By PharmaCompass

2019-09-12

Impressions: 3928

This week, Phispers has news on Novartis, as it pledged to disclose data integrity issues within five business days to the FDA, after facing backlash over its US$ 2.1 million gene therapy — Zolgensma.

The Swiss drugmaker also sold off its Chinese API unit to Zhejiang Jiuzhou for US$ 110.5 million.

The FDA is giving more time to companies to join the two quality metrics programs that it had launched in July last year.

Roche subsidiary Genentech has ended a civil lawsuit against Taiwan’s JHL over the theft of trade secrets pertaining to biotech versions of three antibody products.

Indian drugmaker Lupin has entered into a US$ 720 million cancer deal with Boehringer Ingelheim.

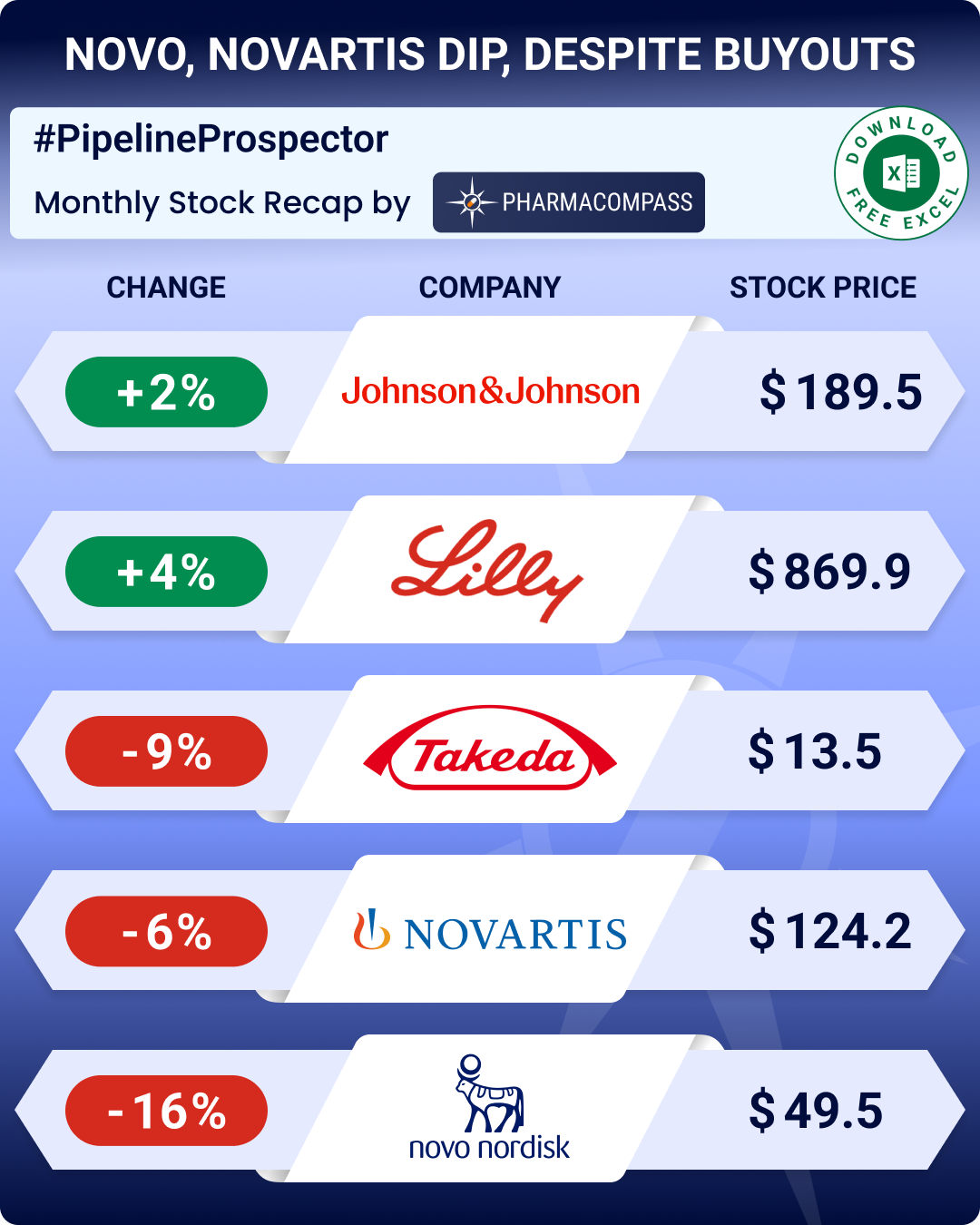

Novo Nordisk decided to follow the example of Sanofi and Eli Lilly and lowered the price of its generic insulin by 50 percent in the US.

And an FDA inspection held last month uncovered a ‘cascade of failure’ at the Ipca Laboratories’ plant in Silvasa (India).

After Zolgensma backlash, Novartis pledges to disclose data

integrity issues faster

Facing an uproar over data manipulation allegations involving its US$ 2.1 million gene therapy Zolgensma, Vasant Narasimhan, CEO of Novartis AG, pledged to tell regulators more promptly if credible questions emerge in future over data integrity.

Zolgensma treats spinal muscular atrophy, the leading genetic cause of death in infants.

Narasimhan also pledged to adopt a similar approach in other jurisdictions. This pledge comes after sharp comments by the acting US Food and Drug Administration (FDA) Commissioner Ned Sharpless, who without naming Novartis, singled the company out in his remarks before a health forum.

“We are making a voluntary commitment to notify the FDA within five business days of receipt by our quality (control) organization of any credible allegation related to data integrity impacting any pending application in the Novartis Group,” Narasimhan said at an investor event.

Five democratic senators had also lashed out at Novartis, and had said this “scandal smacks of the pharmaceutical industry’s privilege and greed.”

In early August, Novartis had said in a statement that it knew of discrepancies in the Zolgensma data it had submitted to the FDA before it won approval for the world’s most expensive medicine in May, but delayed informing regulators until June 28, as it was undertaking an internal investigation on the data.

Though the FDA has concluded that Zolgensma is safe and effective and should remain on the market, the agency has raised questions about the timing of the Novartis disclosure.

The Swiss drugmaker could face possible civil or criminal penalties, the FDA has said. Novartis said it gave “detailed explanations” on August 23 to the FDA about the company’s investigation into the data manipulation, and addressed regulators’ questions over why the company waited until late June to make the disclosures.

The company has said it has “exited” scientists it identified in its data manipulation probe. One of those scientists, Brian Kaspar, through his lawyer, has denied wrongdoing.

He also said Novartis has responded to FDA’s Form 483 and is making documents available as requested, while reiterating that the data manipulation uncovered at the San Diego site “does not impact the safety, efficacy or quality of Zolgensma.”

FDA inspection uncovers “a cascade of failure” at Ipca Laboratories in India

It has been over four years since the FDA banned the entry of finished drug products made by Ipca Laboratories in India. From a recent Form 483 issued to the India drugmaker, it seems like Ipca has a long way to go before the FDA is convinced that it meets its quality standards.

The warning letter issued to the finished drug manufacturing site located at Silvasa in January 2016 highlights that during the FDA inspection, the investigators found data-integrity issues in the Quality Control Lab.

Following an inspection of the same site from August 19 to 23, 2019, the FDA issued Ipca a Form 483, which reveals that the agency continues to have a lot of questions for the Indian drugmaker to answer on its approach to quality.

During the inspection, the FDA investigators observed “a cascade of failure” in its quality unit. And these failures pertain to “controls on issuance of GMP forms, review of laboratory testing data, conducting investigations” and conducting activities as per the written procedures.

The FDA investigators found that the Indian drugmaker had changed the computer system setting of its chromatography software to use the “inhibit integration” function which allowed it to calculate results based on “only select peaks of interest” and avoid integration of unknown peaks. Unknown peaks could represent impurities that were being excluded from the analysis and may have impacted the final decisions.

In another instance, quality control (QC) analysts were found to deviate from standard testing procedures for over 12 years while conducting dissolution tests and for more than over two years while conducting assay and related substances by HPLC (high performance liquid chromatography) tests.

The FDA also raised concerns after uncovering significant gaps in Ipca’s data integrity procedures with respect to handling of its electronic raw data.

Ipca also failed to investigate complaints in a timely manner as a complaint where “hair was found embedded in the tablet” was open for over five months. The absence of established timeline was also found to apply to changes and corrective actions as some changes had been open for almost three years.

Genentech agrees on MoU with Taiwan’s JHL to resolve trade secret theft dispute

In November 2018, we had reported on how former Genentech employees in the US were indicted by a federal grand jury for the alleged theft of Genentech’s trade secrets in order to help a company in Taiwan — JHL Biotech, Inc — develop drugs similar to those made by the Roche subsidiary.

Founded in 2012, JHL Biotech develops biosimilar drugs for China. The trade secrets theft was undertaken in order to guide the development of biosimilar versions of Rituxan (rituximab), Herceptin (trastuzumab) and Avastin (bevacizumab) – Roche’s ‘big three’ antibody products.

This week, there is news that the San Francisco-headquartered Genentech, which is a subsidiary of Roche, has drawn a line under its civil lawsuit with JHL Biotech over the theft of trade secrets, and has agreed to a path in order to resolve the dispute.

In a statement, Genentech said it had agreed on a “memorandum of understanding” with JHL in which the Taiwan company “is required to abandon development of and destroy all cell lines and cell banks associated with Genentech’s medicines…and cease from disclosing, using or sharing any confidential Genentech information in any way in its business”.

The MoU includes the right to conduct unannounced audits to ensure compliance with the agreement. Financial terms of the agreement were not being disclosed.

The company also said JHL had agreed to cooperate fully with Genentech’s investigation into the misappropriation of information at the South San Francisco facility.

Biotech is high on China’s agenda and in its Made in China 2025 policy. However, the US is increasingly losing faith on the Chinese, and biotech and Chinese cancer researchers are being put on notice.

The three ex-Genentech workers, and a JHL employee John Chan, had pleaded not guilty to criminal theft charges brought up by federal prosecutors last year and were released on bond. At the same time Genentech had begun preparing its own civil litigation against the defendants, which is pending the outcome of the federal case.

FDA gives more time for companies to join its quality metric

programs

In July last year, the FDA had announced two programs for quality metrics — the Quality Metrics Feedback Program and the 2018 Quality Metrics Site Visit Program. Companies that were interested in submitting a proposal under these programs were given time until August 28, 2018 to submit a proposal.

Last week, there was news that the FDA is reopening the submission period for its Quality Metrics Feedback Program for another 120 days. The agency has asked drug manufacturers to participate in the program by December 30, 2019. The FDA also reopened the submission period for the site visit program by 120 days.

The feedback program is intended to encourage new drug application (NDA) holders to request Type C Formal Meetings and abbreviated new drug application (ANDA) to submit pre-ANDA meeting requests to discuss quality metrics with FDA. The Quality Metrics Site Visit Program is aimed at giving FDA staff the opportunity to visit drugmakers and “observe how quality metrics data are gathered, collected, and reported to management.”

Novartis sells off Chinese API unit to Zhejiang Jiuzhou

Swiss drugmaker Novartis AG is selling off an ingredient operation in China that it opened 10 years back. China’s Zhejiang Jiuzhou is buying most of Suzhou Novartis in Changshu (China) for US$ 110.5 million (790 million yuan). The operation has about 340 employees.

A Novartis spokesperson confirmed the sale and said it is expected to be complete by 2019-end. Novartis said it believed Jiuzhou was in a better position to ensure jobs and growth at the plant.

The deal includes an agreement for the Chinese company to supply Novartis with ingredients. According to Dow Jones, the company said the deal will bolster its drug development and manufacturing capacities in China while improving its business prospects in Europe and the US.

The Suzhou unit was opened by Novartis in 2009. According to reports at the time, the company had invested about US$ 250 million in the three-building site, which also includes R&D facilities. It had big plans for the unit to support its global production. However, in time, the scenario changed and so did Novartis’ outlook on manufacturing.

Earlier, there were reports that six parties had evinced interest in Suzhou Novartis. Workers have been told that one of the three main manufacturing units will close in April 2020 and layoffs will begin then. The site is slated to maintain some production through next year.

Indian drugmaker Lupin in US$ 720 million cancer deal with Boehringer Ingelheim

Indian drugmaker Lupin and German drug maker Boehringer Ingelheim (BI) are joining hands to work on a cancer cure. BI has licensed an MEK inhibitor from Lupin that it intends to pair with its lineup of KRAS inhibitors, a cornerstone of its emerging cancer drug pipeline.

KRAS is a short name for the gene Kirsten rat sarcoma viral oncogene homolog, which makes a protein (KRAS protein) that is critical in promoting cell growth and survival in non-cancerous cells.

KRAS is one of the most challenging targets in cancer. Cancers driven by KRAS mutations are both common and deadly.

However, there are signs of progress in the KRAS field. Earlier this year, Amgen reported encouraging anti-tumor activity with its AMG 510 candidate, which targets a KRAS mutation known as G12C.

Through the MEK inhibitor, the two drugmakers will target specific cancer cells and potentially treat patients of skin and stomach cancer.

The German drugmaker is paying US$ 20 million upfront for rights to Lupin’s LNP3794 – which has cleared preliminary clinical trials in solid tumors – with up to US$ 700 million upon successful achievement of defined clinical, regulatory and commercial milestones.

Lupin is also expected to receive double-digit royalties on the sales of the product upon commercialization, which would take at least seven years.

Over the last few weeks, this is the second agreement in the KRAS area that BI has entered into, the previous one being a partnership with MD Anderson Cancer Centre in the US.

BI says Lupin’s MEK inhibitor will be combined with one of its candidates in the hope of providing “more effective and durable responses” in KRAS-driven tumors.

Other companies, such as Johnson & Johnson and Mirati, are also working on KRAS, but Lupin's partnership with BI is the first time an MEK/KRAS inhibitor combination will be put to the test.

Novo

follows Sanofi, Lilly; says it will offer generic insulin at 50 percent

discount

After Sanofi and Eli Lilly lowered the price of their insulin earlier this year, Novo Nordisk said it will offer cheaper insulin to Americans.

Novo will offer a generic version of its most heavily prescribed insulin drug — Novolog — used by about a million US patients, at a 50 percent discount compared to the current list price, the company said in a statement. The list price for one vial will now be US$ 144.68.

Novo will also introduce a so-called US$ 99 cash card program from January that patients can use to buy three vials or two packs of pens of Novo’s analog insulins for a flat cost of US$ 99. This would give most diabetics an adequate supply of insulin for one month.

President Donald Trump had made high prescription drug prices a top issue in the 2016 presidential campaign. And in April this year, a US congressional committee had called on executives from Novo, Sanofi and Eli Lilly to testify about the rising costs of insulin.

Following that, Sanofi had announced a cut in the cost of its insulin products to US$ 99 per month for uninsured patients and others who pay cash in the US. Similarly, Eli Lilly had started selling a half-price version of its Humalog insulin in May. The list price for Lilly’s authorized generic insulin — sold under the name Insulin Lispro — is US$ 137.35 per vial.

The PharmaCompass Newsletter – Sign Up, Stay Ahead

Feedback, help us to improve. Click here

Image Credit : #Phisper Infographic by SCORR MARKETING & PharmaCompass is licensed under CC BY 2.0

“ The article is based on the information available in public and which the author believes to be true. The author is not disseminating any information, which the author believes or knows, is confidential or in conflict with the privacy of any person. The views expressed or information supplied through this article is mere opinion and observation of the author. The author does not intend to defame, insult or, cause loss or damage to anyone, in any manner, through this article.”