By PharmaCompass

2022-01-27

Impressions: 4437

The

year 2021 was the second year when the world was gripped by the coronavirus

pandemic. In 2019, the combined value of top 10 biopharma M&A deals was US$

207 billion, which included mega-deals like Bristol Myers Squibb-Celgene, Takeda-Shire and AbbVie-Allergan. The value slipped to US$ 97 billion in

2020 (when we saw

large deals such as AstraZeneca’s acquisition of Alexion and Gilead’s takeover of Immunomedics). And last year, the combined value of top 10 biopharma M&A deals slipped even further — to US$ 53 billion.

The first

two quarters of 2021 were particularly sluggish, and had the pace continued, we

would have seen a record low in recent years. However, M&A activity picked

up in the last quarter.

While a

large part of the reason behind the drop in value of top 10 M&A deals could

be the pandemic and the fact that the mega-mergers over the last few years took

some active players out of the M&A deals bazaar, the increasingly challenging antitrust environment in the US under the Biden administration certainly threw a spanner in companies’ plans for mega-mergers.

In March 2021, the Federal Trade Commission (FTC) and its counterpart competition enforcement agencies in the US, Canada, the UK and Europe launched a working group to update their approach to analyzing the effects of pharmaceutical mergers. This project seeks to address the varied competitive concerns that pharma M&As raise.

Smaller deals, in fact, helped in circumventing the anti-trust challenges posed by the FTC. Moreover, analysts have highlighted high valuations as a deterrent to M&As. As a result, the year saw several small deals, with big pharma companies hiving off non-core assets to streamline their interests, as well as their portfolios.

View Top 100 Pharma & Biotech Deals in 2021 by Deal Size (Free Excel Available)

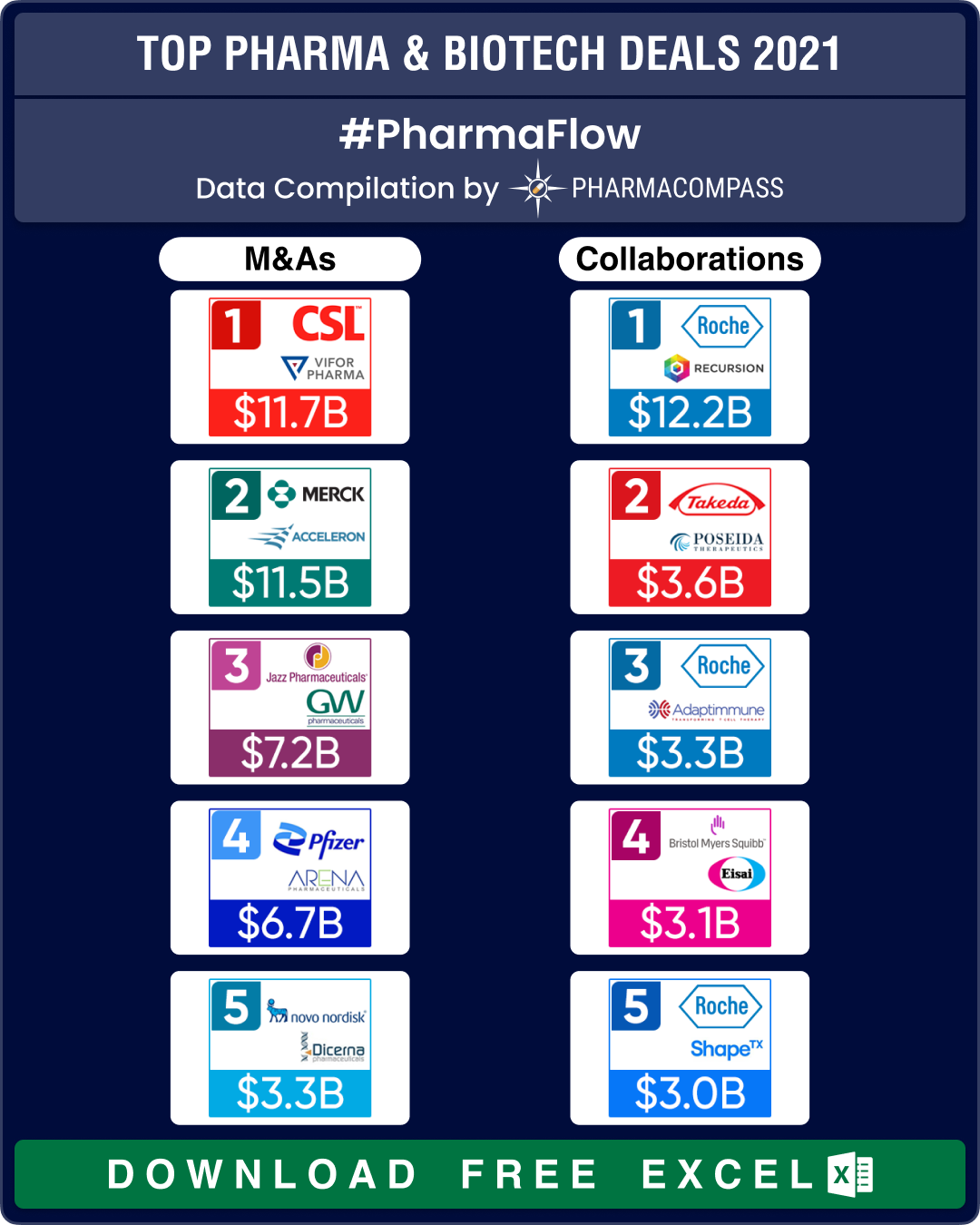

CSL-Vifor, Merck-Acceleron were 2021’s biggest deals

The largest biopharma deal of the year came in December when Australian giant CSL bought 88-year-old Swiss drugmaker Vifor for US$ 11.7 billion (about 10.9 billion Swiss francs) in an all-cash deal. The acquisition was part of CSL’s plan to diversify beyond its blood plasma collection business that has been hit by the Covid-19 pandemic.

The deal is expected to get completed by mid-2022 and will give CSL access to Vifor’s treatments for iron deficiency, kidney and cardio-renal diseases, along with its production sites in Switzerland and Portugal. Following the acquisition, CSL’s pipeline of products will increase to 37 in the development phase – a 32 percent increase over its existing suite of drugs in the pipeline.

Coming

a close second was Merck’s acquisition of Acceleron Pharma for US$ 11.5 billion in September, albeit with some pushback from Acceleron’s shareholders. The acquisition, which got completed in November, is part of Merck’s plan to diversify beyond Keytruda, its immuno-oncology blockbuster drug. It will give Merck access to Acceleron’s lead clinical candidate and potential first-in-class pulmonary arterial hypertension (PAH) drug — Sotatercept — that is expected to post US$ 2 billion in peak sales.

The third biggest deal of 2021 was Jazz Pharmaceuticals’ acquisition of GW Pharmaceuticals, the UK-based manufacturer of the first prescription cannabinoid medicine — Epidiolex — approved by the US Food and Drug Administration (FDA), in a deal worth US$ 7.2 billion. Epidiolex is an oral solution of cannabidiol derived from the cannabis plant. In 2018, the FDA approved the use of this drug to treat Lennox-Gastaut syndrome and Dravet syndrome, two severe early-onset epilepsies. Since then, the drug has also been cleared for tuberous sclerosis complex, a genetic disorder characterized by the growth of numerous noncancerous (benign) tumors in many parts of the body.

View Top 100 Pharma & Biotech Deals in 2021 by Deal Size (Free Excel Available)

Pfizer, Sanofi on shopping spree

Buoyed

by the skyrocketing sales of its Covid-19 vaccine, developed along with its

German partner BioNTech, New York-headquartered Pfizer Inc made investments in other

pipeline-boosting deals.

In December, Pfizer announced it is acquiring California-based Arena Pharmaceuticals for US$ 6.7 billion in cash to help strengthen its portfolio of gastroenterology and inflammatory drugs. The deal will help Pfizer gain access to Arena’s lead candidate — etrasimod — which is undergoing a late-stage trial in ulcerative colitis and a mid-to-late-stage study in Crohn’s disease. If approved, the drug would help Pfizer challenge Bristol Myers Squibb’s ulcerative colitis drug — Zeposia (ozanimod) — which received FDA approval in May 2021. The Pfizer-Arena deal is expected to close in the first half of 2022.

Pfizer’s second-largest acquisition in 2021 was its US$ 2.26 billion buyout of Trillium Therapeutics, which got successfully

completed in November. The deal focuses on Trillium's early-phase inhibitors of

the CD47 macrophage checkpoint. The drugs are designed to unleash the innate

immune system against cancers.

French drugmaker Sanofi was under considerable pressure in 2021 due to the setbacks it received in the race for introducing Covid-19 vaccines. In order to bolster its drug pipeline, Sanofi acquired US biotech Translate Bio for US$ 3.2 billion in August. And in September, it announced it is buying American biopharmaceutical company Kadmon Holdings for US$1.9 billion. Kadmon’s pipeline includes drug candidates for immune and fibrotic diseases as well as immunology therapies.

View Top 100 Pharma & Biotech Deals in 2021 by Deal Size (Free Excel Available)

Oncology, rare diseases, RNA therapies drive M&As

Like in

the past, oncology continued

to be a driver for M&As. Some of the bigger deals in the field of oncology

were Amgen’s acquisition of TeneoBio for US$ 2.5 billion, Pfizer’s acquisition of Trillium and Bayer’s buyout of Vividion Therapeutics for US$ 2 billion.

Rare diseases and immunology also triggered M&As. Horizon Therapeutics’ acquisition of Viela Bio, a rare disease drug company, for US$ 3 billion and Sanofi’s acquisition of Kadmon fall in this space. Through the acquisition of Viela Bio, Horizon will add FDA-approved drug Uplizna to its portfolio of rare disease drugs. Uplizna is the first and only FDA-approved B-cell-depleting humanized monoclonal antibody for the treatment of neuromyelitis optica spectrum disorder (NMOSD), a rare and severe autoimmune disease.

Another interesting development was the emergence of deals centered around ribonucleic acid (RNA). Through the US$ 3.3 billion acquisition of RNA interference (RNAi) specialist Dicerna, Novo Nordisk tapped into the potential of switching off-target proteins in the body. Dicerna develops RNAi-based therapies to selectively silence genes that cause or contribute to disease. The diabetes player has been on the lookout for new approaches to drug development.

Earlier

this month, Pfizer

strengthened its position in the mRNA space through three

new deals, including a US$ 3 billion deal with gene editing firm Beam Therapeutics.

Similarly, Sanofi acquired Translate Bio and its mRNA platform for expressing proteins — an approach that has gained prominence post the success of Covid-19 vaccines from Pfizer-BioNTech and Moderna.

In collaborations, Recursion — an artificial-intelligence-powered drug designer — signed a wide-ranging collaboration with Roche and its Genentech division. The molecule-mining deal could bring in over US$ 12 billion for Recursion. Similarly, Japanese drugmaker Takeda signed a research collaboration for gene therapies with Poseida Therapeutics that could bring in US$ 3.6 billion for the latter. And AstraZeneca licensed a drug from California-based Ionis Pharmaceuticals with an eye to challenge Pfizer and Alnylam.

In non-product deals, Thermo Fisher Scientific acquired North Carolina-headquartered clinical research organization (CRO) PPD Inc, for US$ 17.4 billion. And Dublin-based CRO Icon acquired PRA Health Sciences for US$ 12 billion.

View Top 100 Pharma & Biotech Deals in 2021 by Deal Size (Free Excel Available)

Big pharma show interest in hiving off non-core assets

Over

the last few years, we have seen big pharma spinning off their non-core

businesses. For instance, in 2020, Pfizer spun-out its generic drugs

business (Upjohn) into a joint venture with Mylan. And prior to that, GSK had finalized a consumer health JV with

Pfizer, with plans to split it into a separate company by 2022.

This trend continued in 2021 — Merck spun-out its women’s health portfolio, along with biosimilars and established medicines, into Organon. Similarly, Johnson & Johnson said it plans to de-merge its consumer health businesses and Novartis said it wants to sell Sandoz, its generics drugs unit.

GSK remains committed to spinning off the consumer healthcare business into a separate entity by mid-2022, though it announced earlier this month that its talks with Unilever have failed. GSK rejected a £50 billion (US$ 68.4 billion) offer from Unilever(made in December) for its consumer healthcare unit as the bid “fundamentally undervalued” the business and its future prospects. Unilever has said it will not raise the offer, and has effectively abandoned its plans to buy the unit.

View Top 100 Pharma & Biotech Deals in 2021 by Deal Size (Free Excel Available)

Our view

The year 2022 began with a rather modest buyout — Belgian biopharma UCB’s acquisition of epilepsy drugmaker Zogenix for US$ 1.9 billion. The deal will expand UCB’s portfolio of rare disease drugs and epilepsy treatments.

While this deal may signal that 2022 may be yet another year of low-value deals, PriceWaterhouseCoopers’ new report — Pharmaceutical and Life Sciences: Deals 2022 outlook — says we could see exceptional M&A activity during the year.

Bristol Myers Squibb’s announcement earlier this month that it is planning a slew of deals and M&As over the next two years to offset the loss of revenue from Revlimid and J&J CFO Joseph Wolk’s statement during a CNBC interview that it will be even more aggressive in deal-making in 2022 confirm PwC’s prognosis.

BMS expects to have around US$ 45 billion to US$ 50 billion in free cash flow between 2022 and 2024 to spend on a “balanced capital allocation strategy, prioritizing business development and returning cash to shareholders”. Similarly, J&J has US$ 32 billion in cash and marketable securities. “We are constantly looking at M&A as a key source of growth for our business. Our position in cash today makes us be more aggressive in that area,” J&J’s new CEO Joaquin Duato said.

“The continuation of the US$ 5 billion to US$ 15 billion biotech deals, combined with medium-sized pharma (US$ 50 billion) and medical device (US$ 25 billion) deals is expected to drive significant investment dollars in M&A. The sector could also see a large deal (US$ 100 billion or more) as part of a transact-to-transform strategy, given the continued need for scale,” says the report.

The year is also likely to see big pharma divest or spin off large, non-core businesses. “These transactions will free up capital and allow companies to achieve potential business investments in the future to meet their growth agendas,” says the report.

Larger deals are likely to materialize in the second half of 2022, “driven by a need for scale and an expected settling of the regulatory landscape,” it adds. For now, it certainly looks like 2022 will see a lot more action in the M&A space.

View Top 100 Pharma & Biotech Deals in 2021 by Deal Size (Free Excel Available)

The PharmaCompass Newsletter – Sign Up, Stay Ahead

Feedback, help us to improve. Click here

Image Credit : Top-100-Pharma-&-Biotech-Deals-2021 by PharmaCompass is licensed under CC BY 2.0

“ The article is based on the information available in public and which the author believes to be true. The author is not disseminating any information, which the author believes or knows, is confidential or in conflict with the privacy of any person. The views expressed or information supplied through this article is mere opinion and observation of the author. The author does not intend to defame, insult or, cause loss or damage to anyone, in any manner, through this article.”