By PharmaCompass

2022-09-29

Impressions: 3346

This week, we look at the global market for neurological disorder drugs, which has been growing at a healthy rate of 5.9 percent per annum. There are several kinds of neurology disorders, such as epilepsy, Alzheimer’s disease, Parkinson’s disease, multiple sclerosis (MS), cerebrovascular diseases, besides a plethora of rare neurological conditions.

This market is witnessing a lot of change. Better diagnostic capabilities and a rise in R&D funding from governments and the private sector have resulted in an increase in the number of experimental drugs and drug approvals in this field.

The market for neurological disorder drugs was valued at US$ 79.40 billion in 2021 and is poised to reach US$ 125.60 billion by 2029. The leading players in the field are Merck, AstraZeneca, Biogen, Novartis, Sanofi, GSK, Pfizer, Roche, Boehringer Ingelheim, AbbVie, Takeda and UCB, along with a whole host of emerging players such as Amylyx Pharmaceutical, Alector, Denali Therapeutics and Prothena.

Access the Neurology Newsmakers Dashboard

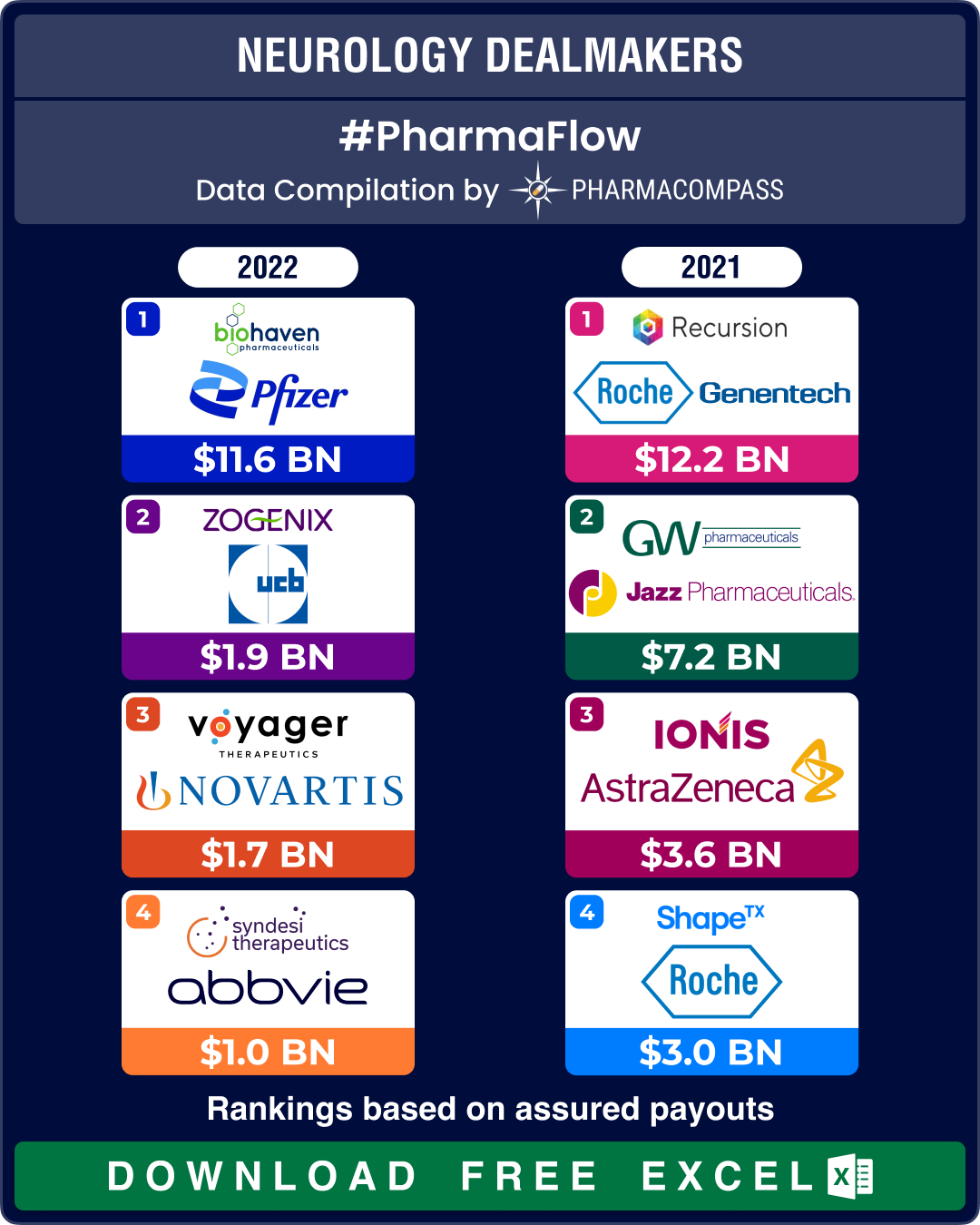

Recursion-Roche deal, Pfizer’s buyout of Biohaven target neurological therapies

With increased focus on R&D, the central nervous system (CNS) therapeutic area has seen several high-value licensing deals and acquisitions. The most significant deal is Recursion’s collaboration with Roche and Genentech (announced in December 2021), valued at US$ 12.2 billion. The collaboration leverages Recursion’s strength in artificial intelligence to identify 40 novel drug targets and develop small-molecule programs in key areas of neuroscience and an oncology indication.

Pfizer’s acquisition of Biohaven Pharmaceuticals for US$ 11.6 billion in May this year was another important deal that has brought Biohaven’s leading oral migraine drug in the US – Nurtec ODT (rimegepant) – into Pfizer’s fold. Nurtec is approved for both acute treatment and episodic prevention of migraine in adults. Pfizer has also gained other CGRP (calcitonin gene-related peptide) receptor antagonists, such as zavegepant (formulated as an intranasal spray to treat acute migraine), through this buyout. Zavegepant is also in clinical trials as an oral soft gel for chronic migraine.

In February last year, Jazz Pharma had acquired GW Pharmaceuticals for US$ 7.2 billion. With this deal, Jazz gets Epidiolex (cannabidiol) oral solution, the first and only FDA-approved prescription cannabidiol medicine, used for the treatment of seizures associated with Lennox-Gastaut syndrome (LGS), Dravet syndrome and tuberous sclerosis complex (TSC), all of which are rare diseases characterized by severe early-onset epilepsy. The European Medicines Agency (EMA) has also authorized the drug under the trade name Epidyolex.

Last year, AstraZeneca entered into a potential US$ 3.6 billion global development and commercialization agreement with Ionis Pharmaceuticals for eplontersen, an antisense medicine that is currently in a phase 3 clinical trial for the treatment of amyloid transthyretin polyneuropathy (ATTR-PN).

In March this year, Novartis announced a potential US$ 1.7 billion licensing deal with Massachusetts-based biotech Voyager Therapeutics to develop three targets for CNS diseases.

Another significant deal announced in January was UCB's acquisition of Zogenix for US$ 1.9 billion in cash, which gave UCB access to Zogenix’s FDA approved drug — Fintepla (approved in June 2020) — to treat Dravet syndrome. In March 2022, the FDA approved the drug to treat seizures associated with LGS. The acquisition has strengthened UCB’s hold on the epilepsy market.

Access the Neurology Newsmakers Dashboard

GSK, AbbVie, Sanofi, Merck strike deals to find cures for Alzheimer’s, Parkinson’s

Drugmakers are increasing their focus on Alzheimer’s, Parkinson’s and other neurodegenerative diseases. In March this year, AbbVie acquired Belgium-based Syndesi Therapeutics for US$ 1 billion. Syndesi’s lead candidate is a small molecule that is under evaluation to treat Alzheimer’s disease and major depressive disorder.

In July last year, GSK and Alector had announced a global collaboration (valued at around US$ 2.2 billion) for two clinical stage first-in-class monoclonal antibodies. The two drugs seek to cure major neurodegenerative diseases, including amyotrophic lateral sclerosis (ALS), Parkinson’s and Alzheimer’s.

In January this year, ABL Bio entered into a global collaboration and license agreement (worth US$ 1.06 billion) with Sanofi to develop ABL301, a pre-clinical stage bispecific antibody designed to treat Parkinson's disease and other potential indications.

In August, AbbVie signed a potential US$ 1.28 billion drug discovery partnership with neurological diseases expert Sosei Heptares for the discovery, development and marketing of therapies for neurological ailments. The following week, Merck signed a potential US$ 1.1 billion research collaboration with Boston-based Cerevance to find new targets for Alzheimer’s disease by utilizing Cerevance’s proprietary technology.

And in August 2021, Shape Therapeutics had entered into a US$ 3 billion multi-target strategic collaboration and license agreement with Roche to develop a gene therapy for certain targets in the areas of Alzheimer’s, Parkinson’s disease, and rare diseases.

Access the Neurology Newsmakers Dashboard

Roche’s Ocrevus, Novartis Gilenya, Sanofi’s Aubagio top neurology charts

The top selling neurological drug in 2021 was Roche’s Ocrevus (ocrelizumab). It was approved in March 2017 to treat adult patients with relapsing forms of MS and primary progressive multiple sclerosis (PPMS). The drug brought in US$ 5.4 billion in sales in 2021. This is the first drug approved by the FDA for PPMS.

The second largest selling neurological drug is Novartis’ Gilenya (fingolimod), which brought in US$ 2.8 billion in 2021. It was approved by the FDA in September 2010 as a treatment for children (between 10 and 18 years) with relapsing forms of MS (RMS), making it the first disease-modifying therapy (DMT) indicated for these patients. However, Gilenya sales have been declining steadily due to increased competition. Novartis has also been fighting patent battles in court.

Sanofi’s Aubagio (teriflunomide) brought in US$ 2.2 billion in sales in 2021. The drug also bagged European Commission’s approval to treat pediatric patients aged 10 to 17 years with relapsing-remitting MS (RRMS). Aubagio was first approved by the FDA in September 2012 to treat patients with RMS. This year, Aubagio’s sales have dropped by 4.4 percent due to generics.

Biogen/Eisai’s Tysabri brought in US$ 2 billion in sales. This is a humanized monoclonal antibody that received FDA approval in 2004 for the treatment of patients with RMS. UCB’s Vimpat (lacosamide) is used for the treatment of partial-onset seizures and primary generalized tonic-clonic seizures. It brought in US$ 1.7 billion in sales in 2021. UCB markets four epilepsy drugs — Nayzilam, Briviact, Vimpat and Keppra — that collectively brought in US$ 2.8 billion in sales last year.

Novartis’ Zolgensma brought in US$ 1.4 billion in 2021. Approved by the FDA in May 2019, this is the first and only gene therapy approved for the treatment of spinal muscular atrophy (SMA). It is a single, one-time intravenous infusion. Priced at US$ 2.1 million, Zolgensma is one of the most expensive drugs. The therapy was in the news recently when two children with SMA died of acute liver failure after receiving Zolgensma.

Access the Neurology Newsmakers Dashboard

Alnylam, Argenx launch pathbreaking drugs to treat rare disorders

Over the last two years, several neurological drugs have bagged regulatory approvals. In June this year, the FDA approved Alnylam’s rare disease drug — Amvuttra (vutrisiran) — for the treatment of hereditary transthyretin-mediated amyloidosis (hATTR) with polyneuropathy in adults. It is the first and only FDA-approved treatment demonstrating reversal in neuropathy impairment.

In December 2021, Argenx received FDA nod for Vyvgart (efgartigimod alfa-fcab) to treat adults with generalized myasthenia gravis. In August 2022, Argenx bagged the European Commission’s authorization of Vyvgart for the same indication.

In September 2021, the FDA approved AbbVie’s Qulipta (atogepant) tablet, the first and only oral CGRP receptor antagonist specifically developed as a preventive treatment for migraine. As of date, Qulipta’s share is one-third that of Nurtec ODT.

In April 2022, the European Commission approved Biohaven’s rimegepant 75 mg for prophylaxis and acute treatment of migraine under the brand name of Vydura. The drug is expected to become a blockbuster drug in 2023 with a potential sale of US$ 1.38 billion. That figure is predicted to rise to US$ 1.85 billion in 2024.

The most talked about neurological drug in the recent past has been Biogen’s Aduhelm. This controversial drug is the first and only treatment that addresses a defining pathology for Alzheimer’s disease. After a disappointing commercial launch, Biogen slashed the price of Aduhelm to half in December last year.

Besides these pathbreaking drugs, several other disease modifying treatments (DMT) are in the pipeline for Alzheimer’s disease. DMTs target the pathogenic pathway of Alzheimer’s to delay the onset or progression of dementia. Like Aduhelm, Eli Lilly’s donanemab is also an anti-amyloid beta monoclonal antibody. Lilly hopes to best its rival and generate revenues of around US$ 6 billion in 2026. In August, FDA granted a priority review designation to donanemab for Alzheimer's disease under the accelerated approval pathway. The PDUFA action date for the drug is January 2023.

Another experimental drug for early Alzheimer’s is Eisai/Biogen’s lecanemab, which has earned FDA’s accelerated approval pathway with a PDUFA action date of January 6, 2023. This week, there was news that lecanemab has succeeded in slowing down the progress of Alzheimer’s disease in a phase 3 trial. Lecanemab met the study’s primary goal by slowing down the progress of the brain-wasting disease by 27 percent compared with a placebo over an 18-month period in patients who are in the early stages of Alzheimer’s.

Roche is gearing up for two phase 3 trials of its Alzheimer’s drug gantenerumab, despite its failure in a phase 3 trial dating back to 2014. If approved, Roche expects the drug to generate around US$ 2.5 billion by 2026.

Access the Neurology Newsmakers Dashboard

Amylyx, Ionis explore experimental drugs to treat ALS

Amyotrophic lateral sclerosis (ALS) is a rare progressive neurodegenerative disease that affects nerve cells in the brain and spinal cord. There are currently only two treatments approved by the FDA for the treatment of ALS – Sanofi’s Rilutek (riluzole), approved in 1995, and Mitsubishi Tanabe’s Radicava (edaravone), approved in 2017.

Amylyx’s AMX0035 is an oral fixed-dose combination of sodium phenylbutyrate and taurursodiol (ursodoxicoltaurine). In September, an FDA advisory committee voted 7-2 in favor of AMX0035. If approved, AMX0035 will be the first ALS treatment to show a significant slowing of disease progression and functional decline. The drug has also demonstrated extended survival in ALS patients. The FDA has extended the drug’s PDUFA date to allow more time to review additional analyses of data from the company’s clinical studies.

Amylyx is also exploring the potential of this experimental drug as a treatment for Alzheimer’s disease and Wolfram syndrome. In June 2022, Health Canada approved the drug for ALS under the brand name of Alvbrioza.

Similarly, Ionis Pharmaceuticals has submitted a new drug application with the FDA for tofersen, an investigational antisense medicine for the treatment of superoxide dismutase 1 ALS. There is currently no treatment for the disease. If approved, tofersen will be the first treatment to target a genetic cause of ALS. The FDA has granted a priority review to the drug. The agency is expected to decide on the drug’s PDUFA application by January 25, 2023.

Access the Neurology Newsmakers Dashboard

Our view

Until recently, several neurological disorders, especially the rare ones, used to go undiagnosed or were under-diagnosed, due to a host of reasons such as the lack of diagnostic technologies. Even today, there is a dearth of therapies for several neurological diseases.

With increase in geriatric population across the globe, there is

bound to be a rise in demand for neurological disorder drugs, and drugmakers

are likely to increase their R&D budgets for this field. Their focus should

result in more pathbreaking cures for patients across the world.

The PharmaCompass Newsletter – Sign Up, Stay Ahead

Feedback, help us to improve. Click here

Image Credit : Access the Neurology Newsmakers Dashboard by PharmaCompass license under CC BY 2.0

“ The article is based on the information available in public and which the author believes to be true. The author is not disseminating any information, which the author believes or knows, is confidential or in conflict with the privacy of any person. The views expressed or information supplied through this article is mere opinion and observation of the author. The author does not intend to defame, insult or, cause loss or damage to anyone, in any manner, through this article.”