By PharmaCompass

2022-11-17

Impressions: 2,741

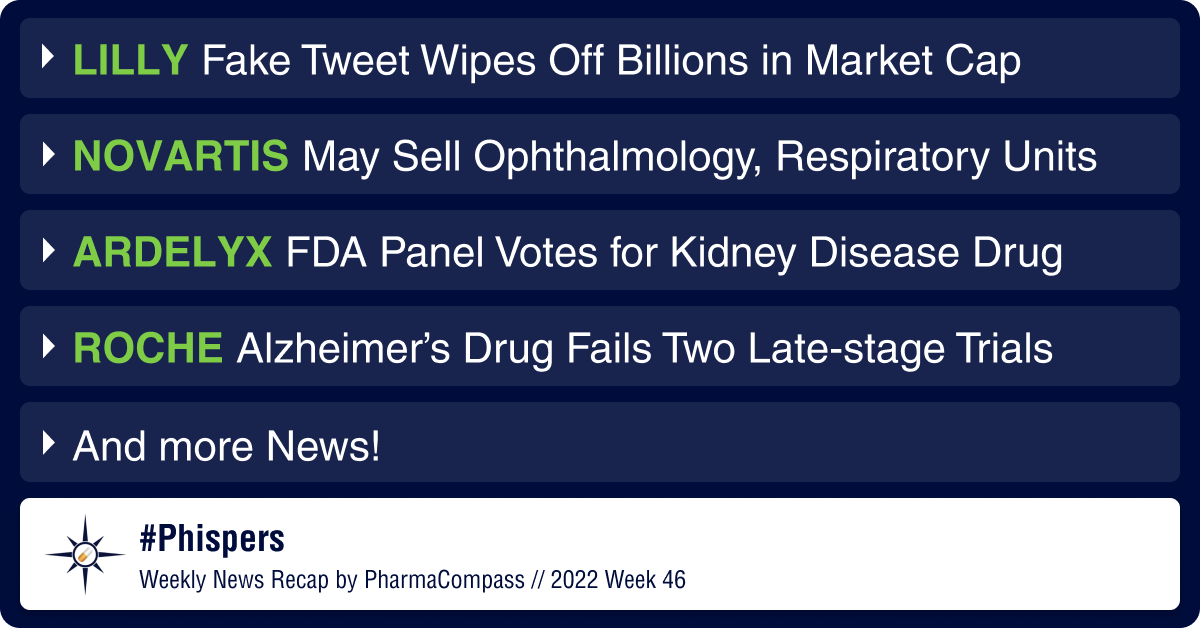

In Phispers this week, Eli Lilly’s stock plummeted 5 percent, erasing billions of dollars in market cap, after a Twitter account impersonating the pharma giant sent out a tweet saying the company is providing insulin for free.

A Bloomberg news report has reported that Novartis is considering a sale of its ophthalmology and respiratory units. In a major blow to Roche, its investigational Alzheimer’s drug candidate – gantenerumab – has failed to slow dementia progression in two phase 3 clinical trials. Retail giant Walmart has agreed to pay US$ 3.1 billion to settle thousands of lawsuits by several US states and municipalities over its role in the opioid crisis.

ImmunoGen has bagged US Food and Drug Administration’s accelerated approval for its drug — Elahere — making it the first med in eight years to treat advanced ovarian cancer in the US. AstraZeneca’s drug combo – Imjudo (tremelimumab) and Imfinzi (durvalumab) – has received its second FDA approval within a month. And, a year after rejecting it, a panel of FDA advisers has recommended the approval of Ardelyx’s drug for chronic kidney disease patients on dialysis.

In regulatory news, the FDA has issued a Form 483 with three observations to Indian drugmaker Alkem Laboratories’ US-based manufacturing facility. The Gambia’s national drug regulatory body has said it has so far not found any link between cough syrups manufactured by an Indian company and the deaths of 70 children. The agency said the medicines have been tested and were found to be safe, adding that many of the kids who died did not take any of the suspected syrups.

The US Securities and Exchange Commission (SEC) has charged Viatris’ chief information officer Ramkumar Rayapureddy with insider trading for allegedly passing on sensitive information to a former colleague who made billions off of it. And, the FTC has challenged risk evaluation and mitigation strategy (REMS) patent listings in FDA’s Orange Book by submitting an amicus brief in court. The amicus brief pertains to a case between US drugmaker Jazz Pharmaceuticals and Ireland-based Avadel Pharmaceuticals.

Eli Lilly halts Twitter ad spending after fake tweet wipes off billions in market cap

Last Thursday, Eli Lilly’s stock plummeted 5 percent, erasing billions of dollars in market cap after a Twitter account impersonating the pharma giant sent out a tweet saying the company is providing insulin for free. The account — @EliLillyandCo — had a ‘verified’ blue check mark, a symbol that Twitter has been using for years to denote an account’s authenticity.

In just a few hours, the fake tweet received over 1,500 retweets and 11,000 likes. Fake accounts with the blue check mark flourished on Twitter last week after the social media rolled out a US$ 8 paid verification service. By the time Twitter removed the fake tweet, it had been six hours and several other fake Lilly accounts had come up, attracting millions of views. Next day, Lilly’s stock had dropped by 5 percent. The stock price of other diabetes drugmakers, including Novo Nordisk and Sanofi, also plunged.

Lilly issued an apology on its official account – @Lillypad – for the “misleading message from a fake Lilly account.” The Indianapolis-based company clarified that it is not offering free insulin. Lilly halted all Twitter ad campaigns and paused its Twitter publishing plan for all corporate accounts around the world.

Another major insulin drugmaker, Novo Nordisk, has paused paid advertising on the social media site. And GSK has implemented a partial pause on Twitter advertising, stopping ads for specific products, but will continue to run corporate advertisements.

Novartis considering sale of its ophthalmology, respiratory units, says report

As part of its ongoing restructuring, Novartis is planning to sell some of its “non-core” assets to raise money to invest in cutting-edge medicines, Bloomberg reported. The Swiss drugmaker is considering the sale of its ophthalmology and respiratory units. However, any potential sale is likely to happen only next year, once its generic unit Sandoz spins out into a separate company.

According to the report, the ophthalmology unit could alone fetch about US$ 5 billion. The discussions are still in initial stages, and the company may decide against sell offs. In 2019, Novartis had spun off its eye care unit Alcon into a separate company.

FDA panel votes in favor of Ardelyx’s chronic kidney disease med

A panel of advisers to the FDA has overruled the agency’s concerns and recommended that the medicine developed by Ardelyx to treat chronic kidney disease (CKD) patients be approved.

The panel voted 9-4 in favor of the oral drug – tenapanor – as a monotherapy to treat high phosphate levels in the blood of patients on dialysis. The advisers also voted 10-2 in favor of the drug’s use alongside existing treatment. The FDA had called the panel’s meeting after Ardelyx’s appeal against the drug’s rejection in July last year.

In major setback, Roche’s Alzheimer’s drug fails two late-stage trials

In June, Roche’s experimental Alzheimer’s drug candidate — crenezumab — had failed to meaningfully slow or prevent cognitive decline in people at risk of a rare, inherited form of the disease. Months later, in another major blow to the Swiss pharma giant, a second investigational Alzheimer’s drug candidate has failed to slow dementia progression in two phase 3 clinical trials.

The Basel-based pharma said the drug – gantenerumab – fell short of demonstrating that it may help patients with early-stage Alzheimer’s disease preserve abilities such as remembering, solving problems, orientation and personal care. Data from the trials showed that treatment with gantenerumab led to only a 6 percent slowing of disease symptoms versus placebo in one study and 8 percent in the other, which are statistically insignificant.

GSK withdraws cancer drug’s indication: In September, GSK had voluntarily withdrawn its cancer med Zejula’s fourth-line indication for the treatment of adult patients with advanced ovarian, fallopian tube, or primary peritoneal cancer and in patients whose cancer was associated with homologous recombination deficiency (HRD) positive status. Now, on FDA’s request, the pharma will stop selling the drug for some ovarian cancer patients whose disease is stable after a second line of chemotherapy.

FDA issues Form 483 with three observations to Alkem’s St Louis site

The FDA has issued a Form 483 with three observations to Indian drugmaker Alkem Laboratories’ St Louis, US-based manufacturing facility. The agency had conducted a pre-approval inspection of the facility between October 31 and November 9. The company said the observations are not related to data integrity. Alkem said it will submit a detailed response to the FDA within the stipulated timeline.

Walmart to pay US$ 3.1 billion to settle thousands of opioid lawsuits

Retail giant Walmart has agreed to pay US$ 3.1 billion to settle thousands of lawsuits by several US states and municipalities over its role in the opioid crisis. Walmart said it “strongly disputes” allegations that its pharmacies were responsible for improperly filled prescriptions for powerful painkillers.

The plan has to be approved by 43 states. Lawyers representing local governments said the company will pay most of the amount over the next year, if the plan is finalized. The US$ 3.1 billion proposal follows tentative deals announced by the two largest US pharmacy chains – CVS Health and Walgreens. Each of them has agreed to pay about US$ 5 billion.

ImmunoGen’s advanced ovarian cancer drug scores FDA’s accelerated approval

The FDA has granted accelerated approval to ImmunoGen Inc’s drug Elahere (mirvetuximab soravtansine) for the treatment of adult patients with folate receptor alpha (FRα)-positive, platinum-resistant epithelial ovarian, fallopian tube, or primary peritoneal cancer, who have received one to three prior systemic treatment regimens. The approval makes Elahere the first wholly owned medicine the biotech has brought to market in its 41-year history. Elahare has also become the first med in eight years to treat advanced ovarian cancer, and the first FDA-approved antibody drug conjugate for platinum-resistant disease.

Astra’s cancer drug combo on a roll, wins FDA approval to treat lung cancer

AstraZeneca’s drug combo – Imjudo (tremelimumab) and Imfinzi (durvalumab) – has received its second FDA approval within a month. Last month, the combo received its first approval to treat adult patients with unresectable hepatocellular carcinoma (HCC), the most common type of liver cancer. And now, the two drugs, along with platinum-based chemotherapy, have been approved in the US for the treatment of adult patients with Stage IV (metastatic) non-small cell lung cancer (NSCLC). The approval is for those who possess an EGFR mutation or ALK alteration.

Seagen’s cancer drug gets FDA nod in pediatric Hodgkin lymphoma: Seagen’s cancer drug Adcetris (brentuximab vedotin) has received an add-on FDA approval to treat pediatric patients two years and older with previously untreated high-risk classical Hodgkin’s lymphoma (cHL), in combination with a standard-of-care chemotherapy regimen.

The approval for the Takeda-partnered antibody drug conjugate is based on data from a phase 3 study where trial participants were treated either with Adcetris or standard-of-care alone. Adcetris was first approved in 2011 to treat Hodgkin lymphoma (HL) and a rare condition called systemic anaplastic large cell lymphoma (ALCL).

EMA recommends Dupixent to treat prurigo nodularis: A European Medicines Agency (EMA) committee has recommended the authorization of Sanofi and Regeneron’s Dupixent (dupilumab) in the European Union as a treatment for adults with moderate-to-severe prurigo nodularis who are candidates for systemic therapy. In September, the FDA had approved Dupixent for the treatment of adult patients with prurigo nodularis, making it the first and only medicine to treat the condition in the US.

Viatris’ chief information officer charged with insider trading

The US Securities and Exchange Commission (SEC) has charged Viatris’ chief information officer Ramkumar Rayapureddy with insider trading for allegedly passing on sensitive information to a friend and former colleague who made billions off of it and split the gains with him. Rayapureddy is also facing criminal charges from the Department of Justice (DOJ).

According to the SEC complaint, Rayapureddy leaked out information about the impending merger of Mylan and Pfizer’s Upjohn unit, an undisclosed drug approval and financial data to his former co-worker Dayakar Mallu. Using this information, Mallu allegedly made around US$ 8 million by trading in Mylan’s stock. He opened an Indian bank account and transferred the funds to it. He also shared a part of the profits with Rayapureddy.

Mallu pleaded guilty in 2021 to DOJ charges of conspiracy to commit securities fraud and aiding in the preparation of a false tax return. He is yet to be sentenced.

Natco named in US antitrust lawsuit on cancer drug: Indian drugmaker Natco Pharma has been named one of the defendants in an antitrust lawsuit in the US regarding cancer drug lenalidomide (Revlimid). Bristol Myers Squibb and Teva have also been named defendants in the lawsuit filed by Walgreens Co. The Hyderabad-based drugmaker said it believes the matter is without merit. Teva is the ANDA holder and the front-end marketing partner for the generic product in the US, it added.

Children’s deaths not due to Indian cough syrups, says Gambian health agency

Over a month ago, there was news from The Gambia that cough and cold syrups containing “unacceptable” levels of diethylene glycol and ethylene glycol may have caused the deaths of 70 children from acute kidney injuries. The World Health Organization (WHO) had linked the deaths to four syrups manufactured by Indian firm Maiden Pharmaceuticals.

Now, The Gambia’s national drug regulatory body said it has so far not found any link between the cough syrups and the deaths. The agency said the medicines have been tested and were found to be safe, adding that many of the kids who died did not take any of the suspected syrups. The real cause of the acute kidney injury cases linked to the child deaths is still “unknown”, the agency said. About 95 percent of the deaths could have been triggered by some “virus” and “bacteria” that could have spread due to unprecedented rainfall and widespread flooding.

FTC challenges REMS patent listings in FDA’s Orange Book

In an amicus brief submitted to a US court, the US Federal Trade Commission (FTC) has argued that patents related to risk evaluation and mitigation strategy (REMS) distribution systems should not block generic or other competition. The amicus brief pertains to a case between US drugmaker Jazz Pharmaceuticals and Ireland-based Avadel Pharmaceuticals.

Jazz claims that Avadel violated its patent for the REMS-based distribution system of its narcolepsy medication, Xyrem. Avadel, which is seeking FDA approval for its own narcolepsy drug, Lumryz, is requesting the removal of the Xyrem distribution patent, known as the ’963 patent from the FDA’s Orange Book.

The FTC has argued for Jazz’s patent to be delisted, citing the Hatch-Waxman Act which states that a brand drug company may only list patents in the Orange Book that claim either a drug or a “method of using” a drug. The patent infringement suit has triggered a 30-month stay on FDA’s approval of Lumryz under the Hatch-Waxman framework.The PharmaCompass Newsletter – Sign Up, Stay Ahead

Feedback, help us to improve. Click here

Image Credit : Phisper Infographic by SCORR MARKETING & PharmaCompass license under CC BY 2.0

“ The article is based on the information available in public and which the author believes to be true. The author is not disseminating any information, which the author believes or knows, is confidential or in conflict with the privacy of any person. The views expressed or information supplied through this article is mere opinion and observation of the author. The author does not intend to defame, insult or, cause loss or damage to anyone, in any manner, through this article.”