drug Administration (FDA) to supply generic drugs into the United States in the coming year reveals that things haven’t changed much – the number of API manufacturing facilities in India (183) and China (102) are almost three and a half times more than those in the US (86).

Generic Drug Facilities Registered with the USFDA in FY 2022 (Free Excel Available)

CARES Act and America’s drug supply chain

In March 2020, the United States enacted the Coronavirus Aid, Relief, and Economic Security (CARES) Act to speed up response efforts and to ease the economic impact of Covid-19. The CARES Act amended the Federal Food, Drug, and Cosmetic Act (FD&C Act) and includes authorities intended to enhance FDA’s ability to identify, prevent, and mitigate possible drug shortages by, among other things, improving FDA’s visibility into the drug supply chains.

The CARES Act requires that each person (including repackers and relabelers) who registers with the FDA with regard to a drug must report to the agency annually “on the amount of each listed drug that was manufactured, prepared, propagated, compounded, or processed” by such a person for commercial distribution.

After going through the guidance, it is evident that the US wants more visibility into its pharmaceutical supply chain and is ramping up its effort to become self-sufficient in manufacturing life-saving drugs in the near future.

Generic Drug Facilities Registered with the USFDA in FY 2022 (Free Excel Available)

Increase in ANDA fees led to drop in registrations

The Generic Drug User Fee Act (GDUFA) is a law designed to speed up access to safe and effective generic drugs to Americans and reduce the costs to the industry. The amended law – GDUFA II – came into force in 2017 with the objective to supplement FDA funds to expedite the generic drug approval process and to increase the number of generic drugs approved while maintaining safety and quality standards. While the user fees generated by the GDUFA II has funded between 58 and 76 percent of the Office of Generic Drugs’ operating budget, the high ANDA (abbreviated new drug application) fees has dissuaded many small generic firms from seeking entry into the market.

|

Fiscal year |

Facility registrations |

|

2013 |

1390 |

|

2014 |

1414 |

|

2015 |

1450 |

|

2016 |

1425 |

|

2017 |

1442 |

|

2018 |

1269 |

|

2019 |

1286 |

|

2020 |

1300 |

|

2021 |

1340 |

|

2022 |

1289 |

As in the previous years, this year the

agency hiked the fee for ANDAs (abbreviated new drug

applications) by nearly 15 percent, and for DMFs (drug master files) by over 7

percent.

Last year, the fee for facilities — finished dosage form (FDF) as well as contract manufacturing organizations (CMOs) — had been reduced. But this year, the fee for FDF facilities, both domestic and foreign, has gone up by over 5 percent. The fee for CMOs has gone up by 5.97 and 4.8 percent for domestic and foreign facilities respectively.

This year, the fee for large-, medium- and small-sized drug applicants has been reduced further.

The

GDUFA facility payments list reveals that as of October 28, 2021, of the 1,289

facilities that have paid their registration fees this year, 652 or 50.6

percent are API manufacturers, 385 or 29.86 percent manufacture finished dosage

forms, 68 (5.27 percent) facilities produce both APIs and FDFs and another 184

(14.27 percent) sites offer contract manufacturing services.

|

Facility payment type |

Total |

|

API |

652 |

|

FDF |

385 |

|

Both |

68 |

|

CMO |

184 |

|

Grand Total |

1289 |

Generic Drug Facilities Registered with the USFDA in FY 2022 (Free Excel Available)

India still has most API facilities

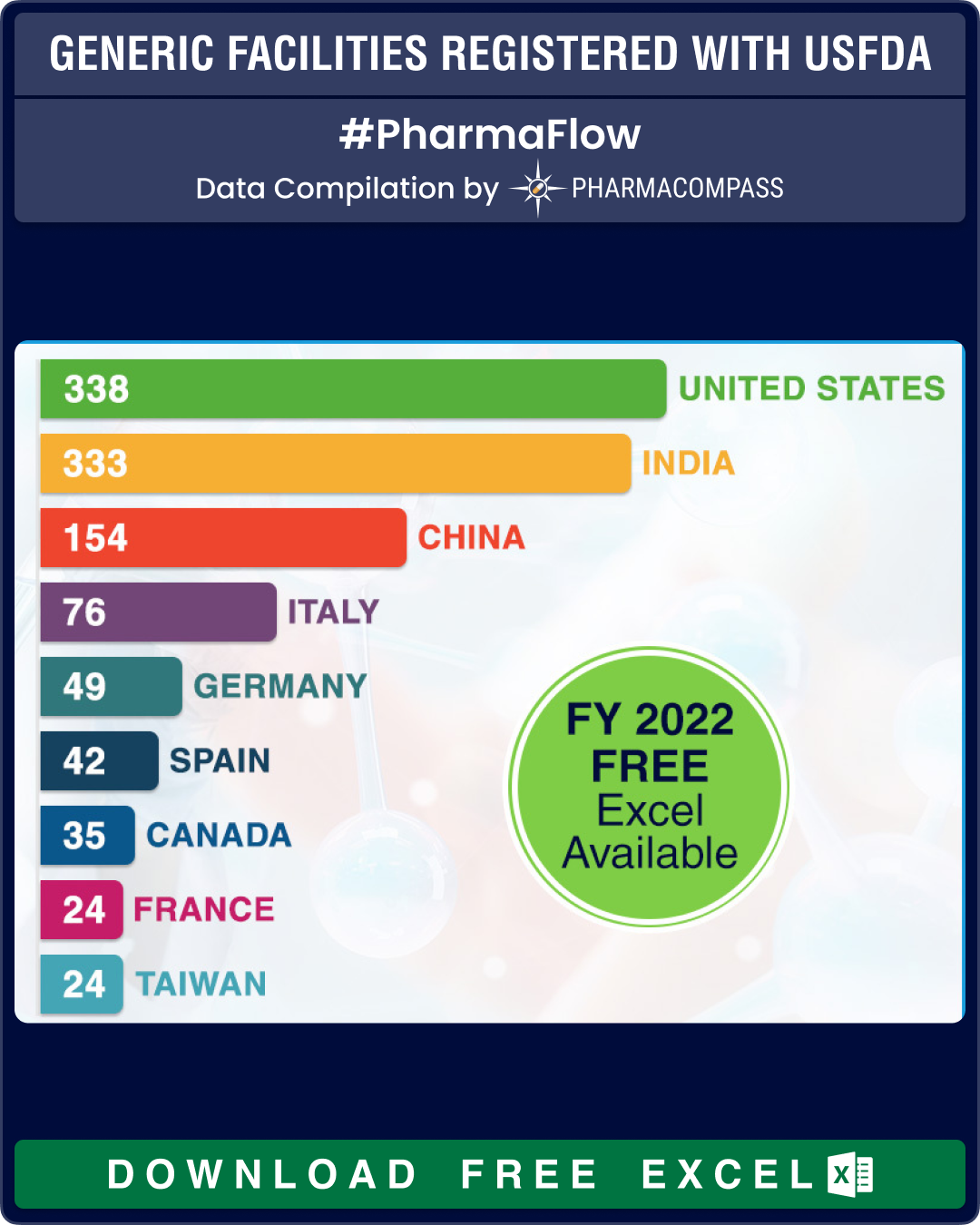

The US tops the list, with a total of 338 facilities that have paid the user fees. India follows a close second, with 333 facilities registered with the authorities. China comes third with a total of 154 facilities registering themselves for FY 2022.

At 183, India has the largest share of API facilities, which is almost equal to the sites of China (102) and the United States (86) combined. In Europe, Italy leads with 56 API manufacturing sites, followed by Spain and Germany that have 28 API facilities each.

For FDFs of human generic drug products, the largest number of facilities are in the US (157 sites), followed by India (113) and China (34).

|

Country |

API |

BOTH |

CMO |

FDF |

Total |

|

United States |

86 |

13 |

82 |

157 |

338 |

|

India |

183 |

20 |

17 |

113 |

333 |

|

China |

102 |

12 |

6 |

34 |

154 |

|

Italy |

56 |

2 |

15 |

3 |

76 |

|

Germany |

28 |

2 |

15 |

4 |

49 |

|

Spain |

28 |

1 |

5 |

8 |

42 |

|

Canada |

7 |

9 |

19 |

35 |

|

|

France |

15 |

2 |

6 |

1 |

24 |

|

Taiwan |

11 |

5 |

3 |

5 |

24 |

|

Switzerland |

16 |

|

5 |

2 |

23 |

|

Japan |

19 |

1 |

|

|

20 |

|

Mexico |

9 |

2 |

1 |

12 |

|

|

United Kingdom |

10 |

1 |

1 |

12 |

|

|

Israel |

6 |

1 |

1 |

4 |

12 |

There

are 27 new facilities that have paid the user fees. Of these, eight are from

India, six from China and four are from the US.

Generic Drug Facilities Registered with the USFDA in FY 2022 (Free Excel Available)

GDUFA III may incentivize small players to increase competition

With GDUFA II slated to end in September 2022, the FDA is developing the framework for GDUFA III, which will cover fiscal 2023 through 2027. Two major criticisms of GDUFA II have been its failure to reduce the number of iterations before approving a facility and to give a level playing field to small players.

This time, there has been a clamour from certain quarters for authorities to take additional steps in GDUFA III to increase the number of first-cycle approvals and discount user fees for small players to improve competition and provide a level-playing field for competition among firms of all sizes. The FDA could consider a financial model like the one in the Medical Device User Fee Act (MDUFA) user fee program to rope in new entrants in the market and increase competition for generic drugs.

The new GDUFA agreement, which the FDA summarized in a federal register notice on October 29, plans to include a capacity planning adjustment to the user fee calculations. This adjustment, which would be implemented in FY 2024, “would include certain limits on its authorized increases.” There is also a proposal for an enhanced mid-cycle meeting that would give the registration seeker an opportunity to ask questions in order “to address possible deficiencies”. However, this mid-cycle meeting could increase the user fees and the time FDA takes to complete the registration process quite significantly.

Generic Drug Facilities Registered with the USFDA in FY 2022 (Free Excel Available)

Our view

This year, while the number of facilities that supply generic drugs to the US is only slightly lower than the previous year, there are chances that registrations would catch up with last year’s numbers in the remaining two months of the year.

At the same time, as countries work towards reducing their dependence on India and China for key pharmaceutical ingredients, we expect the number of facilities in other parts of the world to increase steadily.

Generic Drug Facilities Registered with the USFDA in FY 2022 (Free Excel Available)

The PharmaCompass Newsletter – Sign Up, Stay Ahead

Feedback, help us to improve. Click here

Image Credit : Generic Facilities Registered with USFDA by PharmaCompass is licensed under CC BY 2.0

“ The article is based on the information available in public and which the author believes to be true. The author is not disseminating any information, which the author believes or knows, is confidential or in conflict with the privacy of any person. The views expressed or information supplied through this article is mere opinion and observation of the author. The author does not intend to defame, insult or, cause loss or damage to anyone, in any manner, through this article.”