By PharmaCompass

2021-11-25

Impressions: 2505

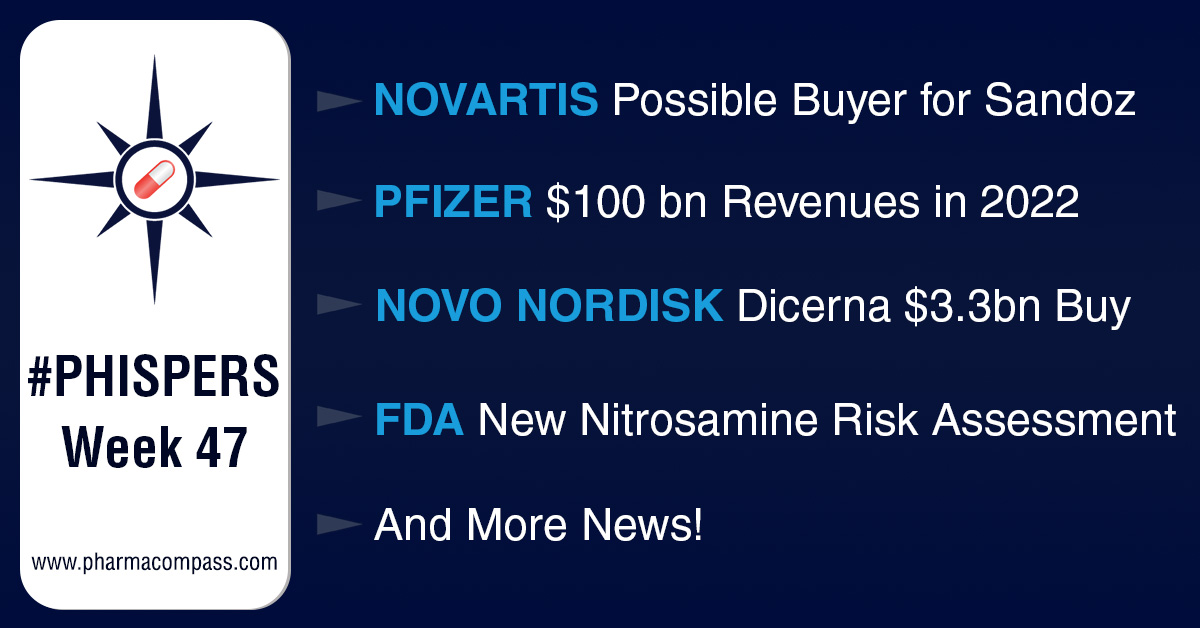

This week, Phispers brings you news on M&As, Covid vaccines, lawsuits, regulations and more. Pfizer is expected to cross US$ 100 billion in revenues next year, all thanks to its Covid-19 vaccine developed in partnership with BioNTech and its antiviral drug Paxlovid. The New York-headquartered drug behemoth also acquired immuno-oncology firm Trillium for US$ 2.2 billion.

In the first jury verdict on the opioid epidemic in the US, a federal jury said pharmacy chain operators — CVS Health, Walgreens Boots and Walmart — contributed substantially to the crises that led to opioid overdoses and deaths in two Ohio counties.

In a recent update, the US Food and Drug Administration (FDA) has suggested that drugmakers consider using certain antioxidants or excipients, such as sodium carbonate and ascorbic acid, in their drug products to inhibit the formation of nitrosamine impurities.

Meanwhile, all adults in America can now take a booster dose of Pfizer or Moderna’s Covid-19 vaccine since the FDA has expanded the emergency use authorizations (EUAs) for both the mRNA shots.

Despite pushback from the activist investors of Acceleron, Merck completed its US$ 11.5 billion acquisition of the biotech.

AstraZeneca formally unveiled its R&D campus in Cambridge, UK, built at a cost of US$ 1.34 billion (£1 billion). The drugmaker announced positive results for its Covid antibody cocktail as the therapy offered 83 percent protection over six months in a clinical trial.

In M&A news, Novo Nordisk bought Dicerna for US$ 3.3 billion, and there was news that Sweden-based investment group EQT and the Struengmann family of Germany were considering a joint move to buy Sandoz, the generic drugs division of Novartis, for US$ 21.6 billion. And GSK is foraying into non-alcoholic steatohepatitis (NASH) by signing a US$ 1 billion asset pact with Arrowhead Pharmaceuticals.

Novo Nordisk buys Dicerna for US$ 3.3 billion; Novartis may have a buyer for Sandoz

The week saw several M&A deals. First, Novo Nordisk agreed to buy Dicerna Pharmaceuticals for US$ 3.3 billion in cash. Dicerna specializes in therapeutics that counteract disease-causing genes.

The diabetes player has been looking for new approaches to drug development. Like many of its rivals, such as Amgen, Regeneron and Novartis, Novo is betting on RNA interference (RNAi) technology, where genes that contribute to disease are silenced or rendered ineffective.

In 2019, Novo had entered into a research collaboration with Dicerna to pursue several clinical candidates for disorders, including chronic liver disease, non-alcoholic steatohepatitis (NASH), type 2 diabetes, obesity and rare diseases. The transaction, which will mainly be financed by debt, is expected to close in the fourth quarter of 2021.

Buyer for Sandoz: In October-end, there was news that Novartis had commenced strategic review of its generic drugs division — Sandoz. This week, German newspaper Handelsblatt has reported that Sweden-based investment group EQT and the Struengmann family of Germany are considering a joint move to purchase the generics outfit for US$ 21.6 billion,

The price would make it the largest pharma deal of the year. EQT and Struengmann, who provided the investment power behind BioNTech, have attracted interest from other private equity investors to join the group, the report said.

Neurocrine in US$ 2.6 billion biobucks deal with Sosei: Neurocrine Biosciences and Sosei Heptares are joining hands for a range of early- to mid-stage neuro assets. The deal gives Neurocrine rights to a “broad portfolio” of drugs discovered by Sosei Heptares.

Neurocrine is paying US$ 100 million upfront and up to US$ 2.6 billion in various milestone payments. Additionally, Sosei is eligible to receive royalties on future sales of any products that result from the collaboration.

Earlier this year, AbbVie had returned the rights to the drugs to Sosei Heptares. These drugs have yet to reach human testing. The most advanced of them — a potential treatment for schizophrenia — is expected to enter a mid-stage clinical trial in 2022.

GSK in pact with Arrowhead for NASH therapy: GlaxoSmithKline is foraying into non-alcoholic steatohepatitis (NASH), a fatty liver condition, by signing a US$ 1 billion asset pact with Arrowhead Pharmaceuticals. Under the pact, Arrowhead said it would get an upfront payment of US$ 120 million and is eligible for additional milestone payments, including up to US$ 190 million at first commercial sale of the product, and up to US$ 590 million in sales-related milestone payments.

The deal centers around Arrowhead’s experimental early clinical-stage RNAi therapy ARO-HSD, which is targeting HSD17B13, a member of the hydroxysteroid dehydrogenase family involved in the metabolism of hormones, fatty acids and bile acids, with the focus on NASH.

NASH affects millions of Americans, a large chunk of them being obese or those with type 2 diabetes. It causes a build-up of fat in the liver which can eventually lead to scarring and, in some cases, severe liver damage, liver failure and even death.

FDA suggests alternative approaches to assess nitrosamine risk

The US Food and Drug Administration (FDA) has suggested that drugmakers consider using certain antioxidants or excipients, such as sodium carbonate and ascorbic acid, in their drug products to inhibit the formation of nitrosamine impurities.

These approaches were outlined in a recent update on possible mitigation strategies to reduce the risk of nitrosamine impurities in drug products.

“These nitrosamine drug substance-related impurities (NDSRIs) are a class of nitrosamines sharing structural similarity to the API. NDSRIs can be generated during manufacturing or during the shelf-life storage period of the drug product,” FDA said. The agency expects manufacturers to ascertain the presence of nitrosamines, including NDSRIs, using the three-step mitigation strategy described in the agency’s guidance.

The update is meant to complement FDA’s guidance issued in September 2020 on controlling the risk of nitrosamine in drug products.

The first of these possible mitigation strategies is derived from reports showing that commonly used antioxidants, such as ascorbic acid (vitamin C) or alpha-tocopherol (vitamin E), inhibit the formation of nitrosamines based on data from human gastric fluid in vitro studies.

Another approach proposed by the FDA calls for using excipients such as sodium carbonate to “modify the micro-environment to neutral or basic pH.” According to the FDA, this should inhibit the formation of NDSRIs. The agency has said that regardless of the approach taken, “each manufacturer should determine the potential benefit from and demonstrate the suitability of any reformulation approach.”

Pfizer likely to cross US$ 100 billion in 2022 revenues, thanks to Covid drug, vaccine

Analysts have predicted that Pfizer’s revenue could reach US$ 101.3 billion in 2022, all thanks to the Covid-19 vaccine it has developed along with BioNTech and its antiviral drug — Paxlovid — that has shown impressive results in clinical trials.

Paxlovid could contribute US$ 24.2 billion in 2022 revenue, SVB Leerink analyst Geoffrey Porges said in a note. The contribution of its Covid vaccine could be around US$ 29.7 billion.

Revenues upwards of US$ 100 billion are unheard of in the pharma industry. Johnson & Johnson, the world’s largest biopharma company by revenue for years, recorded revenue to the tune of US$ 82.6 billion in 2020. Pfizer’s own revenue in 2018 was US$ 53.7 billion, before it separated its consumer health franchise into a joint venture with GlaxoSmithKline in 2019.

Acquires Trillium for US$ 2.2 billion: Pfizer has completed its acquisition of Trillium Therapeutics, a Canadian clinical-stage immuno-oncology company, for an aggregate purchase price of approximately US$ 2.22 billion.

In September 2020, Pfizer had invested US$ 25 million in Trillium. Pfizer’s key interest is in Trillium’s two lead molecules — TTI-622 and TTI-621. These are novel SIRPα-Fc fusion proteins that are currently in phase 1b/2 development across several indications, with a focus on hematological malignancies. Both molecules are also being tested to evaluate clinical potential in solid tumors.

Pharmacy chains in US helped fuel opioid epidemic, says federal jury

In the first jury verdict in an opioid case, this week a federal jury in the US found that pharmacy chain operators — CVS Health Corp, Walgreens Boots Alliance Inc and Walmart Inc — had substantially contributed to the crisis of opioid overdoses and deaths in two Ohio counties.

After six days of deliberations, jurors in Cleveland federal court concluded that the actions of pharmacy chains helped create a “public nuisance” that resulted in an oversupply of addictive pain pills and the diversion of those opioids to the black market.

Mark Lanier, a lawyer for Ohio’s Lake and Trumbull counties, called the verdict a “landmark decision,” and said it paved the way for the counties to seek more than US$ 1 billion each from the companies in redressal.

CVS, Walgreens and Walmart said they would appeal the verdict, and said it ran contrary to the facts. They said the verdict misapplied the public nuisance law to hold them liable under a legal theory that courts in California and Oklahoma have recently rejected in similar cases.

Over 3,300 opioid lawsuits have been filed in the US against drug manufacturers, distributors, and pharmacies. According to US officials, by 2019, the crisis had led to nearly 500,000 opioid overdose deaths over two decades.

All adults in America can take booster dose of Pfizer, Moderna’s Covid-19 vaccine

Last week, the US Food and Drug Administration (FDA) simultaneously expanded emergency use authorizations (EUAs) for both mRNA vaccines so that they can be used as boosters in adults (people aged 18 years and above). Given the recent rise in infections, the move allows millions of Americans to get additional protection against the virus.

On Friday, the director of the Centers for Disease Control and Prevention (CDC), Rochelle Walensky, signed off on the expanded eligibility after the FDA broadened its authorization of booster doses to all adults who had received their second shot of either the Pfizer-BioNTech or Moderna vaccine at least six months before. Those who received the single-dose Johnson & Johnson vaccine are also eligible for a booster dose of any of the vaccines after two months.

Meanwhile, Pfizer said this week that its Covid-19 vaccine provided strong long-term protection against the coronavirus in a late-stage study conducted among adolescents aged 12 to 15 year.

“The updated findings from the companies’ pivotal phase 3 trial show that a two-dose series of the Pfizer-BioNTech Covid-19 vaccine (30-µg per dose) was 100 percent effective against Covid-19, measured seven days through over four months after the second dose,” Pfizer said in a statement.

The vaccine was authorized for emergency use in people aged 12-15 years by the FDA in May and granted full approval for use in people aged 16 and above in August.

Merck completes acquisition of Acceleron; bags EMA’s authorization for molnupiravir

Merck completed its much talked about acquisition of Acceleron Pharma, making it the biggest biotech merger of the year.

The US$ 11.5 billion deal to acquire the biotech and its lead pulmonary arterial hypertension drug — sotatercept — had received enough pushback from Acceleron’s activist investors over the last few months.

Meanwhile, the European Medicines Agency (EMA) said last week that Merck’s antiviral molnupiravir can now be used to treat adults with Covid-19 who do not require supplemental oxygen and who are at increased risk of developing severe disease.

EMA’s authorization is based on data showing the drug reduced the chance that a newly diagnosed Covid-19 patient would be hospitalized or die by 50 percent.

The pill, known commercially in Europe as Lagevrio, has not yet been authorized in the US. The drug has to be taken twice a day for five days, and the EMA said it should be administered as soon as possible after diagnosis of Covid, and within five days of the start of symptoms.

AstraZeneca finally unveils its US$ 1.34 billion R&D campus in Cambridge

AstraZeneca formally unveiled its R&D campus in Cambridge, UK, built at a cost of US$ 1.34 billion (£1 billion). This swanky new facility spanning 19,000 square meters will boast of a suite of robotics, high-throughput screening and AI-driven technology, and will house 2,200 research scientists. This week’s grand opening had Prince Charles as the guest of honor.

Pascal Soriot had initiated the R&D centre in 2013, when he had taken over as the CEO of the drug behemoth. When AstraZeneca first announced its plans to build the new global R&D hub and corporate headquarters, the budget was US$ 500 million and the target was to move-in by 2016. From precision medicines to next-gen treatments, the company has high hopes for the site.

Reports positive results for its Covid antibody cocktail: Last week, AstraZeneca announced that its antibody cocktail offered 83 percent protection over six months. The data gives hope of additional protection to people who do not respond well to vaccines, such as cancer patients.

After six months of the treatment being administered, no severe cases of Covid-19 or deaths from the virus had been recorded among patients who had been given the antibody cocktail. In the placebo group, five participants contracted severe Covid-19 within six months of the start of the trial, and there were two Covid-related deaths.

The PharmaCompass Newsletter – Sign Up, Stay Ahead

Feedback, help us to improve. Click here

Image Credit : Phisper Infographic by SCORR MARKETING & PharmaCompass is licensed under CC BY 2.0

“ The article is based on the information available in public and which the author believes to be true. The author is not disseminating any information, which the author believes or knows, is confidential or in conflict with the privacy of any person. The views expressed or information supplied through this article is mere opinion and observation of the author. The author does not intend to defame, insult or, cause loss or damage to anyone, in any manner, through this article.”