By PharmaCompass

2022-09-29

Impressions: 1,997 Article

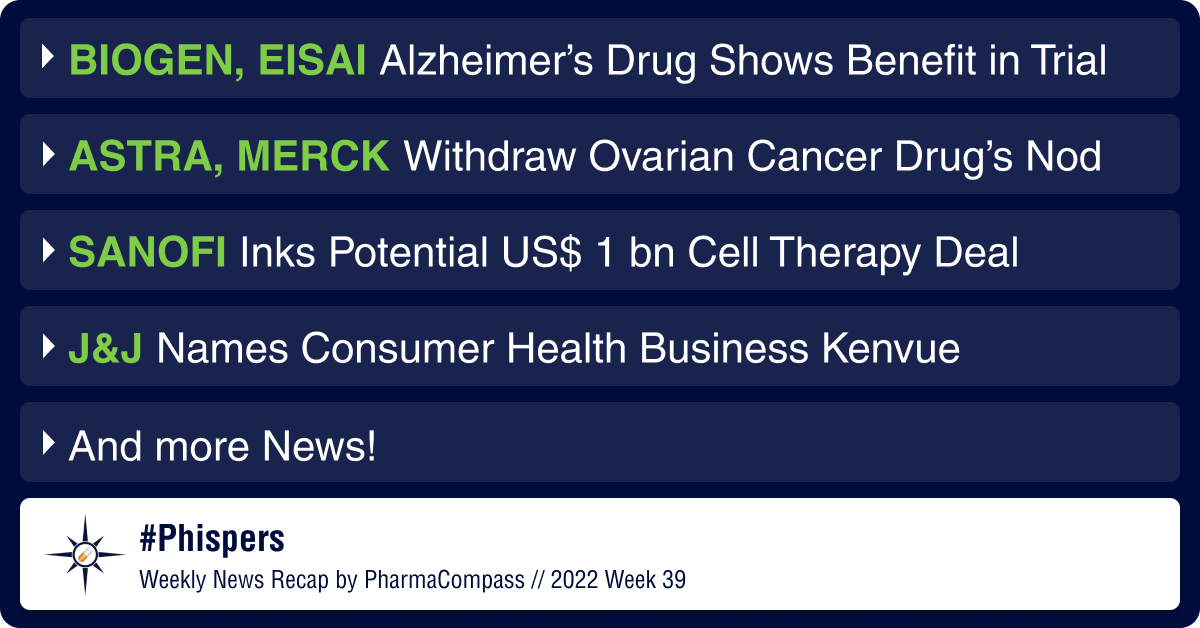

This week, Phispers brings you news of a rare success — after the failure of Aduhelm, Biogen and Eisai said their experimental Alzheimer’s disease drug, lecanemab, was successful in slowing down the progress of the brain-wasting disease in a late-stage trial.

In other pharma news this week, AstraZeneca and Merck have voluntarily withdrawn their blockbuster drug Lynparza’s approval in BRCA-mutated advanced ovarian cancer patients who have received at least three prior lines of chemotherapy.

In deals, Sanofi has inked a potential US$ 1 billion deal with Californian biotech Scribe Therapeutics to develop cancer cell therapies using Scribe’s genome editing technology. And Seattle-based Seagen has agreed to shell out up to US$ 700 million to the Netherlands-based Lava Therapeutics for exclusive rights to a preclinical solid tumor-targeting drug candidate.

In approvals, Japan has approved Daiichi Sankyo’s Ezharmia as a treatment for patients with relapsed or refractory adult T-cell leukemia/lymphoma (ATL), a rare form of blood cancer. And, the US Food and Drug Administration (FDA) has granted accelerated approval to Eli Lilly’s Retevmo to treat adult patients with all types of locally advanced or metastatic solid tumors with a rearranged during transfection (RET) gene fusion.

In other news, Johnson & Johnson has christened its US$ 15 billion consumer health business ‘Kenvue’ ahead of a spin-off, slated for November 2023. And drugmakers in Europe have warned that they may have to stop producing some low-cost generic drugs due to spiraling electricity costs, as the energy crisis worsens in the continent.

In regulatory news, the FDA has stepped up inspections in India in recent months and plans to add more surprise or ‘short notice’ inspections. The agency has issued warning letters to Chinese API producer Zhejiang Tianyu and Germany-based OTC drug manufacturer SystemKosmetik. And just days ahead of the September 30 deadline, the US Senate has reauthorized FDA’s user fee programs, and ensured that the agency doesn’t need to hand out pink slips.

Biogen, Eisai’s Alzheimer’s drug shows benefit in large, phase 3 trial

The makers of Aduhelm (aducanumab), Eisai and Biogen, have announced encouraging results from a late-stage trial of an experimental Alzheimer’s drug — lecanemab. Aduhelm, an Alzheimer’s drug that bagged FDA’s accelerated approval in June 2021, was mired in controversy right from the word go. Biogen-Eisai had slashed the price of Aduhelm by half in December to increase sales.

However, that failure may soon be a thing of the past with lecanemab succeeding in slowing down the progress of the brain-wasting disease in a late-stage trial. This is a rare success as nearly all drugs tested to treat Alzheimer’s have met with failure in clinical trials.

Lecanemab met the study’s primary goal by slowing down the progress of the brain-wasting disease by 27 percent compared with a placebo over an 18-month period in a large phase 3 trial of patients who are in the early stages of Alzheimer’s.

Biogen and Eisai now plan to approach the FDA for a full approval of lecanemab by March next year. The companies have already applied for an accelerated approval based on an earlier phase 2b results from 856 patients. The PDUFA date for lecanemab is January 6, 2023.

Eisai and

Biogen have said they will disclose the full results at a medical conference in November. The result has also raised hopes from two other experimental drugs – Roche’s gantenerumab and Lilly’s donanemab – that are currently in trials.

Astra, Merck withdraw Lynparza approval amid greater risk of death

AstraZeneca and Merck have voluntarily withdrawn their blockbuster drug Lynparza’s approval in BRCA-mutated advanced ovarian cancer patients who have received at least three prior lines of chemotherapy. The drug had received FDA’s accelerated approval for the condition in 2014.

The decision is based on a confirmatory phase 3 trial, where the PARP inhibitor showed a 33 percent greater risk of death compared to chemo in ovarian cancer patients (with three lines of chemo). In a larger trial population that also included patients with two therapies, the risk of death between Lynparza and chemo was similar.

Lynparza’s withdrawal in fourth-line ovarian cancer came months after Clovis Oncology pulled its drug Rubraca in third-line ovarian cancer. Recently, the FDA agreed to GSK’s request to remove Zejula in heavily pretreated ovarian cancer patients whose cancer has homologous recombination deficiency. Like Lynparza, both the PARP inhibitors had demonstrated an increased risk of death in their clinical trials.

Japan approves two Astra drugs: AstraZeneca’s asthma drug Tezspire (tezepelumab) has been approved in Japan to treat severe bronchial asthma patients in whom high-dose traditional corticosteroids don’t work. The approval is based on a late-stage trial where the drug helped reduce asthma exacerbations by 56 percent. This is the third approval for the drug in recent weeks.

Another Astra drug, Koselugo (selumetinib), has also been approved in Japan to treat plexiform neurofibromas in neurofibromatosis type 1 (NF1) that is found in pediatric patients three years and older. NF1 is a genetic condition caused by a spontaneous or inherited mutation in the NF1 gene. Plexiform neurofibromas are tumors that grow along nerves.

GSK appoints new CFO: GSK has appointed its first female

chief financial officer, Julie Brown, who will succeed Iain Mackay to take

on the job in May. Brown will join GSK from luxury fashion

brand Burberry. She has also worked at AstraZeneca for

25 years.

Sanofi inks potential US$ 1 billion cancer cell therapy deal with Scribe Therapeutics

Sanofi has inked a potential US$ 1 billion deal with Californian biotech Scribe Therapeutics to develop cancer cell therapies using Scribe’s genome editing technology. As part of the deal, Sanofi will get non-exclusive rights to use Scribe’s CRISPR-based gene editing technology to develop cancer treatments created from modified natural killer cells, which are a type of immune defender.

The French pharma will pay Scribe US$ 25 million upfront, and the biotech is also eligible for an additional US$ 1 billion in development and commercial milestones along with tiered royalties on any products.

Seagen acquires rights to Lava’s cancer drug: Seattle-based Seagen has agreed to pay up to US$ 700 million to the Netherlands-based Lava Therapeutics, a gamma delta T cell engager biotech, for gaining exclusive rights to a solid tumor-targeting drug candidate.

Seagen will pay US$ 50 million upfront for the exclusive license to develop, manufacture and commercialize Lava’s preclinical stage candidate, Lava-1223, which works by activating certain gamma delta T cells to go after solid tumors that express epidermal growth factor receptor (EGFR). Lava will also get up to US$ 650 million in milestone payments.

Genentech, Arsenal join hands to find cancer cures: Roche’s Genentech unit will

pay US$ 70 million upfront to biotech Arsenal Biosciences to

gain access to its screening and T-cell engineering

tools that will help in the development of a CAR-T

therapy to treat solid tumors. Roche has promised additional payments to ArsenalBio based on the

development and commercialization of experimental T-cell treatments for solid

tumors.

Senate reauthorizes user fee programs days before September 30 deadline

Just days before the September 30 deadline, US Senators Patty Murray and Richard Burr, chair and ranking member of the Senate committee on Health, Education, Labor, and Pensions (HELP) said in a statement that the FDA user fee programs have been reauthorized. These programs are a significant source of funding for the agency. There were concerns that if the programs are not reauthorized, thousands of FDA employees stand to lose their jobs.

“We are glad to announce an agreement to reauthorize the FDA user fee programs, which will ensure that FDA can continue its important work and will not need to send out pink slips. However, there is more work ahead this Congress to deliver the kinds of reforms families need to see from FDA, from industry, and from our mental health and pandemic preparedness efforts.” Daiichi Sankyo’s new class of blood cancer therapy bags Japanese nod

Japan has approved Daiichi Sankyo’s Ezharmia (valemetostat tosilate) as a treatment for patients with relapsed or refractory adult T-cell leukemia/lymphoma (ATL), a rare form of blood cancer. With this approval, Ezharmia has become the first dual inhibitor of histone methyltransferases EZH1 and EZH2 to receive regulatory approval for ATL anywhere in the world.

The nod is based on data from a phase 2 study in which the drug demonstrated an objective response rate (ORR) of 48 percent in previously treated patients. The trial assessed 200 mg of Ezharmia as a monotherapy in 25 patients with relapsed/refractory ATL who were previously treated with mogamulizumab or at least one systemic chemotherapy.

Lilly’s Retevmo bags FDA nod: The

FDA has granted accelerated approval to Eli Lilly’s Retevmo (selpercatinib) to treat adult patients with all types of locally advanced or metastatic solid

tumors with a rearranged during transfection (RET) gene fusion. Patients whose disease have progressed or are

following a prior systemic treatment or who have no satisfactory alternative

treatment options are eligible for this treatment.

FDA steps up inspections in India, to add more ‘short-notice’ inspections

The two-year reprieve that Indian drugmakers had enjoyed since the onset of the Covid-19 pandemic seems to be over with the FDA stepping up its inspections in recent months.

In the last week of August, FDA had issued Form 483s with 11 observations each to two Biocon Biologics facilities in Bengaluru, India. Another Biocon Biologics plant in Johor, Malaysia, had also received a Form 483 with six observations. The agency had conducted the on-site inspections of the facilities between August 11 and 30. During the same month, the agency had carried out inspections at a Cipla site in Goa and issued a Form 483 with six observations.

India has the largest number of FDA-registered drug manufacturing facilities outside the US. FDA plans to add more surprise or ‘short notice’ inspections in India in the coming months. “In terms of (inspection) activity (in India) we are getting closer to pre-pandemic levels,” Sarah McMullen, country director – India, FDA, told The Economic Times.

The US agency used to inspect around 200 facilities annually during the pre-Covid times. However, the numbers dropped to 80 in 2020 and to a mere five in 2021 due to Covid. As a result, the number of official action indications (OAIs) and warning letters fell significantly.

FDA issues warning letters to German, Chinese facilities: The FDA has issued two separate warning letters to Chinese API producer Zhejiang Tianyu Pharmaceutical and Germany-based OTC drug manufacturer SystemKosmetik.

In its letter to SystemKosmetik, the agency highlighted violations of current good manufacturing practices (cGMP) at the company’s facility in Munster, Germany. The site did not have written procedures for production and process control as well as for equipment cleaning and maintenance. Drug products were being manufactured on the same equipment that were used to manufacture non-pharmaceutical products, the agency said.

In its warning letter to Zhejiang Tianyu’s site in Taizhou City, China, the FDA said the company did not conduct a proper evaluation of the manufacturing process to identify all potential impurities. It also noted cleaning failures and lack of investigations related to failed APIs.

Ahead of spin-off, J&J christens its US$ 15 billion consumer health business Kenvue

Johnson & Johnson has named its consumer health company Kenvue as it moves ahead with its plan to spin off the unit in possibly the biggest shake up in the pharma giant’s 135-year history. Kenvue is a combination of the words ‘ken’ (knowledge) and ‘vue’ (sight), the company said.

The consumer health business

is going to become a separate, publicly traded company by November 2023. It

houses household brands such as Neutrogena, Tylenol, Band-Aid, Listerine as well as several baby care

products. The unit generated US$ 14.6 billion in 2021 revenues.

EU drugmakers say energy crisis may force them to stop producing low-cost meds

European drugmakers have warned they may stop producing some low-cost generic medicines due to spiraling electricity costs as the energy crisis worsens in the continent.

Medicines for Europe, a group that represents generic companies on the continent, such as Teva, Novartis’ Sandoz and Fresenius SE’s Kabi business, has sent an open letter addressed to European Union member states’ energy and health ministers.

The body wants the pharma industry to be exempted from the measures the bloc is undertaking to reduce electricity consumption. It has also requested that the off-patent medicines sector be included in relaxed state aid rules intended to support the economy. The bloc’s 27 energy ministers are meeting on Friday to seek agreement on measures to ease the energy crunch in Europe.

The PharmaCompass Newsletter – Sign Up, Stay Ahead

Feedback, help us to improve. Click here

Image Credit : Phisper Infographic by SCORR MARKETING & PharmaCompass license under CC BY 2.0

“ The article is based on the information available in public and which the author believes to be true. The author is not disseminating any information, which the author believes or knows, is confidential or in conflict with the privacy of any person. The views expressed or information supplied through this article is mere opinion and observation of the author. The author does not intend to defame, insult or, cause loss or damage to anyone, in any manner, through this article.”