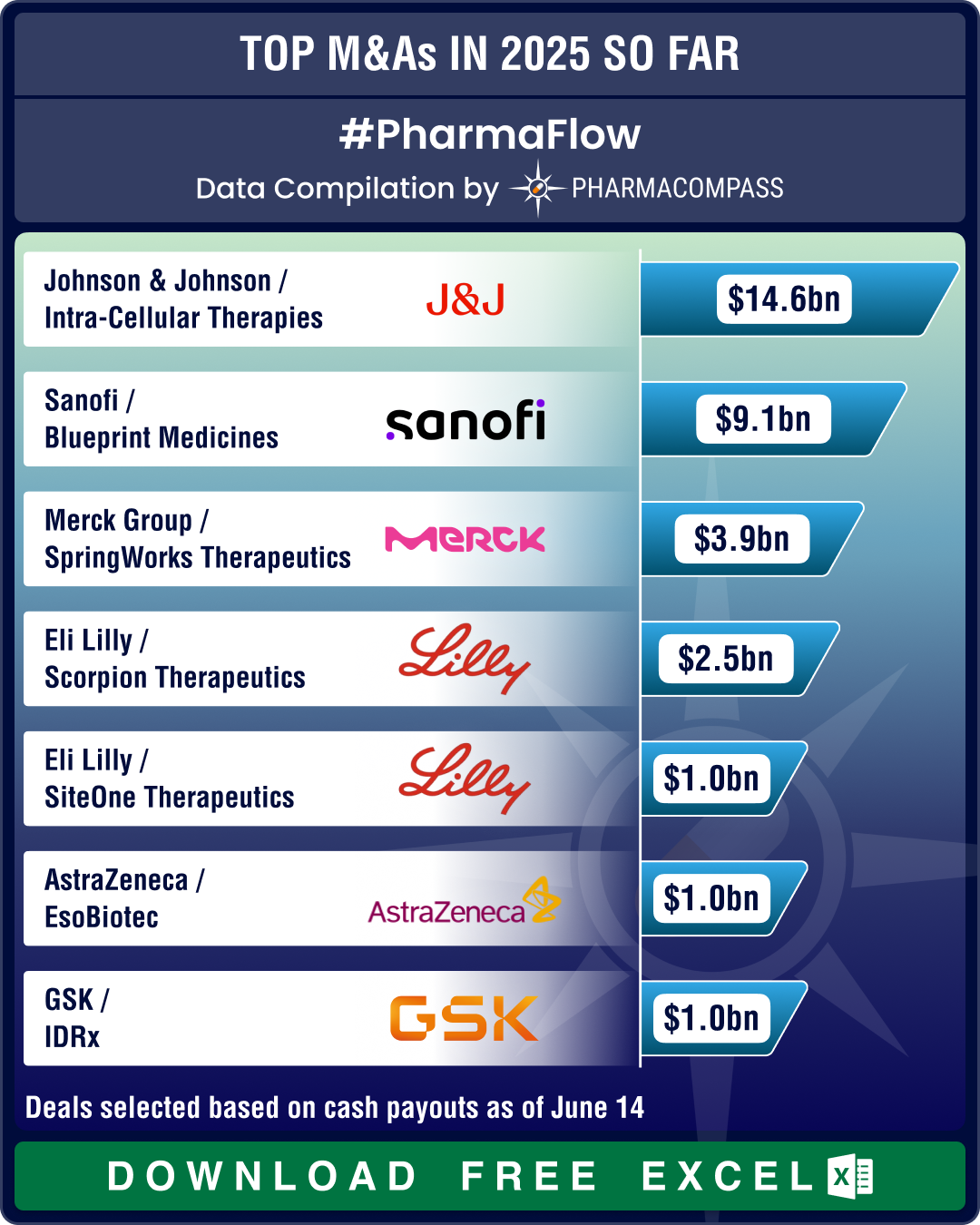

J&J’s Intra‑Cellular buyout, BMS’ oncology gambit, Sanofi’s Blueprint acquisition drive mega deals in H1 2025

The pharmaceutical industry has witnessed a wave of mergers, acquisitions, and strategic partnership

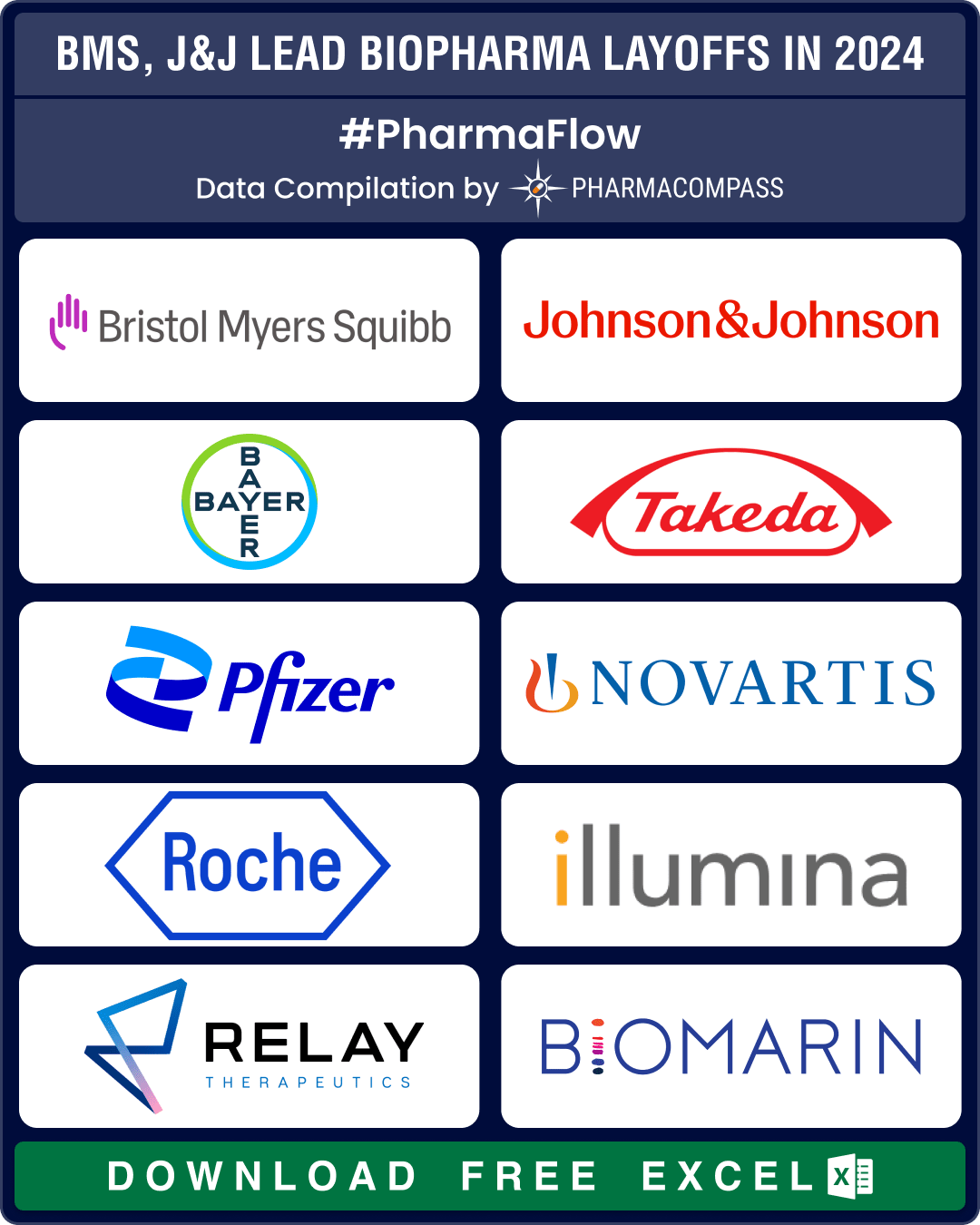

BMS, J&J, Bayer lead 25,000+ pharma layoffs in 2024; Amylyx, FibroGen, Kronos Bio hit by trial failures, cash crunch

Since 2022, there has been a significant surge in layoffs by pharmaceutical and biotech companies. W

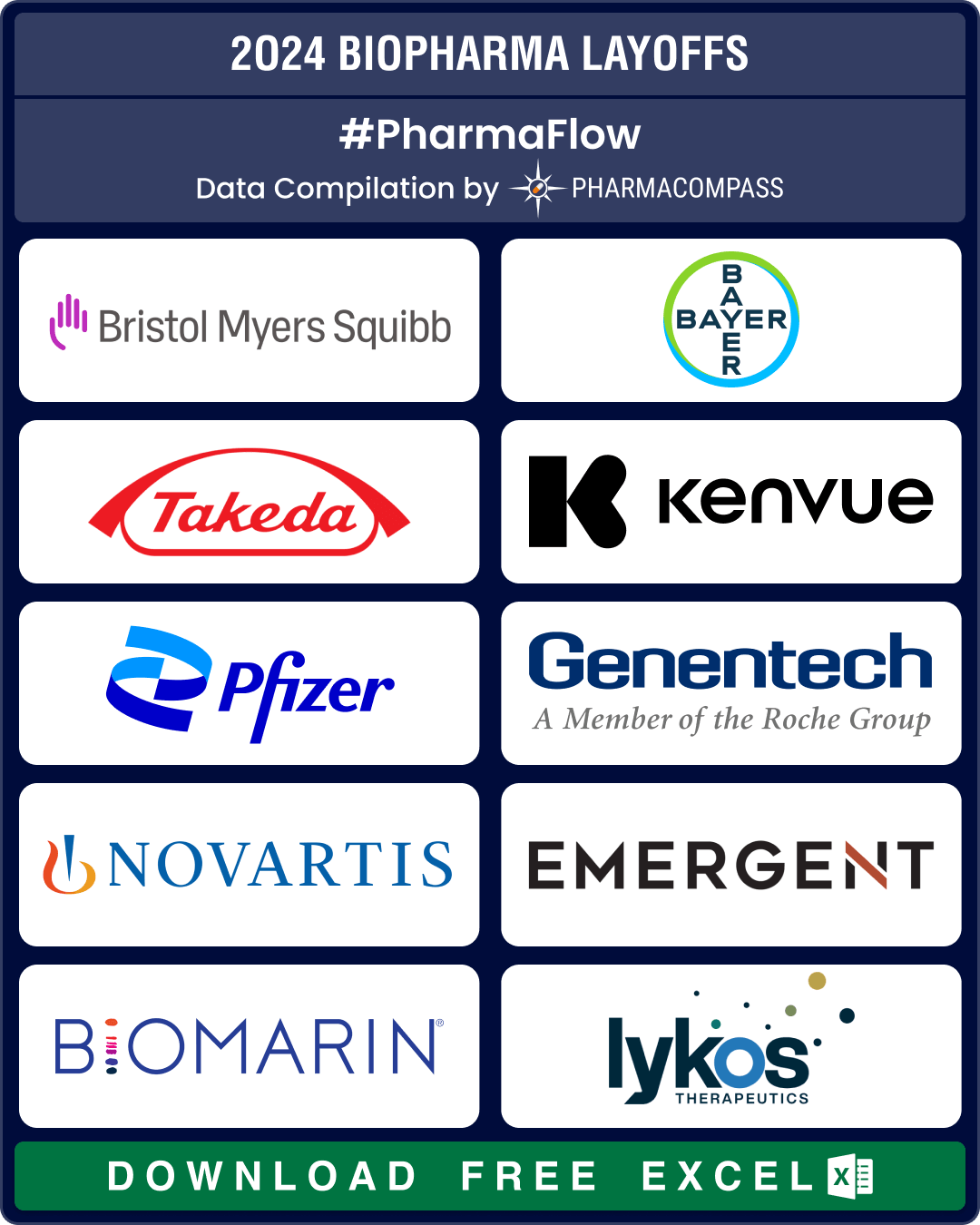

BMS, Bayer, Takeda, Pfizer downsize to combat cost pressures, meet restructuring plans

Over

the last two years, there has been a significant surge in layoffs by

pharmaceutical and biote

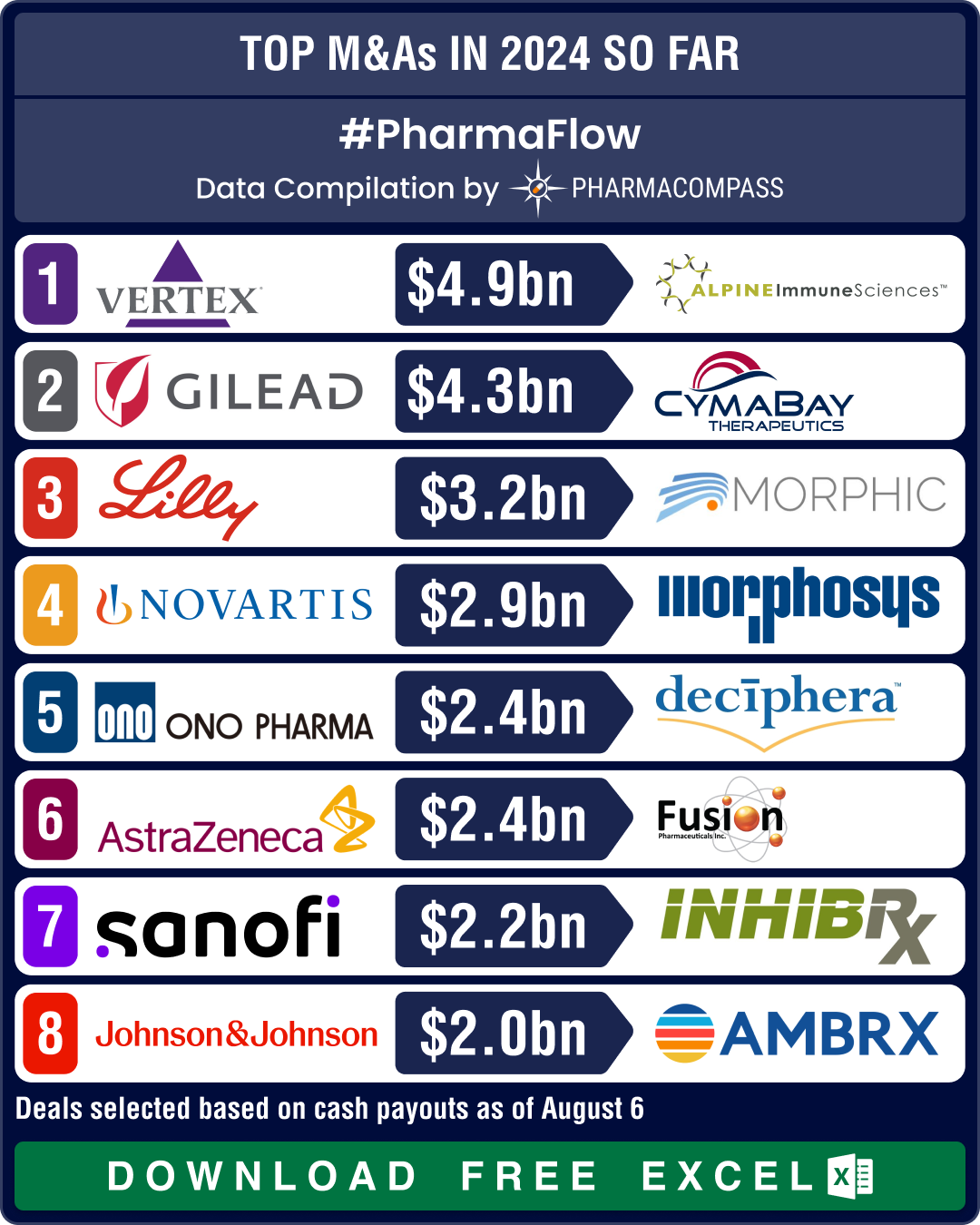

Novartis, GSK, Sanofi, BMS shell out over US$ 10 bn in dealmaking, as mid-size deals take centerstage in 2024

The world of pharmaceuticals and biotechnology continued to evolve

this year with strategic allianc

Market Place

Market Place Sourcing Support

Sourcing Support