By PharmaCompass

2022-04-21

Impressions: 1,859 Article

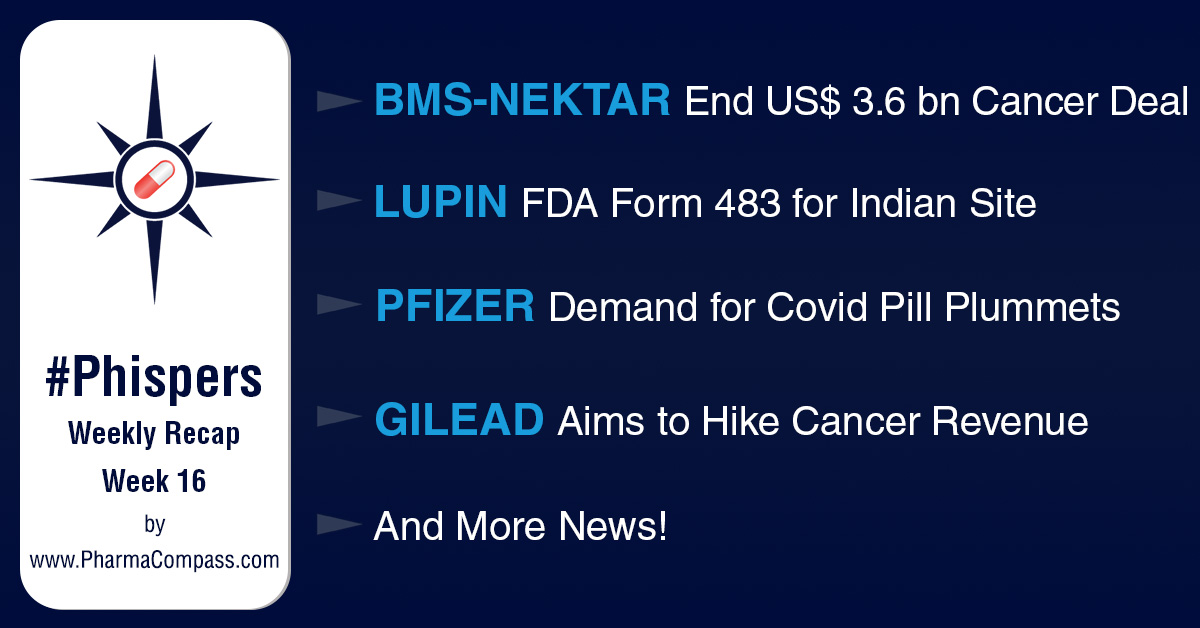

This week, Phispers is back with Covid-19 news. With cases skyrocketing, one would expect Pfizer’s antiviral pill – Paxlovid – to perform well. However, its demand remains low due to reasons such as a slow rollout, complicated eligibility requirements, reduced testing and the potential for drug interactions. Moderna said its Covid-19 booster designed to target the Beta variant and the original coronavirus has generated a better immune response against Omicron and several other variants. And J&J has withdrawn its Covid-19 vaccine from its 2022 guidance.

We also have an update on Nektar Therapeutics and Bristol Myers Squibb. The duo has called off their US$ 3.6 billion global cancer drug development partnership after the failure of two more late-stage trials. Nektar was testing its drug bempegaldesleukin in combination with BMS’ Opdivo in patients with renal cell carcinoma and urothelial carcinoma.

Less than a year after the US Food and Drug Administration (FDA) approved Merck’s 15-strain pneumococcal vaccine Vaxneuvance, the pharma giant has received a breakthrough therapy designation from the agency for its 21-strain vaccine candidate.

Gilead has unveiled its plans to generate a third of its revenue from oncology products by 2030. Its ambition received a boost after the FDA approved commercial production at its subsidiary Kite Pharma’s new CAR T-cell therapy manufacturing facility in Frederick, Maryland.

In regulatory news, the FDA has issued a Form 483 to Lupin’s API facility in Tarapur, India, with four observations. The agency had inspected the facility between March 22 and April 4.

In legal news, Johnson & Johnson’s subsidiary Janssen Pharmaceuticals has agreed to pay US$ 99 million to West Virginia to settle an ongoing court case alleging it had fueled the opioid crisis in the state. And BMS has said it will pay up to US$ 11 million to settle a class action lawsuit accusing it and two other drugmakers of deploying anticompetitive marketing tactics to block generic competition to HIV drugs.

BMS-Nektar end US$ 3.6 billion cancer partnership after two more late-stage flops

Last month, Nektar Therapeutics had suspended two late-stage studies testing its drug bempegaldesleukin in combination with Bristol Myers Squibb’s Opdivo for the treatment of melanoma patients after one of the trials failed to meet the main goals.

The drugmakers have now decided to call off their US$ 3.6 billion global cancer drug development partnership after two more late-stage trials failed to meet their primary endpoints. The two late-stage trials were being tested in patients with renal cell carcinoma (kidney cancer) and urothelial carcinoma (a type of bladder cancer).

BMS and Nektar said they will share the results of the two trials soon.

In 2018, BMS had signed the potential US$ 3.6 billion licensing deal with Nektar, pinning its hope on the success of bempegaldesleukin. Last week, Nektar had stopped all trials involving bempegaldesleukin, following the drug’s failure in multiple studies. The trials included a combination of the drug with Merck’s cancer drug Keytruda.

Gilead plans new pipeline to derive one-third revenue from cancer drugs by 2030

In 2021, Gilead made less than US$ 2 billion of its US$ 27 billion revenue from cancer drugs. But the California drugmaker says it is working on a “world-class pipeline,” unveiling its ambitions to become a major cancer player and generate a third of its revenue from oncology products by 2030. That’s around US$ 12 billion, by a Cowen analyst’s estimate.

The drugmaker expects sales from its already approved drugs, including breast cancer drug Trodelvy and cell therapies Yescarta and Tecartus, to increase in the coming years. But its hopes of a major jump in revenue is centered around 20 oncology drugs that are currently in the pipeline, the drugmaker said in its “deep dive” presentation last week.

Currently, Gilead’s 30-plus partnerships have contributed 20 assets. It plans to secure over 20 indication approvals by 2030 that range from prostate cancer to acute myeloid leukemia and from triple-negative breast cancer to various lymphomas. Its focus will be on testing combination treatments – they will account for more than half of Gilead’s 50 trials planned in oncology.

Meanwhile, Gilead’s plans to beef up revenues from its cancer drugs received a boost this week when the US Food and Drug Administration (FDA) approved commercial production at Kite Pharma’s new CAR T-cell therapy manufacturing facility in Frederick, Maryland.

Kite, a Gilead company, said the 275,000-square-foot facility will produce FDA-approved CAR T-cell therapy used to treat blood cancer. The Maryland site is Kite’s third manufacturing facility. Along with two other existing Kite facilities in Southern California and Amsterdam, the Netherlands, the Maryland site forms the largest, dedicated in-house cell therapy manufacturing network in the world.

Cancer drug Yescarta, which recently received FDA approval as the first CAR-T therapy for large B-cell lymphoma after just one line of prior therapy, will be manufactured at the facility. By the end of 2022, Kite plans to employ 400 people at the Maryland facility.

Demand for Pfizer’s Paxlovid plummets; Moderna’s bivalent jab works on Omicron

Therapies to treat Covid have had a tough going. After the FDA limited the use of monoclonal antibodies, such as Eli Lilly’s bamlanivimab and etesevimab and Regeneron’s REGEN-COV (casirivimab and imdevimab), in treating Covid caused by the Omicron variant in January this year, the agency pulled the authorization granted to GSK and Vir Biotechnology’s antibody therapy last week, citing data that suggested it was unlikely to be effective against the dominant Omicron sub-variant in the country.

This week, there is bad news on Pfizer’s Paxlovid. Even as Covid-19 cases skyrocket across the world, demand for Pfizer’s antiviral pill has remained unexpectedly low. The supply of Paxlovid, which reduced hospitalizations or deaths in high-risk patients by around 90 percent in a clinical trial, has far outstripped demand in many countries like the US, the UK and South Korea.

A Reuters review of data and interviews with experts has found complicated eligibility requirements, reduced testing and potential for drug interactions to be the reasons behind the low demand. The perception that Omicron infections are not severe has also contributed to the decline.

Doctors and pharmacists believe that high-risk patients may not realize they are eligible for Paxlovid treatment as people shift to home tests from laboratory testing. Pfizer CEO Albert Bourla had recently said restrictions on who can receive Paxlovid have limited the use of the drug in Europe. Paxlovid can interact with many widely used medications, complicating its use.

Slow rollout in many Asian countries, where infections have reached new highs, is another reason behind the low demand. However, its demand may increase if Paxlovid is proven to work in studies testing the pill in broader groups. Pfizer has plans to produce up to 120 million courses of Paxlovid this year and expects at least US$ 22 billion in sales.

Moderna’s Beta bivalent vaccine: Days after Britain’s medicines regulator approved the use of Moderna’s vaccine – Spikevax – in children between the ages of six and 11 years, the biotech said a Covid-19 booster designed to target the Beta variant and the original coronavirus has generated a better immune response against Omicron and several other variants.

The company said the 50-microgram bivalent vaccine – called mRNA 1273.211 – proved more effective in neutralizing the Omicron variant at one and six months as compared to the booster of its original vaccine.

The pharma is not planning to file for authorization of the vaccine. It will submit the data to the FDA to lay the groundwork for a future bivalent vaccine that it is testing, which combines an Omicron-specific vaccine with its original. Moderna expects initial data from the vaccine in the second quarter. It is also testing a monovalent booster targeted at Omicron alone.

Meanwhile, the biotech has said it plans to submit an application to the FDA for emergency use authorization (EUA) of its Covid vaccine among very young children — those between the ages of six months and five years — by April-end.

J&J withdraws Covid-19 vaccine from its revenue projections: Following disappointing sales in the first quarter of 2022, Johnson & Johnson has decided not to include its Covid-19 vaccine in its revenue projections. Sales from the single-shot vaccine in the first quarter were US$ 457 million, far off the projected US$ 785 million. J&J had earlier predicted around US$ 3.5 billion in 2022 sales from the single-dose vaccine.

The company said it decided to suspend guidance for sales of its Covid-19 shot as a global supply surplus coupled with vaccine hesitancy in developing markets had led to a slump in demand.

Following the suspension, J&J has reduced its overall revenue projection for 2022 – it is now between US$ 94.8 billion and US$ 95.8 billion, as opposed to between US$ 95.9 billion and US$ 96.9 billion projected earlier.

UK approves Valneva’s vaccine: The UK’s health regulator has approved French pharma Valneva’s Covid-19 vaccine, becoming the first European country to do so. Valneva’s vaccine is the first, whole-virus inactivated Covid-19 vaccine to be approved in the UK. The French pharma said it is in discussions to supply up to 25,000 doses to the UK’s National Health Service and frontline workers in Scotland.

Japan approves Novavax’s vaccine: The Japanese health ministry has approved Novavax’s two-shot Covid-19 protein vaccine, Nuvaxovid, for use in the country. The government has agreed to buy 150 million doses of the vaccine, which will be manufactured domestically by Takeda. Analysts believe Novavax’s shot could generate US$ 4-5 billion in global revenues this year, with sales from the first quarter estimated to reach about US$ 700-800 million.

Merck’s 21-strain pneumococcal vaccine candidate bags FDA’s breakthrough status

Less than a year after the US Food and Drug Administration (FDA) approved Merck’s 15-strain pneumococcal vaccine – Vaxneuvance – the pharma giant has tasted early success with its 21-strain vaccine candidate.

The FDA granted Merck’s investigational pneumococcal conjugate vaccine – V116 – a breakthrough therapy designation last week for the prevention of invasive pneumococcal disease (IPD) and pneumococcal pneumonia in people 18 years and older. The vaccine targets strains that are mostly prevalent in adults.

This designation helps expedite the development and review of drugs and therapies for serious or life-threatening conditions and is based on phase 1/2 trial data submitted by Merck. The New Jersey-headquartered firm plans to begin phase 3 trials later this year.

If approved, Merck hopes its 21-strain vaccine will compete against Pfizer’s Prevnar 20, which has one strain less.

Its 15-strain Vaxneuvance had received approval in July last year, a month after Prevnar 20. Recently, the FDA had requested for more data analyses from clinical trials on Vaxneuvance being used in minors.

Pneumococcal disease is an infection caused by a bacteria called Streptococcus pneumoniae or pneumococcus. Pneumococcal infections can range from ear and sinus infections to pneumonia and bloodstream infections.

Indian drugmaker Lupin’s Tarapur API plant hit by FDA’s Form 483

A few weeks ago, Indian drugmaker Lupin’s facility in New Jersey had received 13 observations from the FDA. And now, the agency has issued a Form 483 to the drugmaker’s API facility in Tarapur, India, with four observations. The FDA had inspected the Tarapur facility between March 22 and April 4.

The Form 483 has noted that the procedures and processes for manufacturing APIs at the facility are inadequate. It also found the company’s cleaning protocols to be inadequate. Lupin also failed to set up in-process sampling and controls at the plant, and its investigations into the plant’s deficiencies were lacking, the FDA said.

The Mumbai-based drugmaker said it is confident of addressing the observations.

This is not the first time that Lupin’s Tarapur facility has come under the FDA’s radar. In 2020, the agency had classified the facility as Official Action Indicated (OAI) (which implies that objectionable conditions were found and regulatory or administrative sanctions by the FDA are indicated).

Rejects Teva’s schizophrenia therapy: The FDA has rejected Teva and its French partner MedinCell’s subcutaneous schizophrenia therapy. The companies did not provide any reason for the complete response letter (CRL). Citing the positive results of the drug’s phase 3 studies, MedinCell said Teva will be responsible for resolving any concerns.

Opioid cases: J&J to pay US$ 99 million to West Virginia, US$ 70 million to Alabama

Johnson & Johnson’s subsidiary Janssen Pharmaceuticals has agreed to pay US$ 99 million to West Virginia to settle an ongoing court case alleging it had fueled the opioid crisis in the state.

The deal means J&J is no longer a part of an ongoing trial that started two weeks ago. The pharma, however, clarified that the settlement is not an admission of guilt. The US$ 99 million settlement will support local community efforts to address the opioid crisis in West Virginia.

In February, J&J and three US drug distributors — AmerisourceBergen, Cardinal Health and McKesson — agreed to finalize a US$ 26 billion settlement to resolve around 3,000 opioid lawsuits.

Meanwhile, J&J will pay around US$ 70 million to Alabama as part of a US$ 276 million opioid settlement deal. Endo Pharmaceuticals and McKesson are also part of the deal. J&J will pay the amount within a year.

BMS settles HIV antitrust suit for US$ 11 million: Three years ago, AIDS activists had filed a lawsuit against Bristol Myers Squibb, Gilead and Johnson & Johnson, accusing the trio of using anticompetitive marketing tactics to block generic competition to HIV drugs.

Now, BMS has said it will pay up to US$ 11 million to settle the lawsuit. It will contribute US$ 10.8 million towards a fund to settle the class action lawsuit and up to US$ 200,000 to cover the cost of "providing notice of the settlement.” It will also open the door for generic competition to its drug Evotaz by removing a barrier preventing Gilead from marketing a fixed-dose combination regimen with a generic version of BMS’ drug.

The settlement will now need an approval from a federal judge in California. The other two companies, Gilead and J&J, are not involved in the settlement.

The PharmaCompass Newsletter – Sign Up, Stay Ahead

Feedback, help us to improve. Click here

Image Credit : Phisper Infographic by SCORR MARKETING & PharmaCompass is licensed under CC BY 2.0

“ The article is based on the information available in public and which the author believes to be true. The author is not disseminating any information, which the author believes or knows, is confidential or in conflict with the privacy of any person. The views expressed or information supplied through this article is mere opinion and observation of the author. The author does not intend to defame, insult or, cause loss or damage to anyone, in any manner, through this article.”