By PharmaCompass

2021-01-28

Impressions: 3340

The year 2020 was a lot different from the preceding year, owing largely to the coronavirus pandemic. The year 2019 had begun with the US$ 74 billion mega merger of Bristol-Myers Squibb (BMS) with Celgene. In comparison, the merger and acquisition (M&A) activity in the first quarter (Q1) of 2020 was subdued, and a lot lower in value as key industry players channelized their resources towards developing vaccines and treatments for Covid-19.

However, M&A activity picked up in the second half of the year, which saw bigger deals, including eight of the top 10 M&As of 2020. As per Informa’s Biomedtracker, the total M&A activity in 2020 accounted for 166 deals and total partnerships accounted for 1,153 transactions with a cumulative value of US$ 131 billion and US$ 183 billion, respectively.

The year 2020 also saw several partnerships being forged to tackle the Covid-19 pandemic, including those in the areas of vaccine development, diagnostics, and treatments to manage the disease. Consequently, more than 300 respiratory disease-related deals were signed in 2020.

View Top 100 Pharma & Biotech Deals in 2020 by Deal Size (Free Excel Available)

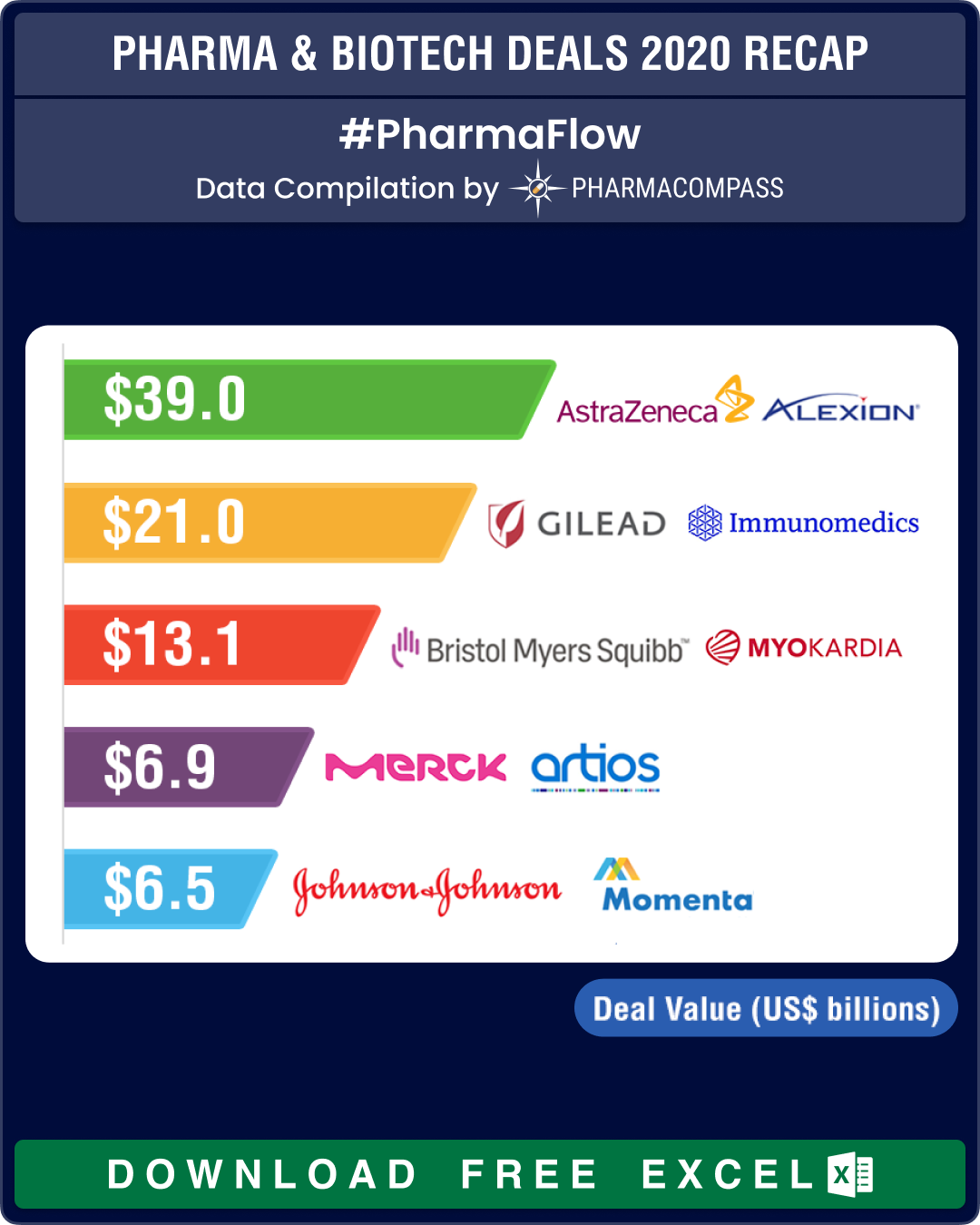

2020’s biggest deal: AstraZeneca buys out Alexion for US$ 39 billion

As the year drew to a close, AstraZeneca acquired Alexion Pharmaceuticals, a Boston-based company specializing in rare disease drugs, in a cash-and-stock deal worth US$ 39 billion.

The deal, which was announced in December 2020,

is expected to close between July and September this year. It is driven by

AstraZeneca’s desire to build a stronger presence in immunology and will make CEO Pascal

Soriot’s target of achieving US$ 40 billion in sales by 2023 a lot

more achievable. In 2019, Astra posted global sales of US$ 23.6 billion.

Alexion’s portfolio includes Soliris and Ultomiris that target C5, a key piece of the immune system. In addition, Alexion’s pipeline includes 11 molecules targeting proteins like Factor D, FcRn, etc.

Last year, Alexion posted sales of US$ 5 billion, led by its blockbuster drug Soliris, and has set a target of achieving US$ 9 to 10 billion in sales by 2025.

Alexion buys Portola: Earlier in May, Alexion announced a US$ 1.4 billion deal to buy rival Portola Pharmaceuticals to gain access to a treatment for reversing the effects of blood thinners.

Alexion will get Portola’s Factor Xa inhibitor reversal agent — Andexxa — that will mark a change in focus for Alexion. Andexxa was approved in the US in 2018 and brought in sales of US$ 111.5 million in 2019.

View Top 100 Pharma & Biotech Deals in 2020 by Deal Size (Free Excel Available)

Digital health deal of 2020: Teladoc to merge with Livongo

Digital health powerhouses — Teladoc and Livongo — announced a merger in 2020, giving rise to the largest digital health entity worth US$ 38 billion.

Teladoc purchased Livongo for US$ 18.5 billion. The deal is much larger than deals like Amazon’s acquisition of PillPack and Google’s US$ 2.1 billion acquisition of FitBit.

The combined tele-health company will continue with the name Teladoc Health and will enable clients, including healthcare providers, health insurers and employers, to offer a broader set of services.

The mega deal took place two days after Siemens Healthineers announced a US$ 16.4 billion offer for cancer radiotherapy player, Varian Medical Systems.

View Top 100 Pharma & Biotech Deals in 2020 by Deal Size (Free Excel Available)

Gilead, BMS, J&J make big acquisitions

In PharmaCompass’ recap report, Gilead Sciences led the list of New Drug Approvals by the US Food and Drug Administration (FDA) and European Medicines Agency (EMA) in 2020 with the highest estimated sales potential. The top drug on the FDA approved list was Gilead’s remdesivir, which received both FDA and EMA approval.

The second drug on the list was Immunomedics’ Trodelvy, rival to Daiichi’s DS-1062. Trodelvy (sacituzumab govitecan-hziy) was granted accelerated FDA approval in April for the treatment of triple-negative breast cancer in patients who received at least two prior therapies for metastatic disease.

In

September, Gilead acquired Immunomedics for US$ 21 billion, adding Trodelvy to its portfolio. According to a statement, Immunomedics is on track to file for Trodelvy’s

regulatory approval in Europe in the first half of 2021.

In March, Gilead had announced it is acquiring cancer biotech Forty Seven Inc for US$ 4.9 billion. Gilead will gain access to Forty Seven’s lead drug, magrolimab, that targets CD47, a molecule often known as the “don’t eat me signal”. Cancer cells use it to avoid the immune system. Gilead’s two major takeovers in 2020 contributed to its goal of becoming an oncology powerhouse.

BMS buys MyoKardia: In October, Bristol Myers Squibb and MyoKardia Inc announced a definitive merger agreement under which BMS will acquire MyoKardia for US$ 13.1 billion.

Through this deal, BMS gains mavacamten, an experimental heart disease therapy with blockbuster potential. The drug is being tested for treating obstructive hypertrophic cardiomyopathy — a disease where a heart muscle thickens and obstructs blood flow. BMS’ willingness to pay a hefty premium to buy MyoKardia reflects its belief that mavacamten can be a significant growth driver in the medium to long term.

J&J acquires Momenta: In August, Johnson & Johnson entered into a definitive agreement to acquire Momenta Pharmaceuticals in an all cash transaction worth approximately US$ 6.5 billion. With this acquisition, J&J has built up the autoimmune section of its pipeline.

The transaction, which was completed in October, includes full global rights to nipocalimab (M281), a clinically validated anti-FcRn antibody, and two other candidates in the clinic and some discovery projects in the works. Nipocalimab recently received a rare pediatric disease designation from the FDA.

View Top 100 Pharma & Biotech Deals in 2020 by Deal Size (Free Excel Available)

A year of collaborations

In 2020, not all big deals were mergers and acquisitions, collaborations also fared well. The biggest collaboration was the global strategic partnership between Merck and Artios Pharma, signed in December, for up to eight novel DNA damage response targets in oncology.

Artios is set to receive US$ 30 million in upfront and near-term payments, in addition to double-digit option fees and up to US $860 million in total milestones per target, taking the potential deal value to US$ 6.9 billion.

Prior to this deal, Merck had also signed a deal with Seattle Genetics to develop its antibody-drug conjugate (ADC) — ladiratuzumab vedotin. Merck plans to take an equity stake and pay nearly US$ 4.2 billion in a series of deals with Seattle Genetics.

View Top 100 Pharma & Biotech Deals in 2020 by Deal Size (Free Excel Available)

AstraZeneca announces deal with Daiichi

Daiichi Sankyo entered into a global development and commercialization agreement with AstraZeneca for its TROP2 directed DXd ADC — DS-1062 — currently in phase 1 clinical development for non-small cell lung cancer and triple negative breast cancer.

Daiichi Sankyo and AstraZeneca will jointly develop and commercialize DS-1062 worldwide, except in Japan where Daiichi will maintain exclusive rights.

Under the agreement, AstraZeneca will pay up to US$ 6 billion to Daiichi Sankyo which involves an upfront payment of US$ 1 billion and contingent payments of up to US$ 5 billion. AstraZeneca said the drug could bring US$ 1 billion or more in annual sales.

View Top 100 Pharma & Biotech Deals in 2020 by Deal Size (Free Excel Available)

Takeda leads 2020 divestments; offloads assets to reduce debt

In 2020, Japanese company Takeda continued shedding various assets to hit its goal of cutting operating costs and retiring the debt it took on to buy Shire Plc in January 2019.

In March, the drug company offloaded some of its non-core Latin American brands to Brazil’s Hypera Pharma. Under the agreement, Takeda will sell 18 branded prescriptions and consumer health drugs to Hypera for US$ 825 million.

Later, in the largest divestment of 2020, Takeda announced it has entered into an agreement to sell its consumer healthcare business unit to Blackstone for US$ 2.3 billion.

The portfolio to be divested includes a variety of OTC medicines and health products that generated total revenues of over JPY 60 billion (US$ 558 million) in 2019.

In September, Takeda further divested some non-core assets in Europe to Cheplapharm for nearly US$ 562 million. The portfolio, composed of non-core prescription pharmaceutical products, generated FY 2019 net sales of approximately US$ 260 million.

In 2020, Cheplapharm also secured AstraZeneca’s Atacand divestment in more than 70 countries for US$ 400 million, and Leo Pharma’s portfolio of four products for EUR 300 million (US$ 357 million).

Other major divestments made by Takeda in 2020 include its sale of OTC and non-core assets to Orifarm, its divestment of TachoSil to Corza Health, and its sale of select APAC assets to Celltrion.

View Top 100 Pharma & Biotech Deals in 2020 by Deal Size (Free Excel Available)

Our view

In a year that was ruled by the novel coronavirus, the biggest collaboration turned out to be the one between pharmaceutical companies and governments, as both sides worked together to bring Covid vaccines to market. For instance, in the US, the Trump administration’s Operation Warp Speed spent US$ 12.4 billion to finance the production and nationwide delivery of vaccines.

With several Covid-19 vaccines getting emergency use authorizations from regulators across the world, it seems 2021 should see a recovery in economic activity. Though 2020 was weak in mega mergers, AstraZeneca’s acquisition of Alexion indicates that M&A activity should bounce back in 2021.

As the focus on drug development constantly evolves, use the Pipeline Prospector, our free access database of global drug development deals and development updates, to get the insights necessary to drive your business forward.

Email us at support@pipelineprospector.com to learn more.

Access the Pipeline Prospector Dashboard for All Deals & Development Updates

The PharmaCompass Newsletter – Sign Up, Stay Ahead

Feedback, help us to improve. Click here

Image Credit : Pharma & Biotech Deals 2020 Recap by PharmaCompass is licensed under CC BY 2.0

“ The article is based on the information available in public and which the author believes to be true. The author is not disseminating any information, which the author believes or knows, is confidential or in conflict with the privacy of any person. The views expressed or information supplied through this article is mere opinion and observation of the author. The author does not intend to defame, insult or, cause loss or damage to anyone, in any manner, through this article.”