By PharmaCompass

2021-03-04

Impressions: 2054

This week, Phispers brings you news on how the pandemic has compelled both the US and the EU to focus on strengthening their supply chains, particularly for drugs. There was also plenty of news on J&J’s single-shot Covid vaccine, as the US Food and Drug Administration (FDA) granted it an emergency use authorization. Post that, US President Joe Biden announced that Merck will manufacture the jab to overcome the shortfall at J&J’s end. He also said the country will have enough Covid vaccines for every American adult by May-end.

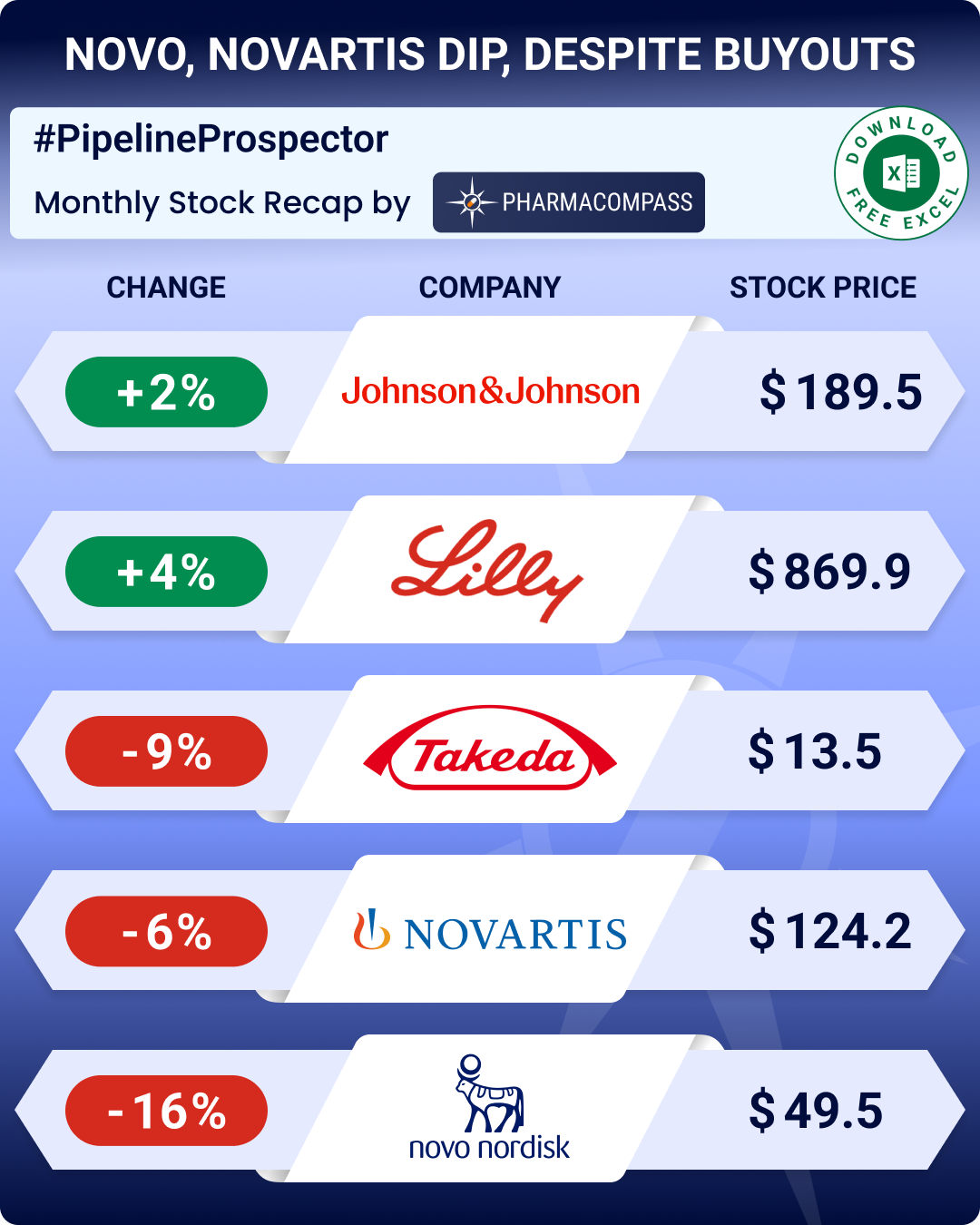

This week’s Phispers also has plenty of M&A news as Dublin-based clinical research organization Icon acquired PRA Health Sciences for US$ 12 billion, Takeda offloaded some more drugs, and Merck struck a US$ 1.85 billion deal to buy Pandion. AstraZeneca capitalized on the success of Moderna’s mRNA vaccine by selling its 7.7 percent stake in Moderna for US$ 1.2 billion.

Meanwhile, the drug industry stepped up pressure on the FDA to solve the growing backlog of inspections. Scientists are inventing a new approach to develop a vaccine for malaria that has properties similar to the RNA based vaccines for Covid. Post the US$ 600 million settlement in the opioid case, partners at McKinsey have voted out its top executive Kevin Sneader. And the generic industry eagerly awaits the outcome of the GSK-Teva case pertaining to a generic heart drug.

Biden administration focusses on fortifying drug supply chains; EU follows suit

US President Joe Biden wants to review the country’s API supply chain. In an order signed last week, Biden demanded a 100-day governmental review of key supply chains, including those pertaining to active pharmaceutical ingredients (APIs) used in American drugs.

In a keynote document, Biden’s team highlighted that 70 percent of US API producers had moved offshore in recent decades. This has made the supply chain vulnerable, especially in the event of more pandemics in the future.

“The American people should never face shortages in the goods and services they rely on, whether that’s their car or their prescription medicines or the food at the local grocery store,” Biden said.

“And remember, the shortages in PPE during this pandemic – that meant we didn’t have the masks; we didn’t have gowns or gloves to protect our frontline health workers.” According to Biden, this will never happen again in the US.

Following US’ example, this week, the European Commission also launched a structured dialog addressing drug supply chain initiatives, in order to safeguard the European Union’s supply of medicines.

FDA issues EUA for J&J’s single shot Covid vaccine; Merck to make it, says Biden

Last week, the US Food and Drug Administration (FDA) issued an emergency use authorization (EUA) to Janssen’s Covid-19 vaccine. Johnson & Johnson owns Janssen, a company headquartered in Belgium. This is the first single-dose vaccine to show efficacy, and the third vaccine to be granted an EUA by the FDA for the prevention of Covid-19. The EUA allows J&J’s vaccine to be distributed in the US for use in adults 18 years of age and older.

Unlike vaccines from Moderna and Pfizer-BioNTech, this jab does not need to be kept frozen while being shipped. FDA scientists have said the single-shot vaccine is effective and prevents hospitalizations from the disease.

J&J also revealed new, encouraging data that shows the jab may do a better-than-expected job at protecting patients against new variants of the coronavirus. However, according to the FDA, there is not enough information to draw any conclusions on the efficacy of this jab in people over the age of 75 years.

The United States had purchased 100 million doses of the J&J vaccine, with an option to buy another 200 million doses. However, the company had a limited number of doses for America’s vaccine rollout. Therefore, the US President Joe Biden has announced that Merck & Co will manufacture J&J’s vaccine. Biden has also said that the US will have enough Covid-19 vaccines for every American adult by the end of May.

The US government invoked the Defense Production Act to help equip two Merck plants to make the J&J vaccine. Biden also said plants already making J&J’s vaccine will step up production by making vaccines around the clock, all days of the week.

Drug industry increases pressure on FDA to solve growing inspection backlog

For the pharmaceutical industry, inspections are a key means of ensuring the safety of drugs. Due to the pandemic, the US Food and Drug Administration (FDA) was able to conduct only three inspections outside of the US from March-September 2020, as against over 600 inspections conducted in 2018 and 2019. The US sources over 70 percent of drug ingredients from countries like India and China.

The pandemic also prevented the agency from undertaking inspections within the US — it conducted only 52 inspections during March-September 2020, compared to roughly 400 each in 2018 and 2019.

This is resulting in delayed treatments. Last month, in a nearly 350-page report to Congress on the federal government’s Covid-19 response, the Government Accountability Office (GAO) had asked the FDA to review its inspections approach and come up with a plan to address its looming backlog.

With no end to the pandemic in sight, drug companies are putting pressure on the FDA to find a solution to the inspection issue, says a report published in Politico. In December, drug lobby PhRMA had warned that the FDA’s current approach “will increase the risk of drug shortages in the global supply chain … and could delay availability of new therapies.” And in late January, industry leaders made their case directly to FDA officials, says the report.

The FDA, on the other hand, has said it continues to perform “mission critical” inspections. It is likely to begin inspection at Jubilant Pharmova’s Roorkee plant in India this week, a CNBC report said. The FDA had classified the plant as an Official Action Indicated (OAI) in December 2018 after an inspection in August 2018.

Scientists explore vaccines based on RNA platforms to conquer malaria

Malaria, a disease that does not have an effective vaccine yet, is one of the leading causes of death around the world. In 2019 alone, there were an estimated 229 million cases of malaria and 409,000 deaths worldwide. Ninety four percent of the deaths were in Africa.

Malaria is associated with a parasite, Plasmodium, that contains a protein that inhibits production of memory T-cells, which protect against previously encountered pathogens. If the body can’t generate these cells, a vaccine is ineffective.

Researchers have now invented a promising new approach for developing a vaccine for malaria, and it has properties similar to the RNA-based vaccine for Covid-19.

The work is funded by Novartis Pharmaceuticals and the National Institutes of Health. GlaxoSmithKline is an assignee on the patent, which if approved, will allow the British drugmaker to produce the jab and make it available to the public.

AstraZeneca sells its 7.7 percent stake in Moderna for US$ 1.2 billion

The success of Moderna’s messenger RNA vaccine to prevent Covid-19 has fetched healthy returns for AstraZeneca. Back in 2013, when AstraZeneca’s CEO Pascal Soriot had just taken charge, he had made an investment of US$ 240 million in Moderna, which was then a startup. Later, the British drugmaker had invested another US$ 140 million. At one point, Astra was the second largest shareholder of Moderna after Flagship Pioneering.

This week, AstraZeneca has sold off its 7.7 percent stake in Moderna for US$ 1.2 billion in cash, in order to beef up reserves to wrap up its US$ 39 billion acquisition of Alexion and its rare disease pipeline. However, AstraZeneca is retaining its R&D collaborations with Moderna.

During the pandemic, the value of Moderna’s shares has steadily surged. It skyrocketed after its vaccine bagged emergency use authorization by the US Food and Drug Administration and was successfully rolled out across the world. Last week, Moderna had forecasted US$ 18.4 billion in revenue in its first year as a commercial-stage biotech.

M&A updates: Perrigo offloads generic business, Merck picks up Pandion

The world of clinical research organizations (CROs) witnessed a significant deal as Dublin-based CRO, Icon announced it will acquire PRA Health Sciences for US$ 12 billion. Once merged, the new entity could be the second or the third largest CRO in the world, according to some reports. The deal is expected to close in the third quarter of 2021.

Japanese drugmaker Takeda Pharmaceutical, which has been offloading drugs post its US$ 62 billion acquisition of Shire, has agreed to sell four diabetes products in Japan to Teijin Pharma for US$ 1.25 billion. Takeda will sell the Japanese marketing rights of the drugs Nesina, Liovel, Inisync and Zafatek to Teijin Pharma subject to regulatory approval, the company said in a press release.

Meanwhile, Merck has struck a US$ 1.85 billion deal to buy Pandion. Through this proposed acquisition of Pandion, Merck will add a pipeline of precision immune modulators and a drug design and discovery platform to its portfolio.

Pandion is developing therapies for the tissue-specific treatment of patients with autoimmune and inflammatory diseases and organ transplants.

And Perrigo, a leading global provider of consumer self-care products, announced it has reached a definitive agreement to sell its Generic Rx Pharmaceuticals business to Altaris Capital Partners for US$ 1.55 billion, including US$ 1.5 billion in cash, subject to customary adjustments.

“As part of the consideration, Altaris will also assume more than US$ 50 million in potential R&D milestone payments and contingent purchase obligations with third-party Rx partners,” a press statement said.

McKinsey votes out top executive after US$ 600 million opioid settlement

Last month, in a rare case wherein McKinsey & Company was held publicly accountable for its work with clients in the US, the consultancy firm agreed to pay nearly US$ 600 million to settle probes into its role in helping bolster opioid sales.

The settlements come after lawsuits unearthed documents showing how McKinsey worked to drive sales of Purdue Pharma’s OxyContin painkiller during the opioid crisis in the US.

Last week, partners at McKinsey & Company voted out its top executive, Kevin Sneader. The decision to deny Sneader a second three-year term as a global managing partner came through a vote by more than 600 senior partners. This was out of the ordinary — according to McKinsey’s internal history book, the last time a firm leader was denied a second term was in 1976.

Generic industry eagerly awaits outcome of GSK-Teva case

In October, a US court had ordered Teva to pay a penalty of US$ 235 million for selling a generic heart treatment — Coreg — that brought in sales of only US$ 74.5 million for the Israeli drugmaker. The penalty was over three times the revenues the drug had brought in for Teva and the matter then went to an appeals court.

The three-judge panel of the US Court of Appeals for the Federal Circuit heard arguments for the second time over in the US$ 235 million verdict won by GSK. And other generic drug manufacturers have been eagerly awaiting the verdict.

According to a Bloomberg report, the appeals court panel has indicated that it wants to ensure generic-drug makers can continue selling low-cost copycat medicines with limited-use labels as long as they don’t actively promote newer uses discovered by brand-name companies.

“This is not a true skinny drug label,” said Glaxo lawyer Juanita Brooks of Fish & Richardson. Skinny labeling refers to the practice of generic drug manufacturers seeking approval for some but not all the indications for which the branded drug has been approved.

The PharmaCompass Newsletter – Sign Up, Stay Ahead

Feedback, help us to improve. Click here

Image Credit : Phisper Infographic by SCORR MARKETING & PharmaCompass is licensed under CC BY 2.0

“ The article is based on the information available in public and which the author believes to be true. The author is not disseminating any information, which the author believes or knows, is confidential or in conflict with the privacy of any person. The views expressed or information supplied through this article is mere opinion and observation of the author. The author does not intend to defame, insult or, cause loss or damage to anyone, in any manner, through this article.”