By PharmaCompass

2020-11-26

Impressions: 72561

Covid-19 has brought a lot of businesses to a grinding halt. However, this is not the case for pharmaceutical manufacturing, which is drawing a lot of attention from across the world. The pandemic has had a positive impact on the pharmaceutical industry.

After years of witnessing a steady decline in generic drug manufacturing facility registrations with the US Food and Drug Administration (FDA), it seems that in 2021 the numbers will once again witness an increase, albeit marginally.

This week, PharmaCompass analyzed the FDA database of facilities that have paid the user fee under the Generic Drug User Fee Act (GDUFA). We found that as of the middle of November, the number of facilities that are able to supply generic drugs to the US is only slightly lower than the previous year. However, some facilities, which have a historical track record of registering with the FDA, are yet to register. Therefore, we believe that by the end of this year, the final number of facilities registered should be higher than that in 2020.

Generic Drug Facilities Registered with the USFDA in FY 2021 (Free Excel Available)

Increase in ANDA fees led to drop in registrations

The Generic Drug User Fee Act (GDUFA) came into effect on October 1, 2012. The law mandated all firms that manufactured human generic drug products and active pharmaceutical ingredients (APIs) for human generic drug products, distributed in the US, to be subject to FDA’s user fees. Five years after the passage of the original law, on August 18, 2017, the GDUFA was reauthorized (as GDUFA II), with provisions that came into effect on October 1, 2017. These provisions will remain in effect until September 30, 2022.

GDUFA II fees varied significantly from those in GDUFA I, due to two fundamental adjustments made to the fee structure:

1. The revenue base for GDUFA II was increased to US$ 493.6 million from US$ 323 million in the final year of GDUFA I. The reason for this increase was the fact that generic drug applications — or Abbreviated New Drug Applications (ANDAs), which are the primary workload driver of the program – increased over the first four years of GDUFA I. ANDA submissions to the FDA were anticipated to be 750 ANDAs per year. However, they increased to an average of around 1,000 per year in the first four years of GDUFA I. To address the increased workload, the FDA had to hire additional staff. GDUFA II’s revenue base factored in these additional costs.

2. GDUFA II is designed to rely on annual program fees, which would shift the fee burden somewhat from facility fees. As a result, while the facility fees remained relatively unchanged or even reduced in some cases, the fee for ANDAs saw an increase of more than US$ 100,000 per application.

|

Generic Drug User Fee Act (GDUFA) (in US$) |

2021 |

2020 |

2017 |

|

Abbreviated New Drug Application (ANDA) |

196,868 |

176,237 |

70,480 |

|

Drug Master File (DMF) |

69,921 |

57,795 |

51,140 |

|

Finished Dosage Form Facility (Domestic) |

184,022 |

195,662 |

258,646 |

|

Finished Dosage Form Facility (Foreign) |

199,022 |

210,662 |

273,647 |

|

Active Pharmaceutical Ingredient Facility (Domestic) |

41,671 |

44,400 |

44,234 |

|

Active Pharmaceutical Ingredient Facility (Foreign) |

56,671 |

59,400 |

59,234 |

|

Contract Manufacturing Organization (CMO) – Domestic |

61,341 |

65,221 |

Not Applicable |

|

Contract Manufacturing Organization (CMO) – Foreign |

76,341 |

80,221 |

Not Applicable |

Although

the facility fees have effectively remained unchanged from GDUFA I to GDUFA II,

the significant increase in ANDA fees resulted in nearly a 17 percent reduction in

facilities which paid their user fees for 2018. The number of facility

registrations have witnessed a marginal decline ever since, although there is

reason to believe that the bottom has been reached.

|

Fiscal Year |

Facility Registrations |

|

2013 |

1390 |

|

2014 |

1414 |

|

2015 |

1450 |

|

2016 |

1425 |

|

2017 |

1442 |

|

2018 |

1269 |

|

2019 |

1286 |

|

2020 |

1300 |

|

2021 |

1287 |

Generic Drug Facilities Registered with the USFDA in FY 2021 (Free Excel Available)

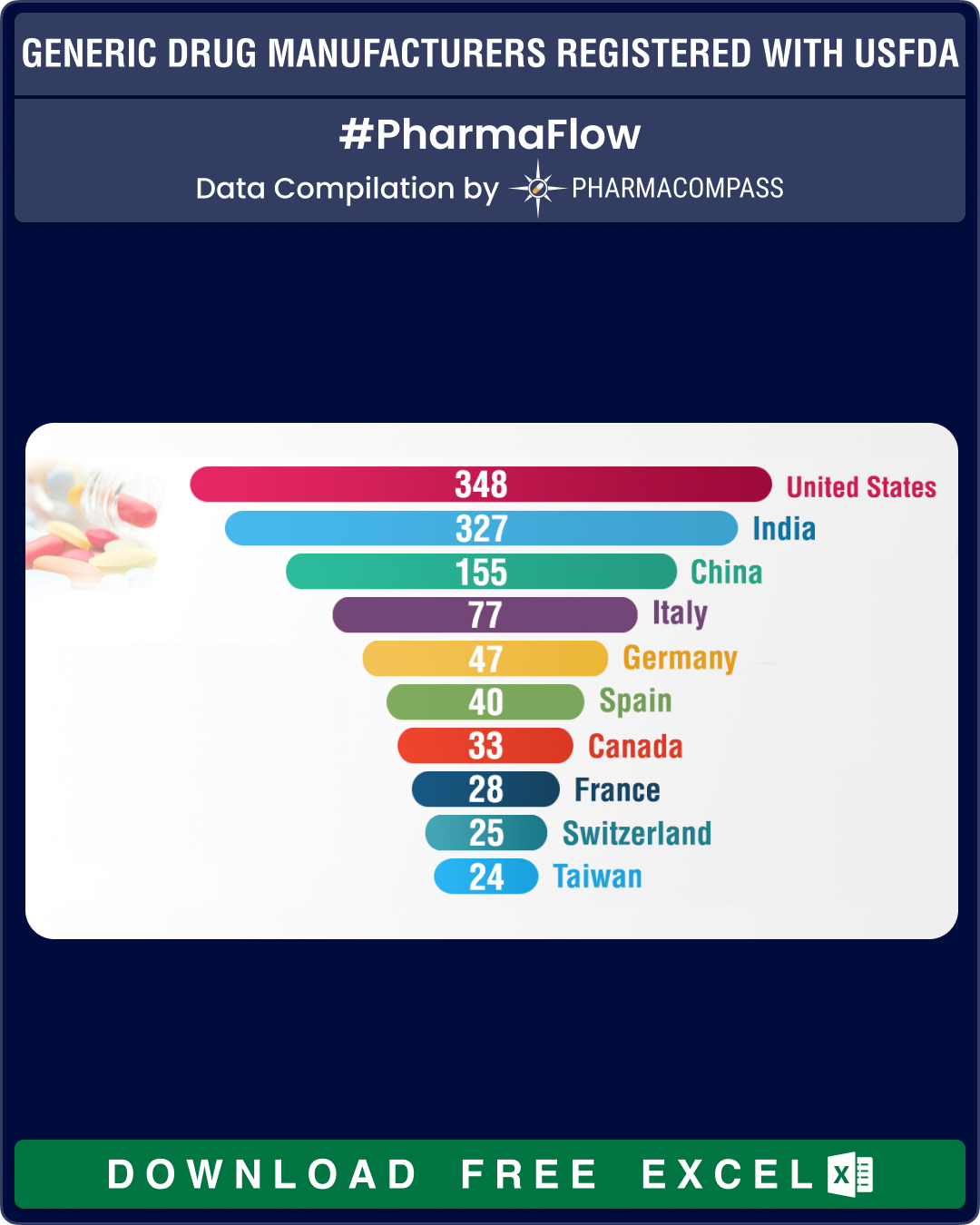

India continues to top API facilities share

Consistent with the trends seen in previous years, we found that of the 1,287 facilities that paid their user fees, a little over half (51 percent, or 655 facilities) are API manufacturers, 30 percent (or 389) manufacture finished dosage forms (FDFs), 67 facilities produce both APIs and FDFs and there are another 176 sites that offer contract manufacturing services.

|

Facility Payment Type |

Total |

|

API |

655 |

|

BOTH |

67 |

|

CMO |

176 |

|

FDF |

389 |

|

Grand Total |

1287 |

At 183, India continues to have the largest share of API facilities, which nearly equals the sites of China (101) and the United States (88) combined. In Europe, Italy leads with 57 API manufacturing sites followed by Germany and Spain, that have 29 and 28 API facilities, respectively.

For FDFs of human generic drug products, the largest number of facilities are in the United States (164 sites), followed by India (113) and China (34).

| Country |

API |

BOTH |

CMO |

FDF |

Total |

|

United States |

88 |

14 |

82 |

164 |

348 |

|

India |

183 |

19 |

12 |

113 |

327 |

|

China |

101 |

11 |

9 |

34 |

155 |

|

Italy |

57 |

2 |

15 |

3 |

77 |

|

Germany |

29 |

2 |

13 |

3 |

47 |

|

Spain |

28 |

1 |

5 |

6 |

40 |

|

Canada |

8 |

7 |

18 |

33 |

|

|

France |

17 |

2 |

8 |

1 |

28 |

|

Switzerland |

17 |

5 |

3 |

25 |

|

|

Taiwan |

10 |

5 |

4 |

5 |

24 |

|

Japan |

17 |

1 |

18 |

||

|

United Kingdom |

11 |

1 |

1 |

1 |

14 |

|

Mexico |

10 |

1 |

11 |

||

|

Ireland |

5 |

2 |

3 |

10 |

|

|

Israel |

5 |

1 |

4 |

10 |

Generic Drug Facilities Registered with the USFDA in FY 2021 (Free Excel Available)

Our view

The Covid crisis led to a surge in demand for APIs and generic drugs, which highlighted the global dependence on India and China for these drugs. The generic facility registrations reveal that almost 38 percent (482 out of 1287) of the facilities registered with the FDA are located in these two countries.

India, a prominent API manufacturer, admitted to its own extreme dependence on China for APIs and intermediates. In July this year, India announced guidelines for its schemes for the development of bulk drugs and medical device parks across the country. These schemes are part of India’s self-reliance campaign.

Similar reshoring initiatives have been announced by the United States, France and Japan, and many other countries that want to reduce their reliance on foreign manufacturers for essential drugs.

While shifting supply chains is certainly a long drawn out process, the wheels have definitely started to turn. This should lead to new generic drug manufacturing facilities registering with the FDA in the future.

Generic Drug Facilities Registered with the USFDA in FY 2021 (Free Excel Available)

The PharmaCompass Newsletter – Sign Up, Stay Ahead

Feedback, help us to improve. Click here

Image Credit : Generic-Drug-Facility-Registrations-with-USFDA by PharmaCompass is licensed under CC BY 2.0

“ The article is based on the information available in public and which the author believes to be true. The author is not disseminating any information, which the author believes or knows, is confidential or in conflict with the privacy of any person. The views expressed or information supplied through this article is mere opinion and observation of the author. The author does not intend to defame, insult or, cause loss or damage to anyone, in any manner, through this article.”