By PharmaCompass

2022-07-28

Impressions: 5349

During 2021, regulatory agencies faced a lot of challenges due to the pandemic as they were not able to conduct onsite inspections. As a result, there was a six percent drop in new drug approvals — in both new molecular entities (NMEs) under new drug applications (NDAs) and new therapeutic biologics under biologics license applications (BLAs) – as compared to 2020.

This year, regulators have been able to conduct onsite inspections. Moreover, the US Food and Drug Administration (FDA) finally has a new elected commissioner — Robert Califf — who took charge in February this year. However, our analysis shows that the FDA’s Center for Drug Evaluation and Research (CDER) approved only 16 drugs in the first half of 2022, as opposed to 27 in the first half of 2021. Similarly, the EMA authorized 10 new drugs during the first six months of 2022, as opposed to 22 during the same period last year. Even the approvals of biologics have been lower this year — only 11 new biologics were approved by the FDA and EMA in the first half of 2022. The agencies had approved 20 new biologics during the same period last year.

From this year, we will also be tracking approvals granted by Health Canada. In the first six months of 2022, Health Canada has approved 25 products.

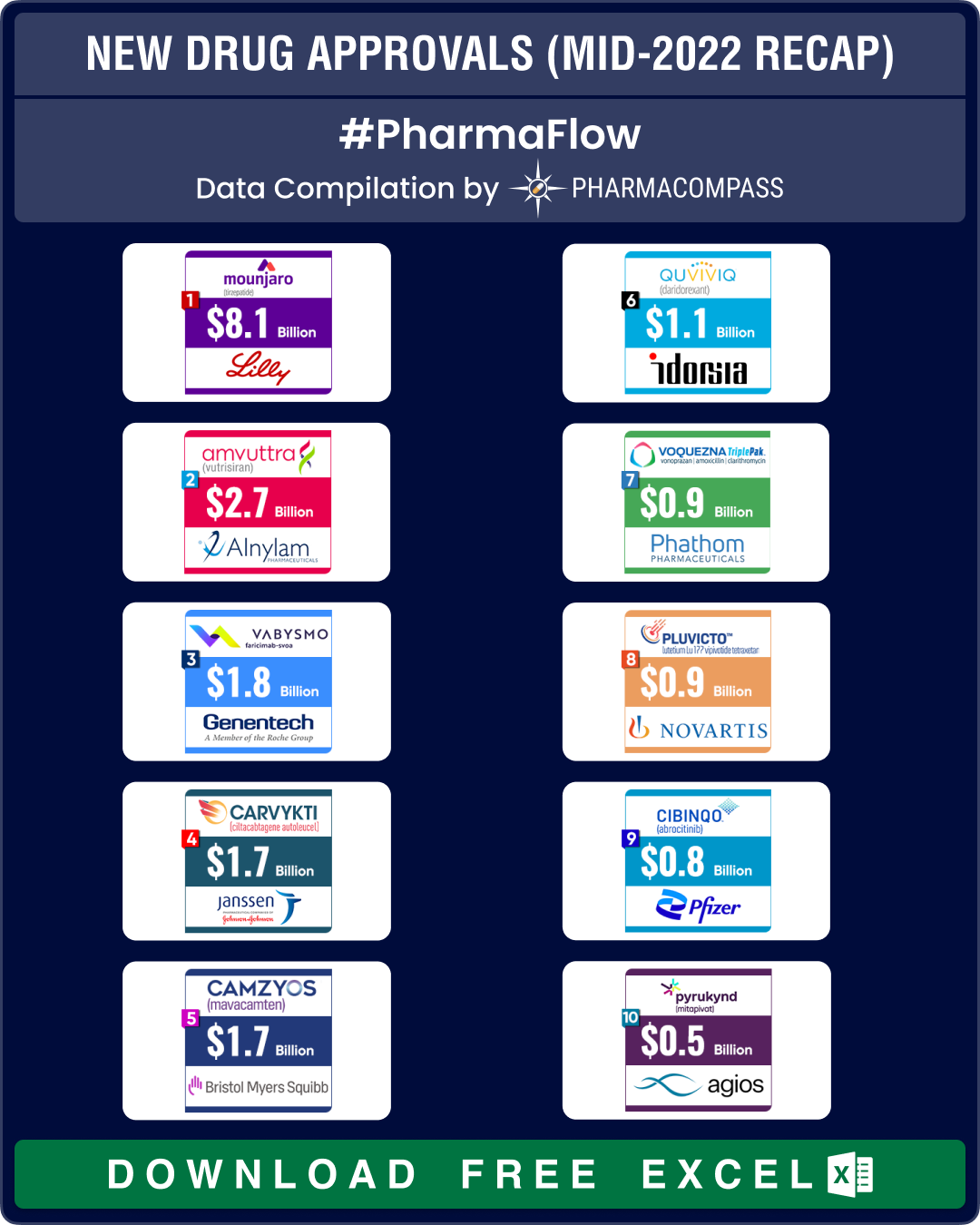

FDA’s list of approvals during the period contains potential blockbusters such as Eli Lilly’s Mounjaro (tirzepatide) for type 2 diabetes, Alnylam Pharmaceuticals’ rare disease drug Amvuttra (vutrisiran), Roche’s bispecific antibody for eye – Vabysmo (faricimab) – and Janssen Biotech and Legend Biotech's CAR-T therapy — Carvykti — to treat multiple myeloma (a cancer of the bone marrow).

View New Drug Approvals in first half of 2022 with Estimated Sales (Free Excel Available)

Oncology drugs continue to dominate approvals

For several years, oncology drugs have accounted for nearly 30 percent of all new drug approvals. This year too, drug approvals witnessed the same trend — out of 52 new drug approvals, 16 (around 31 percent) were oncology drugs.

Some of the important oncology drugs approved were Janssen Biotech’s Carvykti (ciltacabtagene autoleucel) for multiple myeloma, CTI BioPharma’s Vonjo (pacritinib citrate) for primary myelofibrosis, Bristol Myers Squibb’s melanoma drug Opdualag (nivolumab; relatlimab), Immunocore’s uveal melanoma drug Kimmtrak (tebentafusp), Novartis’ Pluvicto (lutetium Lu 177 vipivotide tetraxetan) for prostate cancer and Roche’s Lunsumio for follicular lymphoma.

Infections and infectious diseases was the second largest therapeutic area for approvals with 11 nods granted during the first half of this year, followed by genetic diseases (five), dermatology (five), immunology (four), ophthalmology (two), neurology (two) and sleep (two).

View New Drug Approvals in first half of 2022 with Estimated Sales (Free Excel Available)

Lilly’s Mounjaro to bring in US$ 8 billion in peak sales by 2028

The biggest approval during the first half of this year was that of Eli Lilly’s Mounjaro (tirzepatide) by the FDA as a treatment for adults with type 2 diabetes. This month, EMA’s human medicines committee (CHMP) has also recommended granting a marketing authorization to Lilly’s Mounjaro for the treatment of type 2 diabetes.

Analysts expect the drug to bring in around US$ 8 billion in annual sales by 2028. In a late-stage trial, the drug also helped obese people lose over 20 percent of their body weight, Lilly said. Some analysts have forecast peak sales of US$ 20 billion when the drug is used both as a treatment for diabetes and obesity. If this prediction comes true, Mounjaro could figure among the most successful diabetes drugs. Mounjaro is competing with Novo Nordisk’s blockbuster drug Ozempic.

Another key approval was that of Alnylam’s Amvuttra (vutrisiran), a therapy for hereditary transthyretin-mediated amyloidosis (hATTR) with polyneuropathy in adults. This rare, inherited and fatal disease, also known as hATTR amyloidosis, has debilitating neurological symptoms with very few treatment options. The FDA approval is based on nine month’s data from a phase 3 trial in which Amvuttra stopped or reversed signs of the disease in more than 50 percent of patients. Analysts expect the drug to bring in around US$ 2.7 billion in annual sales for Alnylam. This month, the drug was also recommended for approval by the CHMP.

In January, FDA had granted approval to Roche’s Vabysmo (faricimab), a new treatment for wet-age related macular degeneration (AMD), an eye disorder that can cause blindness in older people. The drug has also received approval for diabetic macular edema (DME) — a condition where excess fluid starts to build up in the eyes of a diabetic patient. The two conditions together affect nearly 1.9 million people in the US and 40 million worldwide. Vabysmo will compete with Regeneron’s blockbuster Eylea, which generated sales of US$ 8.36 billion in 2020 (including US$ 4.95 billion in the US). In May this year, Health Canada also authorized Vabysmo. And this month, CHMP has recommended approval of the Roche drug in the European Union.

At the start of 2022, FDA approved Idorsia’s insomnia treatment Quviviq (daridorexant). This is the first approval bagged by the five-year-old Swiss drugmaker. The drug was also approved by the EMA in April.

View New Drug Approvals in first half of 2022 with Estimated Sales (Free Excel Available)

CAR-T therapy from J&J, Novartis’ prostate cancer drug bag approvals

In February, FDA approved a CAR-T therapy developed by Johnson & Johnson and its Chinese partner Legend Biotech to treat multiple myeloma. Known as Carvykti, the drug is the second approved treatment for multiple myeloma — a cancer that forms in plasma cells (a type of white blood cell). Almost all patients treated with Carvykti responded well to the therapy in a study and no cancerous cells were found in the blood or bone marrow of 83 percent patients after a median follow-up of two years. The therapy, priced at US$ 465,000, is up against Bristol Myers Squibb and 2seventy bio’s rival CAR-T drug Abecma, which was approved by the FDA a year ago. Analysts have pegged the drug’s peak sales at around US$ 1.7 billion. In May this year, the European Commission (EC) granted conditional marketing authorization to Carvykti. The drug is also being reviewed by health authorities in Japan.

In March 2022, FDA approved Novartis’ therapy — Pluvicto — for the treatment of patients with a type of advanced prostate cancer that has spread to other parts of the body. The company had acquired the therapy in 2018 as part of its US$ 2.1 billion purchase of Endocyte.

In cardiology, BMS’ Camzyos (mavacamten) became the first-ever cardiac myosin inhibitor to treat a heart failure known as obstructive hypertrophic cardiomyopathy (HCM). This is an inherited disorder where the heart muscle thickens and obstructs blood flow. Camzyos was the centerpiece of BMS’ US$ 13 billion buyout of MyoKardia in 2020. Analysts estimate the drug to bring in around US$ 1.7 billion in peak sales in 2028.

View New Drug Approvals in first half of 2022 with Estimated Sales (Free Excel Available)

Steep rise in FDA’s CRLs

The first six months of the year witnessed a steep rise in complete response letters (CRLs) from the FDA — the agency issued 22 negative responses, as opposed to 13 during the same period last year. A CRL indicates that the FDA has conducted a complete review of the data in an NDA, ANDA or BLA submission and subsequently found that it cannot approve the application in its present form.

One such drug was Gilead’s lenacapavir, an investigational drug for the treatment of HIV-1 infection. The FDA has cited ‘chemistry manufacturing and controls’ (CMC) issues related to the compatibility of lenacapavir with the proposed container vial as the reason for their action.

Other drugs that received FDA’s CRL are Merck’s gefapixant (the investigational drug for the treatment of refractory chronic cough or unexplained chronic cough in adults), Mallinckrodt’s terlipressin (an investigational drug to treat adults with hepatorenal syndrome, an acute and life-threatening syndrome involving rapid reduction in kidney function for which there is currently no FDA-approved treatment), Pfizer and OPKO Health’s Somatrogon (an investigational treatment for growth hormone deficiency in pediatric patients) and Eli Lilly’s sintilimab (an investigational treatment for people with non-squamous non-small cell lung cancer).

View New Drug Approvals in first half of 2022 with Estimated Sales (Free Excel Available)

Our view

After the pandemic, regulators are showing more rigor around authorizations and drug approvals. The controversial approval of Biogen’s Alzheimer’s therapy Aduhelm (aducanumab) by the FDA in July 2021 has only made it more exigent on regulators to be stringent while granting approvals.

For instance, FDA’s Oncologic Drugs Advisory Committee will meet in September to review the fate of Oncopeptides’ multiple myeloma drug Pepaxto, which was granted accelerated approval by the agency in February 2021. The drugmaker has withdrawn Pepaxto in the US after the FDA said it does not consider the phase 3 Ocean study conducted on the drug as a confirmatory one.

Interestingly, just last month CHMP gave its positive opinion on the drug and also recommended it for getting a marketing authorization.

On one hand, FDA’s increased rigor may add to the overall bearish sentiments being witnessed in the market. On the other hand, this indicates that the FDA — recognized as the gold standard worldwide — is not letting its guard down on safety, quality and effectiveness of the drugs it evaluates for approval. However, given the fact that a lot of molecules are under development the world over, we never know what the second half will be like. The trend may well be reversed in the second half of this year, unleashing the bulls back on the bourses.

The PharmaCompass Newsletter – Sign Up, Stay Ahead

Feedback, help us to improve. Click here

Image Credit : New Drug Approvals by FDA by PharmaCompass is licensed under CC BY 2.0

“ The article is based on the information available in public and which the author believes to be true. The author is not disseminating any information, which the author believes or knows, is confidential or in conflict with the privacy of any person. The views expressed or information supplied through this article is mere opinion and observation of the author. The author does not intend to defame, insult or, cause loss or damage to anyone, in any manner, through this article.”