By PharmaCompass

2019-11-28

Impressions: 7582

This week, Phispers has news of a study that identifies 31 troubled biopharma companies that are at very high risk of going bankrupt in the next 12 months.

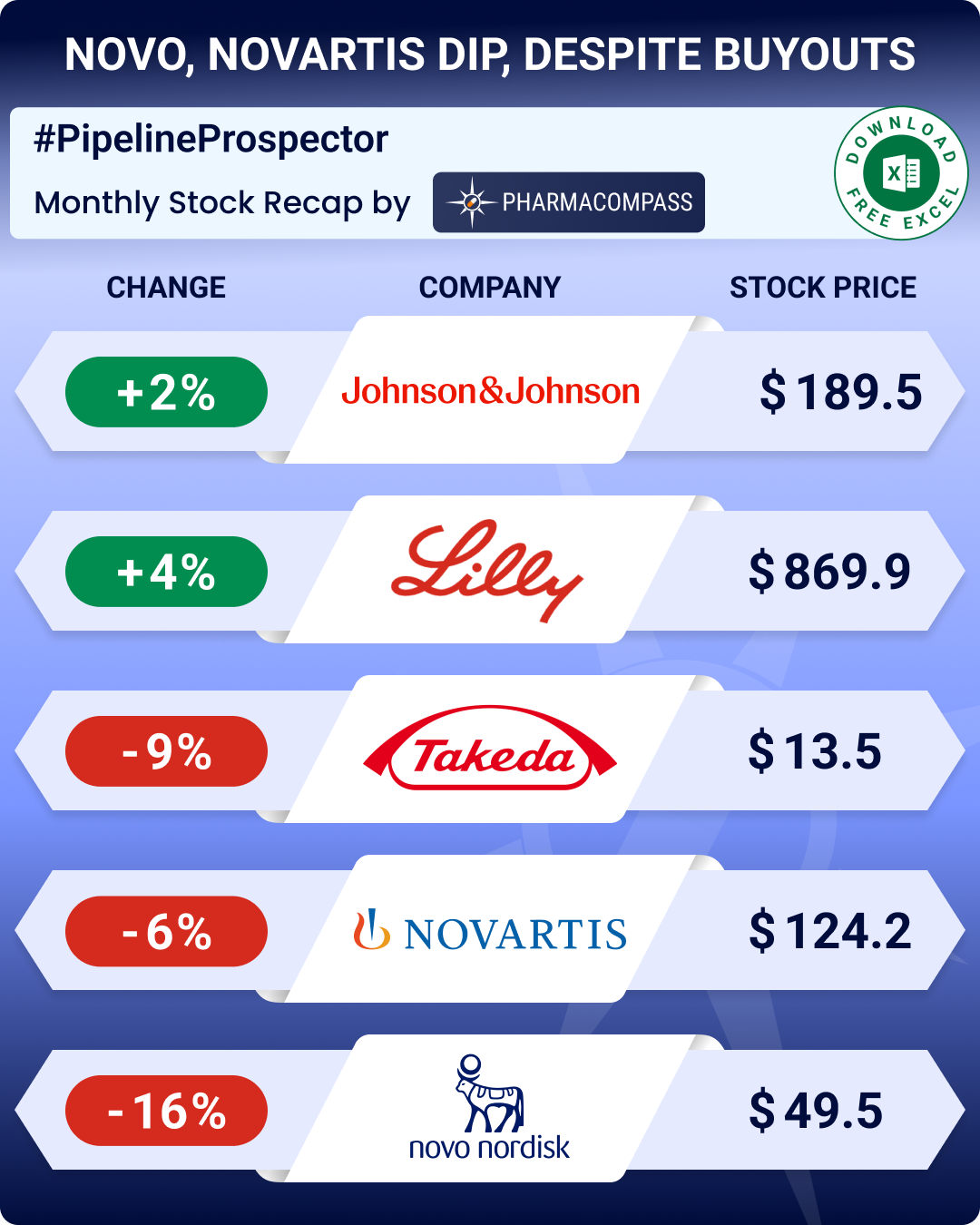

Novartis has agreed to buy The Medicines Company for US$ 9.7 billion.

After Chinese biotech BeiGene, this week there is news of another Asian firm — South Korea’s SK Life Science — winning the FDA nod for its epilepsy drug.

Sanofi’s new CEO Paul Hudson is likely to announce a new strategic plan in December and may sell or spin-off its consumer health unit.

And in compliance news, the operations of Aurobindo Pharma and Acharya Chemicals in India and Torrent Pharma in the US land in regulatory trouble.

Teva, Endo,

Amneal, Bausch among top companies likely to go bankrupt, says study

An analysis undertaken by BioPharma Dive has identified 31 troubled biopharma companies that are at highest risk of going bankrupt in the next 12 months. Amongst these are companies like Teva, Bausch Health, Endo International, Mallinckrodt and Amneal Pharmaceuticals. Also on high risk are small biotechs like Clovis Oncology and Puma Biotechnology.

BioPharma Dive used data from CreditRiskMonitor, a firm that calculates the probability that a company will go bankrupt in the next year using a 10-point scale called a FRISK score. The company says FRISK scores have been 96 percent accurate in predicting bankruptcy.

Though bankruptcy filings have typically been rare in the drug industry, they have ticked up this year primarily due to rising legal, political and market pressures.

Teva is the biggest company on the list. The Israeli drugmaker has struggled to chart a convincing path forward given its rising legal liabilities and eroding revenues. Teva also finds itself at the center of several prominent controversies.

Legally, Teva faces charges of helping spur an opioid epidemic and of conspiring to fix prices with other generic drugmakers.

In December 2017, hundreds of opioid-related court cases were consolidated into a case proceeding in the Ohio federal district court, with Teva one among many industry players facing charges. That led to a recent round of early settlements with two Ohio counties.

Along with these prominent legal battles, analysts have also voiced concern about Teva’s high debt levels, which stood at nearly US$ 27 billion as of the end of September this year.

Novartis agrees

to buy The Medicines Company

for US$ 9.7 billion

Novartis has agreed to buy New Jersey-headquartered The Medicines Company (MedCo) for US$ 9.7 billion. The buyout will give Novartis a late-stage PCSK9 therapy named inclisiran.

Inclisiran is a small, interfering RNA (siRNA) drug which works by blocking the synthesis of PCSK9 in the liver rather than targeting the protein itself.

This allows more receptors on the liver cell surfaced to capture LDL cholesterol to break down. By lowering LDL levels (popularly known as the ‘bad’ cholesterol), the likelihood of major cardiac events decreases.

“The prospect of bringing inclisiran to patients fits with our overall strategy to transform Novartis into a focused medicines company and adds an investigational therapy with the potential to be a significant driver of Novartis’ growth in the medium to long term,” Novartis CEO Vas Narasimhan said.

According to MedCo, the planned approval for inclisiran is set to be completed before the end of the year in the US, and in Europe in the first quarter of 2020, With Novartis picking up MedCo, the rumor mill is abuzz once again. Amarin is said to be another target of a big acquisition with an FDA decision on a heart-helping label expansion for Vascepa coming late next month and prescriptions for the lipid-lowering drug on the rise.

Some bullish investors also think the MedCo deal for PCSK9 candidate inclisiran could spell a buying boom in the cardiology space. They believe an Amarin deal could be worth more than US$ 20 billion, with suitors like Pfizer and Amgen speculated to be in the running. Amarin has not commented on these reports, which it terms as “rumor and speculation”.

After Chinese

firm, first Korean drug company bags FDA nod for its epilepsy drug

The US Food and Drug Administration (FDA) appears to be approving drugs from the Far East at a steady pace. Last week, we reported on the FDA approving zanubrutinib (branded as Brukinsa) developed by Chinese biotech BeiGene. The drug secured accelerated approval for adult patients with mantle cell lymphoma (MCL) — a typically aggressive and rare form of blood cancer.

This week, there is news that the agency approved a new treatment for partial-onset seizures in adults.

The drug — cenobamate — will be sold as Xcopri by SK Life Science, the US subsidiary of the massive Korean conglomerate SK Group. Xcopri will provide another therapeutic option for patients with epilepsy. This approval marks the first time a Korean company has independently brought a compound from discovery to FDA approval.

The company plans to hire a salesforce to support the drug’s launch, which is expected by the second quarter of next year. Xcopri is SK Life Science’s first commercial product.

Cho Jeong-woo, the CEO of SK Biopharmaceuticals and SK Life Science, said the Xcopri approval is a “major step” towards the Korean firm’s goal of becoming a “fully integrated global pharmaceutical company that can discover, develop and deliver new treatment options in epilepsy and central nervous system.”

The launch will take place after the requisite review by the Drug Enforcement Administration, which is typically completed within three months of the FDA approval.

The FDA nod wraps a decade of quiet growth from SK Life Science, which has been developing its presence in the pharmaceutical industry.

The FDA approval is based on results from two global, randomized, double-blind, placebo-controlled studies and a large, global, multi-center, open-label safety study.

Compliance Recap: Operations of Torrent, Aurobindo, Acharya Chemicals run into

trouble

Aurobindo Pharma: News of compliance problems at Aurobindo Pharma continues to emerge. Last month, a US Food and Drug Administration (FDA) inspection of the firm’s Unit VII had raised concerns over the data generated at the site and new Form 483s posted by the FDA showed similar problems at other units. At Unit V and Unit VIII, which were inspected in October 2019, the FDA found no scientific basis for Aurobindo’s quality control chemists to invalidate out-of-specification (OOS) results and investigation conclusions were not supported by scientific data.

Earlier this month, Aurobindo’s Unit IV, a key site for Indian generic major which generates between 10 to 15 percent of its revenues, was issued a 37-page Form 483.

The sterile drug manufacturing facility was found to have inadequate procedures to prevent microbial contamination of drug products. The environmental monitoring activities in the aseptic processing areas were found deficient as were the systems for maintaining any equipment used to control aseptic conditions. In addition, the quality control unit was found to lack authority to review production records to assure that no errors have occurred.

However, unlike the other units there were no concerns raised over the handling of OOS results.

Torrent Pharma: Two years back, the FDA warned manufacturers of non-sterile, water-based drug products of Burkholderia cepacia complex (BCC or B cepacia) contamination, as it had led to the presence of the water-borne opportunistic pathogen in pharmaceutical water systems. The contamination had led to product recalls.

Two years on, Torrent Pharma’s US manufacturing operations was issued a warning letter for failing to control the presence of BCC. Torrent’s US facility in Levittown, Pennsylvania, had discovered the presence of Burkholderia cepacia on its manufacturing equipment. It further identified that their water system was the source of the contamination.

Torrent’s facility in Levittown produces drug products such as rectal suppositories and oral solutions. Following the inspection, which was held from March 11 to April 9, 2019, the firm, committed to cease using its current water system and recalled all batches of drug product which were on the market.

People exposed to BCC are at an increased risk for illness or infection, especially patients with compromised immune systems.

Acharya Chemicals: An API manufacturer based in India — Acharya Chemicals — failed a cGMP inspection performed by the Swiss Agency for Therapeutic Products (Swissmedic) after the inspectors found two critical and three major deficiencies.

The firm that produces APIs such as metronidazole benzoate, amlodipine besylate and cetirizine dihydrochloride failed to address cross-contamination concerns as they did not take appropriate measures while introducing a new chemical entity into their production area. The non-compliance certificate also highlights dust and rust at the facility along with improper solvent recovery management.

Acharya Chemicals’ failure will impact another API manufacturer — Glochem Industries — as the firm supplies the key intermediate for Glochem’s amlodipine besylate and cetirizine dihydrochloride APIs and has been removed as a registered intermediate manufacturer from Glochem’s regulatory filings.

Sanofi CEO to

unveil new strategy in Dec; to sell or spin-off consumer health unit

French drugmaker Sanofi is considering a joint venture or outright sale of its consumer healthcare unit as it readies its new strategic plan that is likely to be announced next month, a Reuters news report said.

Sanofi’s newly appointed CEO Paul Hudson plans to meet investors for a capital markets day in Cambridge, Massachusetts, on December 10.

Also likely to figure in its new strategic plan is an initial public offering (IPO) of the consumer healthcare business, which could be worth around US$ 30 billion, sources said. However, no final decision had been made so far, they added.

According to analysts, divestment or spin-off of Sanofi’s consumer healthcare arm would enable the group to invest more in internal research. Revenue of the consumer healthcare arm grew by 3 percent at constant exchange rates last year to US$ 5.2 billion (Euro 4.7 billion).

Sanofi may also take decision about the future of Sanofi’s ailing diabetes business, which has been under constant pricing pressure in the US, while drawing up its new strategic plan.

Hudson said last month he and his teams would study the performances of every Sanofi division to decide where to invest.

“Prioritization will become increasingly important going forward,” Hudson had told reporters in October. “The reality in business is that some things are more important than others and we have to understand where we must win.”

Meanwhile, Muzammil Mansuri, Sanofi’s head of strategy and business development and member of the French drugmaker’s executive committee, will be retiring from the company. This is the first major management change under Hudson, who took over on September 1.

Mansuri had joined Sanofi in 2016 from Gilead Sciences where he was in charge of research and development strategy and corporate development.

Hudson said in the memo that Alban de la Sabliere, currently head of business development, and Laurent Van Lerberghe, head of strategy, would take on more responsibilities as of December 1 and report directly to him. Even though the group’s new strategy is still in the works, Hudson has made no secret that significant changes were underway.

The PharmaCompass Newsletter – Sign Up, Stay Ahead

Feedback, help us to improve. Click here

Image Credit : #Phisper Infographic by SCORR MARKETING & PharmaCompass is licensed under CC BY 2.0

“ The article is based on the information available in public and which the author believes to be true. The author is not disseminating any information, which the author believes or knows, is confidential or in conflict with the privacy of any person. The views expressed or information supplied through this article is mere opinion and observation of the author. The author does not intend to defame, insult or, cause loss or damage to anyone, in any manner, through this article.”