By PharmaCompass

2021-09-09

Impressions: 2056

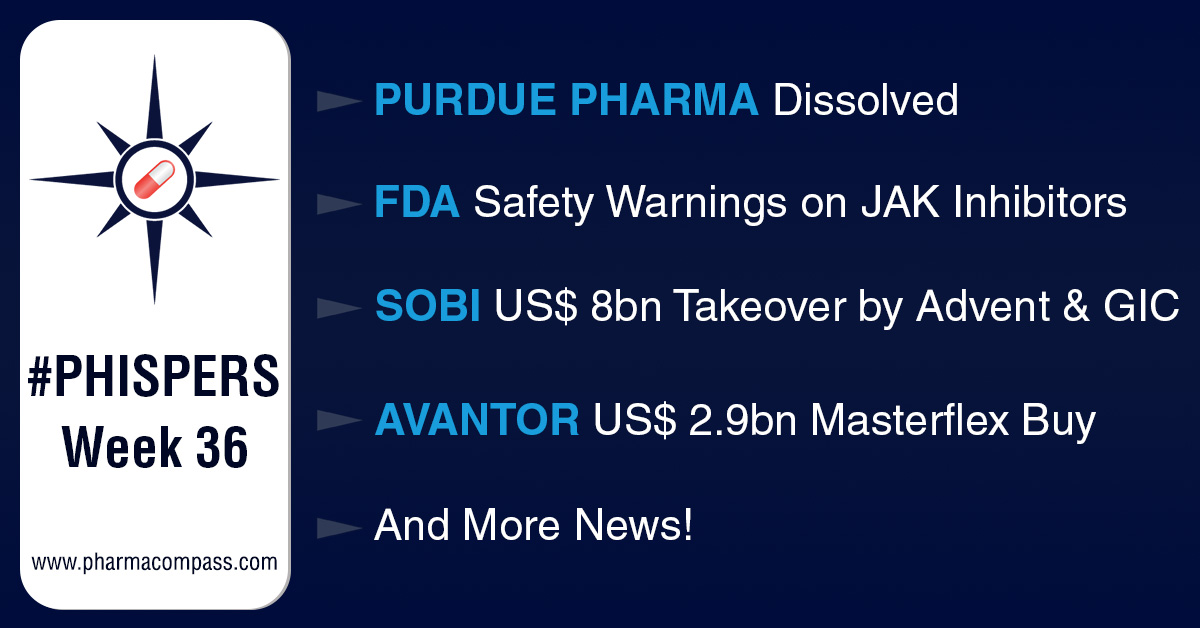

This week, Phispers brings you news on Pfizer’s Xeljanz, which underwent a post-approval study. Post the study, the US Food and Drug Administration concluded that the drug poses an increased risk of serious heart events, cancer and blood clots. As a result, it has asked Xeljanz and two other JAK inhibitors — AbbVie’s Rinvoq and Eli Lilly’s Olumiant — to carry the dreaded heart safety and cancer warnings.

It was a big week for M&As and partnerships. Swedish drugmaker Orphan Biovitrum (Sobi) said it has agreed to a US$ 8 billion takeover by US private equity firm Advent International and Singapore’s sovereign wealth fund — GIC Pte Limited. After acquiring Translate Bio last month, Sanofi announced this week it is buying American biopharma Kadmon Holdings for US$ 1.9 billion. American lab products provider Avantor said it will buy Masterflex from privately held Antylia Scientific in a US$ 2.9 billion deal to strengthen its Covid-19 therapy and vaccine manufacturing operations. And Roche said it is partnering with Adaptimmune Therapeutics to develop and commercialize allogeneic cell therapies for up to five shared cancer targets.

The US Bankruptcy Court has dissolved Purdue Pharma, the company infamous for fueling the opioid epidemic. In a settlement deal, the owners of Purdue — the Sackler family — will pay US$ 4.5 billion against all civil opioid claims in exchange for protections. Critics say the court has let the Sacklers “off the hook”.

The US Court of Appeals for the Federal Circuit ruled in favor of Pfizer and Bristol-Myers Squibb in a key patent fight over their blood thinner — Eliquis (apixaban). Both the drugmakers have welcomed the verdict, which is subject to appeal, and delays generics until 2031.

In Covid news, a Geneva based aid body — Global Fund — has said hundreds of thousands of people will die of tuberculosis, left untreated because of disruption to healthcare systems in poor countries caused by the Covid-19 pandemic. And the AstraZeneca CEO Pascal Soriot has said booster vaccine doses may not be needed for everyone in Britain and rushing into a nationwide rollout of third doses will put additional pressure on the National Health Service (NHS).

JAK inhibitors from Pfizer, AbbVie, Lilly to carry dreaded FDA heart safety, cancer warnings

Last week, the US Food and Drug Administration (FDA) asked three drugs — Pfizer’s Xeljanz, AbbVie’s Rinvoq and Lilly’s Olumiant — to carry new heart safety and cancer warnings.

All the three drugs belong to the JAK inhibitor class of medicines, and they already carry boxed warnings about blood clots and lymphoma.

The FDA required Pfizer to do a post-approval study of Xeljanz. In a statement, FDA said after a large randomized safety clinical trial of the arthritis and ulcerative colitis medicines Xeljanz and Xeljanz XR (tofacitinib), it concluded there is an increased risk of serious heart-related events such as heart attack or stroke, cancer, blood clots, and death.

“We are requiring new and updated warnings for two other arthritis medicines in the same drug class as Xeljanz, called Janus kinase (JAK) inhibitors, Olumiant (baricitinib) and Rinvoq (upadacitinib),” FDA said in a statement. Olumiant and Rinvoq have not been studied in trials similar to the large safety clinical trial with Xeljanz. “However, since they share mechanisms of action with Xeljanz, FDA considers that these medicines may have similar risks as seen in the Xeljanz safety trial,” the statement said.

Post this announcement, AbbVie’s stock fell by about 10 percent at one point last week. Rinvoq was once forecast to bring in about US$ 8 billion annually for AbbVie by 2025. An article in Fierce Pharma quoted Bernstein analyst Ronny Gal as saying that his team is reducing their peak sales estimate for Rinvoq from US$17.2 billion to US$11.2 billion.

Sobi agrees to US$ 8 billion takeover by US PE firm Advent and Singapore’s GIC

Last week, Swedish drugmaker Orphan Biovitrum (Sobi) said it has agreed to a US$ 8 billion takeover by US private equity firm Advent International and Singapore’s sovereign wealth fund — GIC Pte Limited.

Sobi’s board had unanimously recommended that shareholders accept the offer from Advent and Aurora (a nominated investment vehicle of GIC Special Investments Pte Ltd, a subsidiary of Singapore’s GIC).

“The board believes that the terms of the offer recognize Sobi’s long-term growth prospects, as well as the risks associated with those prospects, and provide certainty, in cash, to shareholders,” Sobi said in a statement.

Investor AB and Fjärde AP-Fonden, with Sobi stakes of about 36.45 percent and 6.96 percent respectively, have separately agreed to accept the US$ 8 billion (Swedish Krona 69.4 billion) offer.

The Sobi deal draws comparisons to AstraZeneca’s recent Alexion acquisition. Like Alexion, Sobi is also a rare disease player, with immunology being one of its two focus areas.

Sobi employs around 1,500 people worldwide and had posted revenues of US$ 1.77 billion (Swedish Krona 15.3 billion) in 2020. During the pandemic, Sobi has suffered from weakened demand for its drugs as healthcare has focused on Covid-19.

Sanofi acquires Kadmon Holdings for US$ 1.9 billion: Sanofi has been under considerable pressure to revive its drug pipeline and is also eager to overcome setbacks it has faced in the Covid-19 vaccine race. In order to bolster its drug pipeline, the French drugmaker had acquired US biotech Translate Bio for US$ 3.2 billion last month. And this week, it announced it is buying American biopharmaceutical company Kadmon Holdings for US$1.9 billion.

The acquisition supports Sanofi’s strategy to continue to grow its general medicines core assets and “will immediately add Rezurock (belumosudil) to its transplant portfolio,” Sanofi said in a statement.

Rezurock, a treatment for adult and pediatric patients 12 years and older with chronic graft-versus-host disease (cGVHD), bagged FDA approval in July this year.

“Kadmon’s pipeline includes drug candidates for immune and fibrotic diseases as well as immuno-oncology therapies,” the statement added.

Roche-Adaptimmune deal: Roche is betting big on off-the-shelf cell therapies. In a potential US$ 3 billion bio-bucks deal, Roche is partnering with Adaptimmune Therapeutics, a clinical-stage biopharmaceutical company focused on the development of novel cancer immunotherapy products. The company has sites in the UK and the US.

Roche’s Genentech unit will give US$ 150 million upfront to Adaptimmune to develop and commercialize allogeneic cell therapies for up to five shared cancer targets, the companies said.

The collaboration includes another US$ 150 million over the next five years for additional payments and development, unless the agreement comes to a halt prior to that. The bio-bucks could exceed US$ 3 billion, and Adaptimmune has the option to go for a 50-50 US profit/cost share for the off-the-shelf products.

Avantor to buy Masterflex for US$ 2.9 billion to bolster its vaccine manufacturing

This week, American lab products provider Avantor Inc said it will buy Masterflex from privately held Antylia Scientific in a US$ 2.9 billion all-cash deal to beef up its Covid-19 therapy and vaccine manufacturing operations.

The buyout will help Avantor take advantage of strong demand for Covid-19 vaccines. A top US health official said last week that the government plans to invest US$ 3 billion in the vaccine supply chain, as it prepares to begin offering a booster shot to Americans.

Illinois-based Masterflex manufactures products such as peristaltic pumps, used for research and production of biologic drugs, vaccines and cell and gene therapies. The deal is expected to close in the last quarter of 2021. According to Avantor, Masterflex is likely to add to its adjusted earnings in the first year after the deal’s close.

Purdue Pharma dissolved; Sacklers ‘let off the hook’ in US$ 4.5 billion settlement

The US Bankruptcy Court has put an end to a long legal battle over Purdue Pharma — the manufacturers of the highly addictive painkiller OxyContin that was accused of fueling the opioid epidemic. The court has dissolved the company, and has also approved the settlement deal. The deal shields the company’s owners — the Sackler family — against all civil opioid claims, in exchange for payments to the tune of US$ 4.5 billion.

The settlement deal faced much criticism for not going far enough in holding the Sacklers accountable. Under the deal, the Sacklers will pay about US$ 4.5 billion over the next nine years in exchange for protections, and Purdue Pharma will be transformed into a public benefits company aimed at fighting the opioid crisis. Individual Sackler family members have not pleaded guilty to any of the charges.

Several states, including Connecticut and Washington State, have already said they intend to appeal the judge’s ruling. Critics termed the decision an “insult” to victims of the opioid epidemic, that caused more than 500,000 deaths in the US. Bob Ferguson, attorney general for the state of Washington, criticized the deal as letting the Sacklers “off the hook…in exchange for a fraction of the profits they made.” A few hours after the decision, Ferguson filed an appeal.

BMS, Pfizer welcome US appeals court’s ruling that upholds Eliquis’ patents

Last week, the US Court of Appeals for the Federal Circuit ruled in favor of Pfizer and Bristol-Myers Squibb (BMS) in a key patent fight over their blood thinner — Eliquis (apixaban). In the ruling, the federal judge said that products made by Sigmapharm Laboratories, Sunshine Lake Pharma, and Unichem Laboratories infringed patents protecting Eliquis.

BMS and Pfizer have a profit-sharing agreement on the drug and the duo had settled with a number of generic companies. But Sigmapharm, Sunshine Lake Pharma, and Unichem opted to take their arguments to court.

The decision came about a month after one of three patents for Eliquis was set to expire. Two other patents for Eliquis, which was first approved in 2013, will not expire until 2026 and 2031.

BMS and Pfizer have said they are pleased with the decision that upheld the patents of Eliquis. “We believe in the value of science behind Eliquis and its therapeutic potential for patients, and the underlying intellectual property protecting these innovations,” a statement by the two companies said.

“Based on settlement agreements reached with other generic manufacturers, we currently expect generic entry could occur after 2026 but before 2031, subject to appeals and future challenges,” a BMS spokeswoman said. In 2019, Eliquis was BMS’ top-selling drug with sales of US$ 2.03 billion.

Pfizer and BMS had entered into a worldwide collaboration to develop and commercialize apixaban back in 2007.

‘Poor nations may see higher deaths due to TB, AIDS because of Covid-related disruptions’: Global Fund

A Geneva-based aid body — Global Fund — has said hundreds of thousands of people will die of tuberculosis (TB) left untreated because of disruption to healthcare systems in poor countries caused by the Covid-19 pandemic.

In a few of the world’s poorest countries, excess deaths from AIDS and TB could even exceed those from the coronavirus itself, Global Fund has said. Its annual report for 2020, released this week, shows that the number of people treated for drug-resistant TB in countries where it operates fell by 19 percent. A decline of 11 percent was reported in HIV prevention programs and services.

“Essentially, about a million people less were treated for TB in 2020 than in 2019 and I’m afraid that will inevitably mean that hundreds of thousands of people will die,” Global Fund’s executive director Peter Sands said.

During the lockdowns, clinics, staff and diagnostics normally used for TB were instead deployed for Covid-19 in countries such as India and across Africa. Sands said he expected further disruptions this year due to the Delta variant.

He said the decline in treatment for other diseases “underscores the need to look at the total impact of Covid-19 and measure success in combating it not just by the reduction in deaths due to Covid-19 itself but to the knock-on impact”.

Global Fund is an alliance of governments, civil society and private sector partners investing more than US$ 4 billion per year to fight TB, malaria and AIDS. The United States is its top donor.

Astra CEO on Covid booster dose: Even as the Pfizer and Moderna CEOs have stressed the need for a booster dose of their Covid-19 vaccine, AstraZeneca CEO Pascal Soriot said this week that booster vaccine doses may not be needed for everyone in Britain and rushing into a nationwide rollout of third doses risks piling extra pressure on the National Health Service (NHS).

“We need the weight of the clinical evidence gathered from real world use before we can make an informed decision on a third dose,” Soriot wrote in The Telegraph.

The PharmaCompass Newsletter – Sign Up, Stay Ahead

Feedback, help us to improve. Click here

Image Credit : Phisper Infographic by SCORR MARKETING & PharmaCompass is licensed under CC BY 2.0

“ The article is based on the information available in public and which the author believes to be true. The author is not disseminating any information, which the author believes or knows, is confidential or in conflict with the privacy of any person. The views expressed or information supplied through this article is mere opinion and observation of the author. The author does not intend to defame, insult or, cause loss or damage to anyone, in any manner, through this article.”