By PharmaCompass

2022-03-24

Impressions: 2,742

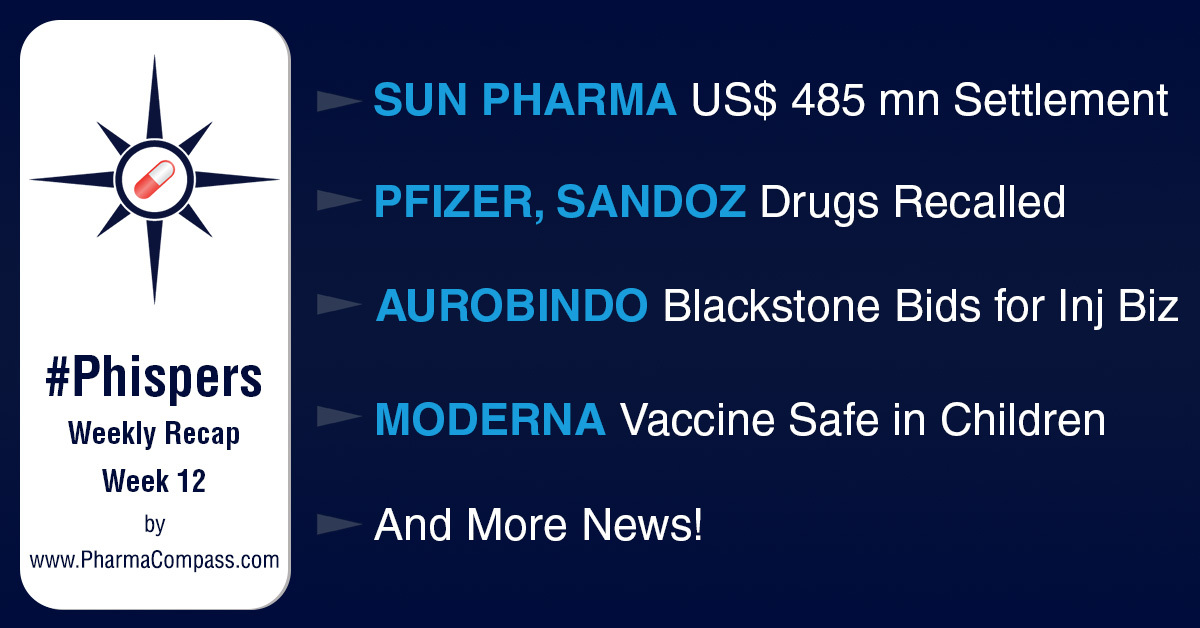

This week, Sun Pharmaceutical has agreed to pay US$ 485 million to settle antitrust lawsuits that alleged the Indian drugmaker’s subsidiary Ranbaxy had delayed the launch of generic drugs by rivals in the US. Meanwhile, Moderna said its two-dose coronavirus vaccine was safe in children younger than six years.

In legal news, former staffers of Pfizer have filed a countersuit that denies charges of stealing trade secrets and questions the drug giant on why it belatedly filed such an ill-founded case. And Seattle-based biopharma HDT Bio Corp sued Emcure Pharmaceuticals for US$ 950 million in the US, accusing the Indian generic drugmaker of stealing and using its RNA-delivery technology to develop a Covid-19 vaccine.

Bristol Myers Squibb’s relatlimab became the first drug in eight years to be approved by the FDA as a new type of checkpoint inhibitor to treat patients with metastatic melanoma or advanced melanoma that can’t be treated with surgery. The drug will be administered in combination with BMS’ Opdivo. Novartis’ Pluvicto, a therapy for the treatment of patients with a type of advanced prostate cancer, also bagged the agency’s nod.

The week also saw several drug recalls in the US. Weeks after its Canadian unit recalled eight lots of Accuretic, Pfizer issued a voluntary recall of the blood pressure drug and two generic hypertension treatments due to the presence of elevated levels of nitrosamine impurities. Similarly, Novartis’ Sandoz unit recalled 13 lots of oral orphenadrine citrate tablets for the same reason. And Adamis Pharmaceuticals recalled four lots of its life-saving epinephrine injection due to concerns over clogs in its needles.

Takeda’s hopes to relaunch its hypoparathyroidism drug Natpara were dashed after it received a complete response letter (CRL) from the FDA. The good news from the Japanese drugmaker was that its oral drug Exkivity gained an edge over J&J’s rival drug (Rybrevant) as it received a conditional approval from the UK’s regulatory agency as a treatment for non-small-cell lung cancer.

Sanofi is planning to list its active pharmaceutical ingredients company EUROAPI on the Paris stock exchange during the first half of 2022. Blackstone emerged as the frontrunner to acquire Aurobindo Pharma’s wholly owned injectables business, valued at around US$ 3.4 to 4 billion.

Sun Pharma agrees to pay US$ 485 million to settle Ranbaxy antitrust cases

Sun Pharmaceutical on Wednesday agreed to pay US$ 485 million to settle antitrust lawsuits that alleged the Indian drugmaker’s subsidiary Ranbaxy had delayed the launch of generic drugs by rivals in the US.

Sun Pharma, which acquired Ranbaxy in 2014, said it has signed a binding agreement to settle lawsuits by direct purchasers of the drugs, including drug wholesalers and indirect purchasers like health plans. The drugmaker said it disputes the claims, but agreed to the deal to “avoid uncertainty.” The deal needs to be approved by US District Judge Nathaniel Gorton.

Drug buyers had accused Ranbaxy of misleading the FDA to obtain tentative approvals regarding the production of the generic versions of Novartis AG’s blood pressure drug Diovan, Pfizer’s acid reflux medication Nexium and Genentech’s antiviral drug Valcyte in 2007 and 2008. Ranbaxy’s actions had delayed the release of rivals’ generic medications and caused drug buyers to sustain massive overcharges, the lawsuits alleged.

HDT Bio sues Emcure for using its RNA-delivery platform to develop Covid vaccine

Seattle-based biopharma company HDT Bio Corp has sued Emcure Pharmaceuticals for US$ 950 million in the US, accusing the Indian generic drugmaker of stealing and using its RNA-delivery technology to develop a Covid-19 vaccine.

The lawsuit said Emcure has applied for two Indian patents on HDT’s technology and has filed for anIPO in India, falsely claiming the vaccine as “indigenously developed” with a “proprietary mRNA platform.”

HDT is developing a self-amplifying RNA (saRNA) vaccine against Covid-19, using its delivery platform Lipid InOrganic Nanoparticle (LION). It had partnered with Gennova in July 2020 to help with the vaccine’s development in India.

The biotech has also sought a court order to permanently ban Emcure from using its secrets. It is also filing a separate case against Gennova in London related to the claims. Emcure said it is “initiating steps to have the claims dismissed.”

This is not the first time Emcure has been in news for wrong reasons. In 2017, 45 US states had alleged that the billionaire CEO of Emcure, Satish Mehta, in cohort with the then president of Mylan (now Viatris), Rajiv Malik, had restricted competition and raised the prices of 15 generic drugs.

BMS’ third checkpoint inhibitor bags FDA nod; to be given along with Opdivo

On Friday, the US Food and Drug Administration (FDA) cleared Bristol Myers Squibb’s relatlimab, making it the first drug since 2014 to be approved as a new type of checkpoint inhibitor to treat patients with metastatic melanoma or advanced melanoma that can’t be treated with surgery.

The Lag-3 antibody drug will be administered in combination with BMS’ blockbuster PD-1 inhibitor Opdivo (nivolumab) to treat patients aged 12 years or older. The fixed-dose combination will be available in the market as Opdualag and will cost US$ 27,389 per infusion.

With the approval of Opdualag, BMS now has three checkpoint inhibitors, including Yervoy (a drug used to treat symptoms of melanoma). BMS has projected the new pairing to reach over US$ 4 billion in sales by 2029.

The combo is key to BMS’ plan to compensate for thepatent losses of three of its top-selling drugs — blood cancer therapy Revlimid, blood thinner Eliquis and Opdivo — in the coming years. Earlier this month, Israeli drugmakerTeva announced the launch of its generic version of Revlimid.

BMS strikes US$ 1.1 billion biobucks deal with Volastra: BMS has forged a potential US$ 1.1 billion oncology drug discovery and development deal with New York-based start-up Volastra Therapeutics.

As part of the deal, Volastra will develop up to three undisclosed candidates utilizing its platform that targets chromosomal instability present in up to 80 percent of cancers. BMS is paying Volastra US$ 30 million in cash and as much as US$ 1.1 billion in milestone payments from potential development, regulatory and commercial milestone payments.

FDA approves Novartis’ advanced prostate cancer drug: On Wednesday, the FDA approved Novartis’ therapy — Pluvicto — for the treatment of patients with a type of advanced prostate cancer that has spread to other parts of the body. Pluvicto is a targeted radioligand therapy for adult patients who have already undergone other anti-cancer treatments. Pluvicto’s wholesale acquisition cost will be set at US$ 42,500 per dose. The company had acquired the therapy in 2018, as part of its US$ 2.1 billion purchase of Endocyte.

Moderna’s new vaccine programs: Moderna has added two vaccine programs to its pipeline.

The first vaccine program is a respiratory combo candidate that will go after SARS-CoV-2, influenza and respiratory syncytial virus (RSV), the three most significant viruses that cause respiratory diseases in adults. This triple shot is being designed as an annual booster and has been christened mRNA-1230.

The second vaccine for the coronavirus is a four-pronged attack. This shot, mRNA-1287, will not include the SARS-CoV-2 virus, but will target HCoV-229E, HCoV-NL63, HCoV-OC43, and HCoV-HKU1. These viruses cause 10 to 30 percent of upper respiratory tract infections in adults.

Sanofi plans to list API spin-off – EUROAPI – on Paris stock exchange

Two years after Sanofi spun out its active pharmaceutical ingredients (API) company EUROAPI, the French pharma giant is getting ready to list it on the Paris stock exchange. Sanofi said it plans to list EUROAPI in Paris before the summer, in spite of turbulent stock markets.

Sanofi will distribute 58 percent of EUROAPI to shareholders, while retaining its 30 percent stake. The EUROAPI board has proposed to submit 58 percent of shares to shareholders at €3.33 (around US$ 3.66) per share. The French Tech Souveraineté intends to buy the remaining 12 percent shares for up to €150 million (around US$ 165 million). The move is part of Sanofi’s rebranding plan, with 6,000 jobs cut, a pruned pipeline and a revamped logo and brand image.

Blackstone likely to acquire Aurobindo’s injectables unit – Eugia Pharma

In May last year, Indian drugmaker Aurobindo pharma had approved the transfer of its injectable assets (Unit IV) into a wholly owned subsidiary known as Eugia Pharma Specialities Limited in order to improve its operational efficiencies and “augment fundraise and strategic tie-ups in future through joint ventures, etc.

This week, there was news that New York City-based investment management company Blackstone has emerged as the frontrunner to acquire Eugia Pharma, which is being valued at around US$ 3.4 to US$ 4 billion (₹260-300 billion). Blackstone is pitted against Baring Private Equity Asia, the only other contender still in the fray.

Post the acquisition, Aurobindo will be split into two, with Eugia Pharma getting vertically demerged into a separate listed company. The Hyderabad-based Reddy family owns 51.8 percent of Aurobindo, which is one of the world’s largest producers of generic medicines. The details of the deal are expected by mid-April.

Meanwhile, Aurobindo has decided to shut down its US manufacturing facility in Dayton, New Jersey, and terminate 99 jobs as of April 26, 2022, according to a notice filed with the state Department of Labor.

Moderna says its Covid-19 shot is safe in children younger than six years

Moderna on Wednesday said its two-dose coronavirus vaccine was safe in children younger than six years.

The biotech said its pediatric shots generated a similar immune response to adults in a clinical trial. While protection against the highly transmissible Omicron variant was about 38 percent in 2- to 5-year olds, it was slightly higher at 44 percent for children 6 months to under 2 years old.

Moderna said the two 25 micrograms shots – a quarter of the dose that adults receive – were spaced four weeks apart. There were no cases of serious illness or hospitalizations in the trial, carried out on around 7,000 children.

Moderna is now planning to ask the FDA to authorize its Covid-19 vaccine in children. If approved, it will be the first shot for children under 5 years in the US. Moderna’s vaccine is already approved by the FDA for use in adults 18 and older. However, it is yet to be approved for 6- to 17-year-olds in the US, although it has been approved for the age group in Australia, Canada and the EU.

Takeda’s lung cancer drug Exkivity bags approval in UK; scores over J&J’s Rybrevant

In May last year, Johnson & Johnson’s intravenous drug Rybrevant (a therapy for an extremely rare and aggressive form of lung cancer) was approved four months before rival Takeda’s Exkivity in the US. However, this week Takeda gained an upper hand in the UK when Exkivity (mobocertinib) received a conditional approval from Medicines and Healthcare Products Regulatory Agency (MHRA) as a monotherapy for non-small-cell lung cancer (NSCLC) patients whose tumors have epidermal growth factor receptor (EGFR) exon20 insertion mutations, after first-line chemotherapy.

As part of a deal Takeda struck with England’s drug price watchdog National Institute for Health and Care Excellence (NICE), the oral treatment will be available at a discounted monthly rate of US$ 25,000 (£19,000) within weeks. J&J's Rybrevant is still under regulatory review in the UK.

Nitrosamine impurities trigger drug recalls by Pfizer, Novartis in US

Earlier this month, the Canadian unit of Pfizer had recalled eight lots of blood pressure drugAccuretic along with 15 lots of another blood pressure drug – Inderal-LA – after detection of higher-than-approved levels of the potential cancer-causing impurity – N-nitroso-quinapril.

This week, recalls spread to the US and Pfizer issued a voluntary recall of six lots of Accuretic along with certain lots of two of its generic hypertension treatments distributed by Greenstone due to the presence of the same impurity.

Similarly, Novartis’ Sandoz is recalling 13 lots of oral orphenadrine citrate 100-mg extended-release tablets after testing unacceptable levels of another potential carcinogen — nitroso-orphenadrine (NMOA). Sandoz’s orphenadrine tablets are used alongside rest, physical therapy and other measures for discomfort relief linked with acute painful musculoskeletal conditions.

Adamis recalls epinephrine injections: Adamis Pharmaceuticals is voluntarily recalling four lots of its life-saving epinephrine injection, sold under the brand name Symjepi. The recall was undertaken due to concerns that clogs in needles can prevent the proper dispensing of the medicine. The recall comes after two different customers complained about difficulty to inject Symjepi, Adamis noted.

Takeda’s bid to relaunch parathyroid hormone drug Natpara hits CRL roadblock

In September 2019, Takeda had recalled its injectable hypoparathyroidism drug Natpara in the US over concerns that rubber particles from the cartridge could fall into the injector when the covering is repeatedly punctured during the 14-day treatment period. Following the recall, Takeda had submitted a prior approval supplement (PAS) application last year with the FDA, proposing a change in the device component to address the issue.

However, the drugmaker’s hopes to manufacture and relaunch Natpara were dashed recently, when it received a complete response letter (CRL) from the FDA saying the application could not be approved in its present form. The drugmaker said it is evaluating the FDA response letter to decide its next steps.

Since there is no other FDA-approved treatment for hypoparathyroidism, the company said it will continue to provide patients enrolled in its Natpara special use program free access to the therapy.

Natpara had received FDA approval in 2015 as the first parathyroid hormone to be taken alongside calcium and vitamin D to control very low levels of calcium in people with hypoparathyroidism.

FDA detects harmful bacteria at Abbott’s infant formula plant: FDA inspectors have found a harmful bacteria at Abbott Laboratories’ plant in Sturgis, Michigan, that makes powdered baby formula. The agency found the bacteria – Cronobacter sakazakii – on machinery that comes in direct contact with powdered infant formula. The agency had carried out the inspection between January 31 and March 18.

Post CRL, Athenex announces jobs cuts, shifts R&D focus: Last year, the FDA had rejected Athenex’s oral chemotherapy drug paclitaxel, sending its stock into a nosedive. Since then, the biopharma has been trying to stem the fallout by adopting different measures. And now, it has announced a series of changes, including shifting its R&D focus to cell therapy programs and layoffs. While refusing to disclose how many of its 652 employees will be laid off, the company said it is implementing various other cost-cutting measures to reduce its operating expenses by half.

Former Pfizer staffers counter its ‘belated and ill-founded’ trade secrets case

Last month, Pfizer had accused two of its former employees of stealing the “hard workof its scientists for two drugs. The former employees — Min Zhong and Xiayang Qiu — had quit Pfizer to form their own biotech — Regor Therapeutics — in 2018. Since then, Regor has secured a deal with Eli Lilly worth US$ 1.5 billion.

Now, in a countersuit, Zhong and Qiu have denied those charges. The biotech has asked the court for a declaration that Qiu and Zhong did not misappropriate any trade secrets or breach their contracts. The company is also asking the court to stipulate that a list of patents for Regor’s technology is, in fact, owned by the biotech.

Regor also questioned why Pfizer waited for so long after Qiu and Zhong’s departure from Pfizer to file the lawsuit. They also said the company made no attempt at mitigation, such as requesting the return of any “inadvertently retained materialsbefore filing the lawsuit.

Zhong and Qiu had both worked at Pfizer for at least 15 years. They were accused of stealing data on two drugs: a specific GLP-1 agonist candidate and leukemia treatment Bosulif.

The PharmaCompass Newsletter – Sign Up, Stay Ahead

Feedback, help us to improve. Click here

Image Credit : Phisper Infographic by SCORR MARKETING & PharmaCompass is licensed under CC BY 2.0

“ The article is based on the information available in public and which the author believes to be true. The author is not disseminating any information, which the author believes or knows, is confidential or in conflict with the privacy of any person. The views expressed or information supplied through this article is mere opinion and observation of the author. The author does not intend to defame, insult or, cause loss or damage to anyone, in any manner, through this article.”