By PharmaCompass

2020-01-16

Impressions: 7886

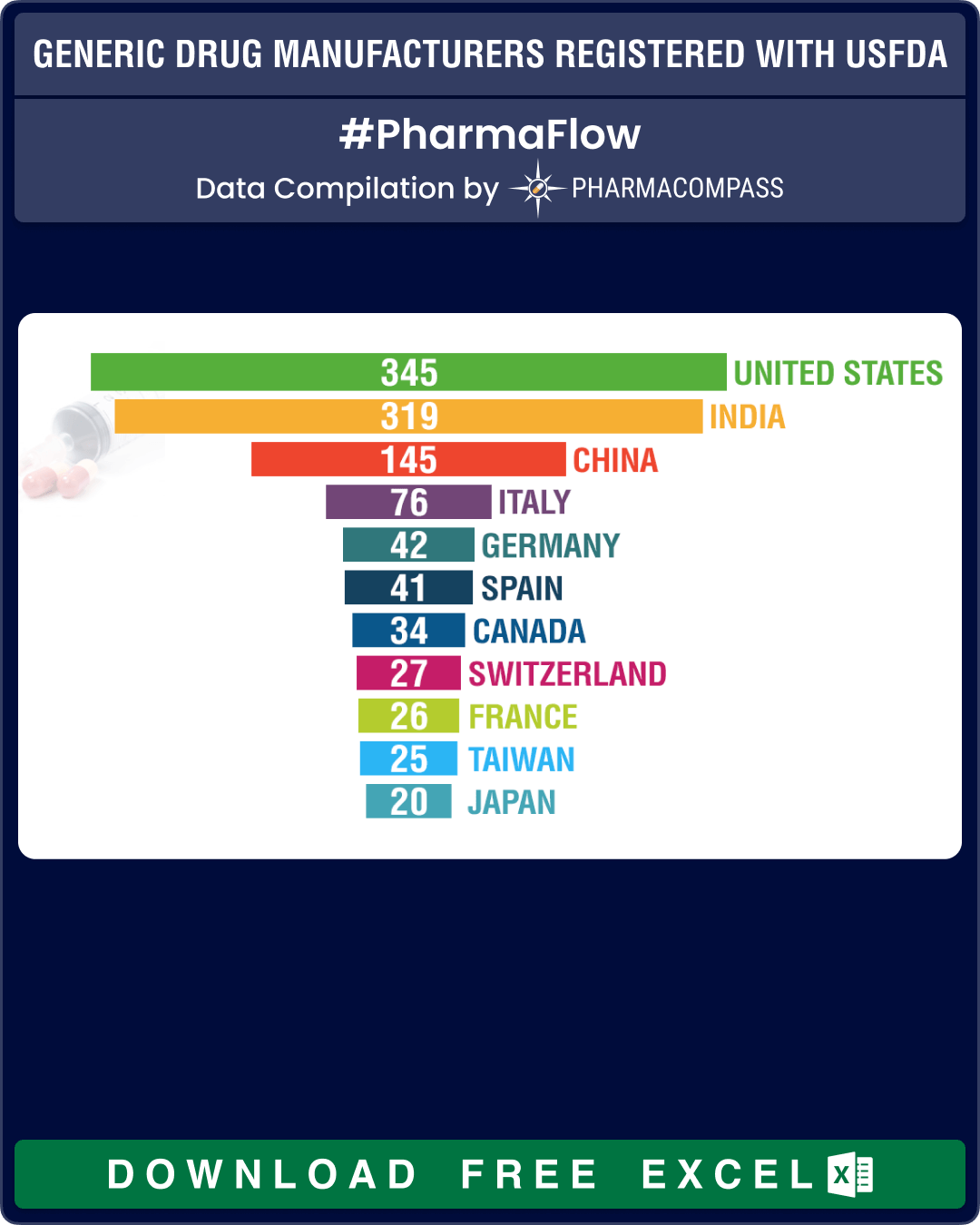

The number of facilities registered with the US Food and Drug Administration (FDA) to supply generic drugs has shrunk year after year. This week, PharmaCompass analyzed the FDA database of facilities that had paid the user fee under the Generic Drug User Fee Act (GDUFA) and found that the trend hasn’t changed — the number of facilities that are able to supply generic drugs to the US continued to be lower than in the previous years.

Viewed in the backdrop of US generic businesses that have been facing headwinds of increased competition, pricing pressure, channel consolidation and concerns over non-compliance, this evolution comes as a surprise as the user fees for this year were either marginally lower or remained unchanged when compared with the user fee for the previous few years.

Generic Drug Facilities Registered with the USFDA in FY 2020 (Free Excel Available)

The GDUFA law had been designed to accelerate the access to safe and effective generic drugs to the people of United States, while reducing the costs for the industry. The law mandates that all firms that manufacture human generic drug products and active pharmaceutical ingredients (APIs) for human generic drug products distributed in the US be subject to FDA’s user fees.

For this year, we found that a total of 1,267 facilities paid their user fees in which a little over half (51 percent, or 656 facilities) were API manufacturers, 30 percent (or 379) manufacture finished dosage forms (FDFs), 61 facilities produce both APIs and FDFs and there are another 174 sites that offer contract manufacturing services.

At 182, India continues to have the largest share of API facilities, which nearly equals the sites of China (100) and United States (84) combined. In Europe, Italy leads with 58 sites followed by Spain, that has 29 such facilities.

The number of Chinese API manufacturing facilities that paid their user fees dropped from 110 in the previous fiscal year to 100 this year.

For FDFs of human generic drug products, the largest number of facilities are in the United States — at 166 sites, followed by India (at 112) and China (at 29).

A total of 61 facilities that had not registered in 2019, registered with the FDA while 76 facilities that had paid their user fees in FY2019 failed to re-register.

India leads the list of new registrations with 21 facilities. This list includes companies like Dr Reddy’s, Sun Pharma, Aurobindo, Emcure and Glenmark. Among the firms that failed to register with the FDA were the operations of global majors like Hikma, Impax Lab, Johnson Matthey, Patheon, Sun Pharma and Vintage Pharma.

Generic Drug Facilities Registered with the USFDA in FY 2020 (Free Excel Available)

There were sites in India and China that have yet to pay their fees like the Indian operations of Wockhardt, Fresenius, Mylan, Neuland, Sun Pharma and those in China of Brightgene Pharma, CSPC Pharma, Lonza and Novacyl Wuxi.

Companies which have run into compliance problems with the FDA — like Vital Lab and Vista Pharmaceuticals — also do not figure in the FDA’s list of firms that have paid their facilities fee.

Moreover, there are 23 firms that changed their classifications on the FDA’s database. We have listed them out in the table below:

|

Company Name |

Facility Location |

2019 Classification |

2020 Classification |

|

Alidac Pharmaceuticals Limited |

India |

CMO |

FDF |

|

United States |

API & FDF |

FDF |

|

|

Annora Pharma Private Limited |

India |

CMO |

FDF |

|

China |

API & FDF |

CMO |

|

|

India |

API |

CMO |

|

|

Germany |

FDF |

API & FDF |

|

|

India |

CMO |

FDF |

|

|

Canada |

CMO |

FDF |

|

|

United States |

FDF |

CMO |

|

|

Japan |

API |

API & FDF |

|

|

India |

CMO |

FDF |

|

|

Hungary |

API & FDF |

API |

|

|

Italy |

FDF |

CMO |

|

|

Isomedix Operations Inc |

United States |

CMO |

API |

|

Finland |

FDF |

CMO |

|

|

Parsolex GMP Center, Inc. |

United States |

FDF |

CMO & FDF |

|

United States |

FDF |

CMO |

|

|

United States |

FDF |

CMO |

|

|

Germany |

CMO |

API |

|

|

United States |

FDF |

CMO |

|

|

United Kingdom |

FDF |

CMO |

|

|

China |

API |

CMO |

The classification change makes a significant impact on the user fee that has to be submitted to the FDA.

Generic Drug Facilities Registered with the USFDA in FY 2020 (Free Excel Available)

The new GDUFA II fees came into effect on October 1, 2019 and is applicable from October 1, 2019 until

September 30, 2020. The new fee (in US dollars) is listed in the table below, along with the fee for the previous two

years.

|

Fee category |

GDUFA II fee for FY 2020 |

GDUFA II fee for FY 2019 |

GDUFA II fee for FY 2018 |

|

Domestic API facility |

44,400 |

44,226 |

45,367 |

|

Foreign API facility |

59,400 |

59,226 |

60,367 |

|

Domestic FDF facility |

195,662 |

211,305 |

211,087 |

|

Foreign FDF facility |

210,662 |

226,305 |

226,087 |

|

Domestic CMO facility |

65,221 |

70,435 |

70,362 |

|

Foreign CMO facility |

80,221 |

85,435 |

85,362 |

Our view

Last year, the generic industry witnessed the announcement of the merger of Mylan with Upjohn, Pfizer’s off-patent branded and generic established medicines business, which is expected to close by the middle of this year. This was yet another attempt by pharma companies to become more profitable in an increasingly competitive generic business. The news came after Teva’s years-long restructuring efforts, wherein it plans to cut down US$ 3 billion in annual costs and pay down its massive debt load.

In late 2018, Novartis finally got rid of some troubled US generic assets by selling over 300 products and several development projects in its Sandoz US generic oral solids and dermatology business to Indian drug maker Aurobindo Pharma.

At a time when there is so much rhetoric around ‘lowering drug prices’, the number of facilities registered with the FDA has been reducing continuously over the past five years. Under such circumstances, it is highly unlikely that capacity rationalization has bottomed out in the industry.

Pharmaceutical manufacturing facilities don’t get created overnight. It takes years for them to refine their practices and comply with the FDA’s stringent compliance standards.

Over 80 percent of all prescriptions filled in the United States are for generic drugs. If the US wants continued access to safe and affordable generic drugs, the country needs to see an increase in the number of facilities registering with the FDA.

Generic Drug Facilities Registered with the USFDA in FY 2020 (Free Excel Available)

Our report was updated on January 24, 2020, to accurately reflect the status of Mylan’s merger with Upjohn, as the deal is yet to close. We also received clarification from companies that some sites which had not paid their facility fee are likely to do so in the coming future. The errors carried in our previous version are regretted.

The PharmaCompass Newsletter – Sign Up, Stay Ahead

Feedback, help us to improve. Click here

Image Credit : Generic Drug Manufacturer Registered with USFDA by PharmaCompass is licensed under CC BY 2.0

“ The article is based on the information available in public and which the author believes to be true. The author is not disseminating any information, which the author believes or knows, is confidential or in conflict with the privacy of any person. The views expressed or information supplied through this article is mere opinion and observation of the author. The author does not intend to defame, insult or, cause loss or damage to anyone, in any manner, through this article.”