By PharmaCompass

2024-04-25

Impressions: 4876

The pharma industry clearly recalibrated itself in 2023, turning its focus away from Covid and onto two of the biggest threats to human health – obesity and cancer. The top lines of the major pharma companies reflect this shift in focus.

We always knew that Pfizer’s record US$ 100 billion revenue for 2022 wasn’t sustainable. Even though Pfizer’s 2023 sales were lower by nearly 42 percent against its 2022 sales, the New York-headquartered drugmaker managed to retain its pole position. The two main reasons behind its ‘top of the charts’ sales of US$ 58.5 billion were Pfizer’s record nine new molecular entity approvals by the US Food and Drug Administration (FDA) and the launch of its vaccine for respiratory syncytial virus (RSV).

Johnson & Johnson came second with sales of US$ 54.8 billion (excluding its consumer business and MedTech units). AbbVie took bronze despite Humira being subject to biosimilar competition and Merck maintained its fourth position. Roche nabbed the fifth position from Novartis (which stood sixth). Bristol Myers Squibb maintained its position at seven, as did AstraZeneca (eighth) and Sanofi (ninth). And Eli Lilly bumped into the tenth spot, knocking out GSK.

View Our Interactive Dashboard on Top Drugs in 2023 by Sales (Free Excel Available)

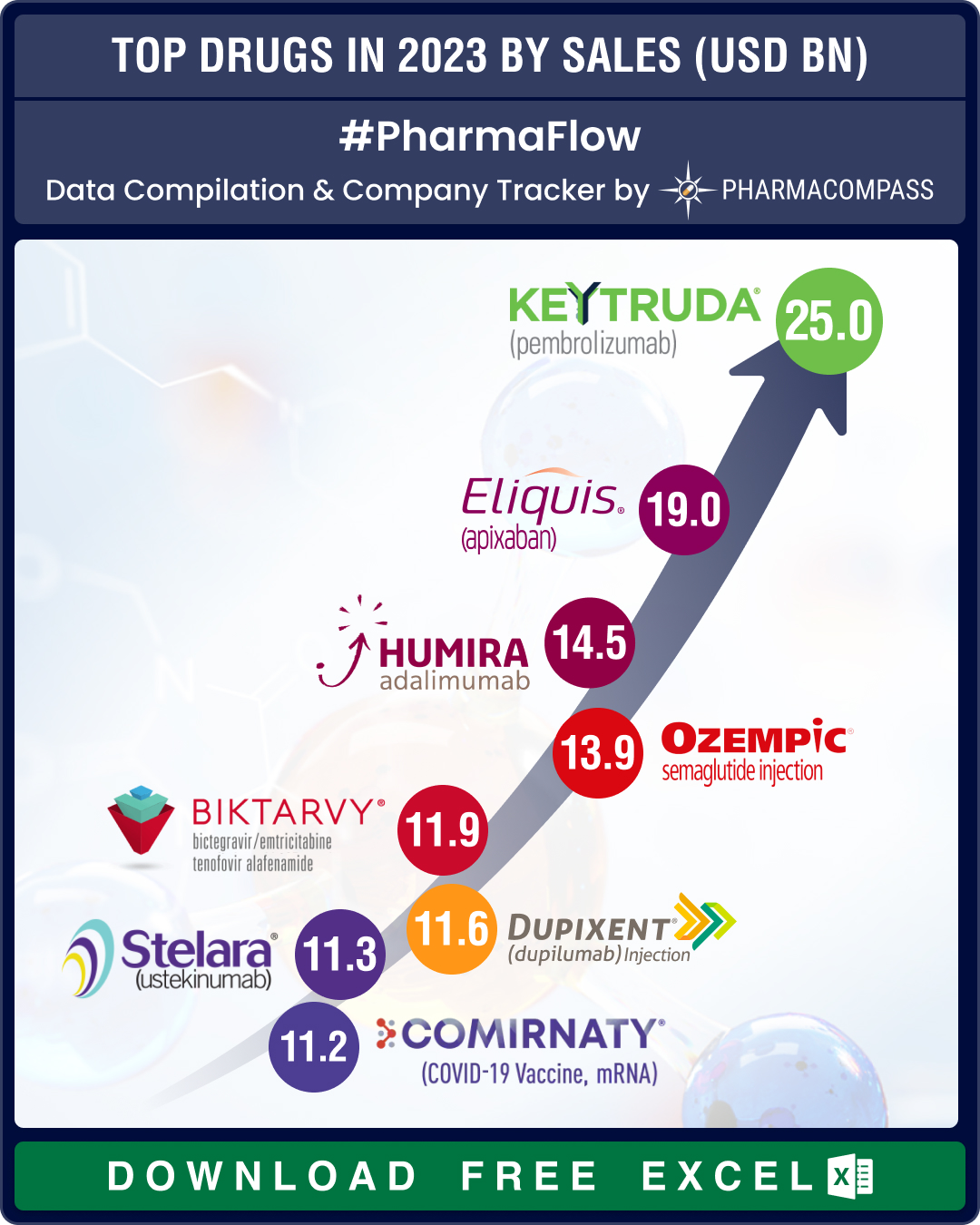

Keytruda, Eliquis, Humira top charts; Novo’s Ozempic debuts top 10 list at number four

Merck’s Keytruda became the number one selling drug in the world, a position that was held by AbbVie’s Humira for long, and Pfizer’s Comirnaty in the Covid years. This oncology drug raked in a whopping US$ 25 billion, with sales increasing 19 percent last year. In fact, Keytruda accounted for 46.7 percent of Merck’s pharmaceutical sales, which grew 3 percent in 2023 to US$ 53.6 billion.

At number two was Pfizer and BMS’ anticoagulant Eliquis — it posted global sales of US$ 18.95 billion (marking a growth of 4 percent on 2022 sales).

With competition from generics, Humira’s sales fell by 32 percent to US$ 14.5 billion. As a result, this blockbuster anti-rheumatic drug fell to the third rank.

The fourth spot was taken up by Novo Nordisk’s Ozempic, the wonder drug that treats type 2 diabetes. Gilead’s Biktarvy, a med that treats HIV-1, saw sales jump 14 percent — from US$ 10.39 billion posted in 2022 to US$ 11.85 billion last year. This way, Biktarvy emerged as the fifth largest selling drug of 2023.

At number six was Sanofi and Regeneron’s Dupixent. This allergic diseases med posted 11-figure sales in 2023, netting € 10.72 billion (US$ 11.59 billion) globally, a growth of 34 percent over 2022 numbers.

At number seven was J&J’s biggest blockbuster immunology drug Stelara that raked in US$ 11.3 billion in 2023. Coming a close eighth was Pfizer-BioNTech’s Covid-19 vaccine Comirnaty — its sales fell by over 70 percent to US$ 11.22 billion in 2023. At the ninth spot was Lilly and Boehringer’s diabetes drug Jardiance that saw a 27.7 percent increase in total global sales at US$ 10.6 billion. And rounding off the list at number 10 is BMS’s Opdivo, a Keytruda rival. Opdivo hauled in US$ 10 billion in total global sales in 2023, a year-on-year increase of 8 percent.

View Our Interactive Dashboard on Top Drugs in 2023 by Sales (Free Excel Available)

Driven by diabetes, obesity care meds, Novo, Lilly post double-digit sales growth

Demand for diabetes and new weight-loss drugs catapulted Novo Nordisk to emerge as the most valuable public company in Europe. Its net sales zoomed 31 percent to DKK 232.3 billion (US$ 33.75 billion) compared to DKK 177 billion (US$ 25.8 billion) in 2022. Net profit jumped 51 percent to DKK 83.68 billion (US$ 12.51 billion) in 2023 from DKK 55.5 billion (US$ 8.32 billion) in 2022 — the highest annual profit for the Danish drugmaker in over three decades.

The growth was driven by Ozempic, whose sales spiked 60 percent in 2023 to DKK 95.7 billion (US$ 13.91 billion), from DKK 59.8 billion (US$ 8.71 billion) the year before.

Rival Eli Lilly’s revenue grew 20 percent in 2023 to US$ 34.1 billion from US$ 28.5 billion in 2022. Mounjaro turned out to be a star for the Indianapolis drugmaker with its sales rocketing 970 percent in 2023 to US$ 5.16 billion. FDA also approved it to treat obesity under the brand name Zepbound in November, which brought in additional revenues of US$ 176 million.

View Our Interactive Dashboard on Top Drugs in 2023 by Sales (Free Excel Available)

GSK’s RSV jab makes strong debut; AbbVie’s immunology drugs post steep growth

GSK’s Arexvy was the first RSV vaccine approved by the FDA. It made a strong debut — Arexvy contributed £ 1.2 billion (US$ 1.5 billion) to GSK’s sales in just four months.

AbbVie posted another solid financial year. Though the drop in Humira revenue was offset by two newer immunology blockbuster drugs, Skyrizi and Rinvoq, the Illinois-headquartered drugmaker did posted a marginal decrease in revenue of 6.4 percent to US$ 54.3 billion. However, revenue from Skyrizi soared 50 percent to US$ 7.8 billion, while Rinvoq’s sales increased 57 percent to US$ 4 billion. AbbVie expects a combined US$ 16 billion from Skyrizi (US$ 10.5 billion) and Rinvoq (US$ 5.5 billion) sales in 2024.

BMS attributed its 2 percent decrease in revenue (of US$ 45 billion) to lower sales of Revlimid in the US due to competition from generics. Sales of the multiple myeloma treatment dropped 39 percent to US$ 6.1 billion. Ophthalmology drug Eylea saw a drop in sales of 4 percent, at US$ 9.21 billion (from US$ 9.65 billion), as competition from Roche’s Vabysmo triggered a price cut by Regeneron. Vabysmo saw sales balloon 324 percent from CHF 591 million (US$ 685.56 million) to CHF 2.4 billion (US$ 2.78 billion) in 2023.

View Our Interactive Dashboard on Top Drugs in 2023 by Sales (Free Excel Available)

Our view

According to data analytics company GlobalData, GLP-1 agonist drugs (such as Ozempic and Mounjaro that treat type 2 diabetes) are slated to overtake PD-1 antagonists (such as oncology drugs Keytruda and Opdivo) as the top-selling drugs on the market in 2024. It estimates a robust compounded annual growth rate (CAGR) of 19.2 percent from 2023 to 2029 for GLP-1 drugs that seem to have more benefits besides bringing down blood sugar levels (such as weight management, benefits to the heart etc).

The market size for GLP-1 is likely to increase to US$ 105 billion by 2029. In contrast, the data firm projects a CAGR of 4.7 percent in the PD-1 antagonist market, with its market size projected to be around US$ 51 billion in 2029. Given these projections, we are likely to see more movers and shakers in our top 10 drug list this year.

The PharmaCompass Newsletter – Sign Up, Stay Ahead

Feedback, help us to improve. Click here

Image Credit : TOP PHARMA DRUGS BY SALES IN 2023 (USD BN) by PharmaCompass license under CC BY 2.0

“ The article is based on the information available in public and which the author believes to be true. The author is not disseminating any information, which the author believes or knows, is confidential or in conflict with the privacy of any person. The views expressed or information supplied through this article is mere opinion and observation of the author. The author does not intend to defame, insult or, cause loss or damage to anyone, in any manner, through this article.”